E-commerce fraud is a type of cybercrime that is perpetrated on an e-commerce site or platform

It typically involves the use of stolen credit card numbers and stolen identities to carry out fraudulent online payment transactions. Common examples of e-commerce fraud include account takeover, return fraud, chargeback fraud, transaction fraud, and triangulation fraud, among others.

Before the internet, the technique used by fraudsters generally involved stealing physical credit cards and making purchases with them. But as commerce and business transactions moved online, cybercriminals and fraudsters also followed suit. Today, fraudsters simply leverage the anonymity of the internet to obtain stolen credit card details from the dark corners of the web and then use them to carry out fraudulent transactions. This level of convenience and anonymity makes e-commerce fraud very attractive to cybercriminals.

According to Juniper Research, e-commerce fraud cost online e-commerce operators about $20 billion globally in 2021

This means that every e-commerce operator must find a way to protect their e-commerce platform and customers against those cybercriminals. With the right fraud protection tools, you can safeguard your business with minimal effort. In this article, we will review the ten best e-commerce fraud prevention software out there to help protect your e-commerce platform from fraud.

The Best E-commerce Fraud Prevention Tools

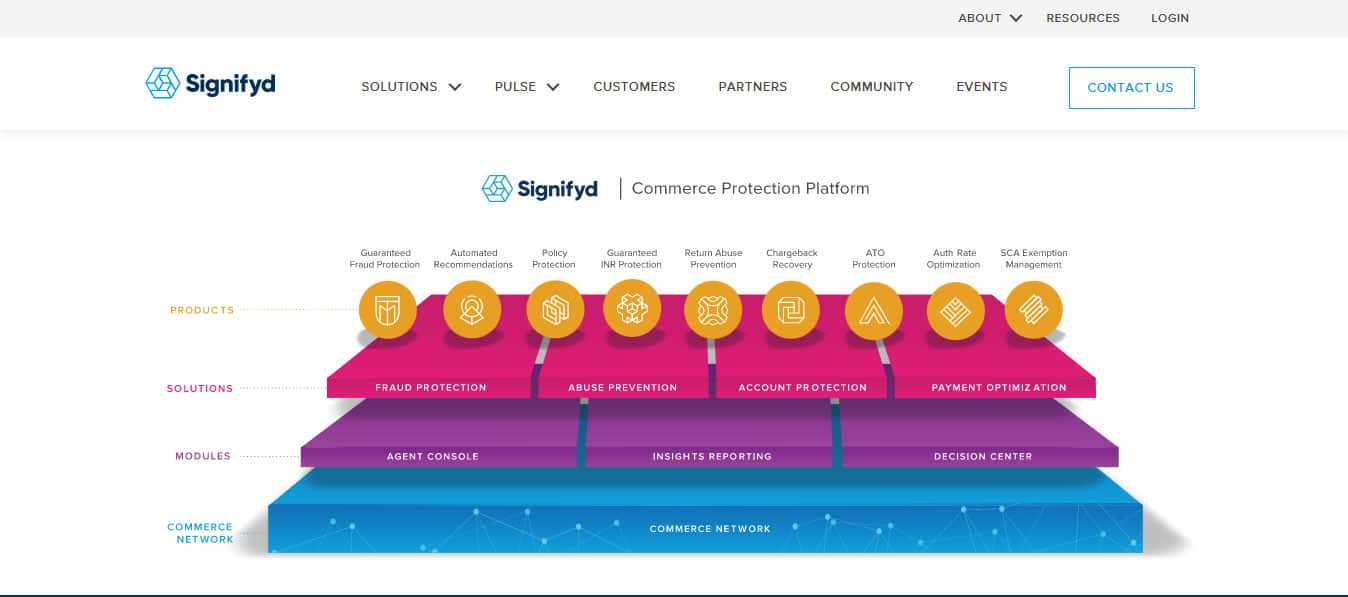

1. Signifyd

Signifyd is an end‑to‑end e-commerce protection platform that leverages its commerce network, big data, and machine learning to maximize conversion, automate customer experience, and eliminate fraud and customer abuse for retailers. This effectively shifts the liability for fraud away from your e-commerce platform, allowing you to focus on sales and business growth while reducing risk.

