Handling your taxes every year can be stressful. There are often many forms to complete and documents that must be provided. All of this should be done in the appropriate time frame, too. Of course, scammers know this and work to exploit the stress and distraction of regular people by conducting tax scams. This type of scam is often designed to exploit people’s fear of the IRS or incurring tax-related debts.

There are two broad types of tax scam that you should be aware of. The first group of scams focuses on filing fraudulent tax returns in your name – a form of identity theft. The second type of scammer is usually someone you trust when it comes to financial or tax-related advice.

Tax scams to look out for in 2021

Our focus is on tax fraudsters who target legitimate taxpayers to steal their money or to steal money from the government using the taxpayer as a proxy. Fraudsters may contact you through the mail, email, or by phone, so be alert on all fronts. Almost all tax scams rely on impersonating an authority figure to make victims pay up.

This video demonstrates a fairly typical phone scam to give you an idea of what to expect, though some scammers will be more convincing than others.

Fake audits and unpaid taxes

This is one of the oldest tricks in the book, but fake audits are apparently still effective enough to be worth fraudsters’ time and effort.

The scammer contacts the target claiming to represent the IRS, CRA, or HMRC. They state that a recent audit identified discrepencies in your tax filings, and immediate payment is required. The fraudster will often make threats of additional fees, jail time, and deportation to spur the victim into making an impulse decision to send the money.

Once the victim is sufficiently compliant, the fraudster provides instructions for sending the money. This might be a bank transfer, wiring service, pre-paid card, gift card, or bitcoin.

This scam is fairly easy to pull off because it doesn’t require the scammer to know much about their target. Emails can be sent out in bulk, and the initial phone calls can be automated so that scammers only need to interact one-on-one with those who respond. Even if only a handful of people fall for the scam, the ease of conducting the scheme makes it worthwhile to fraudsters.

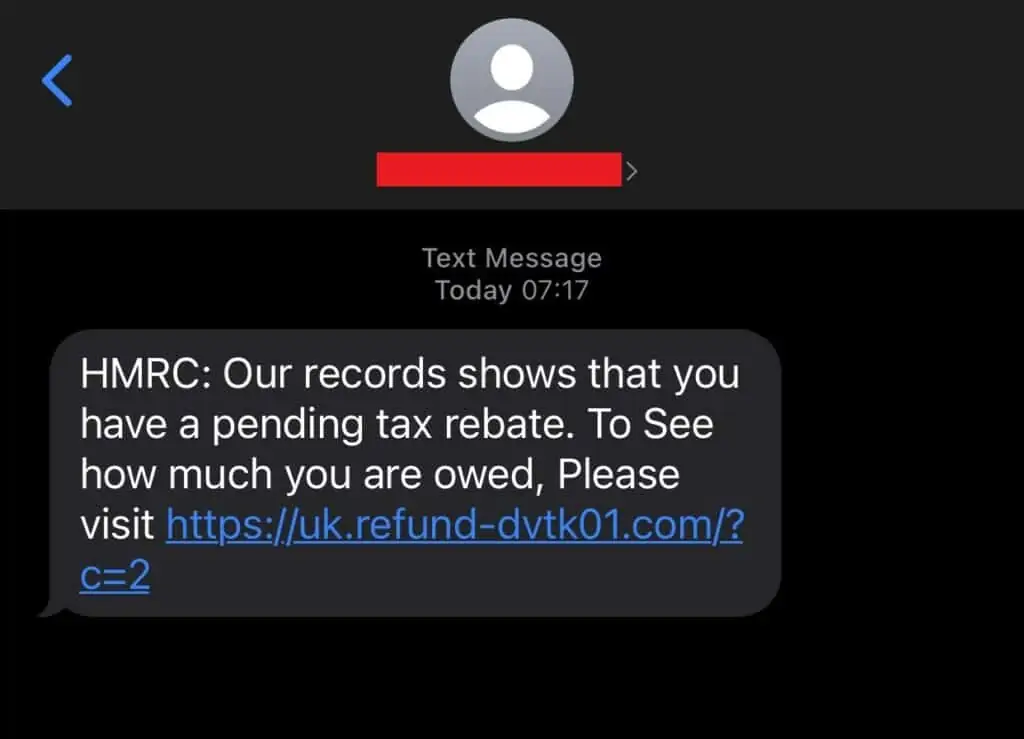

Fake refunds and rebates

In this scam, fraudsters prey on people expecting tax refunds. Victims receive an email, text message, or automated phone call posing as the IRS, CRA, or a taxpayer advocacy group. The message states the target has a refund pending and they can claim it on the tax agency’s website. A link is provided where the taxpayer enters their personal information, which will likely include a Social Security Number (or SIN number in Canada) as well as banking info.

