When you have concerns over losing your identity to a cybercriminal, you may want to consider subscribing to one of the leading identity theft protection services. Some ID theft services, such as LifeLock, offer all-around protection services. Others, like Home Title Lock, focus on protecting you from someone committing fraud with your home title without your knowledge.

When attempting to determine whether you want ID theft protection services, you may want to compare some of the top services. To help you with your decision, I will break down the differences between Home Title Lock and LifeLock.

Don’t want to read the full article?

Because LifeLock offers far more services for your monthly subscription price than Home Title Lock, we would give it the overwhelming advantage in this comparison. If you only want protection for your property title, and you don’t want any other identity protection services, LifeLock even offers a standalone home title monitoring service that is quite a bit cheaper than what Home Title Lock offers. Under either scenario, LifeLock is the easy choice here.

Home Title Lock vs LifeLock Summary

| No value | Home Title Lock | LifeLock |

| Website | https://hometitlelock.com/ | https://lifelock.com/ | Free trial | Average email response time | Identity theft insurance | Up to $1 million | Lock your credit | TransUnion only | Special offer | $8.99 | Highest price per month | $23.99 | Credit monitoring | Phone takeover monitoring | Crime in your name monitoring | Credit reports | Credit score | Home title monitoring |

|---|---|---|

| Best deal (per month) | $19.95 Get 10% off your first payment with an annual plan | $8.99 GET 25% off the first year |

Home Title Lock vs LifeLock: Features

When comparing LifeLock and Home Title Lock, we’ll start by focusing on the one feature they both have in common: Home title monitoring. Then we’ll discuss some of the identity theft monitoring services that LifeLock has available but that Home Title Lock does not. You can use this information to help you make the choice between these two options.

Home title monitoring

Home Title Lock’s only feature is its promise to monitor the use of your home property title. Should someone file documents with your local government’s assessor’s office or property management office that access or mention your home title, Home Title Lock promises to send you an alert.

As part of your initial signup for an annual plan, Home Title Lock offers you a title report, which it calls a $100 value. (However, I was not able to gain a clear answer from customer service about why this report has a $100 value or what exactly the report contains.)

Should you end up being the victim of fraud related to your home title, Home Title Lock will help you file forms with governmental agencies and legal documents that notify others about the finding of fraud.

If you subscribe monthly to Home Title Lock, you will have access to its home title resolution team. If you subscribe to an annual plan, you will receive a dedicated title resolution agent to handle your case when fraud occurs.

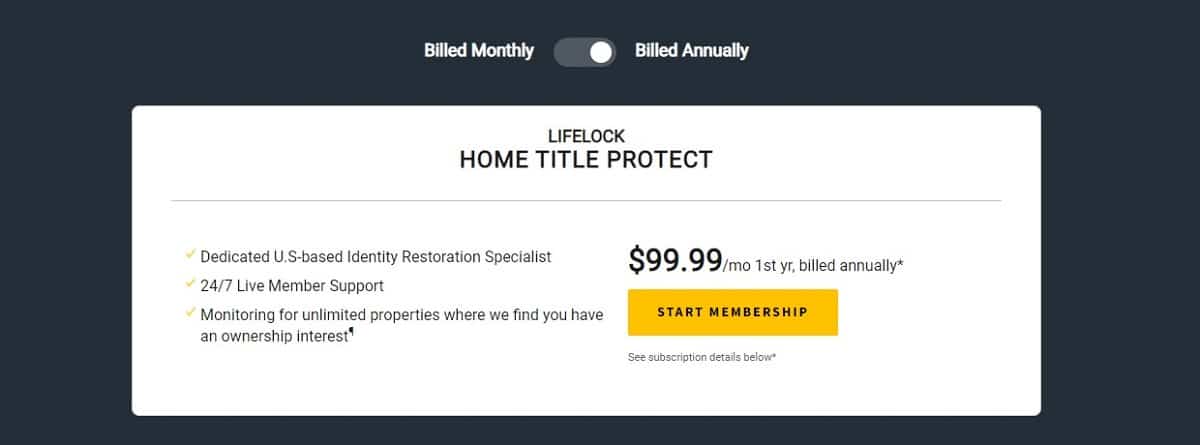

LifeLock offers home title monitoring either as a standalone purchase from its identity theft monitoring services or as part of its highest-priced ID theft monitoring services tier.

