You can potentially reduce your chances of becoming a victim of cyber crime by subscribing to an identity theft protection service. If you are considering this purchase, you almost certainly will be considering LifeLock. This service, which is a division of Norton, monitors your financial accounts and your personal information, sending you alerts any time something seems odd about the use of your information on the internet.

Rigorous testing

In my 2022 LifeLock review, I will work to answer a number of questions readers often have about ID theft protection services and LifeLock, including:

- Is Lifelock worth the money?

- How does it compare to competitors like Identity Guard, Identity Force, Experian and others?

- How easy is it to use?

- What are the main features it offers?

- Is the customer support any good?

During my hands-on review, I found that LifeLock delivers what it promises in terms of giving subscribers notifications and alerts about any odd occurrences with their personal information and financial accounts. Should you suffer theft of your identity, LifeLock’s experts will help you recover your identity. This may be the best feature that LifeLock provides, as most of us would have little idea where to start after suffering identity theft. But LifeLock’s prices are so much higher than other services, it’s impossible for me to give it a surefire recommendation for all potential subscribers.

Summary of benefits: LifeLock

No value LifeLock Website https://lifelock.com/ Free trial Average email response time Identity theft insurance Up to $1 million Stolen funds reimbursement Up to $1 million Special offer $8.99 Highest price per month $23.99 Credit monitoring Investment account alerts Social media monitoring Lock your credit TransUnion only Home title monitoring Phone takeover monitoring Address allocation Dark web monitoring Crime in your name monitoring Credit reports Credit score Best deal (per month) $8.99

GET 25% off the first year

LifeLock: Hands-on review

If you choose to subscribe to LifeLock, it will do a good job of monitoring your information and accounts. It provides services and specialists who are ready to help you if you ever suffer a loss of your identity. It also provides insurance to help you cover the costs associated with recovering your identity as well. In other words, LifeLock delivers what it promises.

You could certainly perform many of the functions that LifeLock provides on your own by closely watching your credit report and your financial account statements for odd activity. But if you don’t have the time or inclination to do this, you may prefer the peace of mind of paying LifeLock to do this work for you.

However, the biggest drawback to LifeLock is that it costs quite a bit more over the long run than other ID theft protection services. You may be willing to pay extra to gain the backing of the LifeLock brand name, though.

Before I dig into the specifics of what I learned during my review, I want to mention that I subscribed to LifeLock, just like you would do. This is not a special account with fake information that LifeLock provided to me. I’m using my own information. I subscribed to the Ultimate Plus tier of LifeLock for a single person, which has a $19.99 introductory cost per month for the first year (plus sales tax).

LifeLock features and insurance

I’ll review each of the features available in LifeLock and how they stacked up during my hands-on LifeLock review.

Insurance and compensation

One of the most well-known aspects of LifeLock is the $1 million insurance policy that it provides to subscribers who suffer a loss of their identity. This number is a prominent part of LifeLock’s marketing materials.

But what exactly does it mean?

If you become a victim of identity theft while a LifeLock member, LifeLock says that it will pay up to $1 million for any “lawyers and experts” needed to resolve your case. This applies to all three tiers of plan.

LifeLock offers additional amounts for expenses and reimbursements that vary significantly between plans.

E xpenses associated with restoring your identity could include:

- Hiring an attorney

- Hiring a private investigator

- Opening new accounts

- Reimbursement for work time you had to miss while trying to recover your identity

- Other out-of-pocket expenses

You will need to provide proof of these expenses. LifeLock does not just hand you a big check. The service may even dispute some of your claims for expenses, so don’t expect to be able to claim just anything as part of the insurance payment.

LifeLock will also require proof of any direct monetary losses you have from your accounts before providing any reimbursement for identity theft.

Ultimate plus subscribers get up to $1 million to cover any personal expenses resulting from identity theft, and a further $1 million to reimburse any actual stolen money. Advantage subscribers are offered $100,000 for expenses and the same for reimbursements. For Standard subscribers this is reduced to $25,000 for expenses and $25,000 for reimbursements. How much you need will ultimately depend on how much you have to lose.

This is one area where LifeLock outshines its ID theft restoration service competitors. Many other services combine the insurance payments and the reimbursement payments, offering $1 million total. If you subscribe to LifeLock, you potentially could be eligible for up to $2 million. If you have accounts with significant amounts of money in them, the extra $1 million for direct financial account reimbursement may be a significant benefit to you.

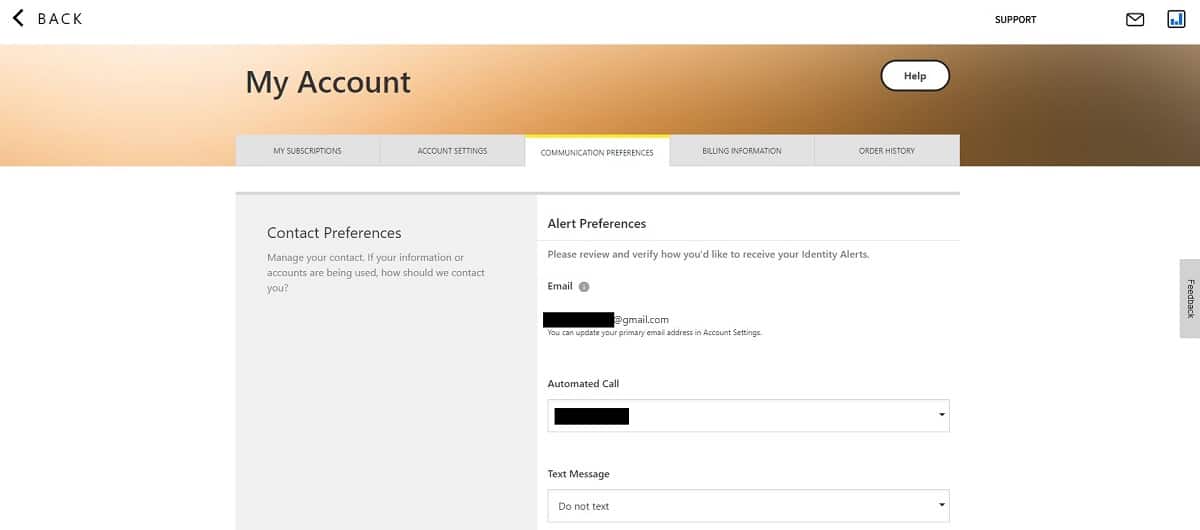

Activity alerts

Alerts are how LifeLock lets you know when it finds something related to your personal information that could indicate a problem with the security of your identity. From the alerts page, you can determine exactly how you would like to receive alerts, beyond seeing them in the dashboard. You can request an email, an automated phone call, and a text message, or you can choose to only use one or two of these notification methods.

When you click on an alert, LifeLock explains the alert and gives you some advice for how you may want to deal with it.

When people are considering subscribing to ID theft protection services, I sometimes see that they have confusion in exactly how alerts work. Some people believe that when LifeLock sends you an alert, it automatically fixes the problem. This is not the case. It simply notifies you of the situation and provides advice how to fix it. It is up to you to take those steps.

