Once you make the decision to subscribe to an identity theft protection service, you want to make sure you select one that will give you the good value and protection it promises. I am going to break down and compare two of the most well-known services: Identity Guard and LifeLock.

Both Identity Guard and LifeLock have strong features and will do a solid job monitoring the web for odd behaviors involving your accounts and personal information. In this article, you will learn everything you need to know to make your own comparison between the two.

In a rush? The winner is LifeLock

Looking for a quick answer? Identity Guard is a little cheaper than LifeLock, but that isn’t quite important enough to make it the deciding factor. LifeLock’s trustworthiness and strong list of useful features give it the edge. I chose LifeLock as the winner between the two. Keep reading to find out more about how I came to that conclusion.

Identity Guard vs LifeLock: Features

There are a number of different features you should be looking for when assessing identity theft protection, and some are more important than others.

Below are some the most important features found in the various identity theft protection services and how LifeLock and Identity Guard stack up against each other.

| No value | LifeLock | Identity Guard |

| Website | https://lifelock.com/ | identityguard.com | Free trial | Identity theft insurance | Up to $1 million | Up to $1 million | Lock your credit | TransUnion only | Special offer | $8.99 | $5.39 | Highest price per month | $23.99 | $19.99 | Credit monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|---|

| Best deal (per month) | $8.99 GET 25% off the first year | $5.39 SAVE 40% on a basic plan |

Activity alerts

Both LifeLock and Identity Guard successfully will alert you to any odd activity regarding your accounts and personal data. Because this is the primary function of identity theft services, they need to excel in this area, and both of these services do.

Identity Guard monitors your bank accounts, investment accounts, debit cards, and credit cards. (The credit card companies typically do a good job of monitoring your accounts on their own, so you may not need Identity Guard’s help in this area.) LifeLock also monitors your bank accounts, investment accounts, and credit card accounts.

Both services will closely watch for unusual activity surrounding your Social Security Number, too, such as new loans and lines of credit. With either LifeLock or Identity Guard, you can set up the service to send you an alert any time one of your accounts has a transaction that surpasses a limit that you set.

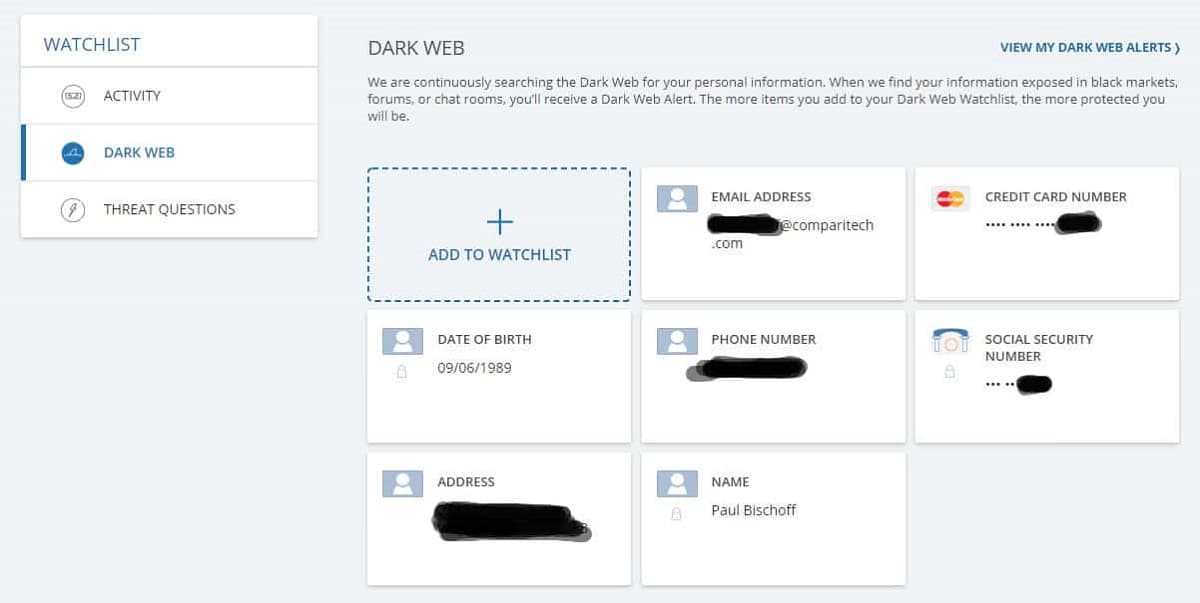

Dark web monitoring

Both services offer extensive monitoring of the dark web to seek out any information of yours that a hacker is offering for sale. This can include passwords, identification numbers, account names, login information and more.

