If you’re part of the “gig economy”, you’re not alone. According to a 2020 survey from Upwork, 59 million freelance workers live in the US alone. Those numbers are growing year-over-year. The same survey found that 20 percent of current employees are considering doing freelance work. This would mean the freelance workforce could increase by 10 million.

While freelance work can be incredibly empowering, it can also come at a significant cost if you’re not careful. That’s because many completely green freelancers far too often fall prey to scams intended to lure them into easy earnings, only to have them ripped away.

As a freelance writer myself, I’ve seen my fair share of scams targeting freelancers. From job postings that are clearly fraudulent, to someone who actually tried to convince me to share my Upwork account with him, I’ve had to navigate the sometimes risky world of freelancing in order to make a living in the gig economy.

What to do if you’ve fallen for a freelancer scam

It can be difficult to admit that you’ve been scammed but the sooner you let your bank and payment services know, the sooner they can lock down your accounts and prevent the scammer from withdrawing your funds (or tricking other freelancers).

The next step is to change your passwords. You may want to use a password manager to make sure that your new credentials are unique and effectively impossible to crack, or set up two-factor authentication to prevent anyone from logging in without your knowledge.

If you opened any files that the scammer sent, it’s a good idea to run an antivirus scan too. This way, they won’t be able to remotely control your computer or monitor your activities from the shadows. We recommend Norton Security and TotalAV, two well-respected services with affordable plans and risk-free money-back guarantees.

Why do freelancers fall for scams?

If you’ve never fallen for a scam, you may wonder how and why freelancers are easy prey for con artists and criminals.

In many freelance industries, such as writing, those with more experience have a much easier time finding work. New freelancers often have to undersell themselves to get work, experience, and portfolio-worthy material. The lack of decent-paying work can lead to significantly lower income or gaps in income.

This struggle to claw one’s way out from the bottom can easily lead to understandable desperation. And when presented with opportunities to move up, many freelancers may have their scam radars tuned down or turned off when presented with the prospect of easy, quick, and high-income work opportunities.

With that in mind, if you’re new to freelancing in any industry and looking to avoid some of the common scams targeting freelancers, here’s a useful list of 10 scams you may encounter on your journey to the top.

1. Work-from-home scams

Although freelance writing, editing, and graphic design are among the most well-known types of freelancing, “work-from-home” schemes have existed for decades and indeed fit within the category of the gig economy.

There are numerous legitimate ways to earn income from home, including through freelance platforms like:

- Upwork

- Freelancer

- Toptal

- Guru

However, some people still fall prey to nondescript work-from-home scams.

Many of these scams seem attractive because they generally do not require any specialized skill-sets, as opposed to most official and legitimate freelancing platforms.

Many work-from-home scams advertise themselves based on supposed high-earnings potential but don’t provide any details regarding what work will be performed until you’ve called their number, or entered into a digital communication exchange with the scam artists.

How to avoid work-from-home scams

The easiest way to avoid these types of scams is to utilize only legitimate freelance platforms. These sites may have scam artists working within them, but most have reporting and monitoring methods that reduce the number of scam jobs that might be posted.

You’ll also want to avoid clicking on any links or web ads similar to the one above. If the “work-from-home” advertisement fails to state what kind of work is being performed, it’s likely a scam, or at the least, overstating the earning potential.

If you’re not sure whether a site or service is legitimate, do a quick Google search, such as “[site name] reviews” or “is [site name] a scam?”. If a website has bad reviews or multiple sources state it’s a scam, look elsewhere for work opportunities.

2. Fake job postings

There are dozens of job boards out there, each with varying levels of content filtering to help remove scams from their systems.

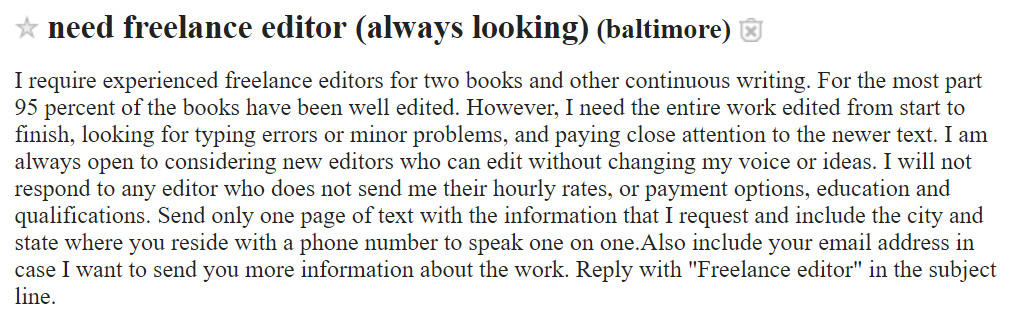

Some offer better protections to freelancers than others. For example, if you’re using Craigslist’s “Gigs” section, there’s no real way to tell whether a job is the real deal or a scam in disguise. Because Craigslist has no features in place to rate the individuals posting work, you have no data to go on that will help you determine if the job poster is a legitimate company or someone hoping to scam you out of house and home.

For example, this job posting on Craigslist provides no way to tell whether the job poster is trustworthy enough to pay for completed work. There’s also no way to tell whether he or she isn’t just phishing and hoping to steal information from applicants.

How to avoid fake job postings

Your best option is to only seek work through official job posting websites and freelancing platforms. However, fake job postings and scams exist on those platforms and sites as well, so there are a few extra steps you’ll want to take.

- Only take work from employers who have a verified work history and good ratings. Most freelance platforms now allow freelancers to rate clients following the completion of projects and allow clients to rate their freelancers. This creates a paper trail, so to speak, which makes it easier to determine whether a client is the real deal.

- However, there may be times when you see an interesting job post from a new client or a potential employer who has no previous history. If that’s the case, be extra cautious before agreeing to do work. If you apply, make sure the client does not do things like ask you to pay money to take work or asks to take communication off of the official freelancing platform.

- Check the client’s feedback score and reviews. Bad reviews do not necessarily mean the client is a scammer. In fact, most individuals who make scam posts won’t have any previous work history on a platform at all. Bad reviews are often an indication of a client who is difficult to work with. Still, there is a chance the client has a tendency to ask for more work than agreed upon or tries to underpay, delay payments, or not pay at all. That might be indicated in the reviews on the platform.

3. Requests to send payment before being hired (pay to work)

The great thing about most freelancing work is that you often already have the equipment you need to get started.

If you’re a freelance writer or artist, for example, you probably have the software you need to start taking work immediately. And if you’re a ride-share worker for Uber or Lyft, owning your own car that passes either service’s inspection standards means you’re ready to roll (literally).

However, some freelance scams will ask you to pay some type of fee or purchase the client’s product in order to begin working for them. Such scams often promise you either access to lots of work for an entry fee or promise huge rewards for reselling the company’s product after you purchase it.

There’s usually no guarantee for either with these types of scams. More often than not, the company or client making individuals pay upfront to work for them are earning a profit by signing people up and/or making them purchase the product they want you to sell.

How to avoid “pay to work” scams

The advice here is simple: if you need to pay to access work with an individual client, don’t work with that client. Note that this is not the same as a service fee for using a platform.