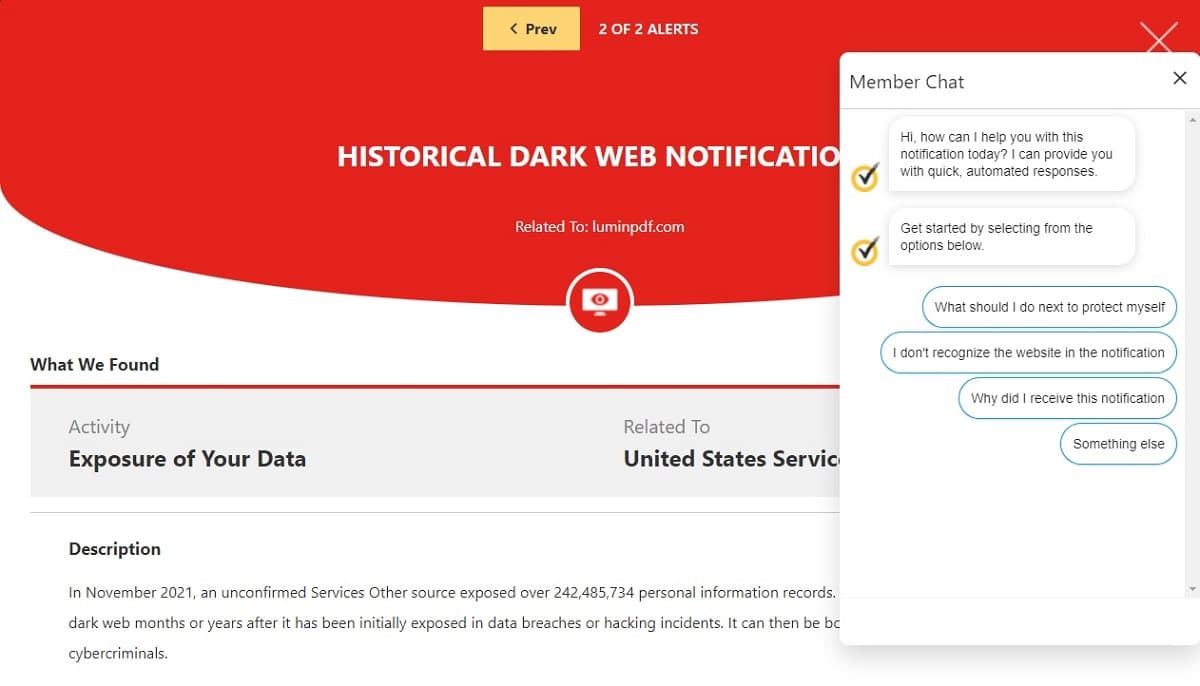

Some alerts will show a Chat button that you can click to try to gain more information about the alert. Understand that the information in the chat is AI driven at first; you are not chatting with a real person. If you go deep enough into your questions for the chat-bot, you may eventually reach a real person, but I never quite could reach a real person in the chats during my tests.

If desired, you can have LifeLock watch your monitored accounts for any transactions that exceed a certain amount, such as $500, $2,000, or another amount. This is a handy feature, but it is something you can set up and track on your own with most banking and credit card accounts.

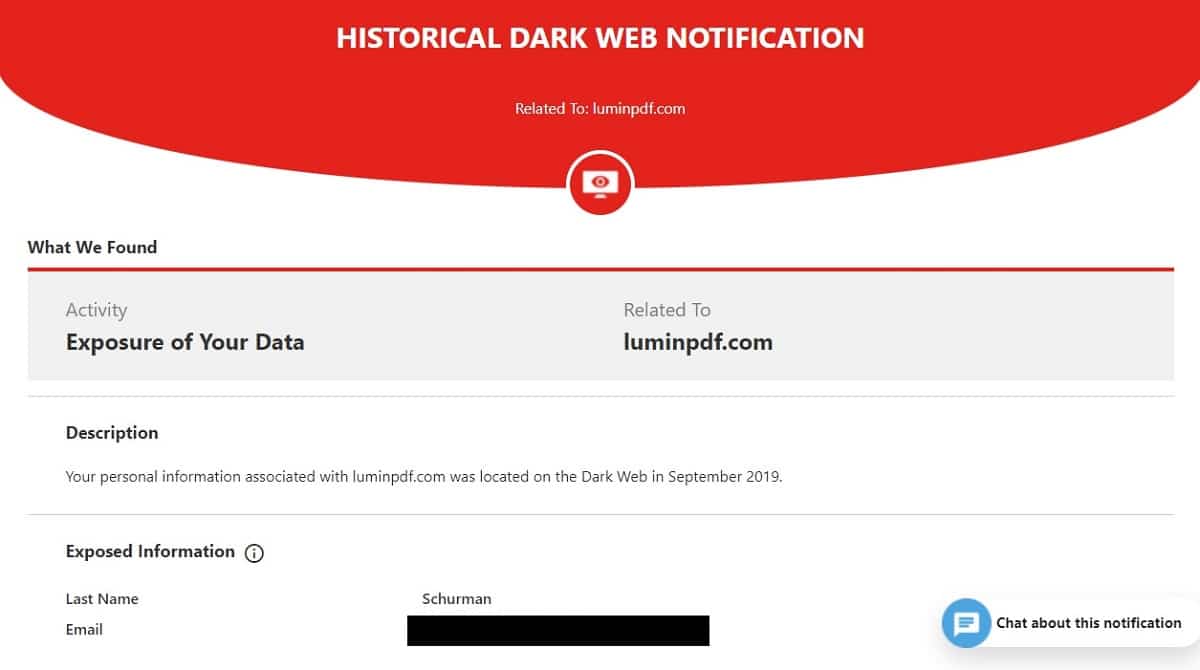

Dark web monitoring

The dark web is a criminal marketplace consisting of websites, chat rooms, and other areas where hackers buy and sell stolen personal information. If your personal information is for sale on the dark web, it increases your chances of suffering identity theft.

My first alert when I signed up for LifeLock related to a dark web situation. It turned out to be a minor issue, but LifeLock still provided a full explanation of where it found the information and the steps I could take to ward off any potential problems.

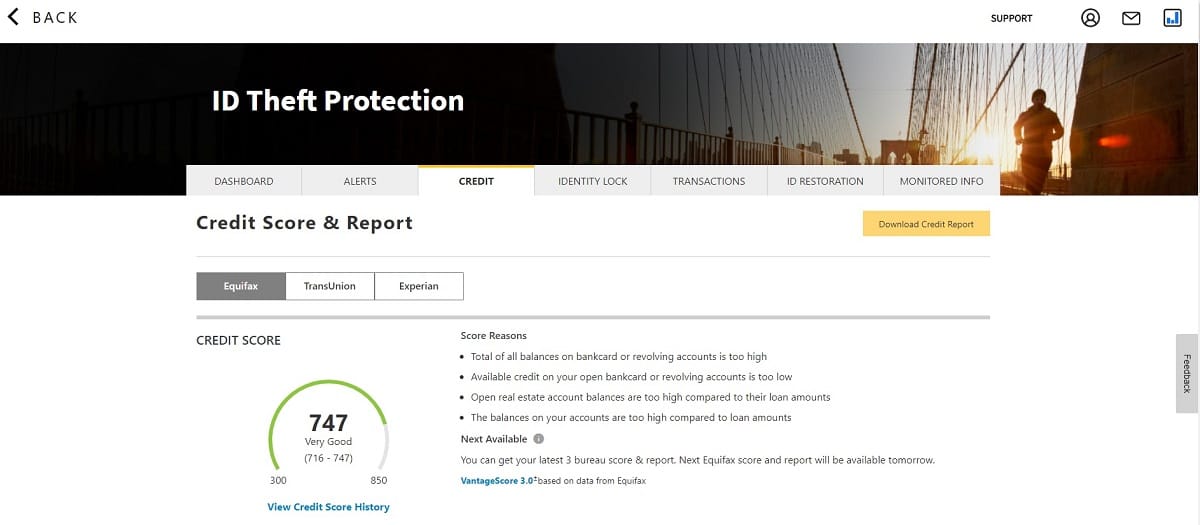

Free credit report and monitoring

The Credit tab at the top of the dashboard window allows you to see your credit score and to access your credit reports. Depending on the subscription tier you are using, you may be able to access reports and scores from all three credit bureaus (although LifeLock only shows your Equifax credit score automatically).

You can see any open credit inquiries you have too. Checking for odd credit inquiries associated with your personal information is a good way to catch the possibility of a breach of your identity.

The Credit window lists all open accounts you have as well as a calculation of your credit utilization. You can obtain this info on your own through the credit bureaus, but it is handy to have LifeLock display all of it for you in this format. LifeLock designs the layout of this page well.

Address monitoring

LifeLock will monitor any attempts that someone makes with the US Postal Service to try to intercept your postal mail by changing your mailing address. LifeLock also keeps track of all your official addresses going back 20-plus years and displays them with your monitored information. If you notice an odd address listed here, this could indicate something is off with the way someone is using your personal information

Public records monitoring

LifeLock will generate an alert for you if it finds any of your personally identifying information in the criminal justice system. Someone who stole your identity may not use it to steal money from you. Instead, this person may give your information to police to avoid taking responsibility for a potential crime.