Both LifeLock and Identity Guard do a good job of alerting you to any of your credentials found on the dark web, while also providing an explanation of how you can alleviate the problem.

Free credit report and monitoring

Both LifeLock and Identity Guard will monitor your credit at all three of the primary credit bureaus at the upper pricing tiers. However, if you select one of the value-based pricing tiers, you may only receive reports and monitoring from one credit bureau.

You can receive monthly credit scores or annual credit reports with either service, but the frequency of the reports you will receive will depend on the pricing tier you select.

Should you want to lock or freeze your credit, preventing anyone trying to steal your identity from opening new credit lines in your name, both services offer this capability.

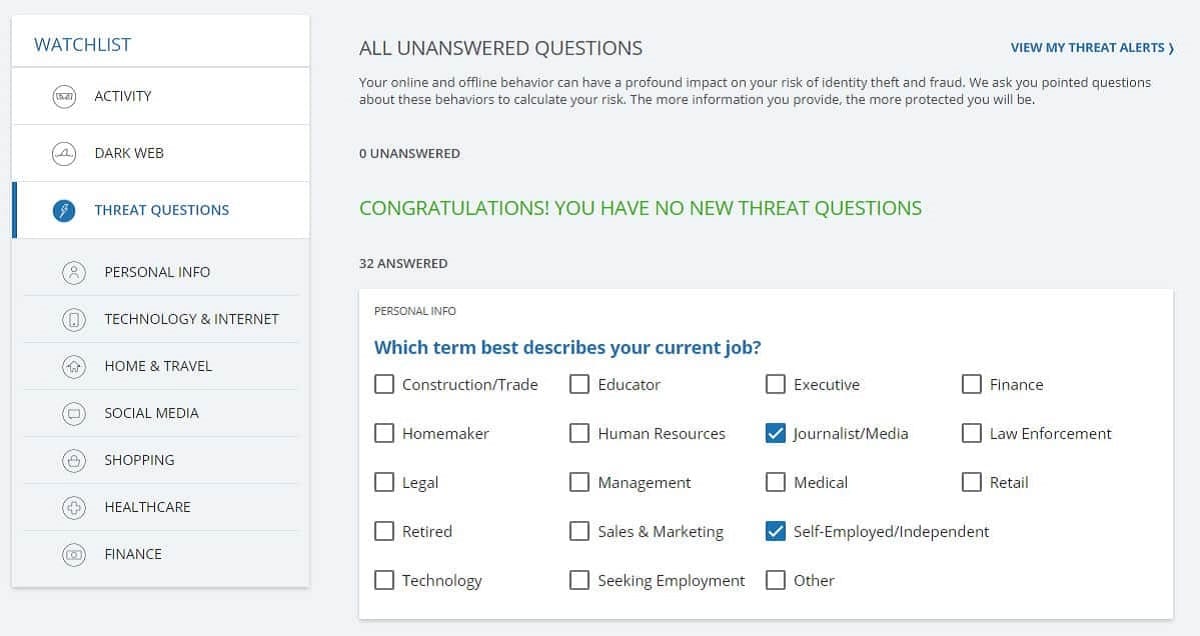

One aspect of Identity Guard that I really like is its Risk Management Score feature. It will ask you questions about your life and financial situation, using that information in combination with your measured internet behaviors to yield a risk score. You can use the score to determine whether you are behaving riskier than you intend to when using the web and whether you need to change some habits.

However, this feature is more like something you’d find in a credit score monitoring service. Some ID theft protection services become bogged down with credit score improvement tips. This is one reason I like LifeLock, as it focuses entirely on identity theft protection.

Address monitoring

Both services will monitor your home title, ensuring that no one steals your identity and uses that information to try to take out a loan against your home.

In this area, Identity Guard provides a bit more detail in terms of the information it watches related to your home and property ownership than LifeLock does. This gives Identity Guard a slightly better chance of catching potentially fraudulent activity earlier than LifeLock.

Both services also provide monitoring of your home address, looking for instances where someone may try to change your address to commit mail fraud.