Key Features:

- Fraud Protection Signifyd’s Fraud Protection solution leverages machine learning models to contextualize identity and intent insights from the Commerce Network with merchants.

- Abuse Prevention Prevents abuses such as Item-Not-Received fraud, unauthorized resellers, chargebacks, promotions, and coupons abuse, among others.

- Account Protection Detects anomalies in shopper behavior and other fraudulent activity including account takeover in real‑time, and defends account integrity

- Payments Optimization Simplifies the customer journey and experience and provides a smooth path to purchase.

Signifyd supports integration with major e-commerce platforms such as Magento, Shopify Plus, BigCommerce, Salesforce Commerce Cloud, and Netsuite, among others. An online demo is available on request.

EDITOR'S CHOICE

Signifyd is our top pick for an eCommerce fraud prevention software package because it offers an advanced, AI-powered solution designed to protect online retailers from fraud while enhancing customer experience. Signifyd’s platform combines machine learning, big data analytics, and a vast network of transaction data to provide real-time fraud detection and risk mitigation, making it an invaluable tool for eCommerce businesses. One of the standout features of Signifyd is its advanced fraud detection engine, which analyzes millions of data points to assess the legitimacy of each transaction. By leveraging machine learning, Signifyd continually improves its fraud detection accuracy, adapting to evolving fraud tactics. This ensures that businesses can stay ahead of emerging threats and minimize chargebacks. Signifyd also provides guarantees against fraud, which is a unique advantage for online merchants. With its fraud protection guarantee, businesses are reimbursed for any chargebacks related to fraud, giving them peace of mind and reducing financial risk. This feature allows retailers to confidently approve more transactions without worrying about fraudulent chargebacks impacting their bottom line. Signifyd integrates seamlessly with popular eCommerce platforms such as Shopify, Magento, and BigCommerce, ensuring quick and easy setup for businesses of all sizes. The platform also provides automated decision-making, which streamlines the approval process and helps merchants scale their operations without compromising on security.

OS: Cloud based

2. Riskified

Riskified provides software as a service (SaaS) fraud and chargeback prevention service. Riskified’s technology leverages machine learning, behavioral analysis, elastic linking, and proxy detection to detect and prevent fraud.

Key Features:

- Machine learning (ML) Riskified uses ML algorithms to provide real-time insights.

- Device identification Riskified utilizes various techniques such as IP and geolocation, proxy detection, order linking, device fingerprinting, chargeback, and many others to understand and track the identity of users and malicious actors.

- Riskified dashboard Riskified’s dashboard helps you to visualize order review time and track the performance of the application.

- Authentication For each transaction, Riskified gives you the option to decide which one to decline and approve to generate further sales.

Riskified platform includes the following key components:

- Chargeback Guarantee Provides real-time order decisions and scales to adapt to your growth and evolving business needs.

- Policy Protect Stops abusers from eating into your profit, while you continue to reward loyal customers with friendly policies.

- Account Secure Prevents ATO and other malicious activities from compromising the integrity of your customers’ store accounts and helps you manage customer interactions related to suspicious account activity.

Riskified supports integration with major e-commerce platforms such as Magento, SFCC, and Shopify.

3. Kount

Kount is a provider of fraud prevention solutions that protects e-commerce brands against digital payments fraud, account fraud, and account takeovers, among others. Kount’s Identity Trust Platform uses machine learning and AI models to protect the entire customer journey.

Key Features:

- Kount Command Prevents digital payment fraud and delivers accurate identity trust decisions in milliseconds

- Kount Control Prevents malicious logins, detects malicious bot activity, and challenges login activity with multi-factor authentication (MFA)

- Dispute and Chargeback Management Helps businesses manage dispute inquiries and chargeback alerts.