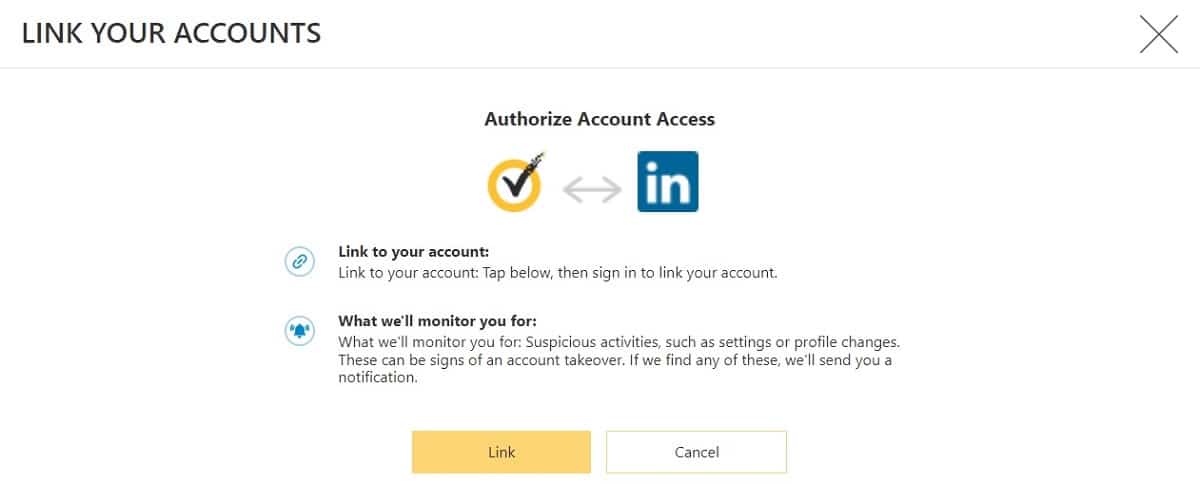

Social media monitoring

LifeLock will keep an eye out for social media posts associated with your accounts that may indicate cyber-bullying or hate speech. The existence of such posts could mean that someone is hacking your account.

LifeLock also keeps an eye on your account for any profile changes or settings changes that could indicate a hack. You would receive an alert if any of these things happen. You can sign up for tracking social media accounts for:

- YouTube Channel

Just as with your financial accounts, you will need to give LifeLock the sign-in information for your account. It will then be able to monitor the account for you.

ID restoration

During my time testing the LifeLock service, I did not suffer an identity theft situation, so I could not perform a hands-on test of this compatibility (I am not complaining about this fact).

Should you suffer a loss of your identity, you will have access to a US-based identity recovery expert from LifeLock, who can answer questions and help walk you through the process of trying to recover your identity.

You will need to call customer support at LifeLock to request help with restoring your identity. If LifeLock agrees that a hacker stole your identity, it will assign a specialist to your case.

Understand that you almost certainly will need to hire a local attorney to help you with the legal aspects of restoring your identity. LifeLock’s specialists will help with notifying the credit bureaus about the possibility of some of your credit information being incorrect or being related to identity theft.

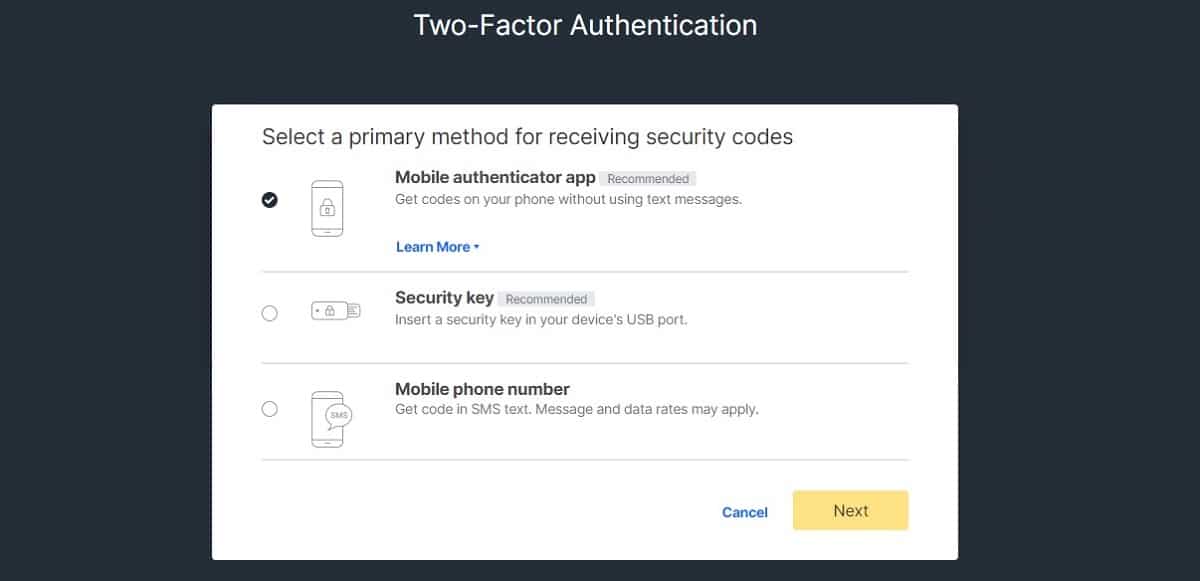

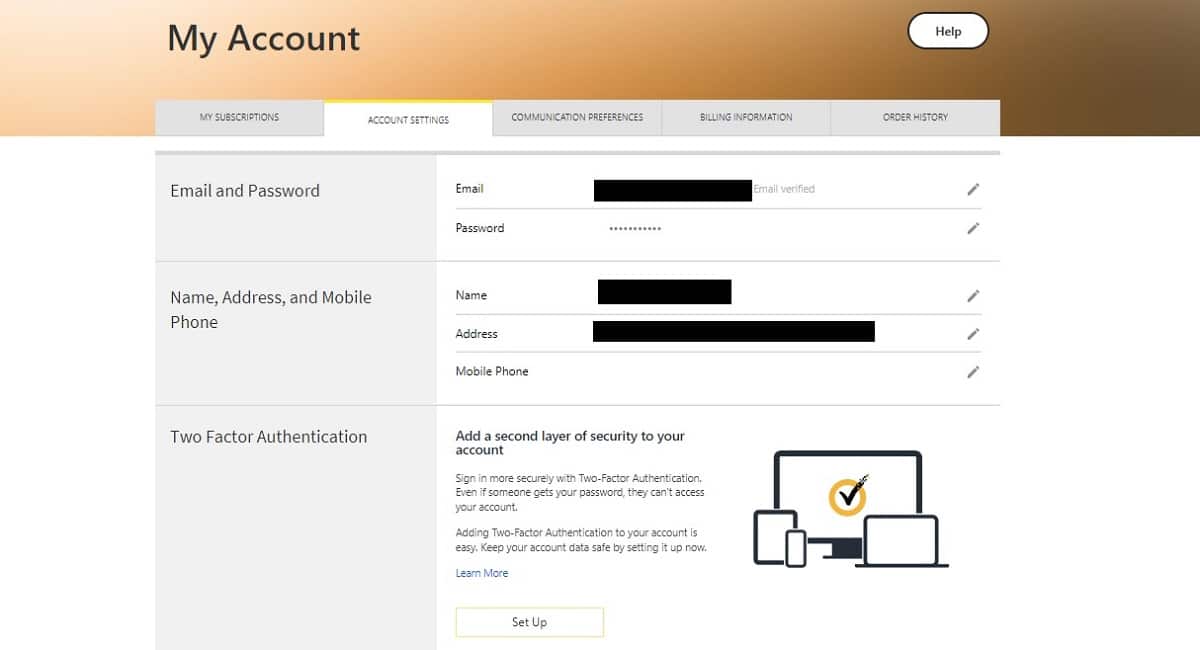

2FA login

LifeLock gives you the option of using two-factor authentication (2FA) with your LifeLock account. This means you will need to provide a username and password to access your LifeLock account. LifeLock then generates a login code that it sends to you through an authenticator app or through a text message on your smartphone. You can also create a security key using a USB thumb drive. When you enter the code or key, you can then gain access to the account.

This prevents someone from hacking your account by simply stealing your password. The hacker would also need to gain access to your smartphone.

You can turn on 2FA by opening your account settings and scrolling toward the bottom of the page. LifeLock does not automatically require you to use 2FA — though we recommend that subscribers do so.