The link provided directs the victim to a phishing site. It looks official but is actually a forged copy of the real IRS or CRA site. Once the victim fills in the form and submits it, no refund is ever issued. Fraudsters now have enough information to steal the victim’s identity. Sometimes these websites harbor malware that can infect your device and steal information or worse.

Like the audit scam, phishing for victims with fake refunds as a lure is an easy scheme to pull off. Most people will not be tricked, but a few will, and that’s all the scammer needs to make it worth their while.

Erroneous refunds

The newest and perhaps most convincing scam in the fraudster’s playbook deals in erroneous refunds. It’s a much longer and more targeted con than the other scams in this list.

Identity thieves start by targeting local tax preparation agencies with hacking attacks and phishing attempts. Once the tax agency has been compromised, fraudsters use its customers’ information to file phony tax refund requests. The IRS processes the return and deposits money into the agency clients’ accounts.

That’s phase one. Phase two starts after the deposit has been made. The fraudster contacts the people who just received the erroneous refunds and demands they be paid back. The fraudster often poses as a tax collection agency working on behalf of the IRS. Victims are instructed to wire money to the fraudster, leaving them both without a refund and possibly in trouble with the IRS for filing a false refund request.

This scam is particularly effective because, due to the information that the scammer gleans from the compromised tax agency, they have access to your private information including your name, Social Security Number, address, bank name, routing number, and account number. Having all that info on hand makes the scammer seem much more credible. Furthermore, the fraudsters in at least one case used the website of a real but defunct tax collection agency. Anyone who looked up the agency would then see a real, registered business. The website looks legitimate but is really a phishing site where victims enter payment details and send scammers money.

Even if you don’t fall for the scam, the fraudsters still have victim’s banking details and Social Security Numbers, so anyone affected should take steps to prevent identity fraud.

In some US-based scams, scammers impersonate the IRS and attempt to steal Electronic Filing Identification Numbers (EFINs) from professional tax preparers. Victims receive an email instructing them verify their EFIN before e-filing taxes. The fraudsters then use the EFIN to file fraudulent returns under the tax professional’s name. Similar scams attempt to steal Preparer Tax Identification Numbers (PTINs) or IRS e-Services usernames and passwords.

Common tax scam tactics

Phone scams

You may receive a phone call with a recorded message. The caller will say they are from the IRS and that there is a warrant for your arrest for unpaid taxes. There may be threats of jail time or deportation if the issue isn’t addressed by calling the given phone number and paying the money due. Victims who return the call are tricked into paying money directly to the scammers, and not to the IRS.

Phishing emails

Scammers create convincing emails that look like they are official IRS communications. The email will instruct the recipient to follow a link to a mock-IRS website where personal details will be requested. Criminals might lure in victims with the promise of collecting a tax refund. The stolen information may be used for fraudulent tax filings or other identity theft-based crimes.

Bank deposit scams

Scammers are now testing a new style of theft. The gain your personal details through a phishing scam or purchase the information on the black market. They use the data to file a fraudulent tax return on your behalf and the return is deposited into your bank account. The scammers then call, claiming to be from the IRS and explain that a fraudulent claim has been made in your name. Of course, they demand that the money must be repaid immediately, and offer anonymous, untraceable methods of doing so.

Dishonest tax return preparer

While most tax preparers are honest, there are some who set out to defraud the government in your name. They may ask you to sign a blank return, for example, leaving them free to claim almost anything without your knowledge. Be cautious of tax preparers that don’t ask for receipts or other usual documentation. Also, be wary of schemes that charge a percentage of your return instead of a fixed fee. That style of fee structure can tempt some to inflate claims in order to receive a larger payday.