- AI-driven fraud prevention Detects emerging fraud to uncover anomalies

- Kount’s global network Drives accurate identity trust decisions that can block fraud and low-trust events in real time.

Kount is highly customizable and this makes it suitable for organizations that want to fully manage their own fraud prevention decisions and outcomes.

Kount supports integration with major e-commerce platforms such as Magento, Shopify, BigCommerce, Salesforce Commerce Cloud, KIBO, and Woocommerce, among others. Pricing depends on factors such as business goals, and transaction volume, among others. An online demo and price quote are available on request.

4. ClearSale

ClearSale is an end-to-end fraud management and prevention and chargeback protection services company that helps e-commerce platforms to detect and mitigate fraudulent transactions. Its fraud detection software combines machine learning with manual reviews to facilitate effective approval of valid orders while maximizing revenues and keeping customers happy. ClearSale is targeted at SMBs, large e-commerce enterprises, and services providers.

The ClearSale platform helps e-commerce companies to track and sort orders based on the determined fraud risk. A manual review process is required for denied transactions to reduce false positives. ClearSale focuses on indicators of card, not present (CNP) fraud management such as chargeback losses, rejected orders, fraud, and response time. ClearSale’s platform includes end-to-end fraud management and prevention.

ClearSale supports integration with major e-commerce platforms such as OpenCart, Volusion, Magento, BigCommerce, Shopify, PrestaShop, and WooCommerce. ClearSale offers two pricing models:

- KPI pricing model includes the ClearSale Chargeback Protection (ClearSale will work with you to identify a target chargeback percentage), and

- a fixed percentage pricing model based on your sales volume.

5. Forter

Forter is a software as a service (SaaS) company that provides fraud prevention technology for online retailers. Forter provides a unified, fully automated fraud prevention platform powered by a global network of retailers, banks, and payment providers to deliver the highest level of accuracy and an exceptional customer experience.

Key Features:

- Trusted Conversions Prevents fraud throughout the entire customer journey (from login to logout), across devices and the web, without compromising customer experience.

- Trusted Policies Gain insight into the sources of malicious behavior and adjust policies and processes to identify and mitigate the impact of those malicious behaviors, including returns, promo, and reseller

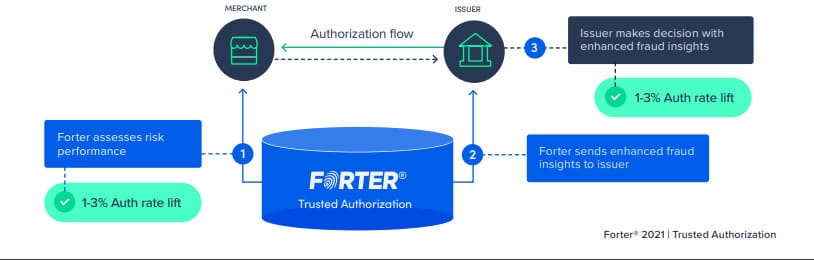

- Trusted Authorization Enables merchants to have a direct connection with issuing banks to share Forter’s fraud decision, fraud insights, and transactional data thereby eliminating false declines by up to 85% and increasing authorization rates by 1-3%.

- Trusted Identities Prevents fraudsters from creating multiple accounts, exploiting consumer credentials, and account takeover attempts.

- Forter Element Targeted at payment service providers, instead of evaluating each transaction individually, Forter Element’s approach measures the trustworthiness of each customer to provide accurate, real-time decisions.

Forter supports integration with major e-commerce platforms such as Adobe, SAP, Salesforce, BigCommerce, and Shopify. A free live demo is available on request.

6. Simility

Simility (now a PayPal company) is an end-to-end fraud prevention and decisioning platform that enables organizations to make data-driven decisions. Simility’s Adaptive Decisioning Platform leverages built-in machine learning models to enable merchants to detect and mitigate fraudulent activities, minimize chargebacks and false positives.