Public records monitoring

Identity Guard and LifeLock will keep an eye for your name appearing in public records areas, such as criminal activity.

LifeLock will monitor sex offender registry lists to make sure no one is trying to impersonate you on those lists.

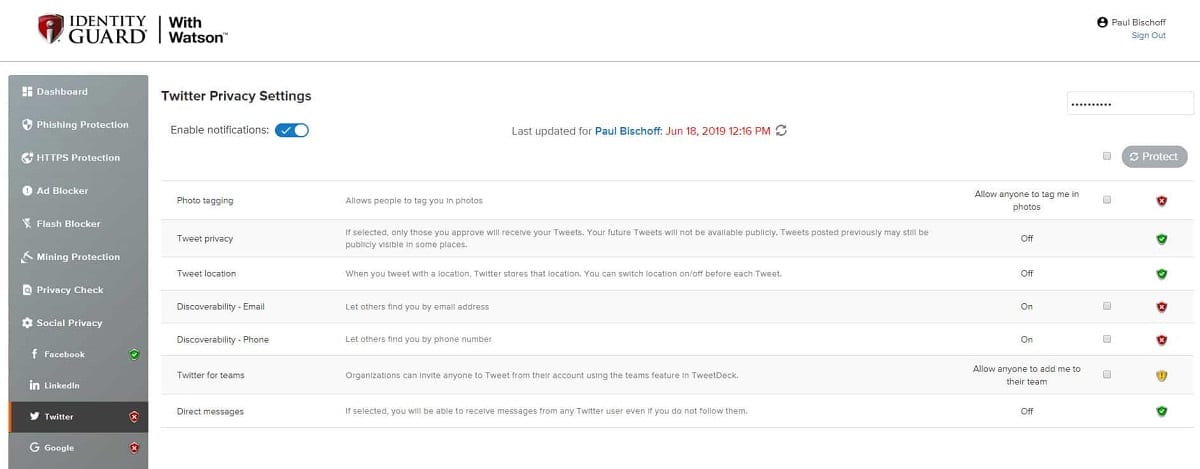

Social media monitoring

Both LifeLock and Identity Guard monitor your social media accounts, making sure that someone isn’t using your account without your permission. They also monitor social media to determine whether someone is attempting to impersonate you.

ID restoration and insurance

Identity restoration is a key component of both of these services. Should someone steal your identity, it can cost quite a bit of money to regain access to your identity and accounts. You may need to hire lawyers and other professionals to help you. Both services offer up to $1 million in insurance coverage to help you restore your identity.

You will receive a case representative who will work with you all the way through the process of restoring your identity.

If you have interest in subscribing to an ID theft protection service primarily because of the insurance coverage, you likely will appreciate the LifeLock brand. Because LifeLock is such a strong brand name, customers feel comfortable that they would receive their insurance payments.

We have no reason to doubt that Identity Guard would provide insurance payments, too, but Identity Guard’s lack of brand-name recognition (at least compared to LifeLock) is a drawback for some customers in this area.

