When you subscribe to Identity Guard, it monitors your personal information, bank accounts, investment accounts, and social medical accounts for any odd activity that could indicate identity theft. But is it worth the subscription price?

I recently put Identity Guard through a full hands-on review. Through my 2023 Identity Guard review, I want to give you a feeling of how the service works and whether it is worth the money. Readers have many questions about ID theft protection services like Identity Guard that my hands-on review will answer:

- Is Identity Guard worth the money?

- Is Identity Guard safe to use?

- What company owns Identity Guard?

- Does Identity Guard monitor bank accounts?

- Is Identity Guard better than LifeLock?

During my Identity Guard hands-on review, I found that it provides all the features you expect to find in an identity theft protection service. It will alert you to any oddities regarding the way your personal information appears on the internet. Identity Guard’s best feature is its ease of use, meaning those new to the idea of ID theft protection will be up and running with this service in no time.

Should you suffer identity theft, Identity Guard offers you up to $1 million in insurance to cover the costs of trying to recover your identity. Identity Guard has a strong feature set, but its best features are only available in the highest pricing tier. The lowest pricing tier probably isn’t going to give you much in the way of protection.

Summary of benefits: Identity Guard

| No value | Identity Guard |

| Sitio web | identityguard.com | Free trial | Average email response time | Identity theft insurance | Up to $1 million | Stolen funds reimbursement | Included in ID theft insurance | Special offer | $5.39 | Highest price per month | $19.99 | Credit monitoring | Investment account alerts | Social media monitoring | Lock your credit | Home title monitoring | Phone takeover monitoring | Address allocation | Dark web monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|

| Coste mensual mínimo | $5.39 SAVE 40% on a basic plan |

Identity Guard: Hands-on review

Identity Guard gives subscribers the ability to receive alerts when their personal information appears on the internet. If any oddities increase your chances of identity theft, you can act on the alert from Identity Guard to make some changes that may better protect you from ID theft.

Should you end up suffering identity theft after subscribing to Identity Guard, the service will assign a specialist to help you try to recover your identity. This professional will give you advice on steps you should take and may help you perform some of the steps.

Additionally, Identity Guard guarantees its subscribers that it will provide up to $1 million in reimbursement to help you cover the costs of recovering your identity, including things like lost wages, travel expenses, financial account losses, and legal costs (all with limitations). You will have to document your expenses to receive reimbursement, as Identity Guard doesn’t just take your word for any expenses.

These are services that nearly all identity theft protection services provide. So how does Identity Guard set itself apart?

Primarily, Identity Guard will appeal to those who are not familiar with identity theft protection services and who may be nervous about trying to use one of these services. Identity Guard caters strongly to novices and to those who need help with the various steps required to make use of an ID theft protection service. It also has explanations of the various features on each screen, as well as easy access to self-help documents.

The dashboard and navigational features found with Identity Guard rank near the top of the industry. The design looks great, while remaining easy to use. The setup process takes very little time, meaning you can track your personal information soon after signing up for the service.

Before delving into my Identity Guard full review, I want to mention a few items that relate to all identity theft protection services. After all, these services typically cost $20 or more per month, and you will want to fully understand how they work before committing your money to a subscription.

Subscribing to a service like Identity Guard does not guarantee that you will never be a victim of identity theft. These services will give you warnings and alerts when it finds your personal information on the internet in odd situations. Such issues could indicate that you have a higher chance of suffering identity theft. However, you will need to take steps to protect yourself. ID protection services just give you warnings and compensation in the event of ID theft.

Some people choose not to subscribe to one of these services, because they know they can work on their own to duplicate many of the features these services provide. If you are especially careful about how you share your information on the internet, and if you keep a close eye on your financial statements and on your credit reports, you often can spot oddities on your own.

When you subscribe to an ID theft protection service, you are paying the service to take these steps on your behalf. For some people, the peace of mind of knowing that a company is keeping an eye on your information for you is well worth the cost. Others may want to try to do the work themselves and save the subscription fees.

If you want help monitoring your personal information on the internet, Identity Guard is a strong service. At the highest pricing tier, it monitors your information in several ways, all packaged in an easy-to-use design that even novices will pick up in no time.

Identity Guard compares very favorably to the features found in the most well-known ID theft protection service, LifeLock, and does so at a lower price.

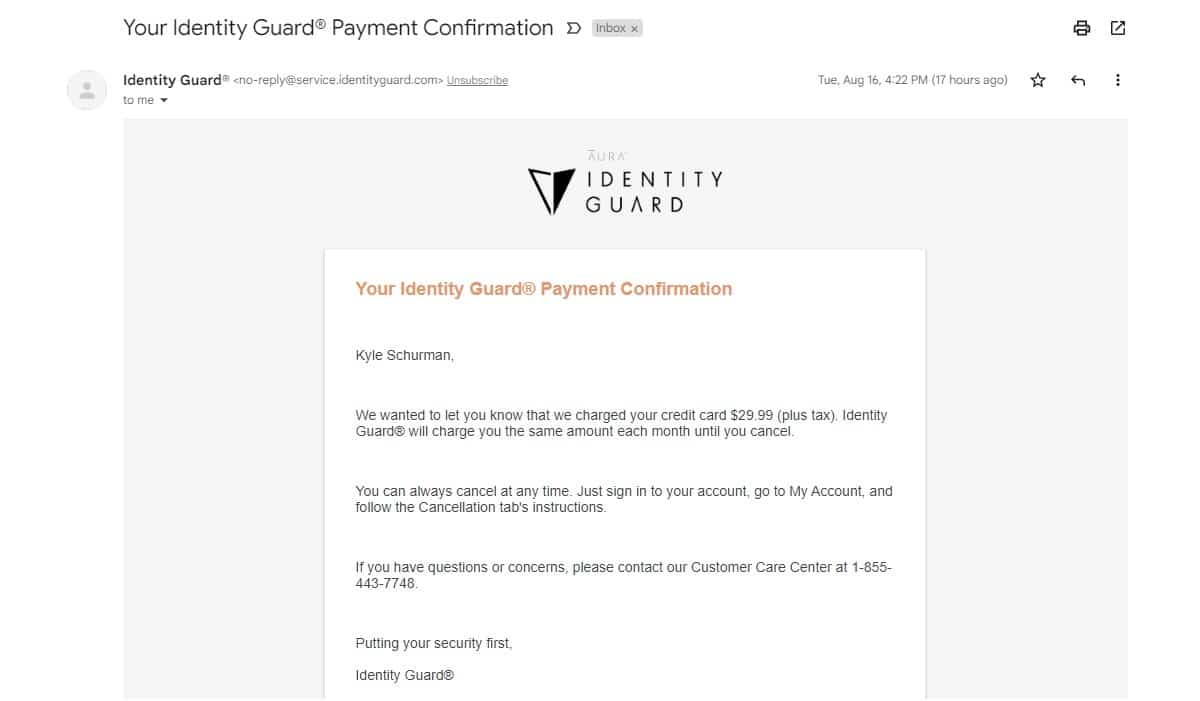

Before I begin breaking down the most important features of Identity Guard, I must mention that I subscribed to Identity Guard myself to write this review. Identity Guard did not supply me with a demonstration account or with an account that has fake information. I entered my own information into the Identity Guard dashboard. I paid $29.99 per month to subscribe to the Ultra tier. This allows me to give readers the most realistic look at how Identity Guard works.

Identity Guard features and insurance

Identity Guard offers a significant number of features for subscribers to the Ultra tier. (The two lower-priced tiers are missing some of these features.) Here is how I believe the features in Identity Guard rank.

Insurance and compensation

Identity Guard matches the majority of identity theft protection services by offering subscribers up to $1 million in insurance reimbursement in case identity theft occurs. This money will reimburse you for expenses you have related to trying to recover your identity.

Understand that Identity Guard does not hand you a check for $1 million if you suffer identity theft. Instead, you will need to show proof of your expenses and of the theft of your identity. You then will only receive a payment that reflects your actual losses.

You may have legal costs associated with trying to recover your identity, and this insurance policy helps with these costs. You also may need to miss time from work or to pay for child care, and Identity Guard’s policy helps with these expenses too.

Identity Guard potentially will reimburse you for direct losses from your financial accounts related to the identity theft situation. However, any losses will be part of the total $1 million insurance policy. Some ID theft protection services offer an additional $1 million in protection for these types of losses.