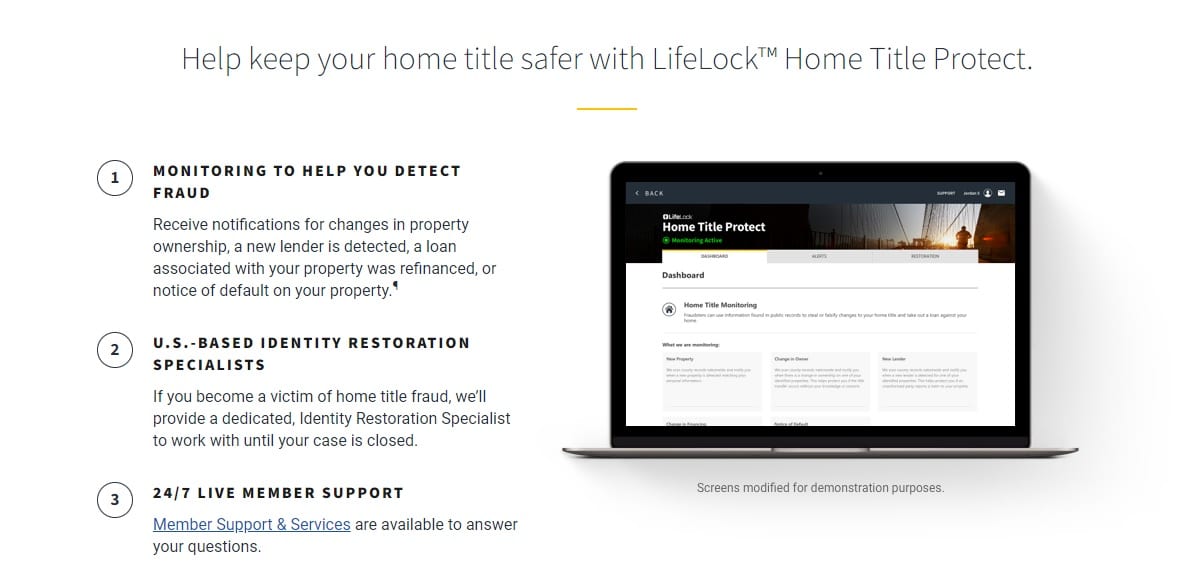

LifeLock Home Title Protect is the standalone service for home title monitoring. It will provide you with alerts whenever some sort of access to your home title occurs in a government office. Should you suffer fraud related to your home title, LifeLock will assign an identity restoration specialist to your case to help you resolve the problem.

If you are a LifeLock Ultimate Plus subscriber, you will receive Home Title Protect as part of this pricing tier. Home Title Protect is not part of the LifeLock Standard or LifeLock Advantage tiers.

LifeLock Home Title Protect has a couple of significant advantages in this area of identity theft protection.

- Pricing: As a standalone product, LifeLock Home Title Protect costs about half of what Home Title Lock costs.

- Number of properties: LifeLock Home Title Protect will offer monitoring of all properties in which you have an ownership interest. With Home Title Protect, however, your subscription only covers one property. If you want to monitor additional properties, you must purchase a new subscription for each one.

Activity alerts

LifeLock, through its main identity theft protection service, will provide alerts for any oddities that occur with your financial accounts, such as investment accounts, bank accounts, and credit card accounts. LifeLock monitors the use of your Social Security Number too.

Primarily, LifeLock will monitor the credit bureaus to determine whether any changes in your credit profile are occurring. Depending on the subscription tier you select, LifeLock may also send you alerts for home title changes, suspicious bank and credit card transactions, social media account changes, crimes reported in your name, phone takeover, and USPS address changes.

With Home Title Lock, you only receive alerts related to changes with your home title. Home Title Lock does not monitor your profile at the credit bureaus.

Dark web monitoring

If your personal information ends up on the dark web, this means it could be exposed to hackers who can use it to open loans in your name, steal your account balances, and cause other significant issues for your life. The dark web can include unsecured websites and marketplaces, as well as chat rooms and forums known to involve hackers.

In this comparison, only LifeLock will monitor the dark web for your personal information. Home Title Lock does not offer this service.