Lost wallet protection

If someone steals your wallet or if you lose it, you potentially lose quite a bit of important information. If you previously entered your driver’s license number, debit card number, credit card numbers, and more into LifeLock’s dashboard, LifeLock’s customer service can help you cancel your existing cards and obtain replacements.

Stolen wallet protection is available in all three pricing tiers.

Data breach notifications

Should a major company announce that it suffered a significant data breach, LifeLock will send you an alert to let you know, just in case you are a customer of that company. You then can take steps to try to counteract the potential loss of your personal information. This service is available in all three pricing tiers.

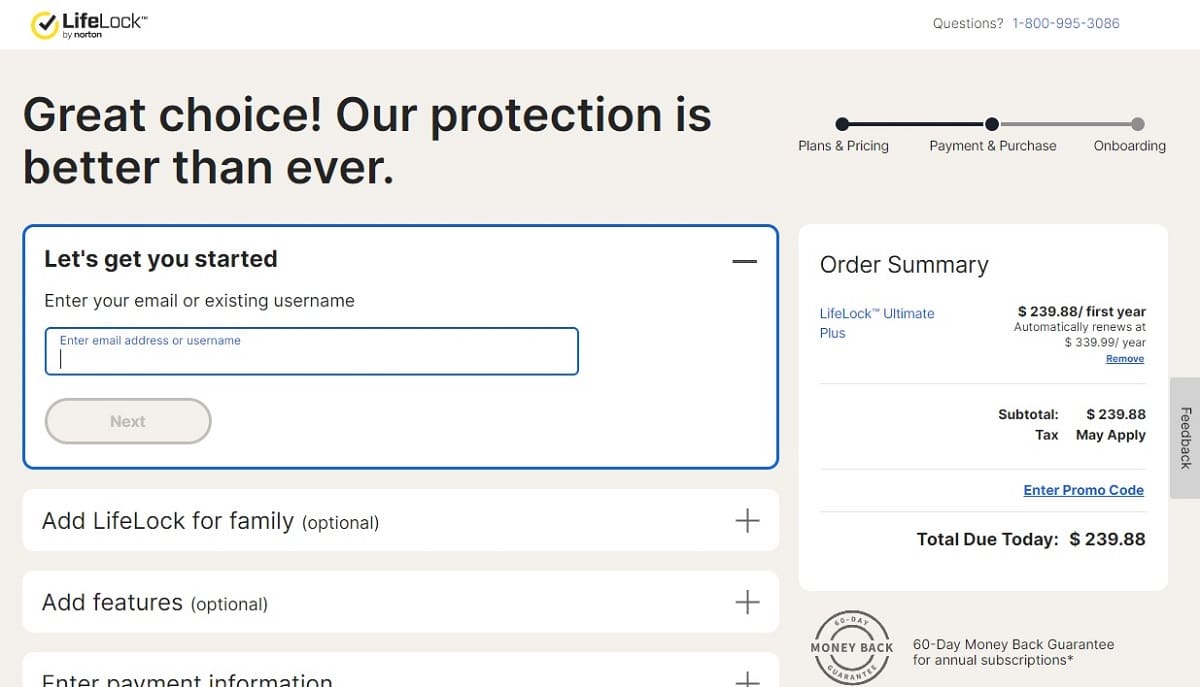

Signup and setup

The signup and setup process for LifeLock is easy. You can be up and running within several minutes with your basic tracking information.

Start by submitting your credit card information. Note that you must agree to the automatic subscription renewal process during signup. You also will need to provide some specific personal information, including:

- Name

- Social Security Number

- Birthdate

- Address

- Phone number

- Email address

You can add additional information for LifeLock to track once you begin using the service. Depending on how many accounts you want to track, it may take a couple of hours to fully enter all your information.

LifeLock recently added the ability to sign up for a 30-day free trial. However, you still must provide your payment information before you can use the trial period. LifeLock simply reduces your first-year cost with one month free if you decide to keep LifeLock.

LifeLock runs as cloud software (or over the Internet in your web browser), so you do not have to download software. You will need an active internet connection at all times to be able to use LifeLock. And it needs to be a fast, consistent internet signal, or you will become frustrated quickly with the performance (more on this later).

When you are ready to sign in to the LifeLock service, you can create a unique username and password, or you can link your account to an existing Google or Apple account and sign in with those credentials.

Ease of use and design

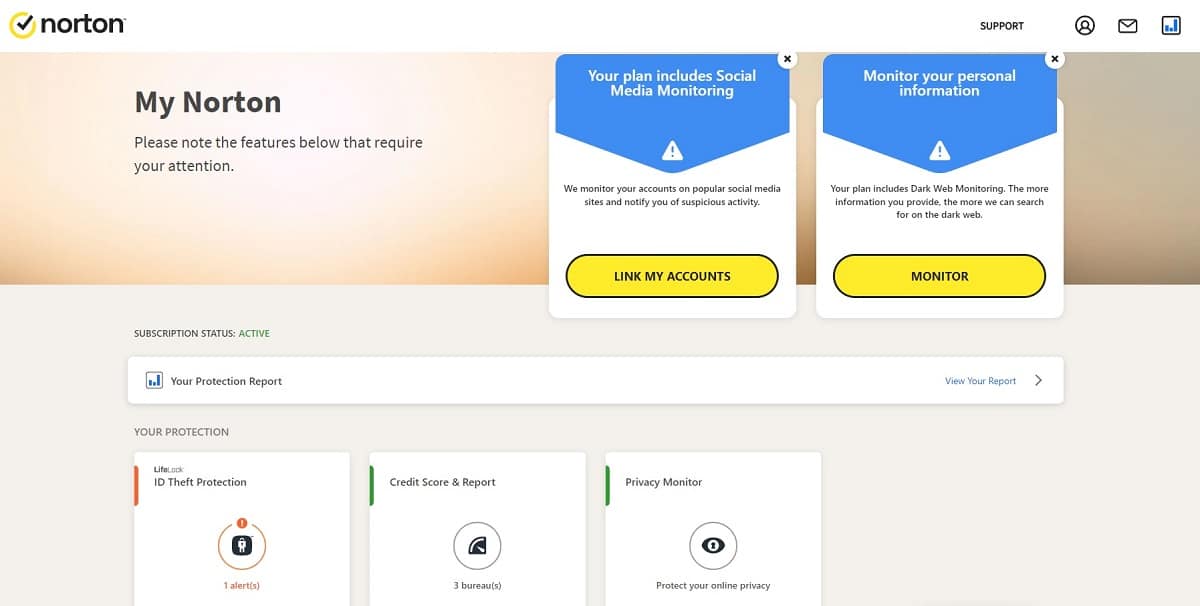

Although the LifeLock dashboard itself is pretty easy to use, it can be a little challenging to reach the dashboard. When you sign in to your account, you will be taken to a My Norton screen. If you have other subscriptions through Norton, you can access these accounts, as well as your LifeLock account, through this screen.

But if you just want to jump immediately into your LifeLock dashboard, you will have to work through a few more screens to reach it. This is an odd design that isn’t as easy to figure out as it should be. It would be much better if Norton simply placed a button to open the dashboard on the My Norton page.

The service ran a bit slower over my internet connection than I expected. Noticeable pauses of a second or two often occurred when I clicked on a button or tab. This probably has to do with the stringent security measures in place for your data in LifeLock, but when you are used to almost instantaneous responses from websites, the pauses are a little frustrating.

Additionally, LifeLock would sometimes automatically log me out of my account after 10 or 15 minutes, regardless of whether I was actively using the account and clicking between screens. Understandably, this occurs for security purposes, so you don’t inadvertently leave your LifeLock account open on a screen where someone else could see it and begin clicking on buttons. But it would be nice to turn off this feature when you are working on a personal computer at home.