Activity alerts

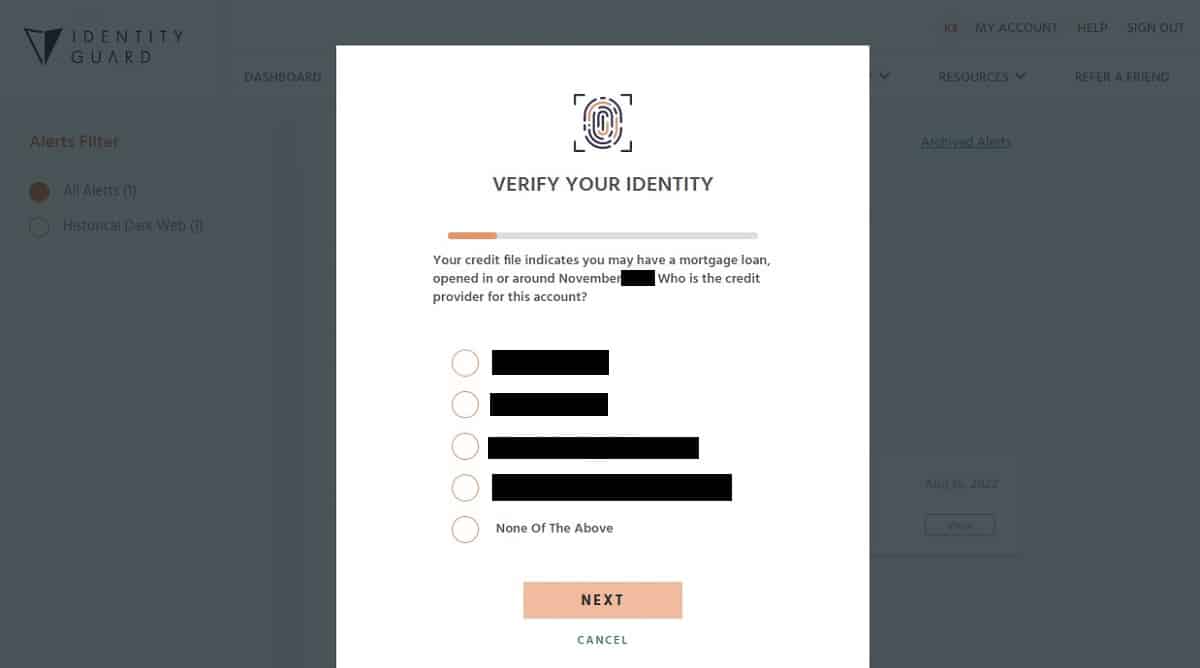

When you want to begin receiving alerts about areas of the internet where your identity is appearing in an unsafe manner, you will need to verify your identity. This verification involves answering a few questions about yourself, where the information you need to provide is part of your credit history.

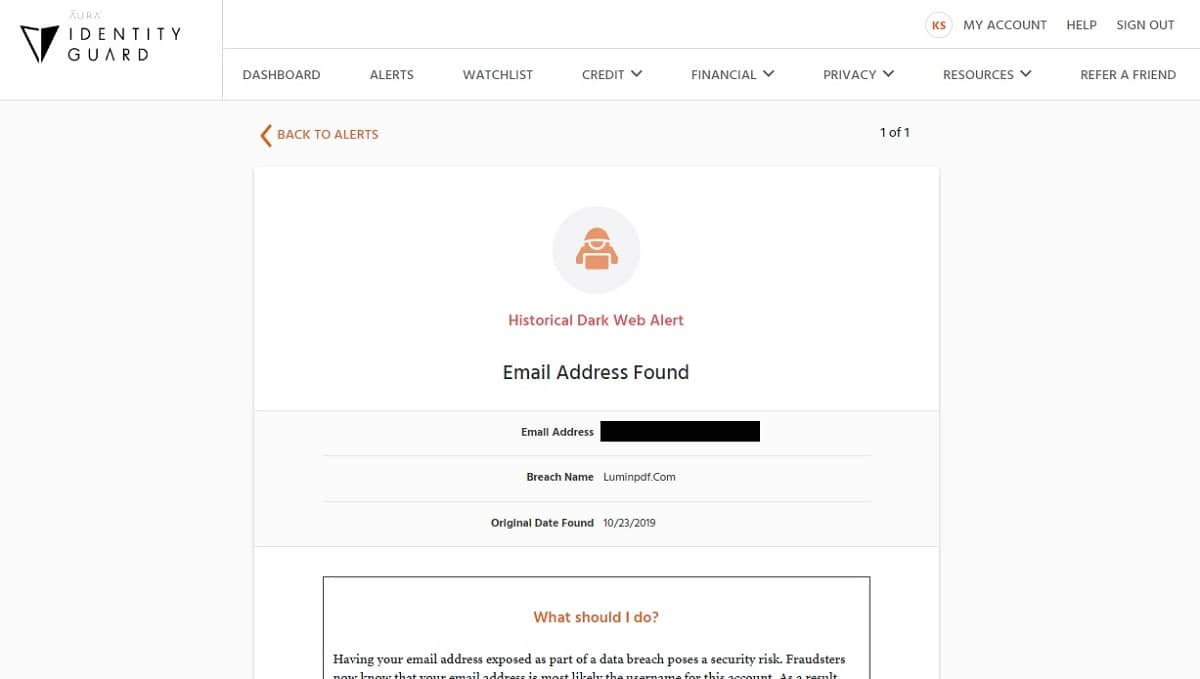

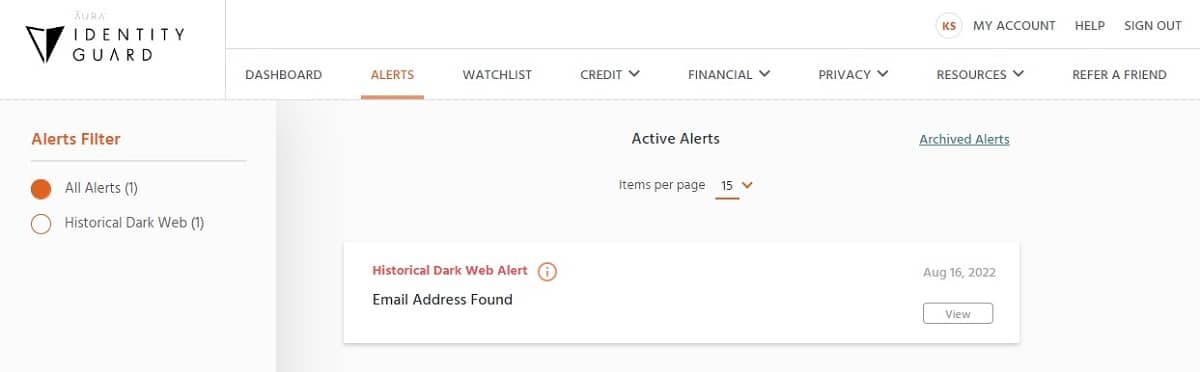

Once you verify your identity, you can see your alerts by clicking on the Alerts link on the dashboard. As soon as I signed up for Identity Guard, it found an old alert for me from a data breach from a few years ago. I already knew about it, but it was good to see the Identity Guard service catch it immediately.

As you scroll through the list of your alerts, Identity Guard will explain the alert and then give you advice on how you can protect yourself based on the type of alert. Once you take care of it, you can choose to archive the alert so that it doesn’t continue to show up in your Identity Guard dashboard.

Dark web monitoring

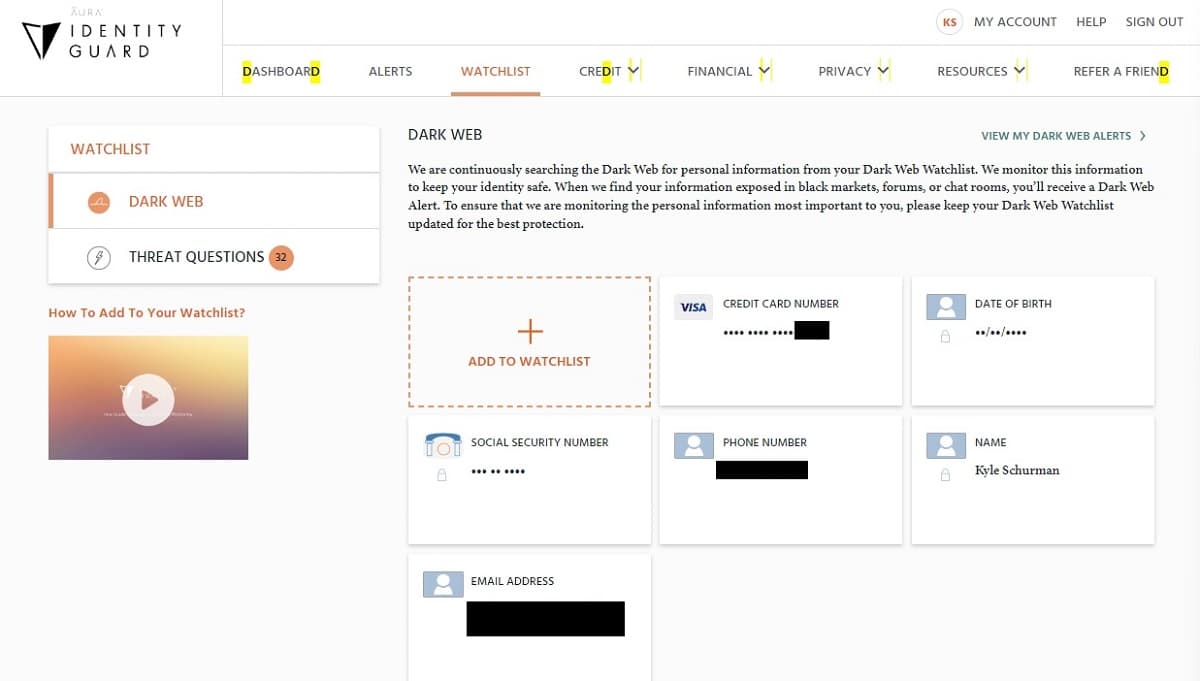

Identity Guard uses its Watchlist feature to inform you about the types of personal information it is tracking on the dark web for you.

The dark web consists of non-traditional websites, chat rooms, and similar areas of the internet where cybercriminals gather. They use these sites to buy and sell personal information from regular people, hoping to put together enough personal information to be able to steal someone’s identity. Things like passwords, account numbers, phone numbers, SSNs, and email addresses all can appear on the dark web, placing your identity in jeopardy.