For example, sites like Freelancer.com and Upwork offer free sign-ups and a limited number of free proposal submissions, but charge a fee for the opportunity to post more proposals. This wouldn’t be a scam, but a cost of using their service to find work—and it’s also not mandatory.

But if you do find a service that requires you to sign up and pay a fee or buy a product before you can do work for them, look elsewhere for work. You’re not likely to earn a return on the “investment”.

4. Pyramid schemes (or multi-level marketing/direct sellers)

Pyramid schemes, (also known as multi-level marketing or direct selling) are everywhere these days. A bit of an off-shoot of the “pay-to-work” scams, multi-level marketing scams work this way:

- You sign up to the service/company and become a “brand ambassador” or some other related term.

- You’re compelled to buy the company’s products ahead of time, usually at a “discount”.

- You’re then tasked to sell those products for the company, which may or may not take a cut of the profit you earn.

- You’re also compelled to get friends, families, and acquaintances to sign up as “brand ambassadors” as well, and the company often offers bonuses if you get more people to sign up to help sell the product.

Unfortunately, multi-level marketing is perfectly legal in many places, including the US, but tenuously so.

Large MLM brands, such as Amway and Mary Kay, have been around for decades and have all faced numerous legal challenges (usually for fraud or abusive behaviors). Others, such as LulaRoe, Herbalife, and Plexus have gained a strong foothold in households across the country despite sketchy origin stories and ongoing lawsuits.

Even worse, many of these MLM schemes have fairly ardent supporters, but just as many individuals reporting the type of MLM horror stories that are highly indicative of scams.

MLMs are far and away one of the most common types of scams, and more often than not prey on stay-at-home mothers desperate to contribute to their household income or find financial freedom.

The companies typically promise an easy path to riches but frequently leave individuals burned out and having spent far more than they earned, or just barely making up the cost of purchasing the company’s products.

There are even websites dedicated to not just outing MLMs for what they are, but also to provide support for individuals who have been hurt by such scams.

How to avoid multi-level marketing scams and pyramid schemes

Many people get sucked into MLM scams before they realize what they’ve gotten themselves into.

By the time it’s too late, many of those who begin working for a direct selling company are out thousands of dollars, as well as friends. This is because MLM companies often push individuals to try to sell to just about anyone they can, including close friends and relatives, many of whom eventually become weary of being viewed as a business opportunity.

The best way to avoid MLM scams is to reject any offer to work with a company that wants you to buy and sell their product for them. Additionally, if the company promises you’ll get rich through their method, they’re probably a scam.

Helpful websites list MLM scams, so knowing the companies by name can help. This list of MLMs on the Reddit group /r/AntiMLM should be a good starting point. Simply search the list for the name of a company that you suspect might be a pyramid scheme. Importantly, if you’re unsure, simply research the company online first.

5. Requests for account information

You’re likely to have different accounts as a freelancer. You most likely have a PayPal account set up for fast transactions, for example, and there’s a strong chance that you are, or will be, part of different freelancing platforms.

Any account you have that’s tied to your business is extremely important. So important, in fact, that scammers might try to gain access to them in order to either:

- Steal access to your account for their own purposes

- Steal money from your accounts

- Hold your accounts hostage in return for a ransom payment

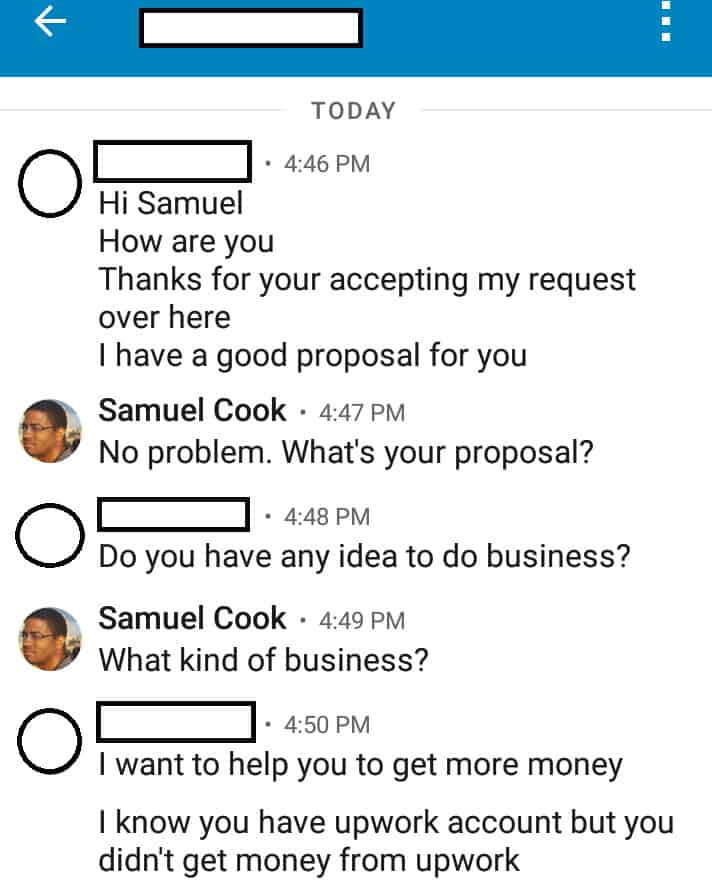

This is a scam attempt I personally ran into not too long ago on LinkedIn. I do a majority of my freelancing work through Upwork, where I maintain a solid rating and great reviews.

While a lot of time and effort went into building that good standing on Upwork, it could also be valuable for anyone who manages to gain access to it.

This is what one scammer was hoping to do when he contacted me on LinkedIn.

The scammer’s proposal seemed innocent enough at first. He wanted to help me earn more money. And as a freelancer, well, that’s always a proposal I’m willing to entertain. After all, many freelancers with varying skills join forces and help each other out. A writer might team up with a graphic artist, for example. It’s often mutually beneficial.

That wasn’t his aim, however, and the red flags went up pretty quickly.

He tried to show me his Upwork profile using a dead link, for example, despite his claims that he had a solid profile. If it had existed at some point in the past, it was certainly no longer active. It didn’t take long before he dropped the obvious scam bomb on me.

I didn’t even bother responding to his last request. There was no need. It was obvious what his game was here. By giving over my account information, I’d be giving him access to:

- My current earnings waiting for transfer into my personal account

- My bank information

- Other personally-identifying information

- My entire Upwork account

Even if his request was legitimate (it obviously wasn’t) account sharing is against Upwork’s terms of service and is also against the policy for most freelance platforms. Doing so would have not only put me at a scam risk but at a huge risk for losing a key part of my freelancing business.

How to avoid account sharing scams

Attempts to get you to share your freelance platform accounts are more common once you become successful and have a good record of solid work. Once that happens, you’ll need to be diligent not to let the appeal of extra earnings sway you away from common sense.

Anyone asking to share your account is likely looking to steal your account, or worse. That aside, sharing freelance platform or PayPal account information is also a huge privacy risk, as your account likely contains a fair amount of personally identifying information and financial information.

If someone asks to share any of your freelancing accounts, just say no.

6. Personal information phishing through tax documents

Of all the scam attempts on this list, a tax document scam was the only one that nearly took me in before I got wise to it. Thankfully, my suspicious nature took hold and I saw all of the warning signs before giving up my information.

