Organizations rely on a wide range of third-party vendors to support their operations, from software providers to cloud services and beyond. While these partnerships bring significant benefits, they also introduce risks, especially when it comes to data security and compliance. The potential for a third-party breach or non-compliance with privacy regulations can have far-reaching consequences, including data loss, financial penalties, and damage to reputation. This is where effective vendor risk management becomes critical.

Our guide to the best vendor risk management software offers businesses an in-depth look at the tools and solutions available to help mitigate these risks. Vendor risk management (VRM) software provides organizations with the ability to assess, monitor, and manage the security and compliance posture of their third-party vendors, ensuring that they meet industry standards and regulatory requirements.

By using VRM tools, businesses can proactively identify potential vulnerabilities in their vendor ecosystem, evaluate their exposure to risks, and take action to address any issues before they become a problem.

Here is our list of the best vendor risk management software:

- Gatekeeper EDITOR’S CHOICE This cloud platform provides vendor and contract lifecycle management with an extensive vendor risk assessment module that connects to the contract creation and tracing system in the platform. Request a demo.

- OneTrust Third-Party Risk Exchange A unique community-sourced database of existing risk evaluations on more than 70,000 vendors that is constantly updated.

- TrustArc Vendor Risk Management A security assessment platform that combines automated processes data gathering frameworks, and human experts to provide a comprehensive risk management service.

- Resolver Vendor Risk Management Software A vendor risk management system that is part of a GRC platform and enables you to assemble a document base for standards compliance proof.

- ComplyScore Risk Scoring A vendor risk management platform that is based around an assessment method that operates through a questionnaire format.

- SAI360 Vendor Risk Management Partnered with data protection and standards auditing systems, this is a cloud-based platform that is a good option for those that need to comply with GDPR.

- SureCloud A cloud-hosted vendor risk assessor that is questionnaire-driven and forms part of a wider compliance management suite.

It is important to assess vendors’ security controls, understand their data handling practices, and ensure their compliance with relevant privacy regulations such as GDPR, CCPA, and HIPAA. Our report outlines the key features of leading VRM software solutions, including risk assessment frameworks, automated workflows, continuous monitoring, and reporting capabilities. These tools will streamline vendor management processes, enhance transparency, and reduce the likelihood of costly breaches or compliance failures.

As the regulatory landscape becomes more complex and cybersecurity threats continue to evolve, the need for reliable vendor risk management is more important than ever. Adopting the right VRM software not only helps protect sensitive data but also strengthens overall security posture, ensures regulatory compliance, and builds stronger, more secure relationships with third-party vendors. This guide serves as an essential resource for businesses looking to navigate the challenges of vendor risk management effectively.

How does vendor risk management work?

The obvious way to check on the security systems of suppliers is to ask them or look through the sales information. However, like your company, those suppliers are going to present a good image of themselves wherever possible. They are not going to tell you the problems that they have faced.

Not only do you need to look into your suppliers before you sign up for their services, but you need to know about the security of their suppliers. Many cloud services don’t manage their servers; they rent space on cloud servers run by other companies. Those service providers also might use the software provided by other companies. That software might include APIs provided by other companies that access processes running on other servers, run by other providers.

To fully assess a vendor, you also need to disclose what other businesses are involved in delivering a service.

It just isn’t realistic to expect a busy IT manager to spend the time to investigate every single contributing supplier in the chain of provision for cloud services. A full investigation would require subscriptions to court reports, tracing systems to identify associated suppliers and access to specialist investigators. Buying in all of those services for every single IT service contract would be prohibitively expensive. Vendor risk management software and services bundle all of those elements together in an affordable package.

Vendor risk systems operate as a combination of services. One is a database of legal actions against companies and the other is a framework for assessing compliance measurements, such as standards accreditation. Vendor risk management systems are usually subscription services and once a list of software providers have been registered, the risk management service continues to track legal actions and data disclosure notifications and will alert if one arises for software or services that are on the list for one of the risk management service’s clients.

The best vendor risk management software

The best vendor risk management software is part of an ongoing service that will continue to search for legal issues related to the companies that supply the clients of that risk management service.

What should you look for in a vendor risk management system?