When you click on Watchlist from the Identity Guard dashboard, you will see the personal information that Identity Guard is tracking on the dark web. If the service finds some of your information, it will send you an alert.

You can add additional information for Identity Guard to track on the dark web through the Watchlist screen, including your health insurance identification numbers, loyalty card numbers, passport numbers, and other types of personally identifying information.

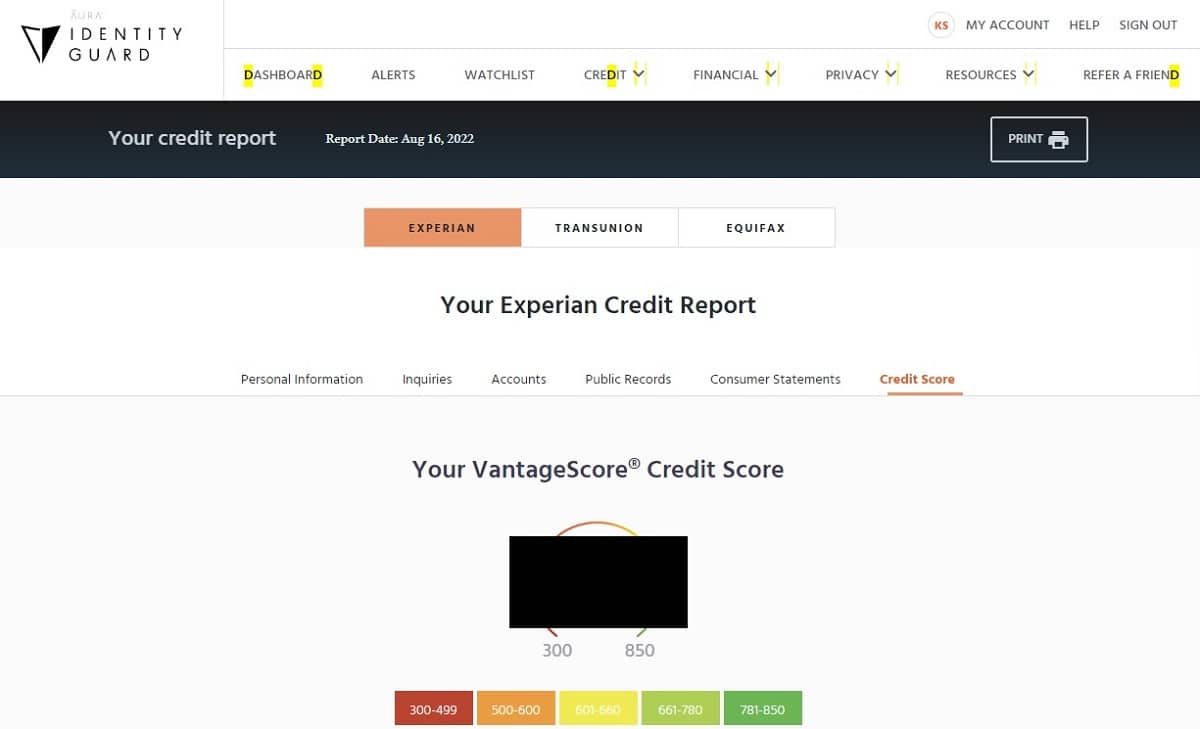

Free credit report and monitoring

If you sign up for the Total or Ultra tiers in Identity Guard, you can receive a copy of your credit report each month, and you can see a representation of your monthly credit score. You will need to be an Ultra subscriber to receive annual credit reports from all three credit bureaus.

Understand that the credit score Identity Guard displays is actually an estimate of your score, based on your credit bureau information. Lenders often use different means of calculating your credit score, so the number a lender gives you may not perfectly match what Identity Guard displays. But the Identity Guard credit score is a relatively accurate estimate.

You can use the copies of your credit report to verify that the information is accurate. If you find something that is inaccurate, it may indicate that you are in danger of identity theft. You should contact the credit bureau to try to fix the issue as soon as possible.

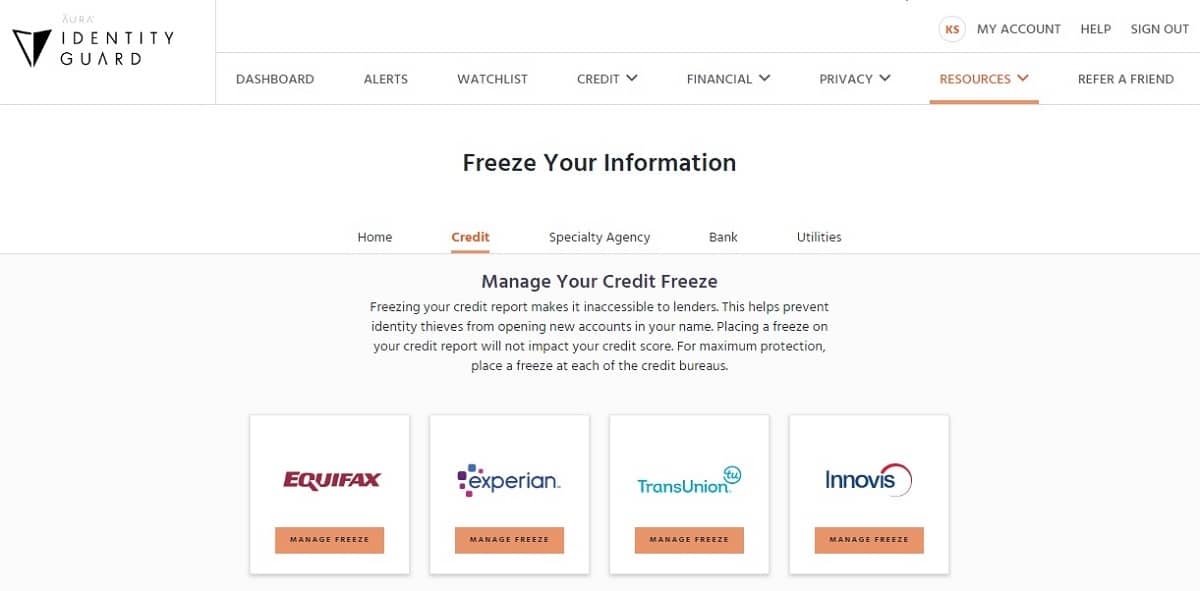

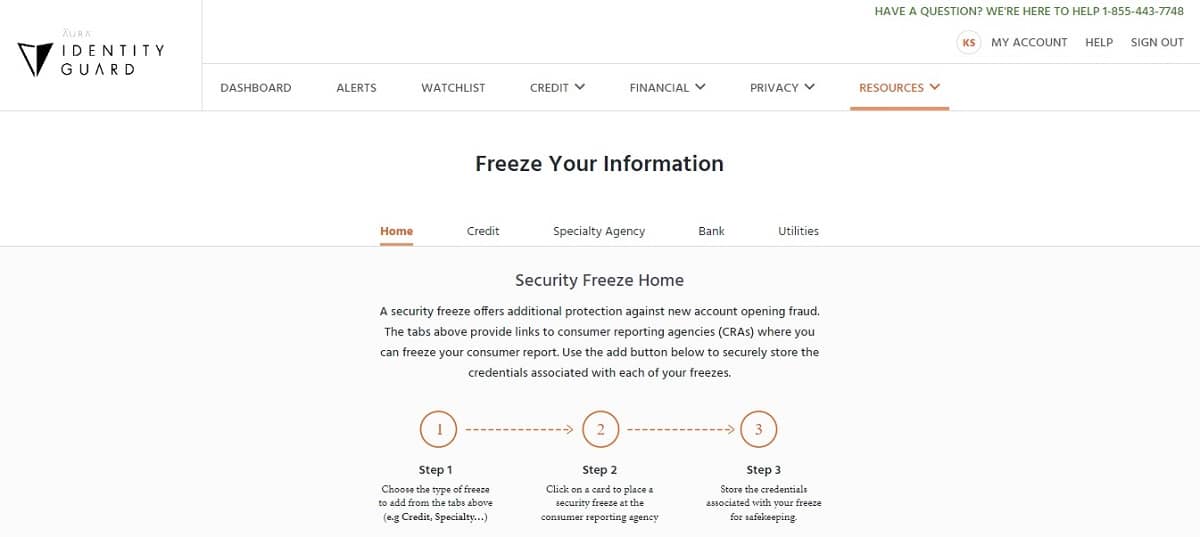

Freeze your credit report

One of the ways to prevent criminals from opening financial accounts or taking out loans in your name is by freezing your credit. When you freeze your credit report, lenders are unable to access it, so they will not allow the opening of new lines of credit in your name.

You can freeze your credit report through Identity Guard at all three primary credit bureaus (Equifax, Experian, and TransUnion), as well as at Innovis. You also can freeze your personal information at places that specialize in things like payday loans.

Just click on the Security Freeze box on the dashboard, and you can access all the options for freezing your credit reports and other personal information. You cannot simply freeze your credit through the Identity Guard interface, though. Identity Guard will send you to the website of the service through which you will be freezing your information (you need to enable popups in your browser.)

Remember that if you choose to freeze your credit report, you cannot open new lines of credit yourself, either. If you plan to apply for a loan or open a new credit card account, you will need to unfreeze your credit before making the application.