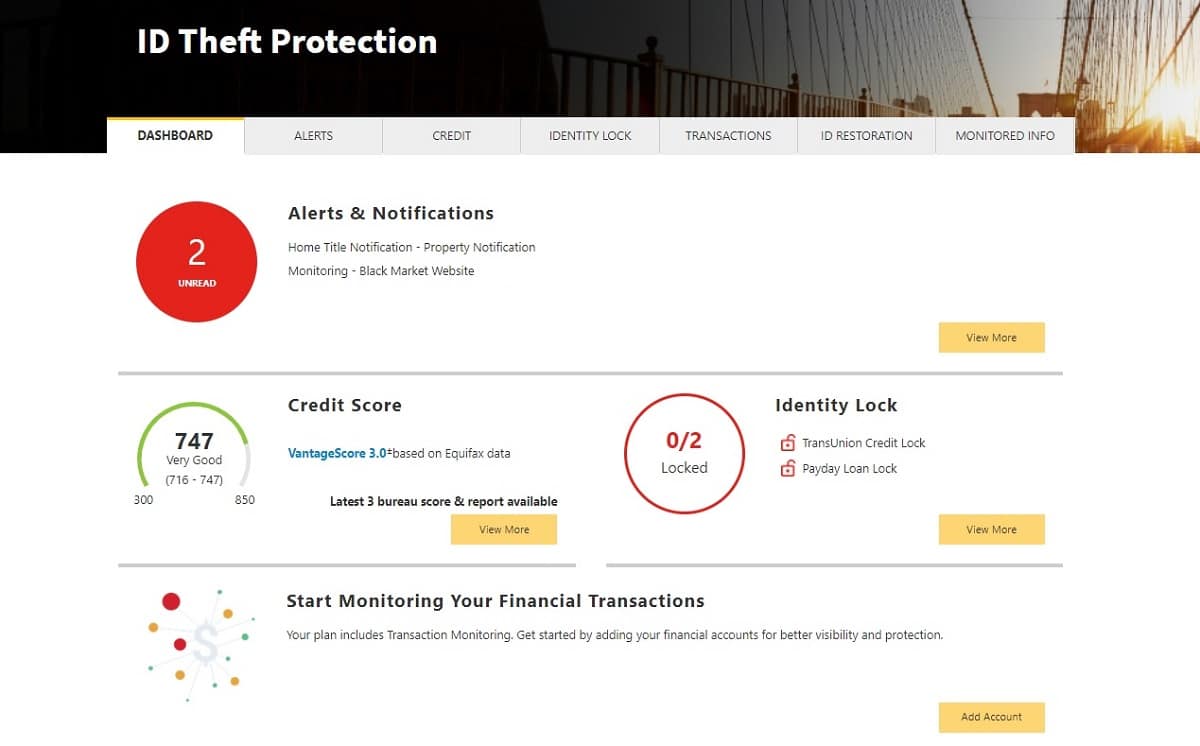

LifeLock dashboard

Once you reach the LifeLock dashboard, it is easy to find the information you want. You can quickly see your credit score, any alerts you have, and your identity lock status. If you are not yet using certain features in LifeLock, you can click a button and begin entering that information.

As you begin exploring the different features on the dashboard, any time you see a gray circle with an “i” in it, you can hover the cursor over it to see additional information.

Along the top of the dashboard window, you can click on any of the tabs to jump to a more specific topic. The tabs include:

- Alerts

- Credit

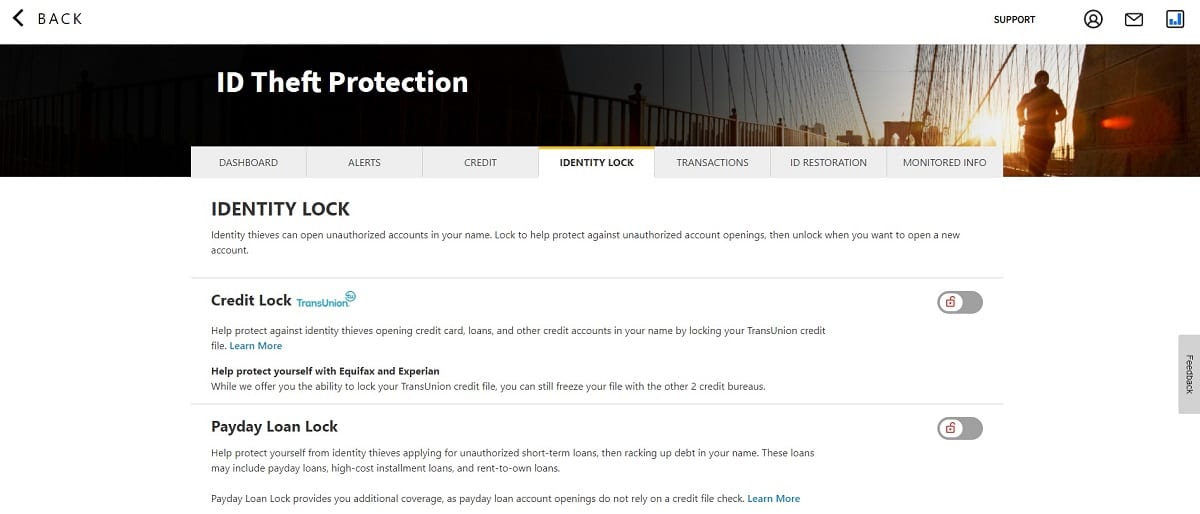

- Identity Lock

- Transactions

- ID Restoration

- Monitored Info

LifeLock support

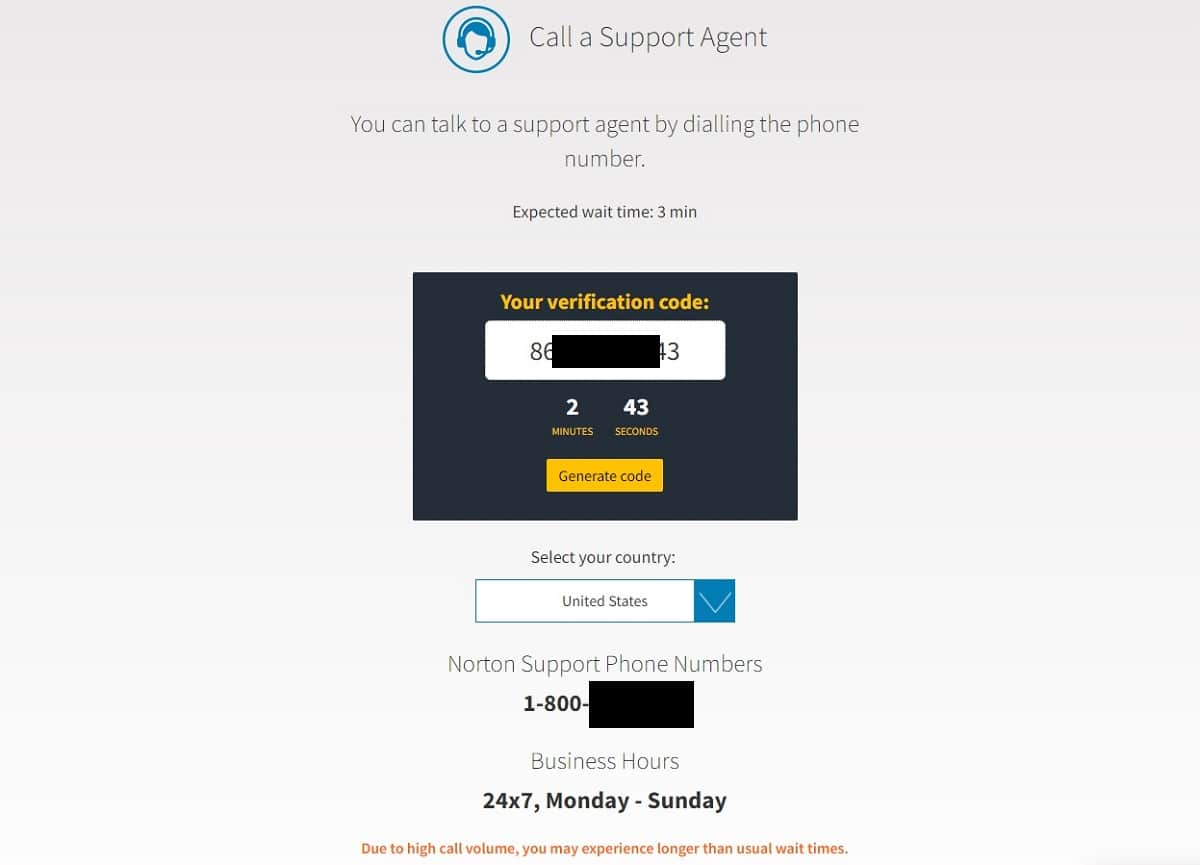

You can gain access to LifeLock’s customer support options on nearly every screen by clicking Support at the top of the window. LifeLock gives you plenty of self-help support options. If you are willing to click through numerous screens, you can eventually find a live chat option. Additionally, you can send a Facebook or Twitter message to try to access a live person in customer support.