Key Features:

- Promotion abuse Protects e-commerce platforms by automatically detecting and blocking fraudulent new account creations before they cause harm.

- Account takeover Prevents account takeover attempts and other unauthorized access to user accounts.

- Transaction fraud Simility’s data-driven Adaptive Decisioning Platform uses manual rules, machine learning models, and link analysis to assess risk, reduce chargebacks, lower false positives, and proactively fight emerging fraud.

- Continuous assurance Provides businesses with a comprehensive view of the end-user and helps detect changes in customer behavior to uncover emerging threats.

Simility is targeted at e-commerce (merchants) and financial services organizations. Simility can be integrated into any platform via an API connection.

7. FraudLabs Pro

FraudLabs Pro provides fraud detection and prevention solutions to protect online businesses from payment frauds such as chargebacks, card not present, among others. FraudLabs Pro performs fraud validation on all elements such as geolocation, proxy, email, credit card, transaction velocity, and others to detect and mitigate fraudulent orders.

FraudLabs Pro analytic engine analyzes transaction parameters and reports fraud analysis. The report provides you with valuable information to help you make informed decisions on the next action based on the fraud distribution score. Is targeted at startups, SMB, and large e-commerce organizations that want to minimize the fraud risks.

FraudLabs Pro supports integration with major e-commerce platforms such as PrestaShop, WooCommerce, Salesforce, BigCommerce, Shopify, and Opencart, among others. It only comes with the monthly subscription option. There is no trial version but you can sign up for a free Micro Plan for evaluation.

8. Nethone

Nethone is a Saas-based e-commerce fraud prevention and detection tool that protects online merchants from common e-commerce fraud such as card‑not‑present fraud, account takeover fraud, and identity fraud, among others. With Nethone, you can automatically lower the risk of fraud, manual review, chargeback, and rejection rate. Nethone’s strengths lie in its highly customizable platform that allows merchants to effectively create their own unique fraud prevention profile. It comes with a dashboard that enables data and user profiles visualization, and tracking of ML decisions based on signals and connections.

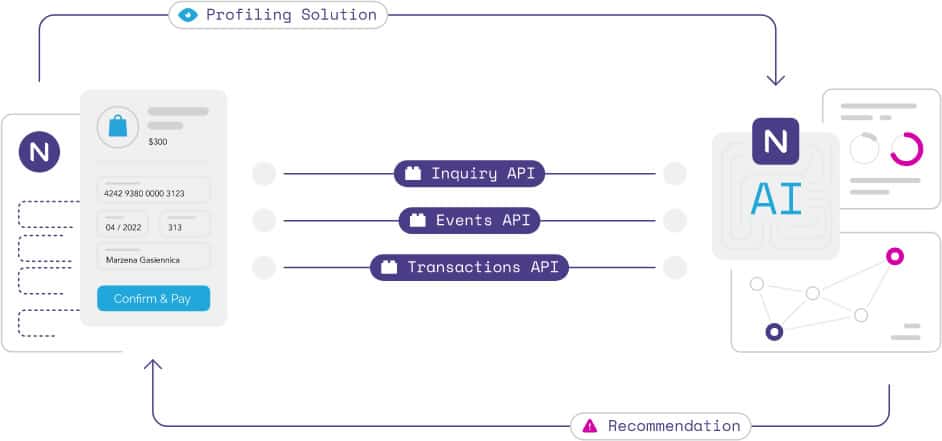

Nethone fraud solution is mostly targeted at e-commerce, Travel, and Digital Lending companies. The solution leverages device, network, and behavioral analytics, to profile users on the merchant site and to give a complete picture of each user on your online platform, detecting fraudulent behavior and providing business intelligence insights. Data is collected via various signals ranging from historical databases to user’s interactions within your website—classified under various categories such as Inquiry API, Events API, Transactions API, and Profiling Solution. The collected data are sent to the Nethone proprietary ML algorithms for analysis and recommendations. All integrations are via the API.

Nethone does not offer free trials but you can sign up for a free 30-minute demo if you’re interested in evaluating the software.