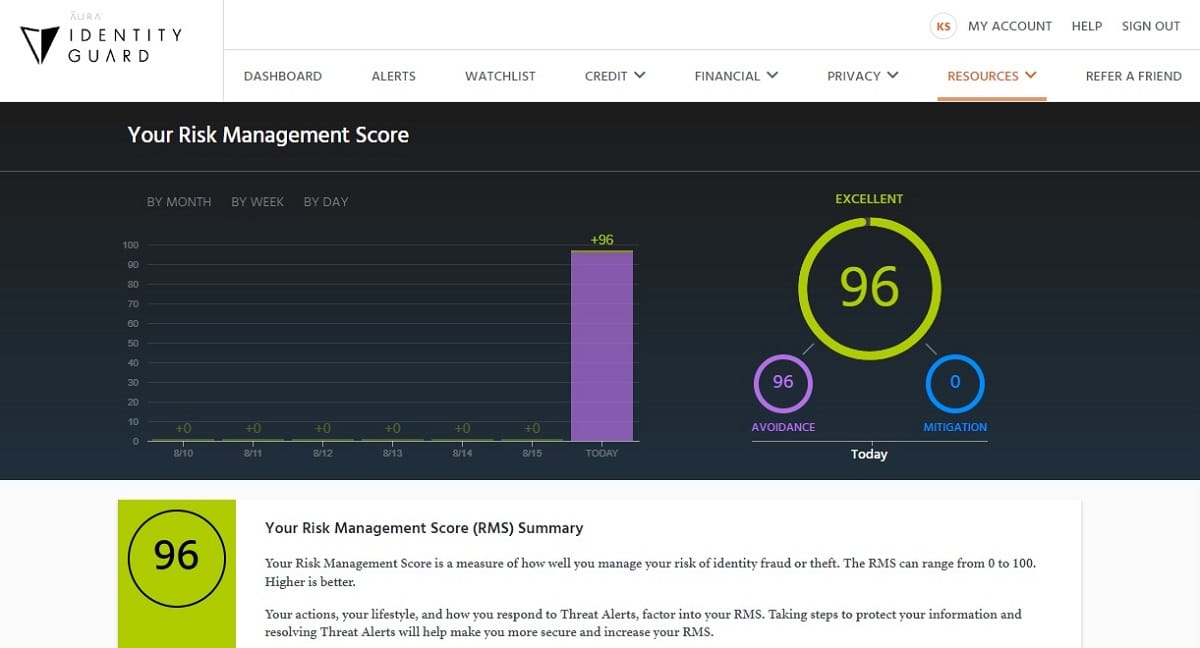

Risk Management Score

One of the most interesting and unique features found with Identity Guard is its Risk Management Score (RMS). This score gives you an estimate of how well you are doing in terms of protecting your personal information.

If your RMS is low, you may want to make some changes in how you share information on the internet.

You can access your RMS by clicking on the Resources menu, followed by clicking Risk Management Score

Address monitoring

Identity Guard will send you an alert if it detects that someone sent a change of address request to the U.S. Postal Service involving your home address. If you did not send this change of address notification yourself, it could indicate someone is trying to divert your physical mail in an effort to find your personal information and steal your identity.

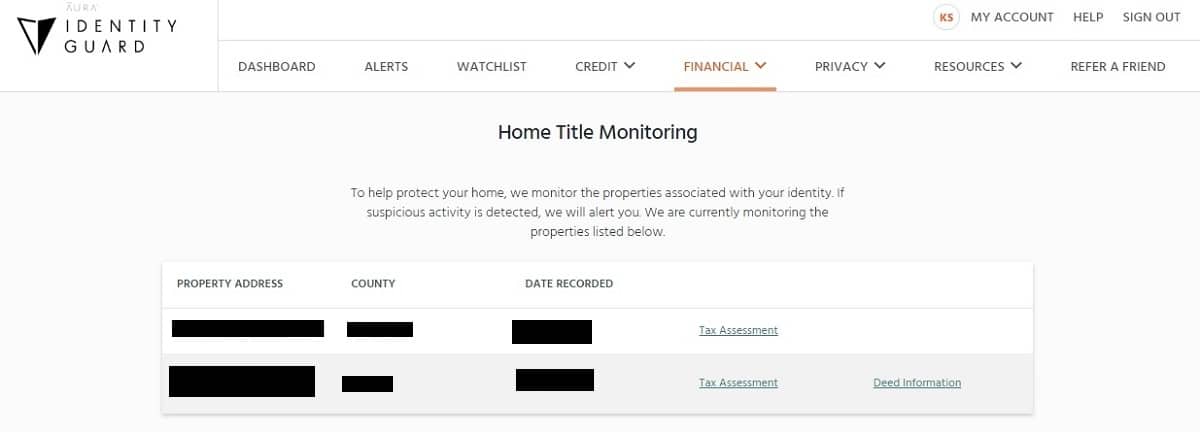

Identity Guard also offers home title monitoring, which is a feature that only a few ID theft protection services offer. If the service detects odd activity surrounding your home title at local government offices, it will generate an alert.

Through the Home Title Monitoring box in the dashboard, you can view information about your property’s deed and tax situation as well.

Court records monitoring

Should your name or personal information appear in any criminal proceedings with any law enforcement agencies in the United States, Identity Guard will generate an alert.

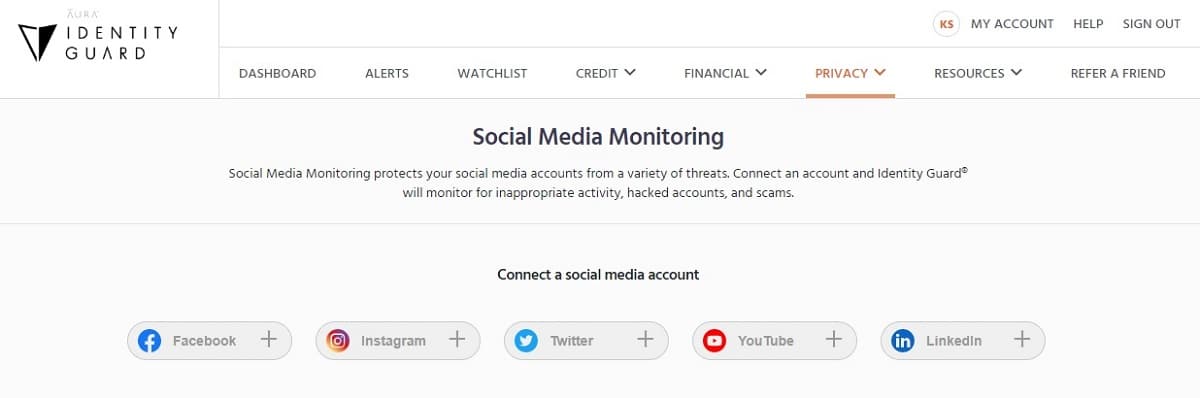

Social media monitoring

Identity Guard can monitor several of your social media accounts for odd activity. When you give Identity Guard access to your accounts, it will watch for hacks, scams, and dangerous or inappropriate posts attributed to you. You will need to give Identity Guard direct access to your account so it can monitor it.

You can receive monitoring for five different types of social media accounts, including:

- YouTube Channel

ID restoration

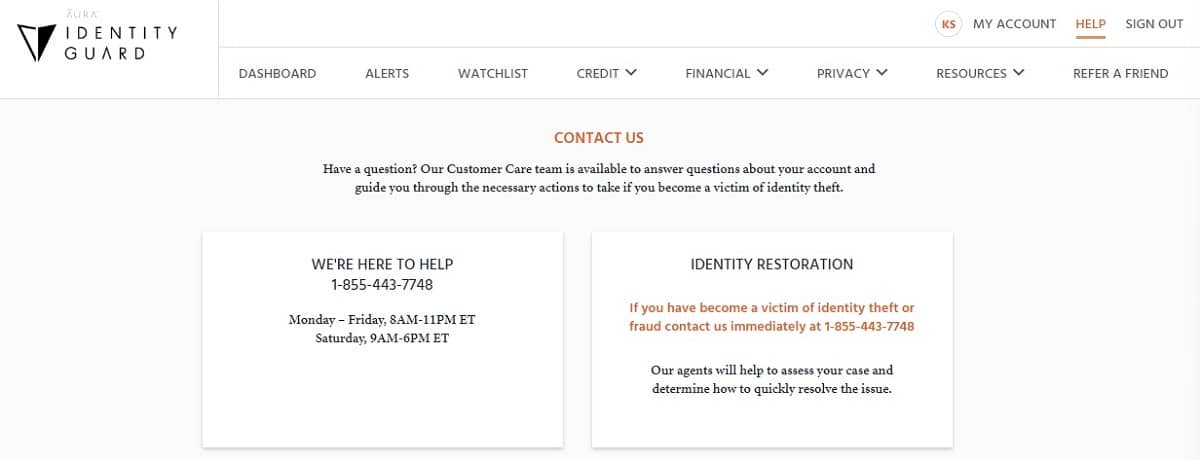

If you believe you suffered identity theft, you should reach out to Identity Guard immediately. Click the Help link in the top right corner of any Identity Guard screen to gain access to the identity restoration phone number.

When you call, the customer service team will assess the situation and help you decide whether you actually did suffer a theft of your identity. If so, it will assign a specialist to your case to help you figure out how to move forward with recovering your identity.

I did not suffer identity theft while I was performing my tests on Identity Guard – which is a good thing. Consequently, I could not test the responsiveness of Identity Guard in this area.

2FA login

Identity Guard does not offer an option for setting up two-factor authentication (2FA) to access your account. This is a disappointing omission, as 2FA provides excellent security protection for online accounts.