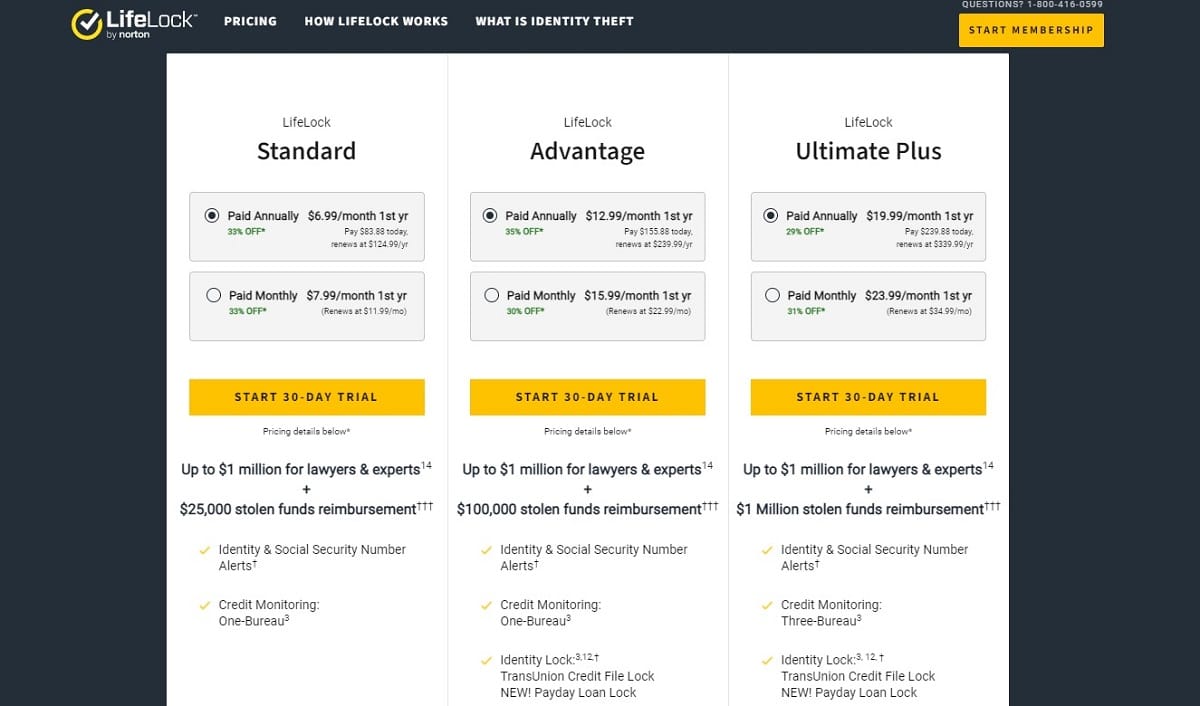

Stolen funds compensation

LifeLock offers you between $25,000 and $1 million to compensate you for any personal funds you lose to the identity thief, depending on the subscription tier you are using.

Here’s how LifeLock’s compensation works:

- Standard: Up to $25,000 in stolen funds reimbursement, up to $25,000 in personal expense compensation, and up to $1 million in coverage for lawyers and experts.

- Advantage: Up to $100,000 in stolen funds reimbursement, up to $100,000 in personal expense compensation, and up to $1 million in coverage for lawyers and experts.

- Ultimate Plus: Up to $1 million in stolen funds reimbursement, up to $1 million in personal expense compensation, and up to $1 million in coverage for lawyers and experts.

Identity Guard does not have a compensation option, but it does give you up to $2,000 in emergency funds to use during the time when you cannot access your personal accounts. (You also have access to up to $1 million in coverage for lawyers and experts.)

Ultimately, this is an area where LifeLock has a major advantage, thanks to its compensation offerings for stolen funds.

SSO or 2FA login

Norton, which owns LifeLock, offers two-factor authentication (2FA) for its accounts, but you will need to access your account settings to turn it on and use it. Two-factor authentication is not automatically enabled.

At the time of this writing, Identity Guard does not offer a two-factor authentication option for guarding your account.

Identity Guard vs LifeLock: Pricing

| No value | LifeLock | Identity Guard |

| Website | https://lifelock.com/ | identityguard.com | Subscription periods | Monthly or annually | Monthly or annually | Special offer | First-year discount for new customers | 7-day free trial | Lowest annual price | $89.99 (Standard Individual tier) | $65 (Value Individual tier) | Lowest annual price (Family) | $221.87 (Standard Family with Kids tier) | $150 (Value Family tier) | Highest annual price (Family) | $467.88 (Ultimate Plus Family with Kids tier) | $399.96 (Ultra Family tier) | Money-back guarantee | 60 days for annual subscription or 14 days for monthly subscription | With some tiers |

|---|---|---|

| Best deal (per month) | $8.99 GET 25% off the first year | $5.39 SAVE 40% on a basic plan |

Because both Identity Guard and LifeLock offer so many different pricing tiers, it can be challenging to figure out exactly which one you want to use. To add to the confusion, both services offer discounts for those who pay annually, rather than monthly.

When comparing the costs of all the tiers, Identity Guard offers a slightly lower price versus LifeLock at the most closely comparable tiers. You may find that LifeLock’s advanced features, such as the personal funds loss compensation, justifies paying a slightly higher price, though.

When glancing at the prices for each tier for the two services, it may seem like LifeLock is the less expensive option. However, LifeLock offers a significant discount of 20% to 33% from its normal prices for new customers in the first year, which skews the numbers a bit. We’re assuming that if you want an identity theft protection service, you are seeking one that you can use for many years, so our price comparison ignores the first-year discount for LifeLock.