Given the nature of the work we do, it’s easy to assume submitting tax forms is just part of doing business. Not so fast. In most cases, you will never need to give a client a W2 or any other form of tax document.

Be wary of clients who try to get you to submit tax documents to them.

In the US, clients should only require you to submit a W2 if they’re paying you by check, or through direct deposit to your bank account, and they expect to pay you more than the federally mandated minimum for independent contractors that can go unreported on taxes (currently $600).

If you’re getting paid through digital payment processing services, clients don’t need to issue a 1099-MISC to you, and therefore don’t need a W2 or your Social Security Number.

How to avoid tax document scams

If your clients plan to pay you through a freelancing platform or electronic payment service, such as PayPal or even by credit card, you won’t need to submit tax documents to them.

The freelancing platform or digital payment service will be required to send you a 1099-MISC if you earn more than $20,000 through that platform or receive that amount or more through that payment system, and will likely already have your SSN and other information on file.

Here are some things to keep in mind about tax document scams:

- Clients working through freelancing platforms should not be asking for a W2 or other tax documents. If they do, it’s likely a scam, or the client is grossly misinformed on their tax responsibilities. If the client presses you on it, don’t give in.

- If you’re working with a client outside of a freelancing platform and you’re not comfortable with giving up your SSN or other information that could be used to steal your identity, request all payments go through PayPal, at least until you’re sure you can trust the client with your information.

- Finally, if you do get a tax document, know the difference between fake a real tax documents. A real W2 will never come as a Microsoft Word document, for example (which it did when I received this scam attempt). The document should also have the most recently available tax year. If you receive a W2 file, check it against the most recently available document here.

7. Suspicious or unusual payment methods

As a freelancer, most of your payment options will be digital. However, some clients may pay through check, while others may use direct deposit or credit card. These are all standard forms of payment and are typically trustworthy.

Some clients will try to scam freelancers by offering to pay via unusual methods. This can include asking freelancers to accept alternative forms of payment (goods and services instead of money) or to accept payment using methods such as gift cards.

How to avoid payment method scams

You should only accept a select few payment methods as a freelancer. These include:

- Directly through the freelance platform you’re using, which will receive the payments and extract a fee

- PayPal or a similar platform like Wise or Payoneer

- Credit card

- Direct deposit

- Check

- Some other, minor payment systems, such as Square, that you may use if you’re the type of freelancer who sells his or her objects through physical means

However, you should never accept payments through means that are wholly atypical or completely unusual. For example, if a client asks to pay you in goods instead of services, don’t accept it (yes, this happens and I have had a client request this type of unusual payment option before).

Clients asking to pay through unusual means are often looking to short-change you, or evade tax obligations.

To keep your own income reporting safe and to avoid suspicious payment behavior from clients, only accept payment through vetted and acceptable means.

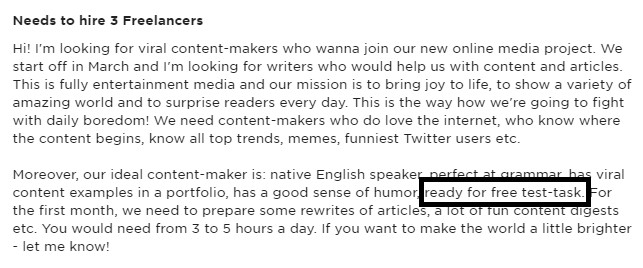

8. “Test” projects

This is a scam that many freelancers, especially writers, experience at least once before they learn their lesson. It goes like this:

- You submit a proposal

- The client responds and says they like your proposal and would like you to do a test project. If all goes well, they’ll hire you on for more work

- You complete the test project, and never hear back from the client again, or the client tells you the work is great but he/she selected another freelancer

In many cases, the client isn’t actually looking to hire. Instead, the client is using test projects to gather quality work from freelancers without having to pay a penny, or by paying a significantly smaller amount than what such a project would usually cost.

How to avoid test project scams

It’s easy and understandable why many freelancers fall for this scam. Getting a response from a client who asks for a test project is often an indication that they liked your proposal and that you’re close to securing the contract. But there are some clients do will abuse this trust to their own advantage.

9. Requests to make contact outside of official channels

The best freelance platforms all include an integrated communication system. This system offers some privacy protections for freelancers, making it possible to communicate about business without having to give out personal information, unless you want to or need to for the job.

Freelance platform communication systems make it possible to easily file complaints against clients for abuse and fraud. This is why some clients may try to move communication off of the official, integrated channels.

If there’s no paper trail to follow on the freelance platform chat system, the freelance platform may not be obligated to assist you in recovering from the negative impacts of fraud.

How to avoid scams through external communication channels

If you’re using a freelance platform, only use the official communication channels until you have developed a strong working relationship with a client. Even then, you may want to stick with the official chat systems that come with these services, as they can help protect both you and the client from potential abuse.

For those freelancing outside of official platforms, your best option is to create a separate email address and phone number for business purposes. You can use something like Google Voice to create a VoIP number disconnected from your personal number and have those communications come through to your mobile device so you don’t have to buy two phones with separate numbers. You may also want to create a separate Skype account for business use as well.

In all cases, it’s best to not give clients access to your social media accounts, if you can avoid it. The only exception may be LinkedIn, where adding your clients may help increase your business opportunities and give you a chance to investigate the trustworthiness and history of a client.

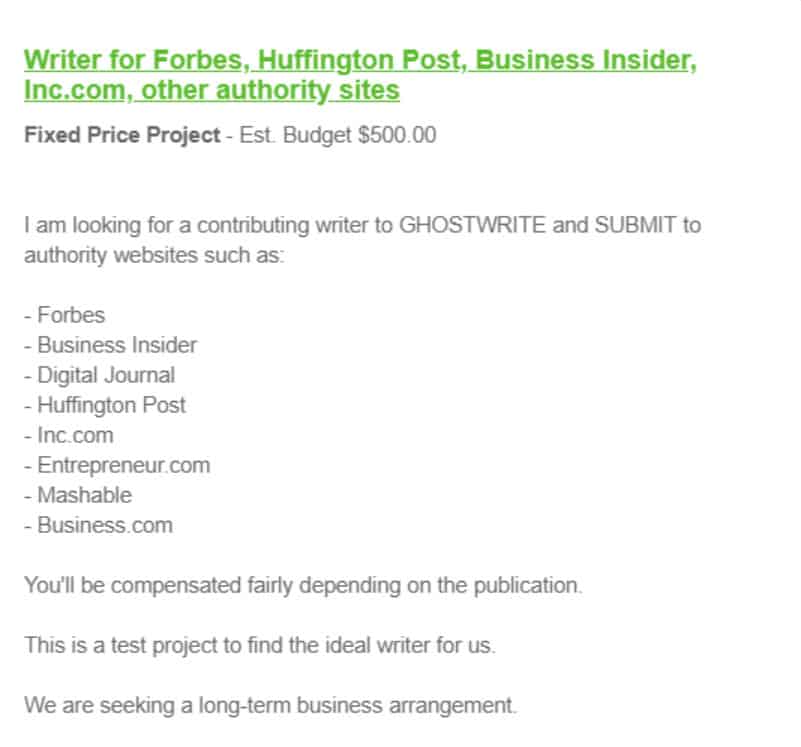

10. Ghostwriting to authority sites

This one is not always a scam but is a considerably unethical ask often targeting freelance writers, in particular.