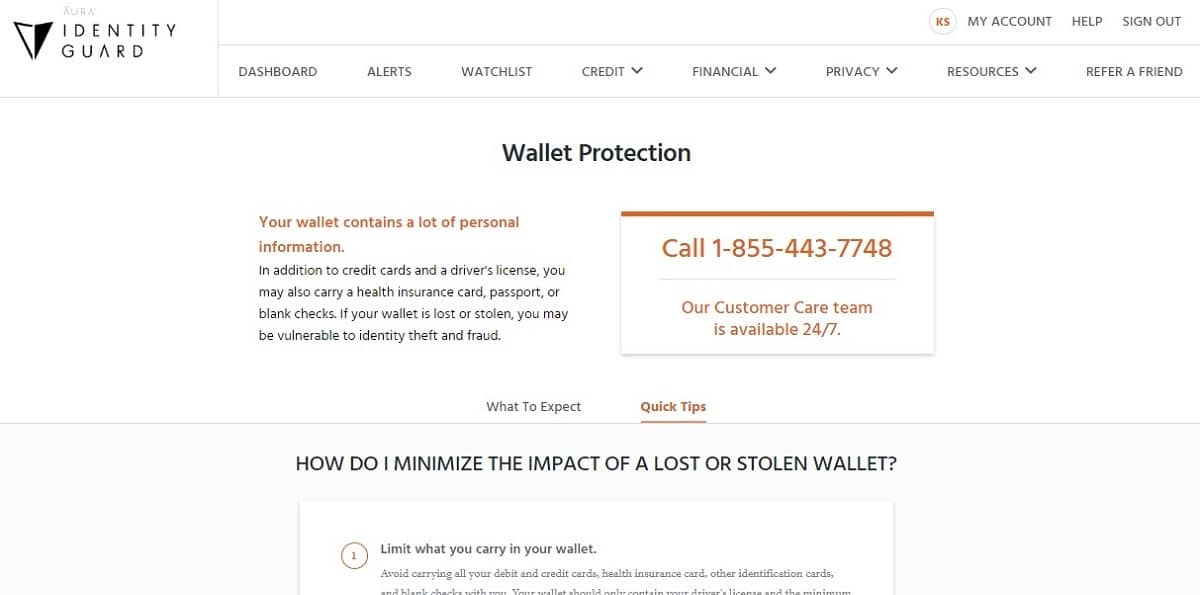

Lost wallet protection

Should you lose your wallet, quite a bit of your personal information becomes exposed. Whoever finds (or steals) your wallet will have access to your credit cards, driver’s license, and other information.

If you lose your wallet, you can call Identity Guard’s customer service team for help. The customer service team will give you advice on how to protect yourself. Should you be unsure about your credit card numbers or other information that was in your wallet, the Identity Guard customer service team can use the information in your account to help you track down the items you lost.

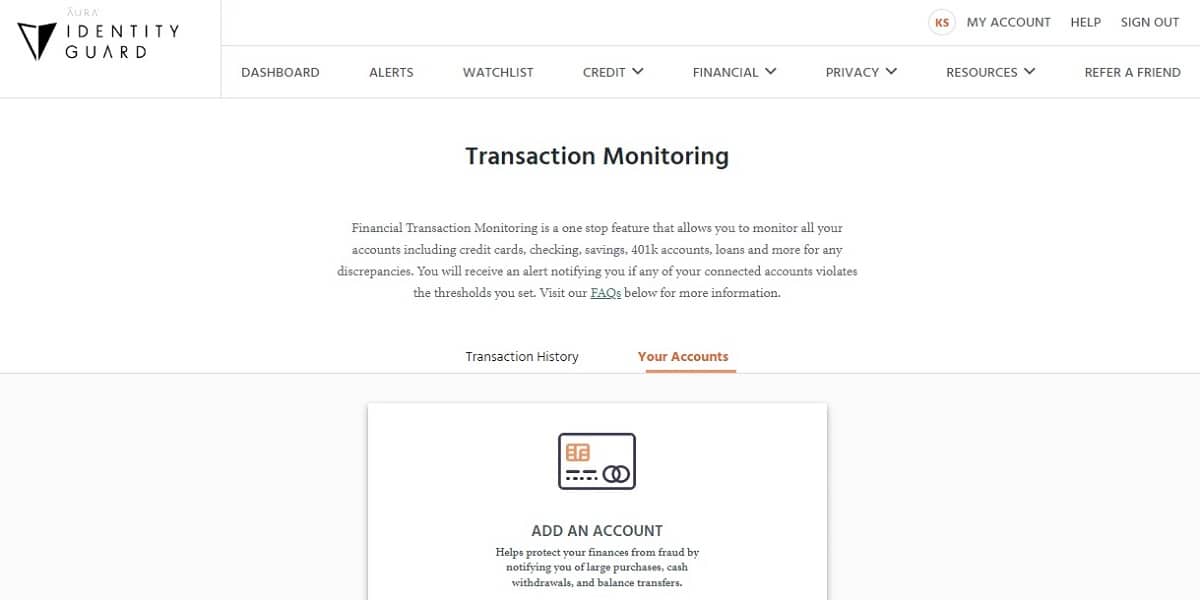

Transaction monitoring

You can click on the Transaction Monitoring box on the dashboard to set up alerts regarding your financial accounts and credit cards. If some sort of transaction occurs in these accounts that exceed an amount threshold that you specify, Identity Guard will create an alert.

You will need to give Identity Guard digital access to your accounts to use this feature.

Signup and setup

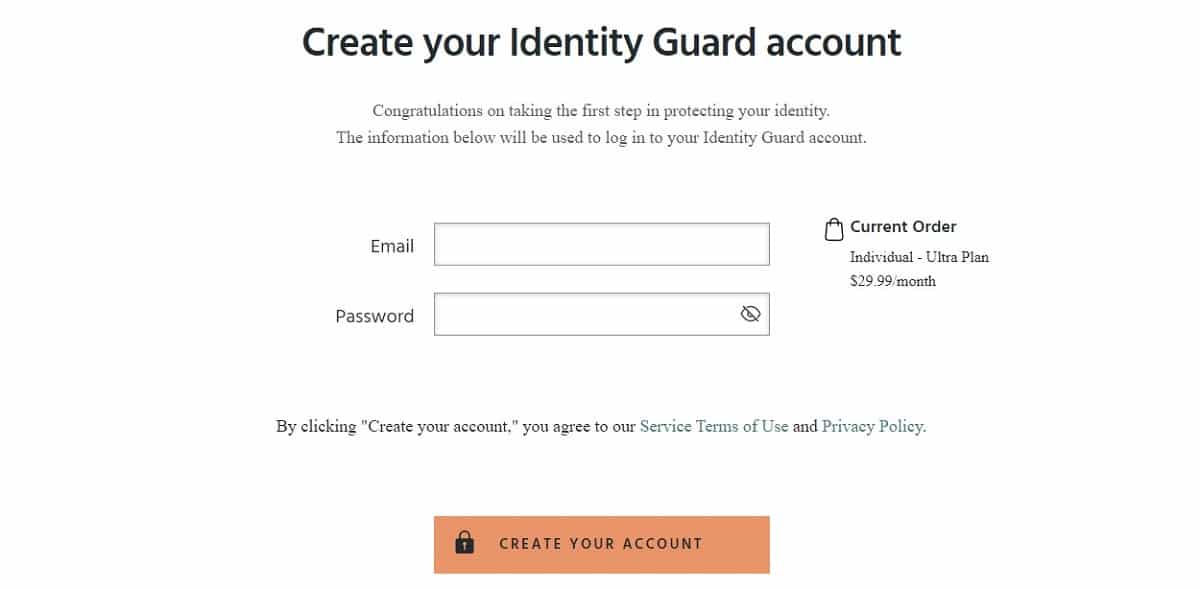

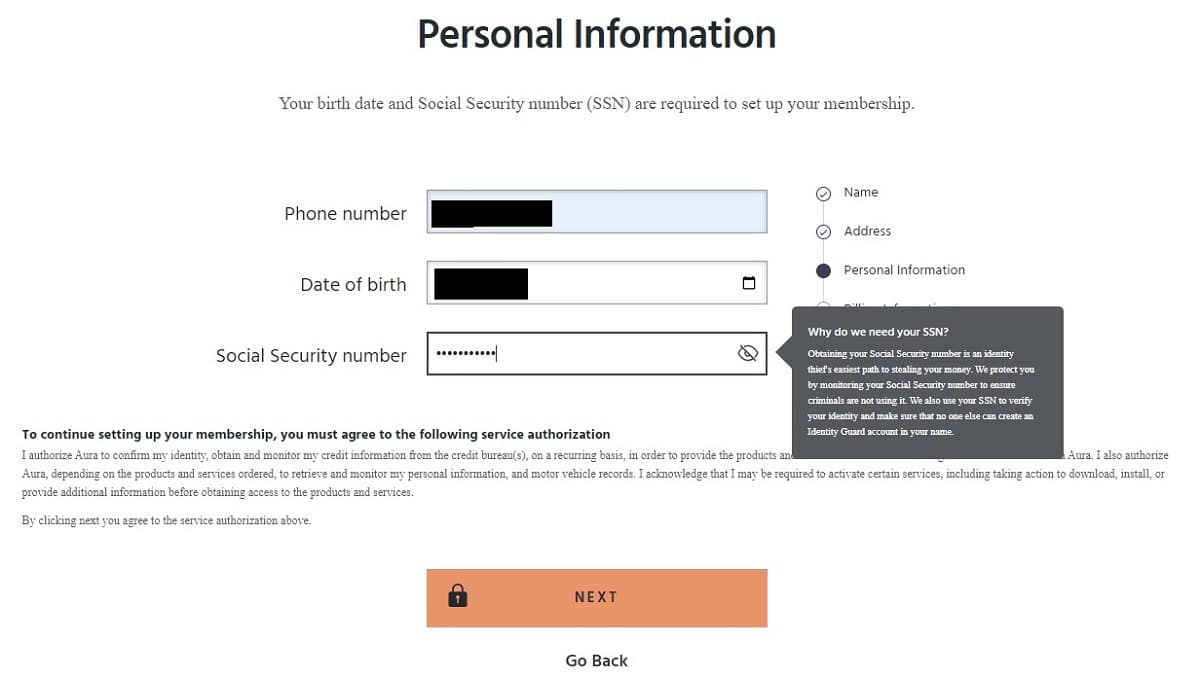

The signup process with Identity Guard goes fast. After you select your plan, you will need to create a password. Then enter your email address, name, address, phone number, date of birth, and Social Security number. Identity Guard will provide popup explanations about why it is collecting certain pieces of information, which is nice for novices to be able to see.