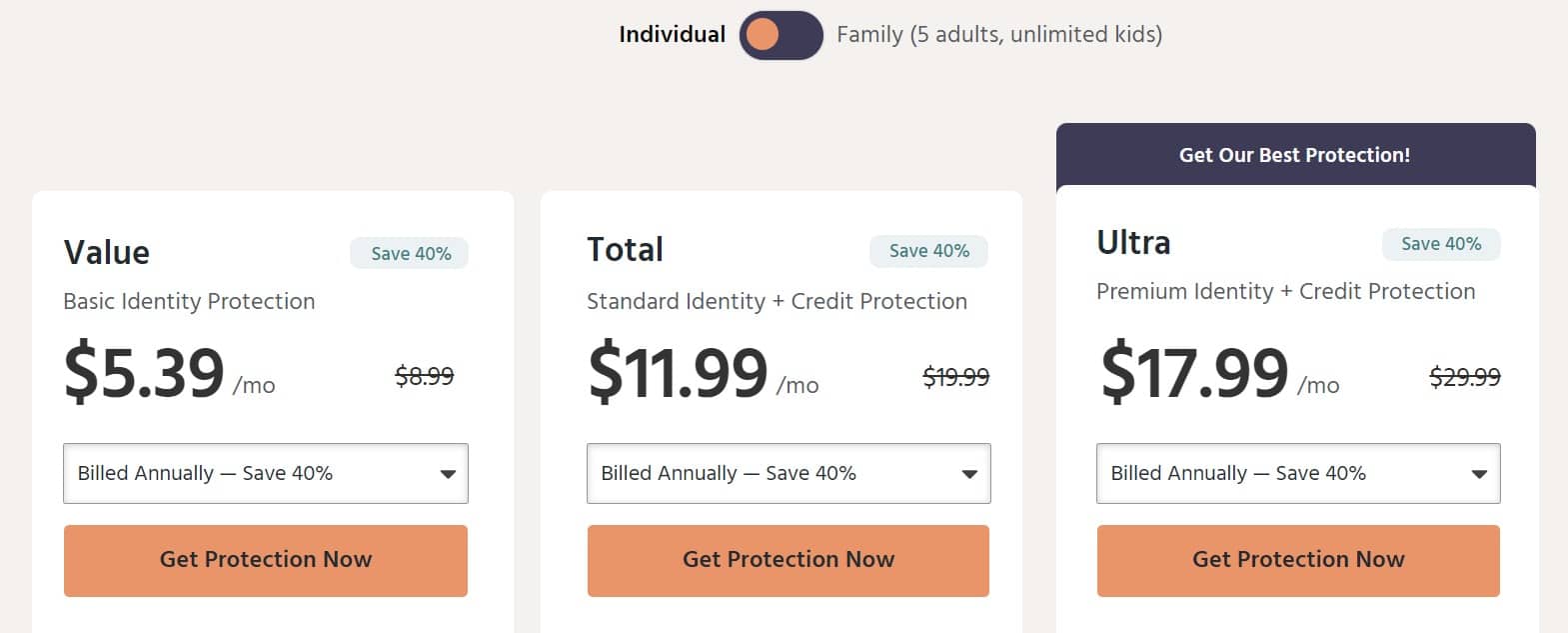

Identity Guard offers three tiers within its Individual plan and three tiers within its Family plan. The Family plan covers all adults and children who are living in a single household. The Individual plan covers one person.

Here are the Identity Guard pricing tiers:

- Value: The Value tier offers basic protection, including data breach notifications, dark web monitoring, identity theft insurance, and high risk transaction monitoring.

- Total: The Total tier includes everything in the Value tier, along with bank account monitoring, a monthly Identity Guard-generated credit score report, and credit monitoring at the three bureaus.

- Ultra: The Ultra tier includes everything in the Total tier, along with a three-bureau annual credit report, a social media insights report, debit card monitoring, credit card monitoring, investment account monitoring, and address monitoring.

LifeLock offers three usage plans and three tiers within each plan. Select among a single-person Individual plan, a two-adult Family plan, and a Family with Kids plan for up to two adults and five children.

Here are the LifeLock pricing tiers:

- Standard: The Standard tier offers basic protection, including identity risk alerts, Social Security Number alerts, identity theft insurance, stolen funds reimbursement, and one bureau credit monitoring.