9. DataDome

DataDome provides cloud-based online fraud and bot management services that protect e-commerce businesses from card fraud, credential stuffing, account takeover, fake account creation, flash sales attacks, and more. DataDome’s mission is to free the web and e-commerce platforms in particular from fraudulent traffic so that sensitive data remains safe and online platforms can perform at optimum speed.

DataDome uses AI and machine learning to determine whether a traffic or user account is a human or a bot by analyzing 5 trillion signals per day. Once a bot-driven fraud attempt is detected, DataDome blocks it right away without impacting business operations. DataDome provides a tool to check your site for bad bots slowing down your website performance and impacting the customer experience. A personalized online demo and a free 30-day trial are available on request.

10. Arkose Labs

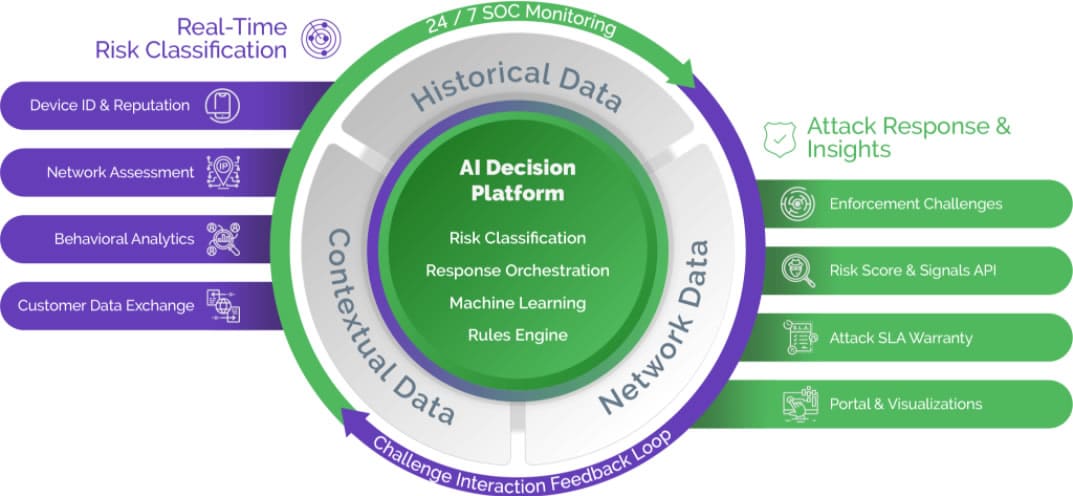

Arkose Labs is an e-commerce fraud prevention solution that focuses on undermining the economic incentive behind fraud by rendering attacks time-consuming, difficult, and expensive. It combines real-time risk classification and targeted enforcement challenges to cripple the ROI of attacks while allowing legitimate users to pass through with ease.

The Arkose Labs AI-powered platform analyses traffic for malicious intent and classifies it based on perceived risk level or profile. It then dynamically tailors authentication to the exact risk profile in order to weed off suspicious traffic or possible attacks.

This is achieved through the following key components:

- Arkose Detect Carries out deep analysis of behavior and device heuristics to segment suspicious activity for the appropriate attack response.

- Arkose Enforce A challenge-response mechanism that generates 3D images in real-time which are tailored to the risk profile and cannot be bypassed by fraudsters at scale.

Arkose Labs provides protection against all kinds of e-commerce frauds such as account takeover, bots, credential stuffing, payment fraud, micro-deposit fraud, fake account registrations, website scraping, API traffic protection, and international revenue share fraud (IRSF), among others. Arkose Labs does not offer free trials but you can book a live demo session if you’re interested in evaluating the software.

Hi there! Quick clarification: DataDome actually analyzes 5 *trillion* signals per day (not billions). More on that here: https://datadome.co/bot-management-protection/harnessing-the-power-of-trillions-datadome-continues-to-expand-signals-collection-for-most-accurate-ml-detection-models/

Well spotted, thank you.