You will have to provide a credit card or other method of payment at the time of signup. After you submit your payment information, Identity Guard will create your account in about 30 seconds. You then can log in with the username (usually your email address) and password to begin using the service.

The first time you use Identity Guard, it will give you a brief overview of how the process works. Novices may want to read through this information, but if you have some experience with ID theft protection services, you can skip it.

You can view some information regarding your identity tracking immediately. You will have to enter some additional information to take advantage of some of the other features of the Identity Guard service. You can enter this other information whenever you want. You do not have to enter everything the first time you access your account.

The next time you sign in to your Identity Guard account, you will need to re-enter the username and password. Identity Guard may pre-populate these text boxes for you, depending on your web browser’s settings.

You do not need to download anything to make use of Identity Guard. It runs inside your browser as cloud-based software.

Ease of use and design

Navigating the various features of Identity Guard is easy thanks to a well-designed interface. It has several drop-down menus, quick links, and graphical buttons that give you quick access to nearly every feature of the service.

Those new to the idea of using ID theft protection services will appreciate the simple-yet-effective design found on Identity Guard. This makes it a strong contender for those who are leery about having to learn how to use one of these services.

Novices will find popup explanations about a wide range of features in Identity Guard. Some screens list step-by-step instructions, so you can easily enter your information or take steps to protect your identity.

Identity Guard also lists its customer service phone number and a clickable Help menu on every screen. If you only access Identity Guard once or twice a month, having help screens and information readily available is a significant advantage.

However, for those who already have experience using ID theft protection services, the constant popup help screens and detailed explanations may cause some frustration.

Identity Guard will log you out of your account automatically after 15-20 minutes of inactivity. This is a security measure in case you walk away from your computer with Identity Guard open. You will see a popup window before Identity Guard logs you out, giving you the chance to remain logged in and use the service, which is a nice feature.

I thought Identity Guard ran fast without any slowdowns over my home internet connection. Clicking a menu or button did not lead to a noticeable delay, which happens with some other ID protection services.

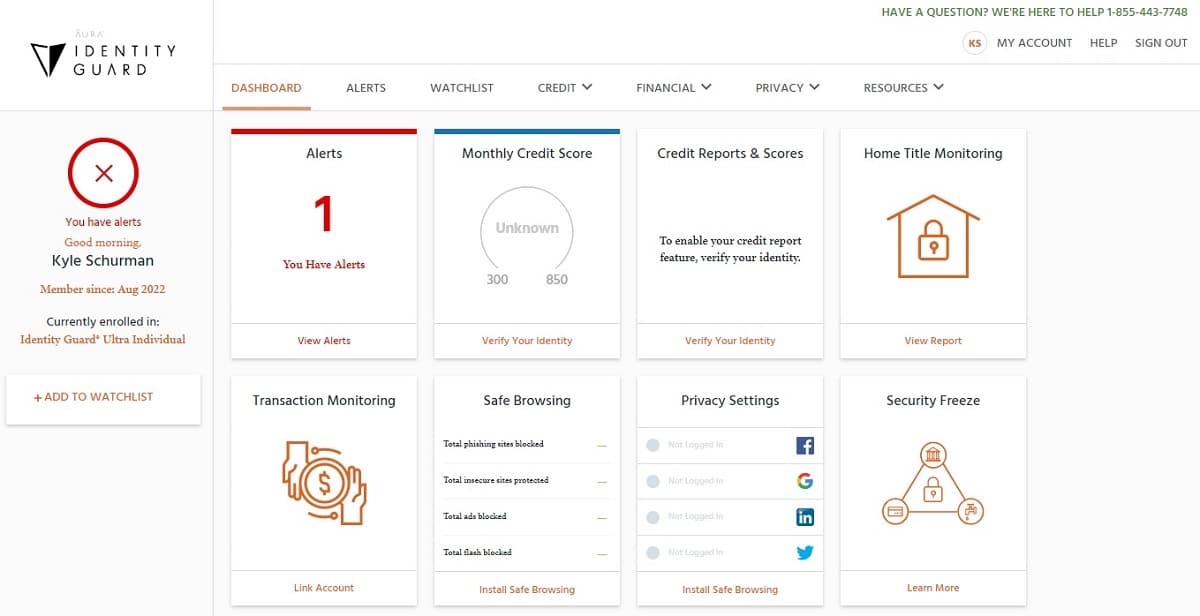

Identity Guard dashboard

Among all the identity theft protection services I’ve reviewed, I like Identity Guard’s dashboard better than any others. It looks great, providing a mixture of clickable icons and drop down menus. It is very easy to find the exact feature you want to use. The menus across the top of the screen include:

- Dashboard

- Alerts

- Watchlist

- Credit

- Financial

- Privacy

- Resources

You also have access to clickable links across the top of the screen to access your account settings, to find help with using Identity Guard, and to sign out of your account.

The dashboard itself includes graphical boxes that give you quick access to Identity Guard’s most popular features. These boxes include:

- Alerts

- Monthly credit score

- Credit reports and scores

- Home title monitoring

- Transaction monitoring

- Safe browsing

- Privacy settings

- Security freeze

- Wallet protection

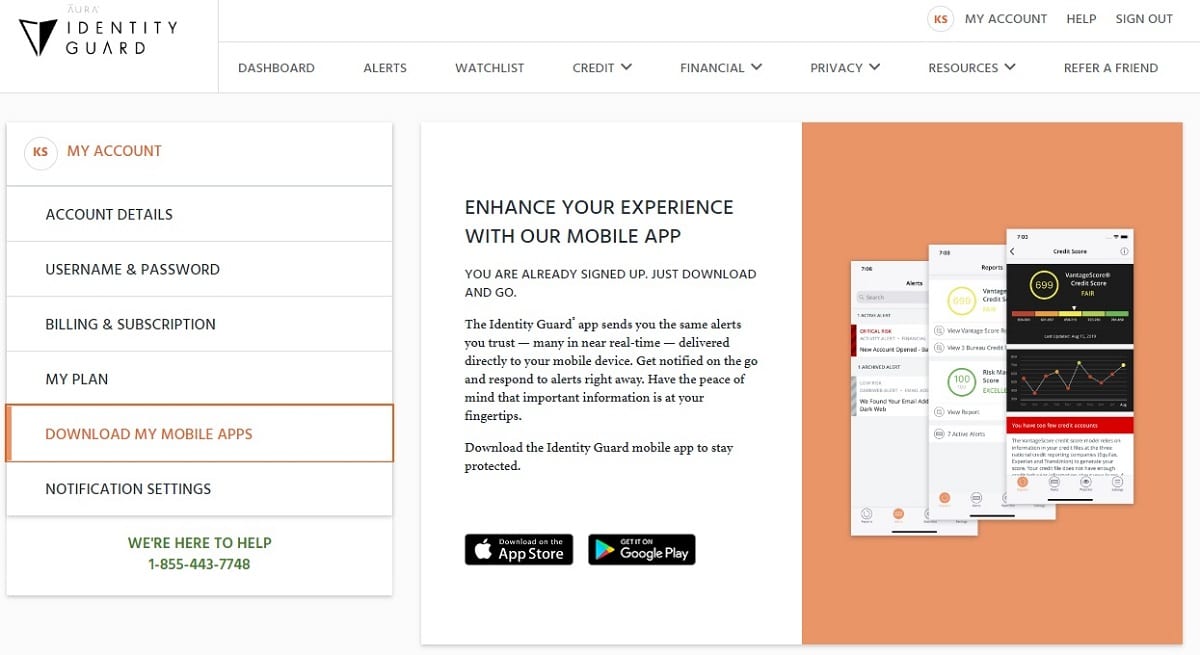

Identity Guard mobile app

If you want to be able to fully run your identity theft protection service account from a mobile app, and if this is the most important feature for you, you probably will want to steer clear of Identity Guard. This app doesn’t give you much help with monitoring your identity, other than sending you alerts about potential issues. You will need to rely on the browser version of Identity Guard to fully use the service’s features.

Identity Guard makes apps for both Android and iOS.