Phone support with LifeLock is available 24 hours a day, seven days a week, but you will have to click through multiple screens to find the phone number to call. You will also need to enter a bit of information about your account to receive a verification code that you must enter before you can connect to a customer service agent via phone.

During my test phone calls, I typically had to wait anywhere from two to five minutes to speak to an agent. Honestly, I considered this level of responsiveness really good, as customer service rarely is a priority for many ID theft protection services. By making you jump through so many hoops to be able to find the customer support phone number, I think LifeLock limits the number of people calling with general questions, which leaves more agents available to deal with current customer service and technical support questions.

Excessive emails

I will mention here that LifeLock generates a lot of unsolicited email messages, both during your subscription period and after you cancel. After signing up for the service, I averaged about one email message per day, providing advice on using the service, newsletters, and other items. These messages were separate from any alert messages.

If you find these types of constant messages incredibly annoying, you do have the option of opting out of some of them through your account settings. However, you cannot completely stop the messages. These types of messages are just part of the deal with many identity theft protection services, but it seems to be significantly more frequent with Norton-operated products like LifeLock.

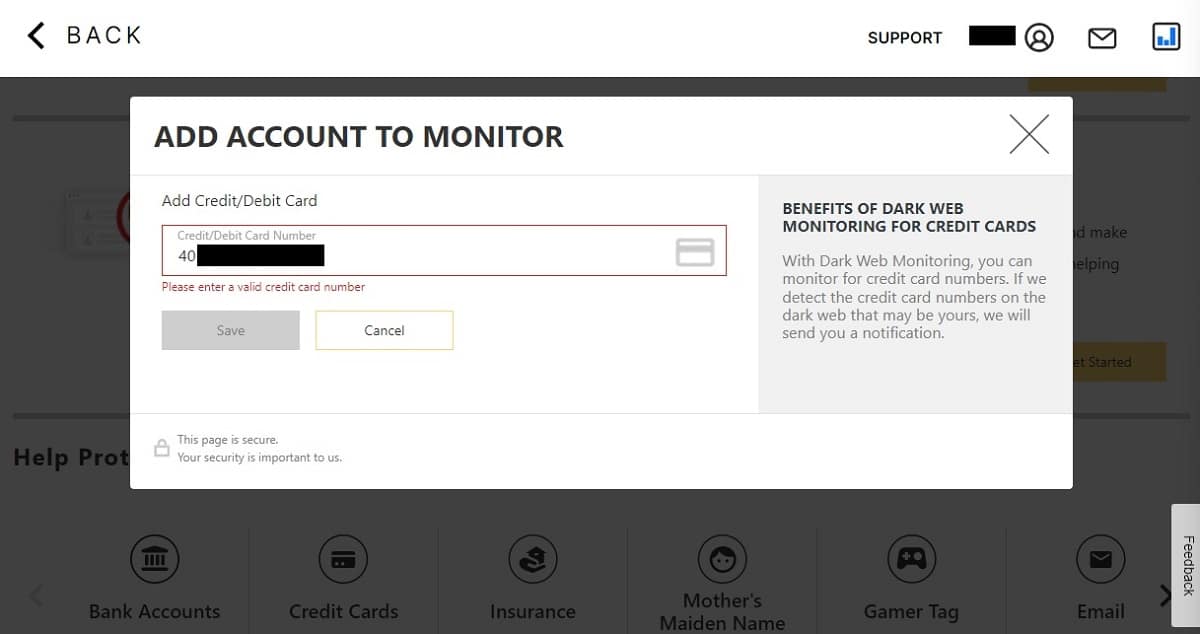

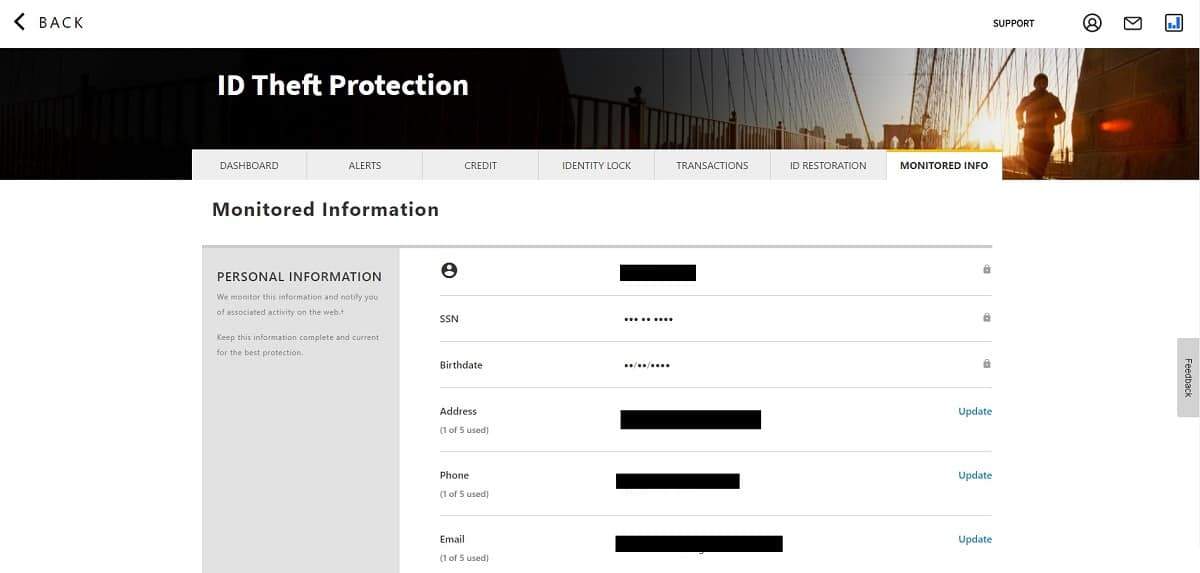

Checking and adding monitored information

If you are unsure at any point about which information you entered into LifeLock for monitoring, you can click on the Monitored Info tab at the top of the screen. If you are missing any information you want to track, you can add it by clicking a link on this page. You can also make edits to any of your monitored information on this page.

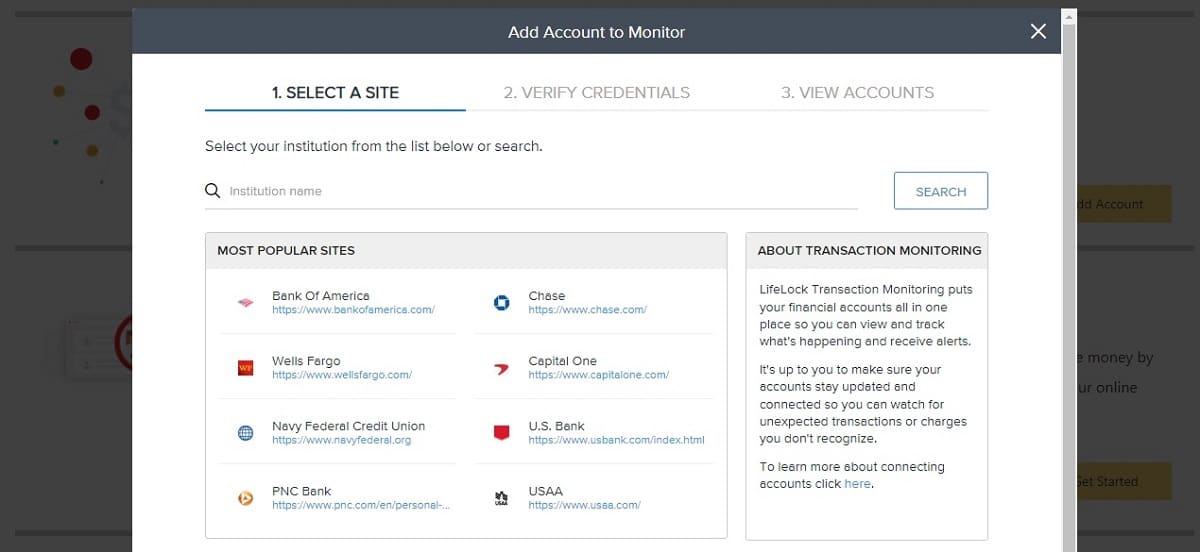

If you want to add a financial account to LifeLock to have the service begin keeping an eye on your transactions from that account, this only requires a few minutes. However, you cannot simply add your account number, such as for a credit card account or a mortgage account, and have LifeLock begin monitoring the account for you.