We reviewed the market for vendor risk management software and analyzed the options based on the following criteria:

- A system that can impose a standard framework on vendor assessment

- A strong legal research team to back the software service

- A subscription service with ongoing supplier status updates

- Options for legal advice

- A service that has a worldwide visibility

- The option of a no-risk assessment period either through a free trial or a money-back guarantee

- A valuable service that is worth the price

When seeking vendor risk management software for this list, we kept those selection criteria in mind but also looked for a range of price options. Although the very best vendor risk management system might be well worth paying for, not every business, especially startups and small businesses can afford the best legal representation in the world.

Process automation and sharing out the cost of legal experts across many clients allows vendor risk management services to bring costs down. So, we looked for the best value possible.

1. Gatekeeper (GET DEMO)

Gatekeeper sets itself apart by integrating contract management with vendor relationships and full risk management service, adopting a Vendor and Contract Lifecycle Management (VCLM) approach. The full platform is designed to automate purchasing through contract definition and enforcement. No company can afford to be let down by a supplier and the Gatekeeper system ensures that will not happen.

Key Features:

- VCLM Integration: Merges vendor risk management with contract lifecycle processes for a holistic approach.

- Continuous Monitoring: Keeps a vigilant eye on vendor risk statuses in real-time.

- Risk Alerts: Notifies you immediately of any changes in risk data for swift action.

- Workflow Automation: Streamlines the risk mitigation process, reducing manual effort.

- Collaboration Tools: Enhances team coordination in managing contracts and vendor risks.

- Risk Overview: Offers a unified dashboard for financial, cybersecurity, and other risk categories.

Why do we recommend it?

The vendor risk management service in the Gatekeeper platform is integrated with a credit assessment system and contracts management. This means that the vendor approval process is integrated into the contract creation and management lifecycle. Vendor risk can change over time and the platform accounts for such eventualities.

The Risk module in the Gatekeeper console enables companies to load up vendor details and perform a risk assessment of each. The risk scores of all suppliers are listed in one screen, showing a traffic light color scheme that shows clearly which vendors are high, medium, or low risk. The Risk Dashboard also lets you see overviews of your current risk position, showing overall risk per vendor sector or per business function. Another summary shows what created a high-risk score for the vendors in your list.

Risk Dashboard also shows a Risk Heat Map, which groups the vendors on your list by risk level, letting you see how much your company is exposed to high-risk suppliers. From there it is up to you how you act on that information.

Clearly, high-risk vendors won’t make it to your supplier list. However, those that pass approval can be selected within the contract creation module to set up an agreement. This section extends to the creation of service level agreements (SLAs) and non-disclosure agreements (NDAs). The system also has an integrated eSign service, so all contact can be agreed digitally.

Who is it recommended for?

Gatekeeper is particularly recommended for organizations operating in regulated industries, such as financial services and healthcare, where meticulous monitoring and auditability of third-party relationships are imperative. Their pricing details are available on their website, starting from $1,125 per month for unlimited users.

Pros:

- Real-Time Risk Tracking: Provides live updates on vendor risk to ensure informed decision-making.

- Automated Risk Response: Initiates predefined mitigation activities automatically upon risk detection.

- Integrated Management: Seamlessly combines vendor risk oversight with contract lifecycle management for efficiency.

- Clear Risk Visualization: Utilizes a color-coded system for easy interpretation of vendor risk levels.

- Vendor Performance Insight: Enables performance tracking with scorecards, offering a comprehensive view of vendor contributions.

- Strategic Spend Analysis: Facilitates financial analysis per vendor or department, optimizing supplier relationships and expenses.

Cons:

- Cost Consideration for SMEs: The platform’s pricing may pose a challenge for smaller businesses to rationalize the investment.

The Gatekeeper system is delivered as a cloud platform. There isn’t a free trial for the platform but you can request a demo to assess the package.

EDITOR'S CHOICE

Gatekeeper is our top pick for vendor risk management software because this is an entire vendor and contracts management system that is able to assess different sources of risk, such as IT failures, missed SLA obligations, or supply chain problems. This system connects vendor risk assessment to contracts management and the risk scoring is an ongoing process, taking account of the latest details of your vendors.

