Intelius is a public record information services company founded in 2003 in Bellevue, Washington. It went public on the stock market in 2008 and was later acquired in 2015 by HIG Capital. Intelius provides two main services: background checks and identity theft protection. We’ll focus on the latter, dubbed Intelius Identity Protect.

Before we get to the review, we feel it necessary to point out a few blemishes on Intelius’ reputation. Between 2008 and 2010, Intelius ran into legal problems including a class action lawsuit accusing the company of signing up and charging customers for memberships in an affiliated company, Adaptive Marketing, without their knowledge. Intelius intentionally made it harder for customers to dispute the charges, according to a Federal Court that accused the company of violating the Consumer Protection Act. Additionally, Intelius was accused of selling private cell phone numbers.

Intelius’ shady past doesn’t inspire much confidence as a service made to protect customers’ privacy from criminals, especially when it has failed to protect customers from itself. Nonetheless, we’re obliged to give it a fair shot in our testing.

Features and pricing

Intelius Identity Protect only offers a single service tier with a monthly price of $19.95 (GBP), but quarterly and yearly subscriptions will drop the cost to $14 and $8.25 per month. The yearly price makes it one of the cheapest identity theft protection services available. Included are both identity theft protection and some credit reporting services.

It’s worth noting that at the end of the test period, when I went to halt the service, IdentityProtect offered me a 50 percent discount on the monthly price as an alternative to canceling my subscription.

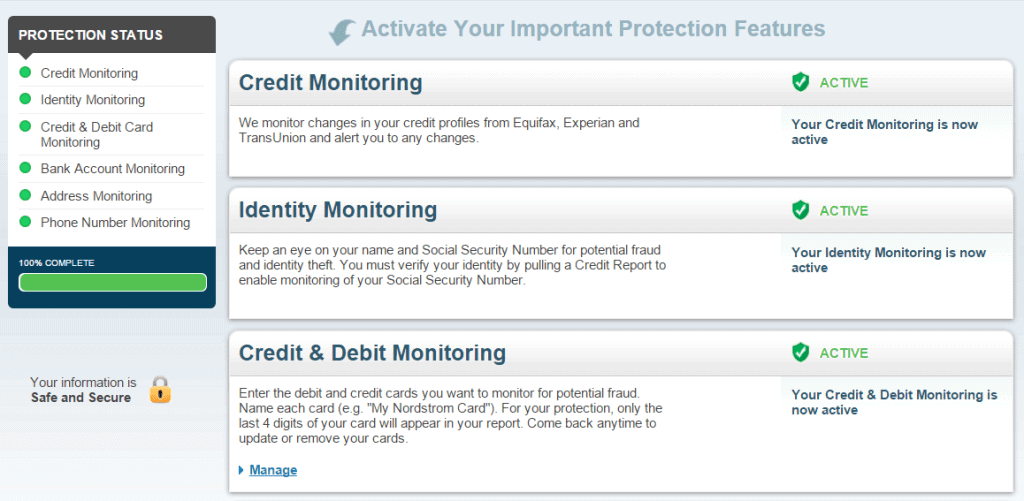

The former includes most of the usual protections: social security number monitoring, credit and debit card monitoring, bank account protection, and address and phone number monitoring. The plan comes with the typical US$1 million of insurance to cover any damages incurred from identity theft.

Because Intelius is also a background check company, it offers more extensive public records monitoring than most of its competitors. That includes any records of your relatives or associates, addresses, nearby sex offender reports, and a property report. The property report on my account was outdated, however, and still had the previous home owner’s information on file.

Other than the public records monitoring, the protections are quite basic. Customers can’t input and monitor their driver’s license, medical insurance, passports, payday loans, or email addresses.

Restoration experts are on hand 24/7 to assist you with canceling cards, contacting police, resolving fraud disputes, and answering general questions.

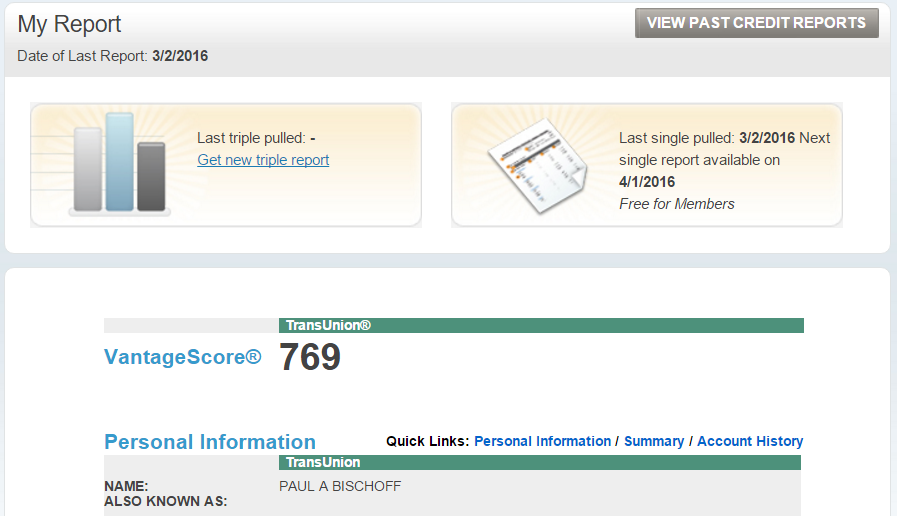

Customers can request one free credit report per month from Transunion, one of three national credit rating bureaus in the US. That’s included in the 7-day free trial as well. If you want a triple credit report from all three bureaus, that will cost $25 extra.