- Advantage: The Advantage tier includes everything in the Standard tier, along with crime alerts, one bureau monthly credit reports and scores, and phone hijacking monitoring.

- Ultimate Plus: The Ultimate Plus tier includes everything in the Advantage tier, along with unlimited credit reports for one bureau, annual credit reports for three bureaus, investment account monitoring, and social media monitoring.

Setup and ease of use

Both Identity Guard and LifeLock are pretty easy to set up and use, although I do like Identity Guard’s interface and dashboard slightly better.

With LifeLock or Identity Guard, you can be up and running on the service within several minutes. You will need to provide a valid ID card (usually a driver’s license) as well as a credit card. If you ever signed up for an account with Norton, you will recognize the interface and the sign-up process with LifeLock.

One aspect of LifeLock that you may find advantageous is that it offers a mobile app for both Android and iOS devices. You can receive alerts through the app, and you can contact customer service.

Identity Guard also has a mobile app available, but its mobile app interface is not as easy to use as LifeLock’s app.

Pros and cons of Identity Guard

Pros:

- AI-assisted monitoring and alerts

- Has a desirable price point versus other identity theft products

- Covers everyone in your household for one price

- Generates a unique Risk Management Score to help you assess your overall risk

- Partners with IBM Watson artificial intelligence to perform its monitoring capabilities

- Dashboard is well organized, making it easy to find the information you want

- Provides identity theft insurance up to $1 million in all pricing tiers

- Gives you clear alerts about any discrepancies it discovers

- Assigns a single person to your case if you have an issue

- Easy to set up and use

Cons:

- No two-step verification on login

- Does not offer 24/7 customer service access

- Isn’t able to freeze your credit as quickly as LifeLock

- No stolen funds compensation

- Its mobile app lags behind LifeLock’s mobile app

- Doesn’t have the brand-name recognition of LifeLock

Pros and cons of LifeLock

Pros:

- Owner Norton is one of the biggest names in computer security

- LifeLock’s brand name is well-known

- Comprehensive monitoring and alerts in top tier

- Offers some features that work in conjunction with Norton, should you already subscribe to Norton

- Has multiple pricing and service tiers from which to choose

- Offers a significant pricing discount for the first year

- Customer service is available around the clock

- Provides identity theft insurance up to $1 million in all pricing tiers

- Offers stolen funds reimbursement insurance

- Has a strong mobile app available

Cons:

- Pricing increases significantly in the second year, surpassing competitors’ prices

- Doesn’t quite offer the level of detail in alerts as Identity Guard

- Dashboard interface isn’t quite as easy to use as Identity Guard’s dashboard

The winner: LifeLock

Although both services do what they promise and do it pretty well, I give LifeLock the advantage versus Identity Guard.

LifeLock delivers 24/7 access to customer service, as well as trustworthy reimbursement of stolen funds. Its overwhelming brand name awareness makes LifeLock far easier to trust for things like its $1 million insurance policy than any competitor, including Identity Guard. If you are a fan of the security services that Norton provides, you may appreciate LifeLock too, since Norton owns it.

Identity Guard has a slight edge in a few areas. It does a slightly better job in clearly giving you alerts through a better organized interface than LifeLock. It also has a lower overall price point, especially in the second year and beyond of your subscription.

One word of warning: Both services run on subscription models, meaning that once you sign up and give them a payment method, you’ll continue to receive charges until you officially cancel. Jumping through all of the hoops to cancel the service can be challenging, although we did not have significant problems with cancellation during our hands-on review of LifeLock and our hands-on review of Identity Guard.

Ultimately, I believe LifeLock’s features and customer service options are better for the majority of users than what Identity Guard offers. For some users, though, Identity Guard will be the better choice, especially if you are looking to save money on your subscription.

Our testing methodology for Identity Theft Protection

When I’m researching the best identity theft protection services, I run the services through a testing process that follows what a typical customer would do. Here are some of the things I look for:

I start by signing up for the service and use it in a manner that is as similar to what you want to do with it as possible. I then seek to run the services through a series of tests. I want to be certain that the services are delivering what they promise.

I pay close attention to the ease of use and the interface of identity protection services. With a service that monitors your personal information and provides alerts when something is wrong, the last thing you need is a confusing interface that makes it very difficult to decipher and fix the problem.

While using and testing the services, I enter information that I believe should not generate alerts, as well as some information that I expect to create an alert. This gives us a basic idea about whether the service is living up to its promises.