Download: Get FREE Demo

Official Site: https://www.gatekeeperhq.com/

OS: Cloud-based

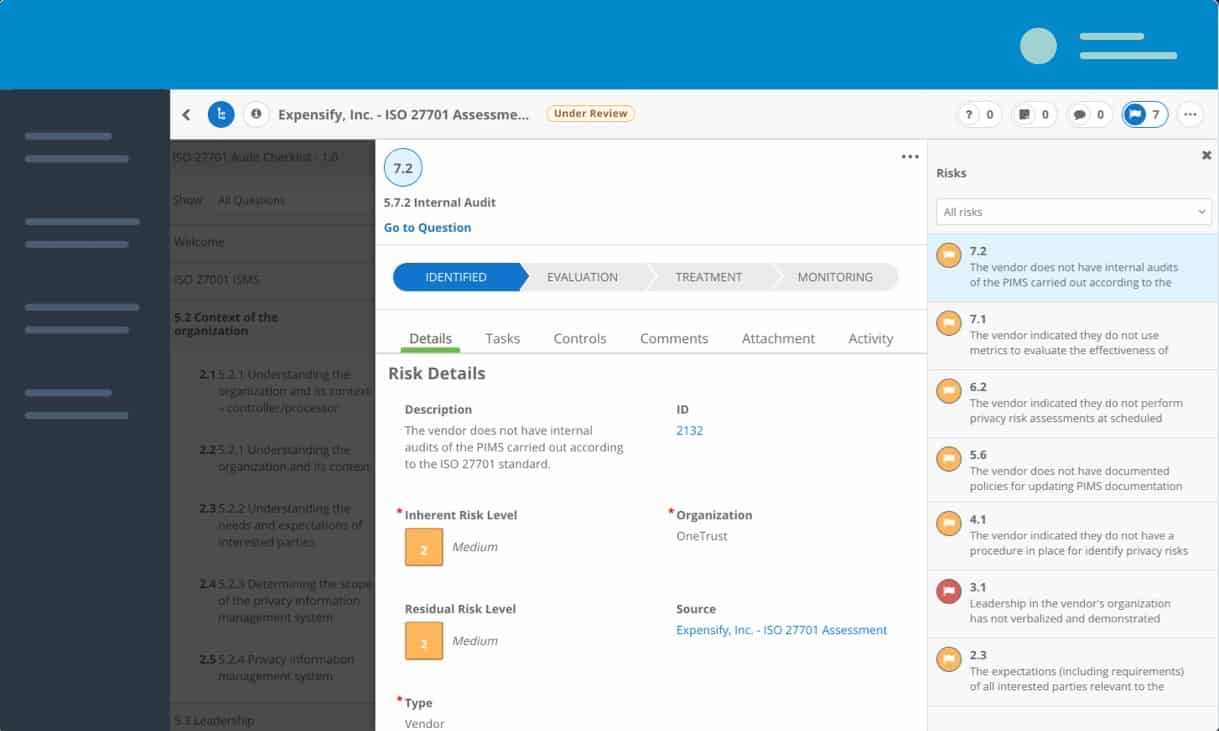

2. OneTrust Third-Party Risk Exchange

OneTrust Third-Party Risk Exchange is a database of “SIGs” filled out by other businesses and made available to other OneTrust Third-Party Risk Exchange subscribers. A SIG is a Standardized Information Gathering questionnaire, a standard intelligence recording format in corporate risk assessment.

Key Features:

- Collaborative Risk Database: A platform aggregating risk assessments shared by various businesses.

- Strategic Risk Intelligence: Gathers crucial commercial risk intelligence from multiple sources.

- Documented Security Incidents: Maintains a record of security lapses for detailed risk analysis.

- Protection Standards Classification: Organizes data breaches by specific protection standards for easy navigation.

- Legal Oversight: Supervised by experienced legal professionals to ensure data accuracy and reliability.

Why do we recommend it?

The OneTrust Third-Party Risk Exchange is a common sense approach to vendor investigations because it shares the findings of companies, so enquires don’t have to be constantly repeated. The exchange data can be accessed repeatedly for updates, providing an alert if a previously cleared vendor experiences a data breach or other weakness.