If you have writing and publishing access to some major websites, such as Mashable, Forbes, or Huffington Post, some potential clients may ask you to submit work to those sites in exchange for money. In effect, these clients are asking you to use your privileged access to secretly promote their product or service.

At times, however, this type of request can be a scam as well. The freelancer takes on the risk of not only losing their ongoing contract and relationship with the websites in question but also may not get paid if the content they write and pitch does not get published.

How to avoid authority site scams

The simplest way to avoid these scams is to never respond to them. If you get invites or requests to use your privileged access or relationship with an authority site to discretely promote a product or service, don’t do it.

Concluding remarks

These are some of the most common scams that freelancers face. But scammers are developing new tactics all the time. This is why it’s important to have a keen eye when it comes to looking for work and communicating with a potential client.

If something sounds too good to be true, it often is. Also, a certain job ad or the way someone communicates with you about work may feel suspicious. In these cases, it’s best to listen to your gut and not agree to any work until you feel assured about the legitimacy of the job.

Carrying out quick research into a company and getting details about the job can be enough to tell apart a possible scam from legitimate work.

Freelancing involves enough stress as it is. By being knowledgeable about scams and attentive when looking for work, you can avoid taking on any unnecessary stress.

Have you seen other scams targeting freelancers? Let us know about them in the comments!

Some individual even arrange seminars to try and convince you, on the importance of registration fee and it implication in online work

Hello,

Just wanted to ask something I am new to freelancing and the company that I was working with is asking for one time $50 processing fee. Is it legit? They told me that it was refundable and legit but I doubt its true since they are so eager to make me send the money to them. Can you help me with this?

This is a good example for scam. These group of people trying through telegram app to catch you. not a single person. group of gang doing this.

“HELLO DEAR REMOTE EMPLOYEE

This is to share congratulations as received from our contractors, your submitted project has been reviewed and compiled, it would please you to know that you would be retained as a true remote employee of which an ID card will be issued after you must have received payment

This is to also inform the employee concerned that Your payments have already been deposited from our Company’s Corporate Payment Portal System into the medium you provided. Do note that the provided medium has been attached alongside your data.

You are required to link your bank account to our Company’s Corporate Payment Portal system, for this payment and that of future payments to go through instantly, This process would be finalized by our partner institution in charge of rectifying such unexpected occurrences.”

Is there any platform where we can expose those scammers? If we upload details of those scammers on a common platform, one can verify from that database whether it’s genuine or not before taking a task.

hi i got an offer saying that i will get paid 3000 dollars to translate 20written images pages for in two days but i already got the same mail and his only way of communication is telegram, and he presented this as the nova scotia provincial library and then said a bunch of apps to get the money . He said i will get the money after the work? should i say yes?

I have around $3000 locked with a company,who want a “payment portal”fee

Great Article. Thankyou so much for such an insightful peace. It will go a long way in helping me as a beginner in the freelancing world.

Hello, Sam:

Great articles. Helpful information.

If a company says that they will need for you secure equipment , but they will send you a check for it. Is this a red flag?

The next day, I was asked to send Zelle transactions to 2 accounts using Gmail addresses to purchase the equipment. We spent the better part of the day sending the money that was deposited into my account to these people. The check had deposited and the funds were available but it still read processing in my bank account.

My hairs raised and I called my bank to report thr Zelle transactions to see if they could be stopped just in case the check comes back to be fraudulent. Pray for me.

Some of the scammer are really

Hi Smartvon. I hope you perhaps see this at some point.

Yes. It is a scam. They tried to do this on me a long time ago. Eventually I realized as much and ditched without ever getting to that part.

A legitimate business will _NEVER_ do an interview over google chat like that.

They will NEVER make you give them money up front. At worst, they should take it out of your salary. Isn’t that the point?

Who uses checks anymore? Scammers and old people, and the old people are dwindling, sadly.

The funds will be available. It is either laundered money or fraudulent. You will have taken the hit, and I hope you are okay. I hope you are safe.

Hi Smartvon,

Thanks for the question. I’m sorry to tell you, but it is quite possibly and indeed likely that you have unwittingly taken part in a money laundering scheme. This type of fraud is common. Never accept jobs that require you to purchase your own equipment in this manner. Legitimate companies do not operate this way.

Here is more information in this:

https://www.fbi.gov/scams-and-safety/common-scams-and-crimes/money-mules

I would advise you to talk to legal counsel ASAP.

HI SAM.

This company called Kwork that messaged me on freelancer told me to message them on whatsapp. I did so. They told me its a copywriting project. They are asking me to pay security fee of USD80 and after completion of the project, it will pay me USD2500 along with security fee.

Should I take this offer?

Hi Sanya!

Upon inspection, I have some doubts that the company that contacted you on Freelancer is actually Kwork. Kwork appears to be a legitimate company and freelance marketplace. It’s possible that they could be hiring people to do work for them on a freelance basis (Upwork does this, for example, as I’ve done freelance work for Upwork the company), but if that were the case they would likely be hiring through their own platform, not a competitor’s platform. No legitimate company hiring for freelance work is going to ask you to pay a security fee. This sounds like a scam, so I would avoid it. If you want to test the waters, tell them you’d be happy to do the work, but won’t be paying a security fee and that you want a deposit on the work upfront. If they back out or are unwilling to do that, it’s just extra confirmation about it being a scam.

I have recently made a freelancer account and today i got my first project but the client is asking to communicate outside freelancer on emails and asking for security fee from my side so that i can work with them. Should i accept the offer or decline it?

More likely than not, this is a scam. You should never have to pay a security fee or any other fee from a client to perform work for that client. Fees paid to a marketplace for using their services are fine; but once you start working for a client, that client should not be asking you to pay them anything to perform the work.

Hi,

Is this really a genunine job beacause they are asking to pay 5000 money if accuracy is not good.

Have you heard about freelancetypers.com. They are asking me to pay USD31, the reason is since i am residing in india, they have to pay one time processing fees to the government of india.

The client should be footing that bill themselves if they want to hire you.

Hello Sam,

This is Ashwin Sevak from India. I have recently started using freelancing to get more projects for my small IT Company,but i was not getting any projects,Well that does not bother ,actually i was about to bidding on a freelancing site but it was premium employer where i was not able to bid on that project,but he were mentioned his Email Address on the description box,So i decided to mail him…I mailed him that yes we are ready to do your project and so and so then after few hours he replied me back.By saying that he need a restaurant site to be build and he is from USA and he is not able to pay from PayPal but can be able to pay by check but he said he will give the check to some of my relative who stays in USA and the relative will transfer the ammount to you in 24HRS…So,he need my relative’s Home address with thier phone number as well as thier name….but i fell like it’s a scam ….what do you think about it

Hey, I have come across the same kind of client. Did you proceed with the deal or not?

There’s absolutely no reason you can’t get paid via PayPal by this individual. Never take payment through an intermediary for work you performed.

I have worked for 3 people. Two of them didn’t reply after sending the project and one didn’t like. What should I do next to avoid these?

Hi Insiya. These are incredibly common issues for freelancers, so I’ll share a few thoughts with you.