Identity Protect includes a tab for reducing junk mail, spam, and telemarketing lists, but these are essentially links to self-service, third-party opt-out services. Intelius won’t do it for you.

Alerts and reports

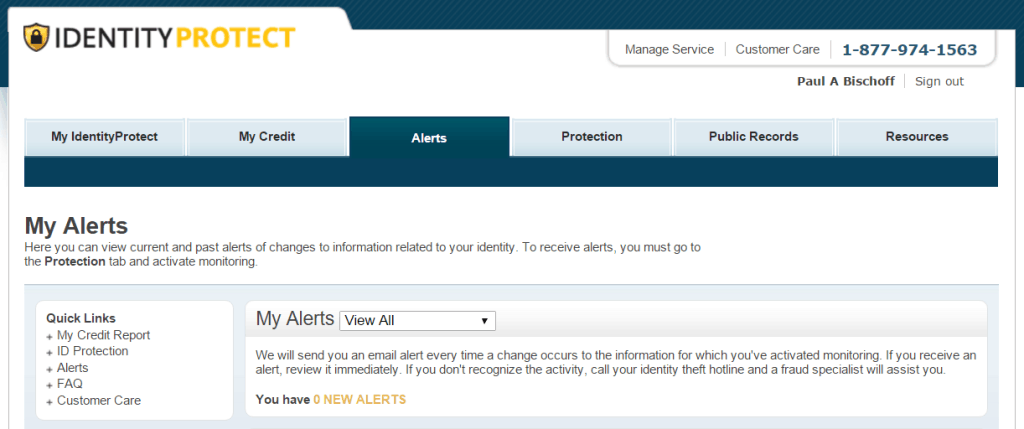

Customers receive emails every time a change occurs in the information that’s being monitored. Alerts are archived on the website in the member portal. They include any inquiries into your credit history; changes in public records, negative information, or general information; and new accounts opened in your name.

Identity Protect doesn’t offer an option to receive alerts by SMS.

The credit reports that come free with an account can be pulled once per month from Transunion. It includes some personal information, new and existing accounts, a two-year payment history, and, of course, your score.

Much like the limited array of protections, the alerts and reports available are very minimal. I didn’t receive a single notification during my testing.

Setup and interface

Setting up an Identity Protect account is quite simple and mostly involves activating the protections. You’ll need bank account numbers, debit and credit cards, your social security number, an address, and a telephone number. A progress bar informs you if you’ve left any of those fields empty.

You won’t be charged until the 7-day free trial expires, but Intelius will ping your credit card to make sure it’s active.

The website is clean and intuitive, consisting of six tabs. The home page is a simple overview of what protections and benefits have been activated. My credit includes the Transunion credit report described above. Alerts is the chronological archive of any notifications you’ve received. Protection is where you activate more credit cards, bank accounts, and other information. Public Records includes any publicly available information Intelius was able to dig up about you, including criminal offenses and a property report. Resources is where you’ll find frequently asked questions, a knowledge base, and testimonials.

Identity Protect, like most similar services, is entirely web-based. There are no desktop or mobile apps.

Customer service

The customer service hotline connected me to an overseas call center, where representatives answered the phone with, “Thank you for calling customer care.” They never mention Intelius or Identity Protect, which to me seems a lot like this is a general customer service call center likely contracted by more than one company. My call dropped on both of the two occasions I contacted it.

I was connected with a representative almost immediately on both calls, which was good, but things went back downhill from there. The verification process was inconsistent; one rep asked me for the last four digits of my credit card, while the other asked me for an email, name, and zip code. I asked a simple enough question: can I change the default free monthly credit report from Transunion to Experian? A simple no would have sufficed, but I was put on hold for over five minutes before the call dropped on my second attempt. Clearly this is not the kind of dedicated support team you want handling your identity and credit restoration.

The phone is the only method of contacting Identity Protect, and it’s available 24/7. There’s no live chat or ticket submission system.

I can at least report that the service is spam- and ad-free.

Verdict

Even with a monthly credit report included in the price, it’s difficult to justify the limited protections and horrendous customer service. Consumers can get so much more from any other identity theft protection service that we’ve reviewed to date. If you just want the cheapest option on the market, then the yearly subscription will suit your needs. But Intelius Identity Protect will have to seriously step it up to get our recommendation and cast off it’s shady reputation.