By entering the names of suppliers, the database brings up any intel on data breaches that occurred involving that business or any failed standards audits. The reporting in this database assesses risk according to a long list of data protection standards that include NIST, HIPAA, PCI DSS, GDPR, EBA, CCPA.

Third-Party Risk Exchange is a division of OneTrust, which is a very well-respected provider of legal services for IT systems. As a top-of-the-line provider, OneTrust is expensive. So, the Risk Exchange is a very clever way to cut the costs of the high-priced service of risk management. Community-provided data reduces the number of highly-paid OneTrust legal experts that need to be involved in providing the service.

Assessments are added to the system all of the time, so subscribers get up-to-the-minute data on vendors and the suppliers of your potential service providers. The system isn’t totally unsupervised. OneTrust legal experts moderate the data entered into the assessment database and add in the risk assessments that they perform themselves on behalf of clients. Assessments are filed on a per-service basis. This is useful because if one product of a company encounters problems that doesn’t mean that the whole business is compromised.

Who is it recommended for?

This tool is undeniably an essential input for any business that needs to lock down risk. The service cuts down time and costs for third-party risk assessment and it can crawl through supply chains. You will need to get an automated risk management tool that can ingest this feed without manual intervention.

Pros:

- Centralized Breach Data: Acts as a pivotal source for information on security breaches and compliance failures.

- Audit Non-Compliance Tracking: Highlights organizations that have failed to meet essential data protection audits.

- Risk Alert System: Efficiently flags companies posing potential risks under numerous regulatory standards.

- Expert-Verified Entries: Ensures the credibility of database information through expert legal verification.

Cons:

- Subscription Requirement: Access to the platform is contingent on a paid subscription, limiting free usage.

The system is enhanced by OneTrust DataGuidance. This is a risk assessment tool developed by OneTrust based on the techniques used by its in-house risk assessors. You can request a demo to get a full understanding of the Risk Exchange system.

3. TrustArc Vendor Risk Management

The TrustArc Vendor Risk Management software is a framework for noting vendor assessments. This tool is operated as a cloud-based platform. It includes a mix of assessment forms (SIGs), a legal notification feed and matching service, and consultation with the vendors themselves.

Key Features:

- Cloud Deployment: A comprehensive, cloud-based platform for managing vendor risk.

- Comprehensive Assessments: Utilizes various forms, including SIGs, for in-depth vendor analysis.

- Legal Insight Services: Provides access to legal research and notifications relevant to vendor risk.

- Direct Vendor Engagement: Includes personal interviews with vendors as part of the assessment process.

Why do we recommend it?

TrustArc Vendor Risk Management is implemented in the platform’s Risk Profile module. This provides a study of internal risk as well as third-party risk. A nice feature of this tool is that it provides reports that show you how far you have progressed towards a risk-free system. This enables compliance teams to accurately display their value.

The TrustArc system isn’t all automated; it isn’t totally reliant on software. Legal experts working for TrustArc perform assessments of vendors and even interview suppliers entered into the system for risk assessment by clients.

Vendors participate in the system because they want to make sales. Each data service and software vendor makes claims to data protection standard accreditation. So, the first step in the assessment is to verify that certification. The vendor should be able to provide data audit results and compliance verification.

Who is it recommended for?

The TrustArc system is a wider package than the vendor risk assessment system. The full package requires a lot of input and effort during onboarding to get the company compliant and there there is a low-level constant background process needed to ensure that the business remains compliant.

Pros:

- Compliance Dialogue Facilitation: Bridges the gap between businesses and vendors for compliance verification.

- Expert Consultation Included: Offers professional advisory services as part of its package.

- Software Compliance Verification: Conducts thorough checks on software packages for compliance assurance.

- Certification Validation: Ensures vendors’ claims of standards compliance are authenticated and documented.

Cons:

- Manual Interventions Required: Involves significant manual effort for thorough risk assessment and management.

Consultants of TrustArc validate all of the compliance proof supplied by vendors, which does a lot of the legwork for you. The combination of software and reliable human expertise is a very reassuring package. It is like hiring a private detective to investigate suppliers. TrustArc consultants also guide exactly what type of privacy performance you need to expect from suppliers depending on which standards you are working to. Supplier issues, such as location, viability, and insurance are also taken into account.