First, There’s no 100% protection against clients who don’t respond after you’ve sent the project. However, you can mitigate the risk of this occurring in a few ways:

1. Work within a freelance network that has protections for this kind of thing. Upwork is obviously the biggest one, but others with protections in place against this type of activity include Freelance.com and Fivver. Typically, clients will load payment into escrow with these services. Once you submit, they have a certain amount of time to approve or disapprove the project, ask for revisions, etc. If they fail to respond in a certain amount of time, you’ll get the money barring any appeals from them. But it at least makes them put some skin in the game, as it were.

2. Create a written contract for work if working outside a freelance network. These are legally binding, so unless a client wants to gamble with a lawsuit, they’ll pay up instead of disappearing. Again, it’s about making sure the client has some skin in the game.

3. Use an escrow service if working outside a freelance network. There are plenty of these available you can use, but Upwork actually has one now that you can use that doesn’t require clients to have an Upwork account. The rates are fairly cheap and it gives you the same escrow protections mentioned in #1.

4. Vet your clients better. Legitimate businesses rarely disappear after getting work from freelancers. They’ll quickly develop a bad name if they do that. So, do your due diligence and avoid working with anyone who seems suspicious.

As for the client who didn’t like the project, #4 somewhat applies here. But also, that may be more on you than it is on the client. Before starting a project, make sure you have all of the details regarding what a client expects, in terms of the end result and expected delivery date. Additionally, communicate throughout the process, especially when you’re unsure of something that the client may or may not like with the end product. Ideally, the client is hiring you as the expert to complete something and they’ll defer to your judgment, but that’s not always true. It’s better to overcommunicate than undercommunicate with new clients.

Hi Sam,

A question about tax forms – what if the request is coming from an editing company that screens and hires freelancers

to me part of their editing teams in various speciality areas (companies like Enago or Edanz)? Similarly, what if they ask for a scanned copy of your highest education degree?

Thanks in advance!

Hi Natalie!

Great question there. There’s no definitive “yes” or “no” on whether you should hand over tax forms. It depends on the nature of how the company is planning to pay you. For example, I do freelance work for Lending Tree, and they pay be via direct bank transfer, and I earn more than $600 in a year from them. As a result, I needed to give them tax forms so that they can issue a 1099-NEC. That’s per IRS requirements. But let’s say they decided to pay me using a credit card, or using PayPal and paying me as a business. A 1099-NEC wouldn’t be necessary, so I wouldn’t need to fill out any tax forms for them.

That said, I’ve had times where I’ve been sent tax forms that were clearly a scam for jobs that would never require them. For example, a potential client once tried to get me to fill out tax forms for a job through Upwork. That was clearly a scam, and the tax forms weren’t even official (they were copy/pasted into a Word doc!).

The questions for you then are:

1. Can you verify the legitimacy of the editing company?

2. Can you verify that the person you’re talking to is actually an official representative of that company?

3. Are they the ones paying you for contracted work, and if so, does that payment method and amount require tax forms?

As for the degree scan, that could just be that they want to verify your educational attainment, though asking for a scan of your degree is a bit of poor proof as those can easily be faked. I’d try to investigate a bit more and verify the authenticity of the company and your contact before handing over any information.

*THIS IS NOT OFFICIAL TAX ADVICE, CONTACT A LICENSED CPA FOR THE MOST ACCURATE INFORMATION*

I applied for a post on freelancer.com and was asked to send an email to an email address, if I was interested. This is the reply I received:

Site: freelance.com

Thanks for the prompt response. Our MOTTO usually encourages our freelancers to “NEVER COMPROMISE QUALITY OVER QUANTITY”. The rates depend on the quality of your work. Serious freelancers earn up to $280 a Day. Below are some of the jobs available on our platform;

1. Data Entry – $25 – $30 per hour

2. Typing – $20 – $35 per hour

3. Form Filling – $30 per hour

4. Copy and Paste – $18 – $30 per hour

5. Photo Posting – $20 – $25 per hour

6. Video Posting – $20 – $30 Per hour

7. Virtual Assistant – $30 – $40 per hour

8. Article/Content Writing – $20/500 Words

9. Article Rewriting – $15/500 Words

10. Web Design – $35 – $60 per hour

11. Graphic Design

12. Logo and Banner Design

13. HTML

14. PHP

15. CSS

16. MySQL

However, before you can access the jobs and start working on the above projects and many more, you will first have to purchase your Workstation that will have a Username and Password to enable you login to your workstation and access the jobs.

This also ensures that we only deal with serious freelancers and keep away spam freelancers.

To purchase your workstation, you will be required to make a one time refundable fee of USD 14.99 via PayPal.

Seems to be some kind of scam, if they are asking for money upfront to purchase a ‘workstation’, whatever that is.

Freelance.com is a site based in France. Do you any knowledge about this? Most of the hits I get on Google simply go to freelancer.com, which is a legit site (I used to work via the site when it was rentacoder.com).

Hi S. Munwani.

Two answers here:

1) Freelancer.com is a legitimate freelance marketplace. However,

2) This potential client raises some red flags.

No serious client is going to make you pay to work with them. I’m a bit confused, though, whether this client is trying to operate as a client, or their own freelance marketplace (which can and do charge money to find work through the marketplace, which is legitimate). I have no idea what their “workstation” is. Personally, I’d avoid them. I can’t say that they are definitively a scam since they’re asking for such a small amount and most scammers try to target larger amounts, but this seems a bit odd.

Have you heard of Automate my gig? for insurance agencies? wondering if they are legit.

Their website doesn’t inspire a lot of confidence, but that isn’t enough for me to determine one way or the other. I haven’t heard of them prior, but for your own sake, you may want to choose a business with a more established web presence.

I am also being contacted by Automate My Gig through Indeed, to have me be a inside sales representative? Their website DOES NOT leave me feeling too secure. Now that i JUST SPENT the last 2 hours trying to figure it out, I’m getting beyond flustered and was just curious to see if you or any of your readers for that matter had heard of them.

Always go with your gut when it comes to potential clients or jobs in freelancing! If it feels suspicious, move on. Better safe than sorry.

As a professional writer, I totally fell for the scam of giving a test job. I felt they needed to see my skills, although I thought it was odd since I have several published books to see that. I gave into their request and was told my work wasn’t good enough. Now, I assume it was, and it was used for a short story for free… lesson learned. I also recently came about a guy in cryptocurrency as I was looking for side jobs who claimed he was in Dubai as we spoke. As I told him I was in Chicago and gave him the time, he said it was midnight. Upon a quick search, he was 3 hours off. He then hired me, per a lame interview on Telgram, and told me he needed funds sent to my account and to send clients cryptocurrency. Upon my research of his company, his website had no https:// and the bottom copyright was new- 2020. red flag. I told him I would do paypal but no-one is using my accounts, ever. He also asked for an address, for a laptop for work to be sent to me, I told him no way, I have several lap tops and here is my P.O box. He told me that he couldn’t send money to paypal, that he had gone over his monthly paypal spending requirements. Um, I didn’t know their was an amount expenditure, but he banked on me not knowing that. I told him, no and that the job was no longer of interest. On his website, there were two company CEO’s, if he needed a transfer so bad, don’t you think he would ask them? here’s the thing. I looked it up and this is called being a money mule. He steals money from accounts, by sending fraudulent checks, the recipient pays for the money because it never clears, he then finds people like me, to launder and filter his money through to make it clean. Hello Ozark. Yeah, I turned this guy in. I had his D.L I asked for with of course, no address, just a P.O box, I found him on another company he never mentioned. Hopefully cyber crime FBI will find him as I kept our conversation, his D.L , etc… fun times.