Free credit report and monitoring

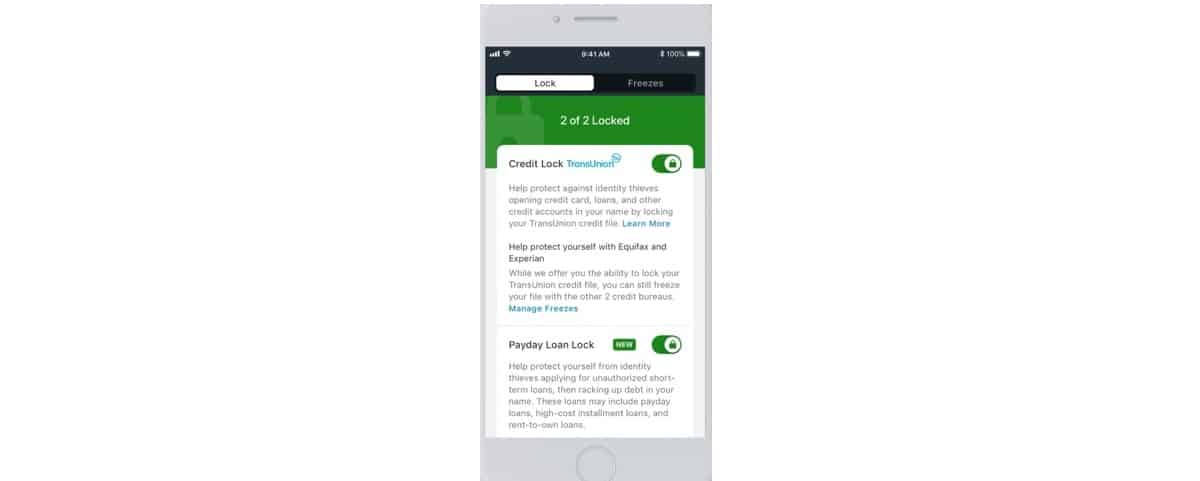

When you subscribe to LifeLock, you will receive free credit reports and monitoring from either one bureau or from all three bureaus, depending on the pricing tier you select. Should you want to freeze your credit, LifeLock makes this an easy process by notifying the credit bureaus.

Home Title Lock does not offer any of these credit monitoring services.

Address monitoring

As part of all three pricing tiers, LifeLock monitors your postal address for any changes. If a hacker changes your address with the U.S. Postal Service, the hacker could begin intercepting your mail.

Home Title Lock does not monitor your mailing address.

Public records monitoring

If someone who steals your identity commits a crime, LifeLock (in its two higher-priced tiers) will monitor public records related to the courts for any appearances of your name.

Home Title Lock does not monitor your name in the public record, although it does monitor your home title’s use in the public record.

Social media monitoring

LifeLock recently added social media monitoring services to its highest-priced tier. This means LifeLock will watch for social media accounts opened fraudulently in your name.

Home Title Lock does not offer social media account monitoring.

ID restoration

Should you suffer identity theft, LifeLock promises to work toward helping you restore your identity. This may include filing legal paperwork or disputing financial records that the identity theft charged in your name.

Home Title Lock does not offer specific services geared toward restoring your identity. Its services all focus on monitoring your home title.

Insurance and compensation

LifeLock has extensive financial insurance available to you if you suffer identity theft. It offers up to $1 million in insurance coverage to subscribers, reimbursing them for any expenses they have while going through the identity restoration process. Should you have a loss of money from your financial accounts related to the ID theft, LifeLock offers between $25,000 and $1 million in compensation for your losses, depending on your subscription tier.

Home Title Lock does not offer insurance or compensation related to any identity theft or home title fraud you encounter.

2FA login

LifeLock gives you the option of making use of two-factor authentication (2FA) with your subscription account. However, you will have to enable it through your account settings. It is not a default setting.

I don’t believe Home Title Lock offers 2FA capabilities, but I cannot be certain. The Home Title Lock website and account settings do not seem to offer 2FA as an option. When I asked customer service about this feature on a few different occasions, I received different answers. In the end, I would not count on having 2FA for your account as an option.

Home Title Lock vs LifeLock: Pricing

| No value | Home Title Lock | LifeLock |

| Website | https://hometitlelock.com/ | https://lifelock.com/ | Subscription periods | Monthly or annually | Monthly or annually | Special offer | First-year discount for new customers | Price per month | $19.95 | $8.99 (Standard Individual tier) | Lowest annual price | $199 | $89.99 (Standard Individual tier) | Highest annual price (Family) | NA | $467.88 (Ultimate Plus Family with Kids tier) | Lowest annual price (Family) | NA | $221.87 (Standard Family with Kids tier) | Highest annual price (Family) | NA | $467.88 (Ultimate Plus Family with Kids tier) | Money-back guarantee | 14 days | 60 days for annual subscription or 14 days for monthly subscription |

|---|---|---|

| Best deal (per month) | $19.95 Get 10% off your first payment with an annual plan | $8.99 GET 25% off the first year |

With Home Title Lock, you will only have two subscription tiers, while LifeLock offers nine different tiers. Some of this difference is understandable, as LifeLock has different tiers for families, couples, and individuals. There is no need for Home Title Lock to offer family tiers, because it only focuses on home title ownership for one property and one person.