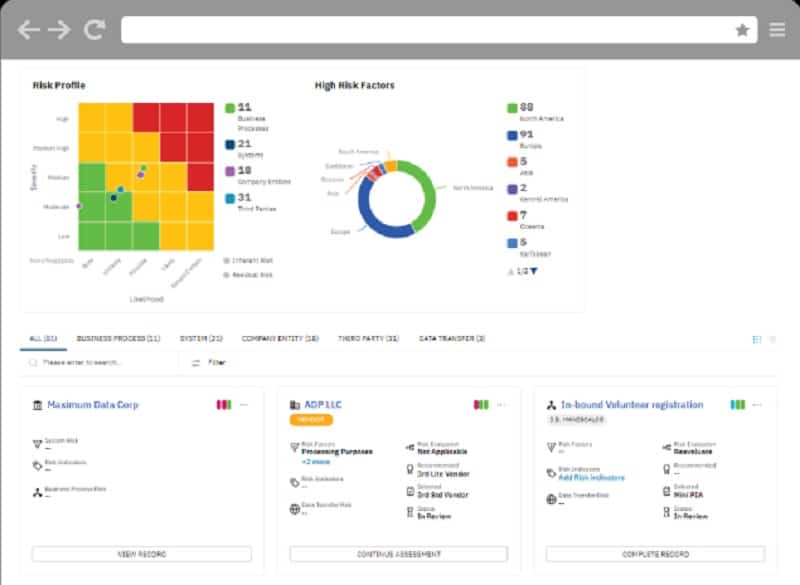

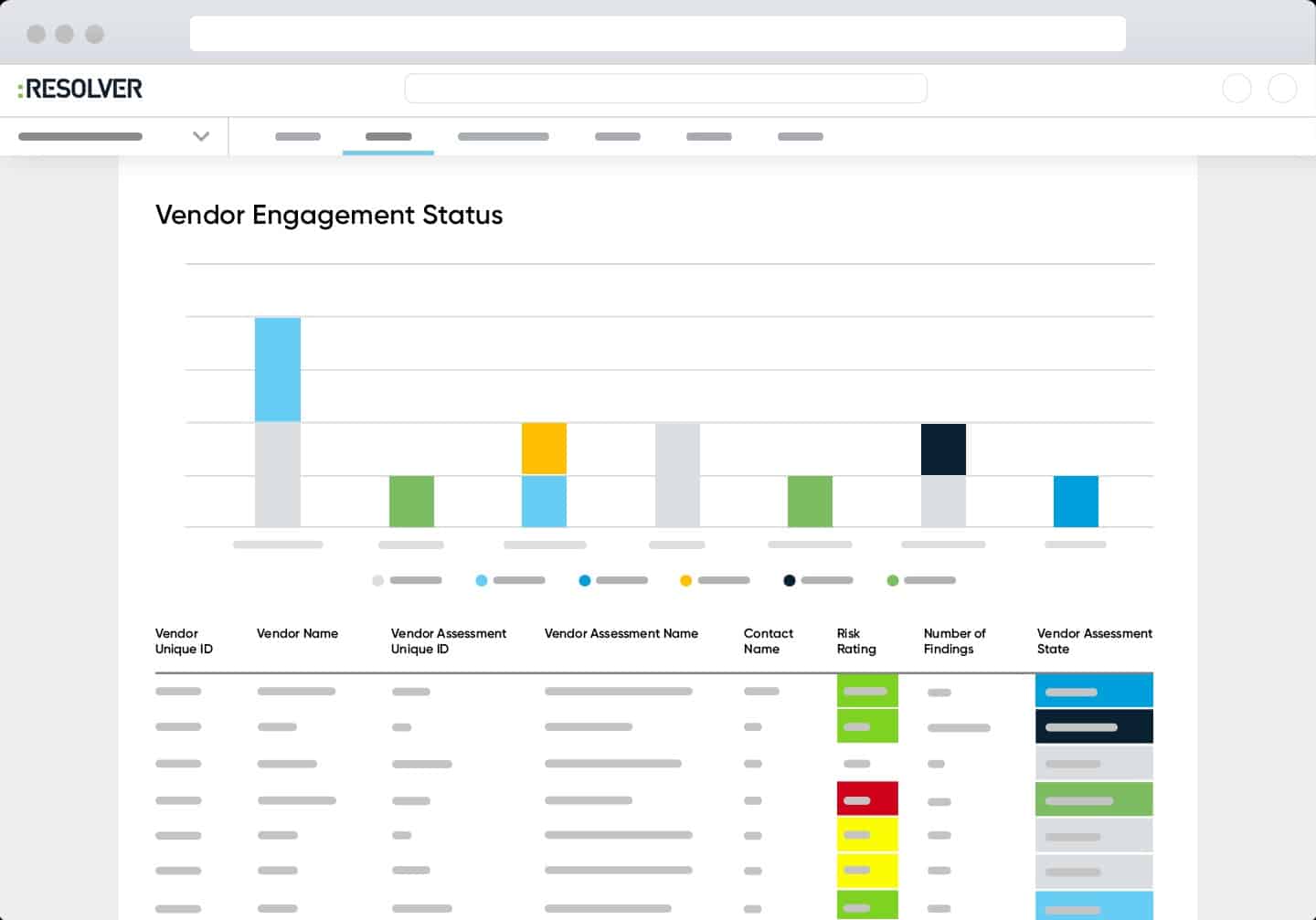

4. Resolver Vendor Risk Management Software

Resolver Vendor Risk Management Software is part of a suite of Governance, Risk management, and Compliance (GRC) tools. This is a cloud platform that can be accessed through any standard browser. The system will check on the suppliers of hardware, software, services, and applications.

Key Features:

- Comprehensive Vendor Analysis: Offers a robust package for assessing various suppliers.

- Real-Time Monitoring: Continuously observes vendor risk levels and updates accordingly.

- Risk Alert System: Notifies users of new or emerging risks associated with their vendors.

Why do we recommend it?

Resolver Vendor Risk Management Software is a component of a cloud-resident GRC suite. The full platform also provides a security monitoring service for ongoing risk assessment once the business is fully compliant. This tool also examines the brand value and reputation of vendors in addition to tracking recent security breaches.

Once vendors and their suppliers are identified, Resolver continues to monitor the risk status of those businesses so you can be sure that you won’t be caught further down the line. The Resolver system can be used to assess the suppliers of new purchases and also to audit your existing system.

The Resolver system provides an assessment framework that standardizes a checklist of expectations the suppliers need to match to contribute towards standards and legislation compliance. The assessment forms in the service should be sent out to vendors for completion. The assessment requests also list requirements for copies of certificates, which can then be stored within the Vendor Risk Management system to document confirmation of accreditation as part of the standards compliance audit requirements.

Who is it recommended for?

The Resolver system is a package for large companies. The company doesn’t publish its price list. In terms of market sector, the platform has customers across industries, including the health sector and financial institutions. The tool provides a benchmark that is a useful judgment on progress for businesses that are new to system risk management.

Pros:

- Extensive Business Insights: Conducts in-depth research on a predefined list of companies for risk assessment.

- Breach and Audit Tracking: Monitors and records instances of data breaches or compliance failures.

- Certification Documentation: Efficiently collects and archives vendors’ compliance certificates.

Cons:

- Limited Accessibility: Lacks a free trial option, restricting preliminary evaluation opportunities.

You can request a demo of the Resolver GRC platform, which includes the Vendor Risk Management software.