Customer service responsiveness is another key component of testing the best theft identity protection services. If you ever experience a problem, you need assurances that you are going to be able to speak to or reach out to someone who can help as quickly as possible.

Ultimately, I want to make sure that the user experience with any of these ID theft protection services is as good as possible and matches what the company claims.

Identity Guard vs LifeLock FAQs

How does identity theft protection work?

Identity theft protection services will constantly monitor activity on the web to search for irregularities regarding your personal information and your financial information.

By finding these issues and alerting you to them as early as possible, it gives you the best chance to fix them before they result in identity theft. However, you should not expect these services to automatically prevent any risk of identity theft for you. Even if you subscribe to one of these services, you still may experience identity theft. You still need to be careful about the information you share online, as this is your best defense.

Can LifeLock help me after someone stole my identity?

Yes. If LifeLock determines that someone stole your identity or obtained some of your personal data that could lead to a theft of your identity, the service will work with you to try to mitigate the damage. Additionally, LifeLock offers up to $1 million in insurance protection that helps you with the costs of trying to restore your identity.

Can Identity Guard help me after someone stole my identity?

Yes. If it appears you suffered some sort of identity theft or that you have risky information exposed on the web, Identity Guard will walk you through the process of trying to protect your information. Identity Guard offers up to $1 million in insurance protection designed to help you regain control of your identity as well.

Does LifeLock compensate me for stolen funds?

Yes, LifeLock offers a stolen funds reimbursement package with all of its pricing tiers. Depending on the tier you select, you could be eligible for a reimbursement of any stolen funds of between $25,000 and $1 million.

Does Identity Guard compensate me for stolen funds?

No, Identity Guard does not offer a reimbursement of stolen funds. However, the service does give you access to up to $2,000 in emergency funds to help with expenses if you find you cannot gain access to your bank accounts after the identity theft occurs.

Should I change my phone number after identity theft?

Even though it can be a hassle, changing your phone number after suffering identity theft usually is a good idea. Because your phone number often will have an association with your financial accounts and other aspects of your personal information, criminals may be able to continue to use that number with your new accounts, continuing to create headaches for you. When you switch to a new phone number, you have a better chance of starting fresh after recovering your identity.

Why would I want monitoring for all three credit bureaus?

With monitoring from all three credit bureaus, you have a greater chance of finding errors as early as possible. It is possible that an error or an odd situation with your accounts may only appear at one of the three bureaus. If you are not receiving monitoring from all three bureaus, you could miss this error, meaning there will be a delay in dealing with the problem.

Do credit cards offer identity theft protection?

Generally, credit cards don’t offer the full suite of identity theft protection features that subscription services like LifeLock and Identity Guard offer. However, credit card companies will monitor your credit card accounts for odd transactions and provide alerts to you for free. Some credit card companies offer to monitor your credit reports too, or they may scan the dark web for your personal information. However, these free services don’t have the depth and breadth of features found with dedicated identity theft services.

Does credit monitoring hurt your credit?

No, credit monitoring does not hurt your credit score. Accessing your own credit report does not harm your score, either.

Should I get ID theft protection?

It really depends on your needs. If you feel comfortable doing things like tracking down your own credit reports, monitoring your own financial accounts, and setting up alerts with your various financial accounts, you can duplicate many of the services of identity theft protection services on your own. The ID theft protection services do simplify the process, so you may be willing to pay a monthly cost to have them do the work for you.

A major advantage of the ID theft protection services for many people is the insurance they offer to help you cover the cost of trying to regain your identity. Understand, though, that it sometimes can be difficult to obtain the insurance payments you believe you deserve. You may have to jump through quite a few hoops to make the services give you the payments. It also can be difficult to cancel your subscription if you believe the service is not giving you the features that you thought you would receive. This is an unfortunate reality of many types of subscription-based services like this, so you will have to decide whether the potential hassles often associated with these services is worth the chance that you could receive an insurance payment or a stolen funds reimbursement payment if someone steals your identity.

Ultimately, people who may receive the biggest benefit from ID theft protection would be the following.

- People who suffered a previous identity theft may be more susceptible to another breach, making ID theft protection well worth considering.

- People who rarely have a reason or an ability to check their credit reports on a regular basis, such as children.

- People who struggle to manage and secure their accounts through the Internet or through an app, such as elderly people who dislike using technology.