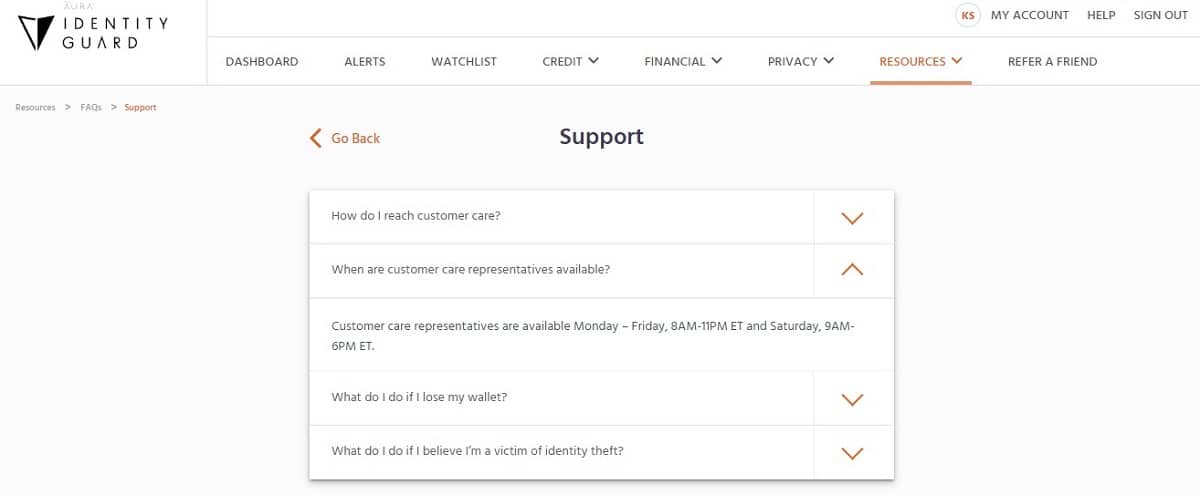

Identity Guard support

Identity Guard does a good job of making sure subscribers can access customer support options when they need them.

The customer service phone number appears on almost every screen. Additionally, Identity Guard offers multiple self-help options, making it easier to use the service and to learn more about all its features.

Its customer support team is available during normal business hours Monday through Saturday (but not on Sundays) and on weekday evenings. You can call or email customer service whenever you need help, but there is no live chat option.

If you suffer identity theft, Identity Guard’s customer support team does have an option where you can gain access to a live person 24/7.

During my test calls to the Identity Guard customer service team, I was able to speak with a live person within a few minutes during normal business hours.

Expect to receive some marketing email messages and emails designed to help you make the most of Identity Guard’s features. These may come as frequently as a few times per week, which some people will dislike. However, generating these types of emails is something that every identity theft protection service does, and you have very few options for putting an end to them.

Identity Guard: Pricing

| No value | Identity Guard |

| Sitio web | identityguard.com | Subscription periods | Monthly or annually | Special offer | 7-day free trial | Price per month | $8.99 (Value Individual tier) | Lowest annual price | $65 (Value Individual tier) | 4-year pricing plan | $300 (Ultra Individual tier) | Lowest annual price (Family) | $150 (Value Family tier) | Highest annual price (Family) | $399.96 (Ultra Family tier) | Money-back guarantee | With some tiers |

|---|---|

| Coste mensual mínimo | $5.39 SAVE 40% on a basic plan |

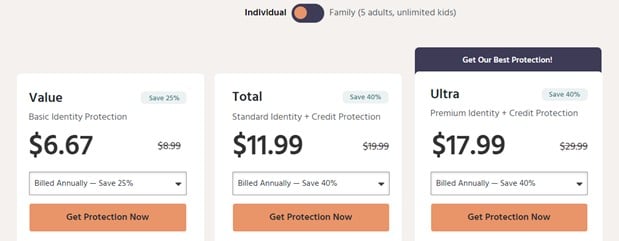

Identity Guard offers more pricing tiers than the average identity theft protection service. Its lowest-priced tier is one of the cheapest available among ID theft protection services. However, its priciest tier ranks higher than its competitors, other than LifeLock.

You will have the option of paying month to month or annually with Identity Guard. The annual payment plan offers roughly a 26% discount over the 12-month period versus paying month to month.

Auto renewal options

You will need to agree to Identity Guard’s automatic renewal process when you subscribe to the service. This is something that every major identity theft protection service does. With the renewal process, Identity Guard automatically charges your payment method when your subscription comes up for annual or monthly renewal.

This can be a frustrating situation for those who plan to cancel the service but then forget to do so before the renewal deadline.

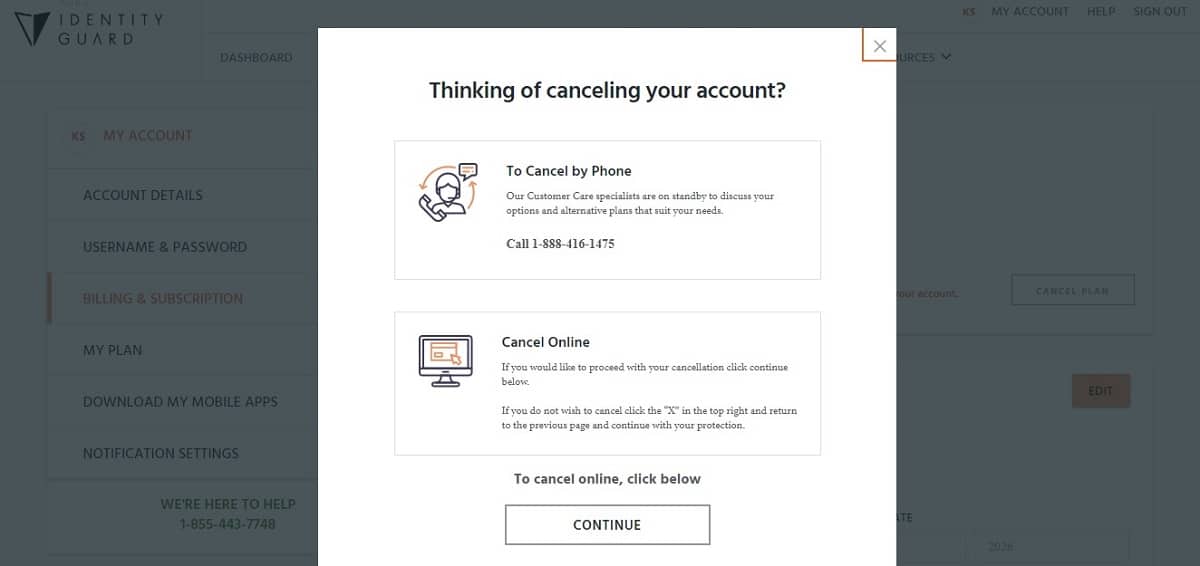

How do I cancel Identity Guard?

As with the majority of identity theft protection services, canceling can be a bit of a hassle. Some customers report through online reviews that they continue to receive charges for their subscription, even after they believe they canceled.

With Identity Guard, after we tested the features found with this ID theft protection service, we also went through the cancellation process, so we can give you advice on how to cancel the Identity Guard service.

To cancel Identity Guard, you will need to dig through your account settings screens. Click on My Account at the top right of the dashboard screen. Along the left side, click on Billing & Subscription. You then will see a Cancel Plan button along the right side. Click on it to start the cancellation process.

You also can cancel via a phone call to customer service. Your subscription remains active until the official end of your subscription period, even after you cancel. There is no refund for the unused portion of your subscription.

As you are going through the cancellation process, you should take screenshots of the notifications you receive, and you should keep your emails. Should you end up with a dispute over the cancellation, you will want this evidence available.

Additionally, you should read through the Identity Guard terms of use before signing up for the service. This document describes the legal ramifications of being a subscriber. Should anything change with regard to the service’s offerings, it will appear in this document first.

One final piece of advice: I would always use a credit card to subscribe to an identity theft protection service like Identity Guard. I did not have any problems with canceling Identity Guard, but if you do when you attempt to cancel, your credit card company will have a better chance of helping you dispute the charges than your bank.

Identity Guard pricing tiers

Identity Guard offers both a family and an individual pricing plan. The family plan allows two adults in the household and all children under the age of 18 to be part of the plan. You then have three pricing tiers within those two pricing plans.

- Value: The Value tier offers only basic features, including data breach notifications, dark web monitoring, and $1 million of ID theft protection insurance if you lose your identity.

- Total: The Total tier includes everything in the Value tier, along with bank account monitoring, credit monitoring at all three credit bureaus, and a monthly credit score from one bureau.

- Ultra: The Ultra tier includes everything in the Total tier, along with social media monitoring, credit card monitoring, investment account monitoring, crime in your name monitoring, USPS address change monitoring, and an annual credit report from all three bureaus.

The majority of users will want the Ultra tier, but those who have a simple financial life can probably receive adequate protection in the Total tier. As your financial life becomes more complex, you could upgrade to the Ultra tier in the future. The Value tier’s features are not going to give you much of a chance to catch an identity thief before something happens to your information.

You can choose to pay each month, or you can save money by agreeing to pay for an annual plan. When you pay for the annual plan, you receive a discount that’s roughly equal to two months of the monthly plan.

However, should you choose to cancel the Identity Guard annual plan after you paid the entire annual fee, you will not be able to receive a refund. So if you think you may cancel the service after a few months, you probably will want to pay monthly.

Identity Guard does allow you to change from a monthly plan to an annual plan at any time, so if you start with the monthly plan and decide you want to keep the service long term, you then can switch to the annual plan.