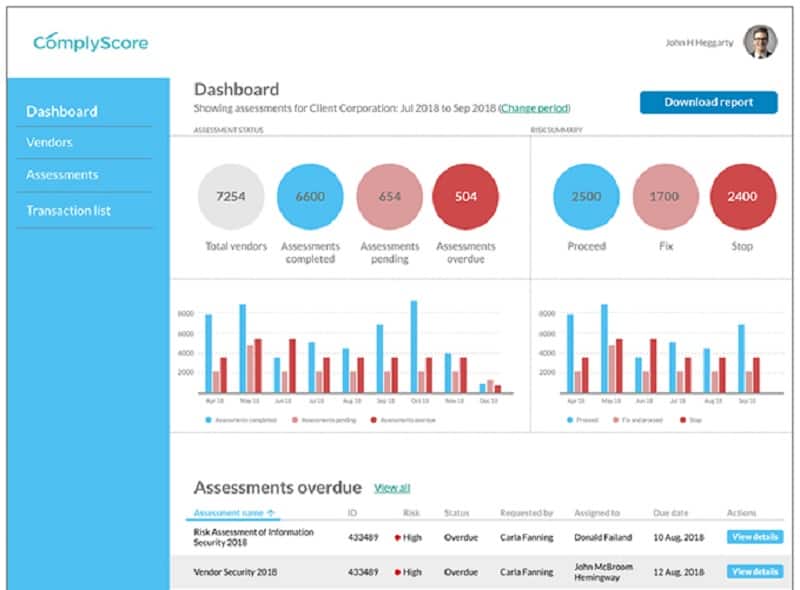

5. ComplyScore Risk Scoring

ComplyScore Risk Scoring is an online platform for vendor risk assessment that is provided by ComplyScore. The system is based on a questionnaire format, which creates a standard assessment framework for each vendor.

Key Features:

- Structured Evaluation: Utilizes a consistent questionnaire framework for vendor assessments.

- Extensive Questionnaire Library: A comprehensive collection of assessment questionnaires at your disposal.

- Supply Chain Analysis: Delivers thorough insights into the supply chain, revealing tiered vendor relationships.

Why do we recommend it?

ComplyScore Risk Scoring focuses on third-party risk management. The entire ComplyScore platform is a third-party risk management system. The software also implements ongoing GRC. The central value of the service is that it gives you a benchmark of acceptable risk. That’s useful for businesses that have no experience in risk assessing.

The assessment questionnaires should be sent out to vendors for information. The completed responses then go into an online database where analytical tools grade them to provide a ranking of each vendor’s suitability. A response can also reveal suppliers to those first-tier vendors, who then can be approached to fill out more questionnaires and possibly reveal deeper layer suppliers.

The result of an investigation will be a hierarchy of suppliers behind each product, whether that be hardware, software, applications, or services. The risk scoring of each collection of suppliers can be adapted according to the standards that you need to comply with.

The risk management platform also includes a contract risk assessor. You can store all risk assessments and business documentation in a collated store to identify the risk assessment status of each vendor. The platform also offers a Residual Risk service, which continues to check on the statuses of all logged suppliers.

Who is it recommended for?

The ComplyScore company offers its risk management system for use by businesses and it also has a managed vendor risk package, which gives you the consultants and technicians to run the system and perform vendor risk assessment for you. Unfortunately, ComplyScore doesn’t publish its price list.

Pros:

- Acquisition Integration: Facilitates the gathering of vendor data during the procurement process.

- Contractual Risk Analysis: Incorporates tools for assessing risks associated with contracts.

- In-Depth Supplier Insights: Offers a deep dive into the supply chain for a layered understanding of vendor risks.

Cons:

- High Cost: The platform comes with a significant price tag, potentially limiting its accessibility.

The ComplyScore service is offered in three editions. The packages are pricey, with the cheapest edition, called Standard, starting at a subscription price of $50,000 per year plus an Implementation Fee of $15,000. You can request a demo to assess the ComplyScore system.

6. SAI360 Vendor Risk Management

The SAI360 Vendor Risk Management software system is part of a wider GRC system. BWise is a subdivision of SAI Global. Other modules in the platform include governance and compliance features for companies that need to handle PII.

Key Features:

- In-Depth Corporate Analysis: Specializes in comprehensive research into corporate vendors.

- Ongoing Vendor Assessment: Conducts continuous investigations to ensure vendors remain compliant.

- Regular Vendor Re-Evaluations: Implements frequent checks to update vendor risk profiles.

Why do we recommend it?

SAI360 Vendor Risk Management goes through third-party risk management to fourth-party risk as well. The tool prioritizes the risks that you need to deal with, which could mean adjusting your partnership programs or supply chain, or, if you also use the platform’s internal risk management and compliance management tools, your own working practices.

This service allows you to put all of your vendor management tasks in one place. Assess initial options for purchases by checking on their providers and then continuing ongoing monitoring of vendor reputation and compliance.

The system includes a risk identification service, so you don’t waste time verifying suppliers of products that don’t impact data protection standards requirements. The vendor management system also ranks suppliers by the level of criticality. The overview of vendor management lets you see exactly how many different suppliers you currently deal with.