Instead, you will need to have an online account already existing with the financial institution that you want to monitor. You’ll then enter your login information for that online account to give LifeLock access to your information. This creates a bit of extra hassle for users who don’t have pre-existing online accounts for their financial accounts, as you would have to create your online account at your financial institution first and then add that information to LifeLock.

LifeLock can monitor your checking and savings accounts with a bank, as well as your credit card accounts, in the two highest pricing tiers. It will monitor 401(k) and other investment accounts in the highest pricing tier only.

LifeLock: Pricing

No value LifeLock Website https://lifelock.com/ Subscription periods Monthly or annually Special offer First-year discount for new customers Price per month $8.99 (Standard Individual tier) Lowest annual price $89.99 (Standard Individual tier) 4-year pricing plan $239.88 (Ultimate Plus Individual tier) Lowest annual price (Family) $221.87 (Standard Family with Kids tier) Highest annual price (Family) $467.88 (Ultimate Plus Family with Kids tier) Money-back guarantee 60 days for annual subscription or 14 days for monthly subscription Best deal (per month) $8.99

GET 25% off the first year

Before digging into the costs associated with a LifeLock subscription, I must mention that LifeLock offers a significant discount on its pricing to new customers. This discount lasts for one year before you begin paying the full price. The discount is between 25% and 40% for most pricing tiers.

Although this discount may tempt you into signing up for LifeLock, the price increase in year two and beyond will create significant sticker shock for you. In the pricing figures listed in this chart, I chose to ignore the first-year pricing discount. I believe most people who want to subscribe to an ID theft protection service are looking for a long-term relationship, which reduces the advantage of the one-year discount. I’m not complaining about paying less money for LifeLock initially, but it is important to understand exactly what you will be facing in terms of payments down the road.

Auto renewal options

When you sign up for LifeLock, you must agree to the service’s automatic renewal process. This means that LifeLock will automatically charge your payment method each time your account comes up for renewal.

This is a bit of an annoyance, as you may forget about canceling the account until it is too late. It’s especially annoying when the second-year price hike with LifeLock is so steep. You may end up with unwanted charges because of the auto renewal policies.

You do have the option of turning off auto renewal after you subscribe to LifeLock, but turning off this feature may leave you unable to access some discounts that you are eligible to receive for other Norton products. Norton makes it disadvantageous for you to turn off the auto renewal feature.

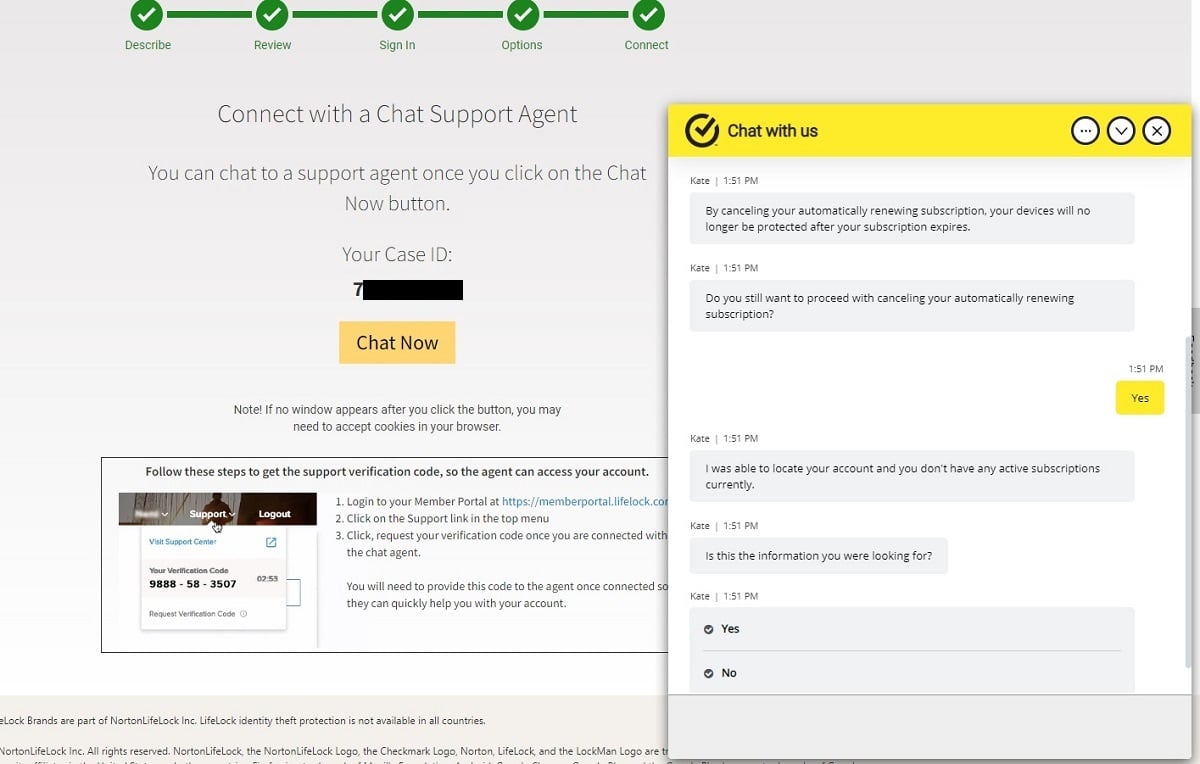

How do you cancel LifeLock?

Canceling an identity theft restoration service like LifeLock can be challenging. LifeLock does offer the ability to cancel the service, but you will have to call or make the cancellation request through live chat.

When I canceled my LifeLock subscription after performing my review, I had a pretty easy experience. It took about 10 minutes.

I went through the chat cancellation function rather than calling. The first few minutes, I was stuck with an AI chat-bot that couldn’t verify my account. It then gave me the chance to chat with a human, which I took.

After connecting with a human on chat, I still had to jump through a few hoops to verify that I wanted to cancel. Still, the process went easier than I thought. First, I received a confirmation email message regarding the cancellation. I was then told my credit card would no longer receive a charge — and LifeLock lived up to that promise. I cannot guarantee that your cancellation attempts will go as smoothly as mine did, but I was surprised at how easy the process was.

When you do cancel, you will continue to have access to LifeLock until your subscription period runs out. During this period, expect to receive multiple emails asking you to return to LifeLock and to reactivate your subscription. You can only request a refund of your payment if you subscribe annually and you make the request within 60 days of the signup process.

Before signing up for LifeLock, make sure that you read the LifeLock terms of service and the LifeLock cancellation and refund policy for information. This information is subject to change at any time, so always check with these pages for the latest policies.

LifeLock pricing tiers

LifeLock offers three different pricing plans with three pricing tiers within each of those plans. The three pricing plans are:

- Individual

- Two adults

- Up to two adults with up to five children

The pricing tiers within these three plans include:

- Standard: If you subscribe to the Standard tier , you will save money, but this tier only tracks a limited amount of your identifiable information, such as your Identity and Social Security Number. For users who pay monthly, the Standard package costs $11.99 for one individual, $23.99 for two adults, and $35.99 for two adults and five kids.

- Advantage: The Advantage tier adds monitoring of your financial accounts and an annual credit report from one credit bureau to the features in the Standard tier. For users who pay monthly, the Advantage package costs $22.99 for one individual, $45.99 for two adults, and $57.99 for two adults and five kids.

- Ultimate Plus: The Ultimate Plus tier will be the best option for most people, as it provides monitoring in a wide range of areas related to your identity. It is pricey, though. As mentioned earlier, our review is for the Ultimate Plus tier. For users who pay monthly, the Ultimate Plus package costs $34.99 for one individual, $69.99 for two adults, and $79.99 for two adults and five kids.