Pros and cons of Identity Guard

Pros:

- Partners with IBM Watson to help you monitor your identity

- Has an extremely low-priced tier for those who only need the basics

- The dashboard has a great look and design

- Provides you with timely alerts about any potential problems

- Generates a Risk Management Score to help you assess your potential identity risk

- Allows you to switch from a monthly plan to an annual plan, if desired

- Sign up process goes quickly

- Service has plenty of help screens and explanations for novices

- Delivers identity theft insurance of up to $1 million, even at the lowest pricing tier

- Gives you full credit monitoring from all three bureaus in the middle pricing tier

- Annual credit report from all three credit bureaus in the highest pricing tier

- Offers a discount for paying annually

Cons:

- If you cancel your subscription early, you cannot receive a refund for the unused time

- Requires auto renewal secured with a credit card or bank account

- Mobile app offers almost no value

- Customer service is not available on Sundays

- Lowest pricing tier probably won’t help you avoid identity theft

- No credit reports or credit score available in lower-priced tier

- Upper pricing tier has an above average price point versus competitors

Identity Guard: Our final verdict

Through my hands-on review of Identity Guard, I found a strong identity theft protection service. First and foremost, Identity Guard does a good job of monitoring your personal information, financial accounts, and other items that could leave you vulnerable to identity theft.

Identity Guard is extremely easy to use, which is great for newcomers. It provides detailed explanations about all the features it provides. Additionally, the design of the Identity Guard dashboard and interface is one of the best in the industry. It is easy to find exactly what you want to see.

I would not recommend subscribing to the lowest-priced Value tier, even though it has a great price point, because it really doesn’t track much information. However, it does offer a $1 million insurance policy regarding costs you have related to recovering your identity. If the insurance policy is the only reason you want to subscribe to an ID theft protection service, this tier may appeal to you.

The highest-priced Ultra tier monitors a wide variety of items related to your personally identifying information, giving you a high level of service.

At its upper pricing tier, Identity Guard costs a little more than the average ID theft protection service, but it also delivers more features in a nicer looking format than the average service.

The biggest drawback to Identity Guard is its surprisingly poor mobile app. I also would like to see some slightly tougher security measures when accessing my Identity Guard account in my web browser, including 2FA.

However, if you have no plans to use the app and if you only access Identity Guard on a personal computer at home that no one else uses, these drawbacks will not affect you.

Bottom line: Identity Guard is one of the best ID theft protection services on the market. Its above average features range from a well-designed dashboard to detailed explanations of its services to high quality monitoring features. It gives you access to credit monitoring from all three major bureaus, and it simplifies the process of freezing your credit and other personal information. If you subscribe to the highest-priced Ultra tier – which is the tier I would recommend – you will end up paying a little more than average for Identity Guard versus other ID protection services, but its features justify its price point.

Our testing methodology for identity theft protection

There is no question that the most accurate reviews of identity theft protection services require hands-on testing. That is why I always subscribe to and test the best identity theft protection services first hand.

Simply reading marketing materials and looking at the service’s website is not enough to give readers a true picture of how the ID protection service actually works. Real-world performance of these services is often different, sometimes significantly different, than what marketing materials will claim. The only way to wade through the marketing is to test the products myself.

To gain the most realistic feel for how these services work, I enter my own information in the service. Some of the information I enter should generate alerts, allowing me to be certain the service is delivering the information monitoring actions that it promises.

Additionally, I want to test the services for their ease of use. I contact customer service and technical support, ensuring that the company is responsive to its clients. After all, if you suddenly need help from one of these services, you need some reassurance that the company is going to answer the phone promptly.

As mentioned earlier, I signed up for an Identity Guard account to perform my hands-on review. I paid for this account subscription. I did not accept a demonstration or complimentary account from Identity Guard. I wanted my tests to mimic the way you as a reader would use the account.

FAQs

Is Identity Guard worth the money?

I am a believer in Identity Guard’s service, and I would recommend it to someone who is going to purchase a subscription to an ID theft protection service. Understand that you will be paying a little more than average for Identity Guard’s highest-priced tier versus competitors’ services. However, I believe the extra cost is worth it. Ultimately, you will have to decide whether Identity Guard’s prices fit into your budget and will deliver the value you are seeking.

Is Identity Guard safe to use?

Identity Guard protects the personal information you submit to make use of the ID theft protection service. Although I would like to see Identity Guard include some tougher security features, like 2FA, to access your account, it is secure enough for someone using it at home on a computer.

What company owns Identity Guard?

Aura currently owns Identity Guard. Intersections Inc., which began operations in 1996, initially founded Identity Guard. Intersections teamed with iSubscribed to rebrand itself as Aura in 2019. By the way, Aura offers its own identity protection subscription service separate from Identity Guard that includes some identity theft prevention features, financial account protection features, and safe browsing features.

Does Identity Guard monitor bank accounts?

When you give Identity Guard digital access to your bank accounts and investment accounts, the service will monitor them for odd situations that would trigger an alert. Identity Guard also can monitor these accounts for transactions that exceed a limit that you can set, sending you an alert.

Is Identity Guard better than LifeLock?

In my Identity Guard vs LifeLock comparison review, I gave Identity Guard the nod. Identity Guard has a feature set that equals LifeLock and that surpasses it in some ways. Although Identity Guard has a higher price point than some other ID theft protection services, its price over the long term is lower than LifeLock at the middle and upper pricing tiers. (LifeLock has a significant first-year discount, but its price in the second year and beyond exceeds Identity Guard.)

Should I get ID theft protection?

Deciding whether you should purchase an identity theft protection subscription is a choice you will need to make yourself. You need to take into account the complexity of your financial life, your comfort with tracking your own personal information, and your budget.

Certainly, ID theft protection services offer advantages for you. They keep an eye on your personally identifying information on the internet, alerting you to oddities that could indicate you are susceptible to identity theft.

Rather than paying a service to monitor this information for you, you could choose to save the subscription fee and keep an eye on this information yourself. By monitoring your credit reports and financial account statements, you may be able to spot oddities just as effectively as an ID theft protection service can.

However, some people do not feel comfortable trying to watch this type of information themselves, so they do not mind paying the protection service to do the work for them. Additionally, the ID protection service may catch oddities faster than you can do on your own.

Some of the people who may benefit most from purchasing a subscription to an identity theft protection service would include:

- Busy people: If you don’t believe you will have the time to keep a close eye on your information, paying for a subscription may give you peace of mind.

- Senior citizens: Retired people may not seek out loans or watch their credit reports as closely as they did when they were working. The ID theft protection service can help in a situation like this.

- Children: Kids can be victims of identity theft, just like adults can. However, parents have little to no reason to keep an eye on a child’s credit report, so paying an ID theft protection service to do this work can be beneficial.

- Past victims: Statistics show that if you were a victim of identity theft in the past, you are more susceptible to another breach in the future versus a random person. Having an ID theft protection service watching your back in a case like this can be beneficial.

I must mention here that some people have an incorrect idea about what identity theft protection services actually do.

Subscribing to an identity theft protection service does not guarantee you protection against identity theft forever. Rather, the ID theft protection service alerts you when it finds information about you that could leave you vulnerable to an identity theft situation. The service may give you some advice on how to fix the issue, but you need to take those steps yourself.

Should you suffer identity theft, again, the service does not fix the problem for you with the snap of a finger. It will give you advice on how to proceed and access to a specialist who can help you figure out exactly what personal information is in jeopardy. It should give you reimbursement for your expenses related to recovering your identity.

However, you may need to take steps like hiring attorneys, financial professionals, and private investigators to help you regain control of your personal information. The ID theft protection service will not make the recovery process instantaneous, either. It still will take several months or longer.

Additionally, ID theft protection services sometimes generate false alerts or inconsequential alerts. You really won’t know if the alert is something that should worry you until you dig into it. It can be frustrating to receive false alarms.

The subscription process can be frustrating too. Primarily, you will need to agree to an auto renewal subscription policy, which means your payment method will continue to receive charges for the service until you actively cancel it. Canceling ID theft protection services can be challenging and can require multiple phone calls.

An option for someone who doesn’t want to pay for an ID theft protection service is to simply keep a close eye on the type of information you share on the internet. Don’t give out your email address or contact information to every website that asks for it. Only make purchases from websites you trust fully. Be careful about the type of personal information you share on social media.

You also can choose to freeze your credit report at the three major credit bureaus. This prevents someone from opening a line of credit in your name and leaving you potentially liable for the balance.

No identity theft protection service is going to be perfect. You should not just assume that the services will work as well as they claim in their marketing materials. Be a little skeptical about the features and services you will receive.

As long as you have a good understanding of how these services work in real-world situations, you’re ready for any drawbacks you encounter. You also should be able to make a smart, informed decision about whether you want to subscribe.

All Identity Guard reviews

All Star Identity Guard reviews

All Identity Guard positive reviews

All Identity Guard critical reviews

All related Identity Guard reviews

See all reviewsI signed up for the ‘Total’ plan after my sister was a victim of credit card fraud. I went for Identity Guard as Iiked the idea of artificial intelligence, especially as it is powered by a big name like IBM. So far it seems easy to navigate and set-up and the reports look slick. I’ve added all of my credit cards, my SSN, my driver’s licence etc and like the idea of seeing everything in one place and receiving alerts for suspicious activity.

So far so good but I suppose the real proof of how good Identity Guard is will be if and when there is fraudulent activity on one of my accounts.