The system provides a framework for vendor risk assessment through firms and checklists. There is also a section for contract conformance that tracks the delivery of SLAs. In each case, workflows in the assessment framework provide points for interaction with the provider and checklists of points to confirm. Some measures can be undertaken to address risks that are identified by the process.

Who is it recommended for?

Like most of the tools on this list, the SAI360 package is designed for use by large organizations. Big businesses are more likely to suffer a risk if their vendors have a security breach than if their customers are damaged. With small businesses the reverse is true.

Pros:

- Integrated GRC Components: Seamlessly integrates with a broader GRC platform for comprehensive risk management.

- SLA Performance Monitoring: Tracks the fulfillment of service level agreements with vendors effectively.

- Streamlined Procurement Process: Provides a structured framework for evaluating potential acquisitions.

Cons:

- Resource-Intensive Research: Requires significant manual effort to perform thorough vendor evaluations.

The discovery of a problem with a supplier might lead you to drop its products. The Vendor Risk Management software lays down procedures to follow for finding replacement services, hardware, or software in that event.

7. SureCloud

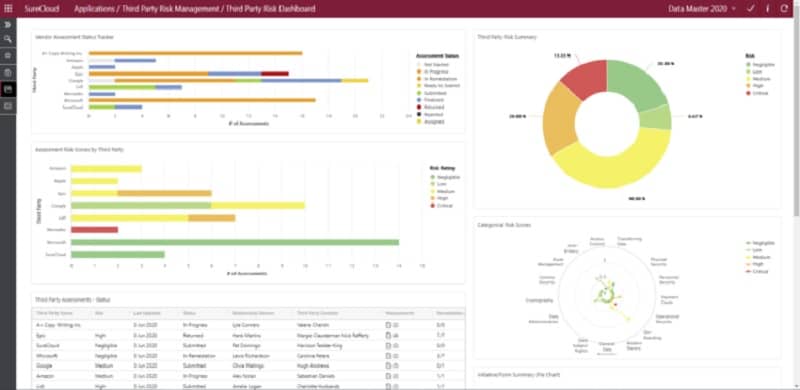

SureCloud is a package of governance and compliance services that includes a risk management module. The Third-Party Risk Management software system gives you a central repository for your vendor assessments and verification. The system is offered in three plans with greater automation with higher editions. The lower edition, called Standard, provides a space for you to log your assessments. The higher plans, called Business and Premium are form and workflow-driven, automating much of the vendor risk assessment process.

Key Features:

- Automated Forms: Utilizes form-based assessments for systematic vendor evaluation.

- Dynamic Risk Updates: Incorporates a risk assessment feed to keep vendor data current.

- Comprehensive Verification: Offers a dedicated service for thorough vendor validation.

Why do we recommend it?

SureCloud is a large GRC platform with many modules and the Third-Party Risk Management tool is one of them. This service works best in conjunction with all of the other services on the platform to get a company into compliance and then stay there and prove it.

The process of vendor risk management has two strands. You can set up a form-based assessment that requires the participation of the vendor. This workflow also indicates the documentation, such as standards accreditation and audit certificates, that you need to ask for and store. These questionnaires are tailored to the standards that you are following and the category of product that each vendor supplies.

The second powerful element in the Third-Party Risk Management system is a feed from BitSight, which is a security rating agency. This provides an instant assessment of the risk attached to each of the vendors that you enter into the system. That service is an add-on and isn’t included in the plan subscription price.

Who is it recommended for?

This service focuses on technology suppliers such as SaaS providers. It also looks at the software packages that companies run on site. Rather than scanning those tools, the system scans for reports of data breaches suffered by each provider or reported weaknesses in the software. SureCloud doesn’t publish a price list.

Pros:

- Streamlined Compliance Data: Centralizes information on potential compliance obstacles presented by vendors.

- Manual Exploration Tools: Provides a structured approach for detailed vendor investigations.

- Interactive Questionnaire System: Facilitates communication with vendors through a specialized library of forms.

Cons:

- Limited Initial Access: Access to the full suite of features is restricted without a trial period.

You can request a demo to see the cloud-hosted Third-Party Risk Management system for yourself.