You’re not allowed to list a PO Box as your home address on your driver’s license, at least in the states I’ve lived in. Another tip off that it’s a scam.

Hi! Do you know anything about Techsol291?

I don’t know anything about Techsol291. I also can’t seem to find any information about that specific name.

Do you know anything about by the name Freelancer World? They said that I am expected to receive over $1600. Should I trust them since they seem really sketchy?

Go with your gut.

I was contacted via email by a client who wanted a writer/editor to rewrite and structure her research on Racism. Was to be used at a talk and printed as hand-out. I spent days with racism definitions, through history, types then edited too much and spent more time making it closer to 6000 words requested. She sent a bankers check from a credit union. Red flag was 1000. Fee was “mistakenly” sent by asst as 3500.50 and I was to send her difference with extra 200 for my good job. Sent by a Miller in Las Vegas. I called bank, they suggested call credit union with number of check. It was not listed. When I mentioned Miller, ctedit union said i wasn’t the first call about the Miller fraudulent check scam. “She” just emailed me name of person to get “difference.” I am not repkying. Scary.

Hi Sam

Recently I’ve come across what seems to be legit opportunities for work only to get asked to send between $200-$400 to have a laptop and phone shipped to me so I can start working.

The other day I had one. I asked what do they do when people can’t pay upfront. The answer was ‘what can you pay now’ erm, nothing!

Another I was then asked if I could purchase an PlayStation gift card for $50 so they could have the product key and then this would grant me access to the payroll system so I could begin work?!?!

I’m sure it’s all a scam, and I’ve not sent any money, but I’m finding it hard to find any decent work that doesn’t involve money upfront for equipment!

Hi Rebecca!

If they’re asking you to send money to perform the work, it’s more likely than not a check scam of some kind. The biggest warning sign here is asking for a Playstation gift card. That’s a scam.

Hey I was asked to go sign up on the Wire app for an interview from Freelancer.com. Is this legit? The employer profile has no reviews and im a little suss’d out about going on new apps without knowing why they want me there

Hi,

its same happend with me. i just want to know did you get interview on same day and hopefully they said you are hired.

please give me more inforation if you can share is its scam?

Hi Dave, I’d always be wary about doing interviews outside of the platform for a client without reviews.

I posted on Craigslist that I’m a marketing freelancer. I got two emails, one came last night and the other came this morning. I messaged the one from last night and they are asking me to make post to Craigslist and Facebook Market Place of properties that are up for rent. The guys name is [redacted] and when I look the name up there is a real estate person with that name in the area. But he told me he is an online publicist. He wanted me to do 5 posts a day and will pay me $250 through cash app. Being excited that I got an opportunity it started to seem fishy with the information he sent me. The first two I did were all different properties in different states but the same number of beds and baths, description style, and told them to email a different email each time. Then said if anyone messages or inquires about it to tell them to send an email the email associated with the post and not to respond again afterwards. I’m debating on deleting the post because I would hate for someone else to get scammed over my posts. What are your thoughts?

Hi Tyra:

PLEASE DELETE THE POSTS YOU MADE FOR HIM IMMEDIATELY.

It appears you’ve fallen into what’s known as a housing scam, and you’ve been set up as the middle man — and the fall guy in the event that the posts get reported to authorities. Here’s some more information about Craigslists rental scams: https://themortgagereports.com/36545/craigslist-rental-scams-and-how-to-avoid-them

Just a point of advice for future endeavors: Never use a payment option like Cash App to accept payments as a freelancer. You have little to no protection under that payment option. Obviously, many other payment options also offer little protection (even PayPal gives you no protection for digital goods), but Cash App is, for all intents and purposes, untraceable, making it easy for the user to cut and run.

for starting a job they are asking to deposit certain amount which will be refunded after completing the work. can i trust them?

Never take a job that requires you to pay them to perform work.

How can a freelancer get protected via PayPal or other payment methods and avoid chargebacks made by the client after work has been delivered? Many ask for a refund making a stupid excuse and stealing the work of the freelancer.

I’ve been SCAMMED roughly guys… hope there is a solution for that!?

I was in one of the freelance websites calls peopleperhour.com

someone made a proposal as –order processing– and he told me he has costumers in Poland need goods and he’ll order them from Germany since Germany is cheaper than UK where he lives.

but he needed me to send the package to his costumers.

like the goods of the order from online shops in Germany and they will come to my address, and then when they come to my address and send them to his costumers and that was for a month and that happened to me last month.

but at the end of the month, he didn’t replay …. and I was ok with that… I didn’t lose too much.

buy then before yesterday I received two posts (Warning – Debit ) that I have buy for goods.

and he ordered above 15.000 thousand euros.

GOD SAFE FROM THAT

I know am now in a serious situation with that but I’ll hire a lawyer and see what will happen.

pray for me guys, am in a serious situation.

Thanks and I wish you all not having what I have now.

Happy Easter and stay healthy

Sorry to hear that, Wal! Hope you’re able to resolve this.

Hi Anyelina!

This is a REALLY good question. The answer is probably less than encouraging, though.

As far as PayPal goes, there’s no protection against chargebacks for *digital* goods. PayPal offers seller protection for physical goods, but not for digital ones. So unless you’re set up with a client who’s paying you with direct deposit, you’re pretty much at risk of chargebacks.

Your best protection when using PayPal or other payment methods like it is to be conscious about who you’re doing business with. Vet them as heavily as possible.

Outside of that, this is why I tend to like and use Upwork. It offers payment protection because it’s in their best interest to protect against that. Now obviously, you’re paying Upwork a fee (20%, then 10% on accounts with $500 or more in earnings, then 5$ on accounts with $10,000 or more in earnings). Other freelance networks also offer payment protections, again, because it’s in their best interest to do so.

Your alternative to that is to shirk PayPal altogether and opt for a payment service that has chargeback protection. Stripe offers chargeback protection, for example. And you can use its invoicing feature the same way you might with PayPal, so your clients don’t need to have a PayPal account.

All told, PayPal isn’t the friendliest option for digital goods sellers like remote freelancers, so you may just need to explore alternatives that actually offer some protection for you.

Just got potentially scammed off of Freelancer. I was contacted by a female (from Nigeria. Instant red flag due to the email scams that have been happening for a decade) that then directed me off site to the Wire app at which point I went through what seemed to be a legit online interview. I gave relevant information and nothing that (to my knowledge) could allow them to gain access to anything personal. But I gave them my name, city of residence, phone#, bank I deal with and my phone provider. Not sure what they can do with that but I’m sure I’d be surprised. I’ve been a victim of identity theft before so I am very wary of anything involving me giving out serious info and because of the previous ID theft all my banking and credit ect is on lock so I dunno what’s to come. But heads up to anyone out there like myself beginning a new online career.