‘I’m on your side’ tax preparer

The first type of scammer alters your tax filings without your knowledge. The scammer who acts as if they have your interests at heart may encourage you to overstate your income or deductions. They may play fast and loose with business credits or other entitlements. Don’t get swept up in the hype of trying to fool the IRS. If the claims do not truly apply to your situation, you may face consequences long after the tax preparer has taken their inflated cut.

Fraudulent tax preparer

Unsurprisingly there are people out there who pretend to be official tax preparers during the busy filing season. If they are not qualified or registered there is a much higher chance that you could file a fraudulent return. The scammers may also steal your personal details while assisting you with bogus paperwork.

Anyone who is paid to assist with or prepare another person’s taxes must have a valid Preparer Tax Identification (PTIN) number. If your preparer refuses to sign your return, that’s a red flag. They may promise a big refund, charge fees based on the size of your refund, only accept cash, claim fake deductions, lie about your income to qualify for tax credits, or direct refunds to their own bank account.

Fraudulent charity worker

In some circumstances donating to a charity can be beneficial when it comes time to file taxes. Scammers know this and will impersonate official charities or create fake ones to con people out of their money.

Tax protesters

Tax protester schemes don’t have any direct financial incentive for the fraudster. It’s more of a troll than a scam, but can still be costly to victims.

The consumer receives a message via phone, email, or text stating that they are not required to pay income tax. The fraudster makes some sort of cloudly legal argument as to why the victim is exempt, often entailing some argument about a natural person versus a legal person. The goal of a tax protester is to convince other people not to pay their taxes.

Failure to pay taxes can lead to fines and even jail time, so don’t heed their words.

See also: Best identity theft protection

How to protect yourself against tax scams

Until you are 100 percent certain that the caller or sender is from an official tax agency, do not give up or even confirm any personal or financial information.

Protecting yourself against tax scams can save yourself a lot of hassle and stress. Here are the best ways to be proactive about protecting your identity and your tax activity.

Know how the IRS and CRA work

They will never initiate a conversation with you via phone, email, text message or social network. The only way the IRS will contact you is via an old-fashioned letter in the mail. If anyone contacts you claiming to be from the IRS, they are trying to scam you.

Verify repayment requests

If you are contacted by someone claiming to be from the IRS, or anyone demands that you send money to them via wire transfer, contact the IRS through their official channels to verify the request. If they cannot confirm it, the first caller is a scammer.

Verify your tax preparer credentials

Before you share your tax information with a preparer, check they are authorized to file taxes. Use the Tax Preparer Directory to confirm details.

Never sign blank documents

This applies to checks, tax paperwork and any other official documentation. It leaves you open to untold exploitation and misrepresentation.

Verify your chosen charities

Use the Tax Exempt Organization Search to ensure your chosen charities are official. Make donations using checks or electronic transfers to create a record of the transaction. Cash payments are more difficult to prove.

File early

Tax scammers file fraudulent returns as soon as they have adequate information. If you file your true tax paperwork as soon as you can, there is less time for scammers to apply before you. Have your paperwork ready so when annual documents are released, you can file straight away. File electronically. If you file electronically, the process if often much faster than if you submit hard copies. Elect to have any refund paid by direct deposit. If you’re unsure, here’s how to file federal taxes.

Stay informed

Protect yourself by staying current with tax scam consumer alerts from the IRS, such as this recent news release. They describe the most recent known attempts to impersonate the IRS and other official bodies in order to facilitate malware dispersal and identity theft.

Pay how you want

Scammers often request payment in a form that’s untraceable to law enforcement. This might include a prepaid credit or debit card, gift card, money wire service like MoneyGram or Western Union, or even a cryptocurrency like Bitcoin. If the caller requests payment in a specific form, then it’s almost certainly a scam.

Real government tax agencies will have multiple payment options available and allow you to pay how you want, including credit cards, debit cards, and bank transfers.

Don’t be fooled by logos and letterhead

In the old days, it was difficult for criminals to reproduce official letterhead and logos, but in today’s world doing so requires very little effort. Don’t be swayed by emails and letters just because they contain official-looking IRS logos and letterhead.

Even phone numbers can be faked with caller ID spoofing. The caller ID that appears on your phone when you receive a call can make it seem like the real IRS is ringing you. They may also use IRS titles and fake badge numbers.