Pros and cons of LifeLock

Pros:

- Provides identity theft insurance up to $1 million in all pricing tiers

- Offers up to $1 million in reimbursement for stolen funds in its highest-pricing tier

- Dashboard is well-designed

- Owner Norton is one of the biggest names in computer security

- Customer service is available around the clock

- Gives new users a significant price break in the first year

- Delivers the monitoring features that it promises

- Recently added social media and payday loans monitoring features

- Recently added to a 30-day introductory free trial period

- Credit report information is thorough and easy to read

- Can add as many or as few financial accounts for tracking as you want

- Phone support response times are a little shorter than I expected

- Can be up and running with the basics for LifeLock within several minutes

- Offers two-factor authentication to secure your account

Cons:

- Pricing increases significantly in the second year, surpassing competitors’ prices

- After year one, its prices are much higher than other ID theft protection services

- Dashboard has a noticeable lag after you click on buttons

- Finding the customer service phone number to call support is a challenge

- The automatic log-out security feature is very aggressive

- Generates a large number of unsolicited email marketing messages

- Lowest-priced tier is extremely basic with no financial account monitoring

LifeLock: Our final verdict

Through my hands-on review of LifeLock, I found that it delivers the alerts and monitoring features aimed at protecting your identifying information that it promises. Its marketing materials may exaggerate the ease of use of some of its features, but the service gives you the basics of what it promises.

The dashboard you will use to manage your account settings and to see the alerts and information about your account is well-designed. Most of the information LifeLock gives you is easy to understand and is useful.

Having the ability to see all of your credit information in the same place you are receiving alerts about any odd circumstances related to your personal information is very handy.

Not the cheapest

The biggest drawback for LifeLock is its price. LifeLock is significantly more expensive than other ID theft protection services, especially once LifeLock’s first-year pricing discount comes to an end.

The cost issue becomes greater when you realize that you almost certainly have to subscribe to the highest pricing tier of LifeLock to receive the features you really want in this type of service.

There are a few reasons why you may be willing to spend extra to sign up with LifeLock versus a cheaper ID theft protection service. I do appreciate that LifeLock offers up to $1 million in reimbursement if you lose any funds in your financial accounts from identity theft. This is a significant advantage over other ID theft protection services, especially for people who keep a lot of money in their accounts.

Additionally, the LifeLock service has the most well-known brand name among identity theft protection services, which may give you peace of mind that it will be around for many years into the future. I believe the other major ID theft protection services will continue to provide service well into the future too, but some people simply feel more comfortable with the brand name they know.

Bottom line: If you are going to spend the money for an identity theft protection service, LifeLock is well worth considering. It gives you the alerts and information about your personal information that it promises to deliver. However, its significant expense in year two and beyond should give you pause. If you decide to go with LifeLock, just know that you will be spending a higher than average amount for it versus its competitors. I’m not sure its overall feature set, when compared to competitors, is worth the extra cost.

LifeLock vs. other ID theft protection services

I have written several comparison articles that break down the LifeLock features and pricing against other identity theft protection services. In general, I found that the service offerings from these other ID theft protection services and LifeLock are very similar.

However, LifeLock doesn’t compare favorably with some of those other services in terms of price, especially after LifeLock’s first-year pricing discount comes to an end. Other services typically do not match LifeLock’s significant first-year pricing discounts, though.

Here are my LifeLock versus other identity theft protection service comparisons articles, so you can see how they stack up for yourself.

- LifeLock vs. Experian IdentityWorks

- LifeLock vs. Costco Complete ID

- LifeLock vs. Identity Guard

- LifeLock vs. Home Title Lock

- LifeLock vs. IdentityForce

Our testing methodology for identity theft protection

When I am testing the best identity theft protection services , I like to use hands-on testing methods to try to make sure that these services deliver on the promises that they make in their marketing materials. Sorting through the marketing hype can be a challenge with subscription software like this, especially for consumers who don’t deal with the software on a regular basis like I do.

When testing ID theft protection software, I attempt to use the ID theft protection software in the same way that you as a consumer would use it. I attempt to generate alerts and to have the software monitor as many different types of accounts as possible. I also want to try to give you an idea of whether these services are easy to use by explaining all of the different features they offer and by discussing how you can set them up and use them.

Finally, I also make use of the various customer service and technical support features that these ID theft protection software services provide. Are they responsive to the needs of subscribers? Is it easy to find the answers to your questions? This is an important aspect of deciding whether you want to subscribe to a particular identity theft protection service.

As mentioned earlier, I am paying for a LifeLock subscription, just like you would do. These are not demo accounts or scaled-down accounts made specifically for testing.

An ID theft protection service monitors your personal identification information that’s in use on the internet, as well as your online accounts and credit reports. If the service finds any oddities regarding your personal information, it will generate an alert for you. The service should explain the potential risk behind the alert and give you some potential solutions. The idea behind generating warnings about potential breaches of your identity is to give you time to take steps to make some changes to your account information, usernames, and passwords to protect your information before a hacker steals it and takes control of any aspects of your life. The alerts may indicate that a hacker is probing your personal information, so you may have time to take steps to protect yourself before a full identity breach occurs. If a hacker steals your identity, the hacker may be able to open loans in your name, impersonate you online, or steal money from your financial accounts. Some hackers may even steal your tax refund. Because attempting to recover your identity is such a difficult process, people should take steps to protect their information at all times. It can be a long, expensive process to try to regain control of your identity, so it is better to take steps to prevent the theft of your identity in the first place. If you cannot stop the loss of your identity in time, the identity theft protection service that you subscribe to should give you some advice and specific steps to help you regain control. This is a major part of the benefit of subscribing to these services. If you subscribe to LifeLock and if you suffer a loss of your identity, LifeLock will assign a restoration specialist to your account. This person’s job is to help you figure out how to recover your identity and how to gain control of your life again. You still will need to do quite a bit of the legwork on your own, but LifeLock’s team can point you in the right direction. From a financial perspective, as a LifeLock subscriber, you will have access to up to $1 million in insurance to cover any costs you have associated with trying to recover your identity. You also will have another up to $1 million in reimbursement funds if a hacker who steals your identity also steals money directly from your financial accounts. I cannot give you a one-size-fits-all statement about whether you should purchase a subscription to LifeLock or any other identity theft protection service. Subscribing to an ID theft protection service is a personal decision, depending on your personal situation. If you have the time and inclination, you can duplicate nearly all the services that an ID theft protection service provides for you by keeping a close eye on your financial account statements, by monitoring your credit report, and by being careful about the type of personal information you share online. However, some people simply don’t have the time or desire to take these steps on their own. They are willing to pay a service like LifeLock to perform all the monitoring work for them. You may think of your subscription to an ID theft protection service almost like an insurance payment for identity protection, like you’d pay for insurance on your home or vehicle. ID theft protection services will help you financially if you suffer a loss of your identity, and this is a key benefit that some people like to have available. Some of the specific types of people who may receive the biggest benefit from identity theft protection services include: Some drawbacks to ID theft protection services include the possibility of false alerts, the amount of marketing messages and emails you may receive, and the cost per month. Like with any subscription service, you need to make sure you are taking advantage of the service’s offerings on a regular basis. Subscription services are more than happy to keep taking your money, even if you stop actively using the service and forget to cancel. Speaking of canceling, this can be a difficult process with identity theft protection services. You may have to take multiple steps to actually complete the cancellation. When the services have your payment method on file, they are not going to give up that revenue stream easily. This is one reason I always recommend that you use a credit card to subscribe to an identity theft protection service, rather than your debit card or bank account. If you have a dispute with the service about canceling, your credit card company is more likely to help you stop the payment versus your bank. Certainly, identity theft protection services provide benefits for subscribers. But these services are expensive, and they are not perfect. I always recommend that people maintain some skepticism about the promises these services make. Pay attention to the drawbacks of ID theft protection services, rather than focusing only on the benefits they will provide. Keep an open mind about what you will be receiving, and you will have an easier time deciding whether you want to subscribe to these services.How does identity theft protection work?

Can LifeLock help me after someone stole my identity?

Should I get ID theft protection?

All LifeLock reviews

All Star LifeLock reviews

All LifeLock positive reviews

All LifeLock critical reviews

All related LifeLock reviews

See all reviewsI had lifelock for 2 years. I had someone use my name and credit card number to order a computer. I called lifelock. The person on the phone said that there was nothing they could do. I promptly canceled my subscription to lifelock.