I’ve just posted two projects on Freelancer and within seconds of posting each I got bids from females in Nigeria for a ridiculously cheap price. Asked Freelancer helpdesk and they think it’s legit but still very wary

Hi Mike,

It’s probably not a scam, but you’re likely dealing with people who peruse job postings and use copy and pasted proposals. For your own sake, it’d likely be a case of “you get what you pay for”. If you want the best quality out of your projects, you’ll just need to make sure to vet the freelancers you’re hiring and be willing to pay more than bargain prices for the work.

Hi Adam,

Sounds like you fell into a scam. And it also sounds like you’ll need to be a lot more cautious in the future. Withy our name, city of residence, phone number, and bank name, they can call your bank and pose as you to enter your account. They’ll use social engineering techniques to convince some potentially hapless bank employee on the phone to give them more of your account information, and potentially attempt an account takeover, or to access your account to transfer funds from it. They don’t need your password or SSN to do this.

Hi i contacted through linkedin website for freelancer customer service representative for uk based company.He took my interview in whatsapp chat and selected me.Everything seems to be ok and he did a payment to me 2000 dollars through cheque from company side on my nameand told me to download one software powerleadspro and told me to purchase 10 apple gift cards of 100 dollar each to activate the license of that software .I told him that i can not do as it is too much time consuming so he told me to atleast send him 10 apple gift cards so when i denied him that i can not do that thing as i m busy and i heard quite alot about gift card scam so he gave me account no of national bank of canada and rbc as well to transfer the amount and which shows to be not working when i tried to send the payment through interac transfer .I told him to send me the same account no from which i got cheque but he never interested on that. Then he gave me a warning that if i ll not return his amount then he will report the authorities for theft and i will be blacklisted.I told him to come to me and i will return as i am not able to deposit. his linkdin account is also deleted now.

Can you guide me what it seems , does he seems a genuine person to you or it feels like a scam?

Everything about this seems suspicious. This is undoubtedly a scam.

Hi Sam, so one company contacted me via Freelancer and did the interview over hangout chat. I got selected within 15 minutes of the interview. They asked me the details about my address and phone number and after that my photo and photo ID. I’m not quite sure if this is legit or not. Can you suggest something here, please? thanks

Hey Reena,

Did this work out and was it a legit job? I had the same thing happen to me today.

Thanks!

Definitely don’t give out any personal information. Red flags everywhere on this.

Definitely sounds like a scam! Many red flags and I would report them.

Hi there,

This sounds just like a job offer I’m working on right this moment through Freelancer. They contacted me based on my resume and like you, I was selected within 15 minutes. They are sending me a check to pay for the equipment from a vendor of their choice. Today I received a request via email to sign an employment-at-will document and a PDF W-4. The company has what looks like a well-done website, they’re based in Munich, and no scam alerts pop up when I researched them. The spelling errors are to be expected, I suppose, but I’m more concerned about the seemingly scripted chats, which are very close to another company that reached out to me and did this same process yesterday. I’m hopeful but terrified as well! Not sure what to do next.

Hi Julie! I just saw your comment and wanted to let you know that companies sending cheques to buy equipment etc are usually a scam. If you google that, they will bounce the cheque and you will loose money.

Hope it isn’t a case. I am going through the google hangouts interviews and they are all the same, so damn strange.

Apparently I got a job and was asked if I have specific equipment and after asking if it has to be exact same one, nobody bothered to answer.

Good luck!

Thanks Olivia!

100 percent agree.

Hi Julie,

Does sound like you have a tough choice to make there regarding whether or not to trust it. I always recommend people err on the side of caution. I’ve never had a freelance job that required a W-4, and the only time I was asked to fill one out, it was a scam that I thankfully caught onto prior to sending any information!

You say the company is based in Munich. Are they paying US taxes? I’m not a tax expert, so don’t take this as expert advice at ALL, but it seems weird that a Germany-based company would be paying US income tax on your earnings. I’d research their requirements on that and maybe ask about it before sending them your SSN. I’d also look into the full details of the email address you received from them and review the PDF document you received to ensure it’s legitimate.

Always defer to your better judgment in these instances. Jobs come and go, so never operate under desperation. If a job doesn’t give you a good feeling or feels suspicious, always better to walk away and look for the next one to come along.

Hi Reena!

I could honestly go either way with this one. Some clients have been scammed by freelancers on platforms like Freelancer and Upwork before, as some freelancers pretend to be from the US or UK, for example, while they’re actually in a different country. To counter this, they often take additional steps to verify identity outside of what already exists on the platform. And Freelancer, to its credit, does do a good bit of ID verification, but there are still loopholes.

Of course, it could be the precursor to some type of scam which involves using your information. It’s really hard to tell. I wouldn’t blame you if you backed out nor if you decided to proceed. Obviously the former is the safest option, but if you do choose to proceed, do so with caution, and maybe ask why they need the additional verification (in a nice way, of course!). If they start asking for really personal information, that’s your clue to back out fast.

What if the employer has no reviews and asked me to send an email with my name to his outlook email?!

He claims that this is for “more information and further procedure.”!

What precautions should I take?

Thanks in advance.

I work in freelance.com. I wrote a proposal to a client through email and I was message back that I was been awarded the job to build a website and he ask me to send the name and address of any of my representative in the US so that he can mail out the check, Is this legit or not? moreover after 1 day I saw a similar project on freelance and I do the same as the first instance and I got message back that I was been awarded, but I was confused because the message was purely similar except that the link to the sample site and State they are living , they ask for similar payment method in similar word. PLEASE I AM CONFUSED !!!!!

Hey Abdul, may I know what happened finally? Is it a scam ?

Hi Abdul,

There’s nothing to be confused about here. That has all the markings of a scam. I’d avoid doing any work with this client, especially if they’re trying to pay by check. When using a digital platform, every client should be paying digitally, and ideally, through the platform’s payment system.

Avoid giving any personal information away. And especially don’t get anything like SSNs.

Hi there,

Can you tell me if this is legit or scam. “I am a independent contractor specialist; i do receive several projects from different companies such as Banner advertisement, data entry projects, payroll projects etc. Then i employ extra hands to handle them for me, i have an ongoing payroll project which have been handling for more than 4months now but unfortunately i got a new job that requires me to travel always so i am not able to handle the project anymore. I will like you to handle the payroll project if you are available; it requires no skill so this means any individual can getit done!

Duties includes:

— Printing of workers Check

— Put in UPS/USPS envelops

— Print Postage Labels/Fill out postage labels

— Stick label on corresponding envelops

— Drop at any UPS/USPS drop off boxes or Store closer to you

Work time/pay:

— Three days a week

— 2hrs per day (flexible hours)

To begin you will need to get some basic materials such as UPS express envelops and UPS nextday airbill forms.. You can get as many as possible at the nearest UPS drop off boxes or UPS service hub closer to you.. They are free to pick up .. You will also need to get Business Check paper from amazon it cost about $30 you will reimbursed when receiving your first week payment.. Let me know if interested”

I’m an on and off freelancer, recently getting back on it. This is something new to me.

Thanks

Obvious scam.

I’d be wary of anything dealing with sending checks for someone else in that manner. Personally, it sounds like you’d be serving as a middleman in a check fraud scheme and would likely be on the hook / held responsible if it turned out to be one. Not worth the risk. Anyone who needs that kind of service is going to hire a legitimate payroll company to handle their payroll.

Thank you Sam!