Check for HTTPS

Phishing websites are often designed to look just like the real IRS or CRA websites. Their aim is to trick you into entering private information, which is then used to steal your money or identity. However, these fake sites in all likelihood won’t have a valid SSL certificate.

If you are directed to a website supposedly belonging to the IRS or CRA, check the URL bar for HTTPS. At the top of your web browser, you should see a green padlock icon with https:// at the beginning of the web address. This means two things: your connection to the site is secure and the owner of the site is who they say they are (they have a valid SSL certificate).

If there’s no HTTPS or the padlock icon is shown in red, then you might have landed on a phishing site. Do not enter any information and exit the page.

Read more: Common phishing scams and how to recognize and avoid them

Call your tax agency

If at any moment you suspect that you could be a target of a scam and aren’t sure whether some correspondence from an official tax agency is legitimate or not, put on the brakes. Close the web page, hang up the phone, and don’t give any personal information. Call the IRS or CRA using the numbers on their official website and ask if the letter or phone call is real. You can also confirm if and how much you owe.

If you think you owe taxes in the US, call the IRS at 800-829-1040. If you don’t think you owe taxes, you can call the Treasury Inspector General for Tax Administration (TIGTA) to report the call as a scam. More on reporting scams below. In Canada, most people will want to call the phone number for individual tax enquiries at 1-800-959-8281.

Letters sent by the IRS always contain a phone number to call at the top right of their letters. Before calling, you should cross reference this number with those posted by the IRS online.

Signs that you may have been scammed

Watch for these unusual signs that indicate you may be a victim of a tax scam.

- You are asked to pay additional tax, receive a return or have other communications about a tax filing in a year when you did not file a return,

- More than one tax filing was made using your Social Security number,

- IRS record shows you earned income from employers that you do not work for.

If you have been scammed

If you think you are a victim of tax-related fraud, you can take steps to alert the authorities and limit damage to your financial standing and credit score. You must continue to file your taxes as required, even if a fraudulent claim has been made in your name. A paper-based return may be necessary in these cases.

- Report the fraud to the Federal Trade Commission.

- Contact a major credit bureau to have a fraud alert placed on your file. The fraud alert should be applied to all 3 major bureaus. This will stop fraudulent credit applications being approved in your name.

- Equifax, www.Equifax.com, 800-525-6285

- Experian, www.Experian.com, 888-397-3742

- TransUnion, www.TransUnion.com, 800-680-7289

- Notify your financial institutions, banks and credit providers about the scam. You may need to close accounts and reset banking passwords.

If your Social Security Number has been compromised and you are concerned that you are a victim of a tax scam or related identity theft, you must take the following action with the IRS:

- Respond immediately to any paper-based notices or letters from the IRS. (Remember, they will not call or email you about this),

- Complete IRS Form 14039, Identity Theft Affidavit if you believe someone has used your SSN to file a tax return in your name. Any attempt to file electronically will be rejected if your SSN has already been used. A paper filing will be required instead.

In the USA, you can send tax-related phishing and scam emails to phishing@irs.gov.

Canada

Canadians are at risk of tax scams. Be aware that some scammers work to promote evasion schemes that may appear legitimate but are not. The Canadian government offers advice on how to spot these scams. If you are concerned that you are a victim of tax fraud in Canada, follow the steps listed by the Anti-Fraud Centre to report the crime to the Canadian Revenue Agency. A list of official charities can help you to make financial decisions about where to donate money safely.

UK

UK citizens are not immune to tax scams. In the last financial year, HMRC reported nearly 15,000 websites for malicious or fraudulent content and received over 770,000 notifications of phishing emails and SMS messages from the public. If you have reason to think you have been scammed, report the crime to Action Fraud at 0300 123 2040 or use its online fraud reporting tool. Use the charity register to verify that charity fundraisers are legitimate before donating.

You can also forward suspected HMRC-related scam and phishing emails to phishing@hmrc.gov.uk.

Australia

The Australian Tax Office provides advice and direction for Australians who suspect they are victims of tax scams. Advice includes reporting any financial loss to the police and to Scamwatch. In Australia, many tax scams focus on aggressive phone calls relating to fake tax debts, and more recently, refund-for-a-fee scams. The Australian Charities and Not-for-profits Commission keeps an updated list of official charities for tax and other purposes.