I was asked to deposit a cheque I received via email. I am suspicious on this alone. To compound my concern is that the company I’m supposed to be working for isn’t the name on the cheque. I am delaying any further action until I am certain this isn’t a scam. The company that has supposedly hired me is a legit company from what I can glean, has anyone ever encountered that before?

Same thing for me, what ended up happening with that? Was it legit?

Is Guru.com a scam?

Hi Sam

I’m Ife, I got this message from Cpg corporation during the course of an interview:

You will need to obtain it from the vendor so the vendor can also preload it in the laptop and everything will be good to go. The cost is $800, I believe you’d be able to make the purchase of this equipment now via my instructions, Any Amount spent now will be reimbursed back to you together with your Sign up Bonus which you will be getting thru your first pay check ..

Please how true can this be

Hi Ife!

Your situation sounds similar to other posts on here. I’ll give you the same recommendation I gave to others in a similar situation:

Avoid freelance jobs that require you or ask you to purchase equipment and then be reimbursed later. Especially when they’re asking you to pay that much upfront. You have no guarantees that they will pay you back, and most likely they won’t. This type of thing is a common scam tactic.

Not a scam at all! Feel free to try it out.

Hi,

I received 3 offers of work via email for copying text from an image to a word document. They are asking for 30$ deposit before sending the first set of images and they say this money will be refunded after full completion of the first set of images. Is this a scam? Thanks

Hey! So I made a bid for and got text stating the kind of photos they want me to give them, which is fine and decent enough in my opinion but then the person told me to chat in private WhatsApp number as his/her manager wantse to. Should I give my phone number? No

I also got the same offer but I checked the company and its legit and it actually is an internet services company so it makes sense they want to covert image to text right? Has anyone tried working for them?

Hi Catalina,

Did you also receive an email from the company to do the work? Did you verify the email address, and not just the country? Also, a legitimate company can also operate fraudulently, or at least in ways that are not very rewarding for the freelancer. I’d be extra cautious trying to work for any company that wants you to pay them to work for them. The company should be taking that financial burden on itself, not passing it off to the freelancer.

Hi Lavinia,

I had got the same email submit the deposit in Skrill or Neteller, and the give the pin to them looks totally fictitious, I didn’t deposit so far and fear definitely I will lose money. I would suggest don’t go for it as it is outside the official channel.

Hi Lavinia,

I can’t see any reason why this project would require you to submit a deposit. I would avoid this job.

Same with me client wants to pay me 200$ for leaving the company as loyalty bonus while I refused to work for the company at the end of the interview. This feels fishy that client wants to pay me money while I was a employee for 2 mins.

I have a question, I’ve been freelancing off and on for a while but am new to Freelancer.com’s platform. the first project I accepted ended up being fake and I didn’t realize that I would be charged a fee just for accepting projects I thought that the fee would come out once I was actually paid. How can I know to accept projects offered to me. I’m trying to get work and also some good reviews but now i’m wary of projects offered to me because if I accept and they turn out to be fake I’m still charged the fee for accepting.

Hi Shaina,

That’s an interesting one. I ended up preferring Upwork for a few reasons, one being the fact that Freelancer tends to nickel and dime pretty much everything you do when using its platform. Unfortunately, there’s no way to avoid this happening completely. However, I suggest not accepting work from any and every client that sends projects. Instead, review a clients’ feedback from other freelancers, and perhaps avoid working with clients who have no work history on the platform, or who have some concerning negative feedback from other freelancers. That’s a technique I use on Upwork and it’s worked out splendidly for me.

Hi Sam,

I’m Kim,

Recently I was interviewed via google handouts and sent check via email to put in my bank account 3 times, they said that the fund to buy equipment worked for me and asked me to send it to a third party to they ship the device to me, is it legal?

Hi Kim,

Were you able to start your job? Was it a scam? I am facing the same situation right now.

Hi Kim,

How did your freelancer job of that particular company go? Was it legal? I just got a job proposal of the exact kind.

Hi Kim, I can’t speak on the legality of that, but it doesn’t sound like it’s on the up-and-up or anything you want to risk taking part in.

I have a client who requires me to use a specific type of computer. They say they are going to be sending me a check to help pay for this. Seems fishy. Am I paranoid?

Same here. Client sent me a cashiers check for computer equipment but requesting I only deposit it via ATM so I can send them the receipt for their records. It just seems iffy.

A cashier’s check is actually among the least suspicious ways they might send you money to purchase the equipment they want you to buy. If you’re depositing the money directly into your own account, as well, there’s not really any fraud going on unless they’ve somehow managed to get a bank to sign off extracting money from someone else’s account to give to you (which would be incredibly difficult).

More on cashier’s checks:

https://www.nerdwallet.com/blog/banking/how-do-i-get-cashiers-check/

That’s a little strange, but I don’t know if I’d call it a scam, specifically. If they plan to purchase your computer equipment for you to help you do the work, that’s a good thing. I’d wait to make sure the check is viable, or see if they can send the payment for that digitally instead.

Dear Sam,

How do you think about below case. They said with me:

“Most important is For you paying the 10% of your working equipment today, so the vendor can purchase your working equipment and have them shipped to your home address immediately for you to make use of the equipment to commence your training orientation with your regional supervisor and get started with work. The total funds for your working materials and equipment’s is $3,555. Correct Immediately the company vendor confirm your $355 10% today. The working equipment’s will be purchased and deliver to your home address in the next two days and i will provide you with the tracking number for you to keep it tracked”.

Thank you!

Hi Helen,

I’d steer very clear of this. It sounds like a scam.

How about security deposit ? The client want a security deposit as requirements to get the project.

Hi Lourdes,

That’s the same as paying to do the job. If a client is asking for a security deposit just to get the job, I’d be wary of that client. That’s a huge red flag. If the nature of the job requires the client to have certain types of liability insurance, that client should be clear on that. But that would involve you separately purchasing liability insurance through an insurance provider, then showing proof of insurance. There aren’t any circumstances I can think of where you should ever offer to give a security deposit to get a job. Renting an apartment, sure, but not landing freelance job.

Hi cook,

One of the client approached me to connect using Hangout. Sent me 2000 cad worth of check for buying the softwares required to perform my job and asked me to deposit that using my mobile banking app.I have deposited the money and confirmed with the bank of the check was clear.As per bank,the check is clear And the amount got deposited.Now the person is asking me to buy a gift card with that amount and send the unique number which is on the back of the gift card.They said they will send the laptop once i send them the numbers on the gift card.They require this to activate the softwares in the laptop.What do you think,Is this a fraud?

Hi Arvind,

None of that adds up. If they needed you to buy software, they could easily buy it themselves and send it to you, or send you the access key. There’s absolutely no reason to send you money for that purpose. Asking for the money back via gift card is highly suspicious. Also, even cleared checks can bounce. I suspect they’re trying to get you to pay them money via a gift card, which they can’t be voided after you’ve bought it, and then the check will bounce.

Don’t send them any money back!

Hi SK!

I’m not quite sure I’m following your issue here, but it *sounds* like someone’s asking you to pay money to get money you’ve earned. As a general rule, you should not have to pay money to work jobs from providers. The only edge cases here are paying services like Upwork or Freelancer to use their platforms. But when it comes to client-to-freelancer work, you should not be paying the client to work for them, or paying them before you can receive payment yourself.