It is difficult to compare the pricing tiers for LifeLock and Home Title Lock because they offer such different levels of features. (Going forward, I will only focus on LifeLock’s tiers and options that include home title monitoring.)

LifeLock’s standalone Home Title Protect and Home Title Lock offer nearly identical services, but LifeLock’s Home Title Protect is significantly cheaper ($99.99 per year versus $199 per year).

The LifeLock Ultimate Plus tier offers full identity theft coverage, including LifeLock’s home title monitoring capability. Comparing Ultimate Plus to Home Title Lock, you will save a little bit of money with Home Title Lock. Remember, however, Ultimate Plus has far more services and features than Home Title Lock.

Auto renewal options

By subscribing to LifeLock or Home Title Lock, you will be subject to the auto renewal policies of both services.

When you submit your credit card or bank account information at the time of your initial signup, you must agree to the terms of service. These terms require that you agree to allow either Home Title Lock or LifeLock to automatically charge your credit card or to withdraw funds from your bank account at the time of subscription renewal.

Should you fail to successfully cancel your account before the renewal period starts, you will receive a charge for your chosen subscription period.

If your credit card or banking account information changes before the renewal period begins, you must notify LifeLock or Home Title Lock about the change. If the company cannot charge you, it will notify you of the problem and give you a certain amount of time to fix the problem before canceling your account.

Cancellation options

Both Home Title Lock and LifeLock make the cancellation process seem simple, but it can be challenging. You can cancel the service through the website or by calling customer service. Understand that it may take several phone calls or chat sessions to complete the cancellation process. Subscription services like these two typically do not make canceling easy.

Because of the potential for delay in finalizing the cancellation, I would not recommend waiting until a day or two before your subscription renewal period comes up to try canceling the service.

With Home Title Lock, if you cancel your account within 14 days after the start of the subscription period, you should receive a full refund. If you cancel after the 14-day period, you will have to keep your account until the end of the month. If you subscribe to an annual package, you then should receive a prorated refund for any unused months.

With LifeLock, refunds may be available, but restrictions apply and will depend on your particular situation. I would recommend requesting your refund at the time of the cancellation and being persistent. Do not wait to try to receive a refund several days or longer after you call about the cancellation, as this will make the refund process more complicated.

Before signing up for either LifeLock or Home Title Lock, thoroughly read the LifeLock terms of service and the Home Title Lock terms of service for the latest information, as these terms are subject to change.

Home Title Lock pricing tiers

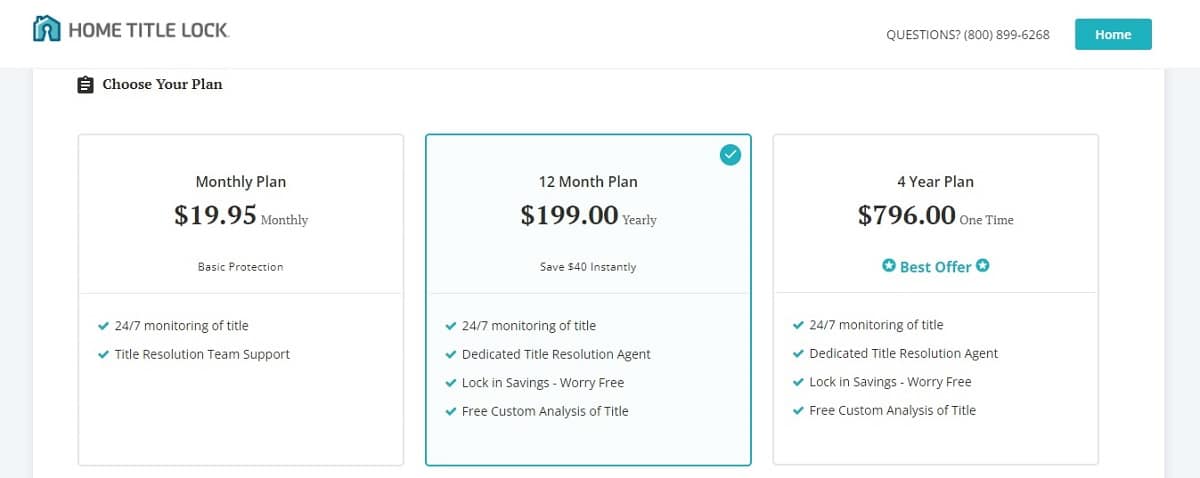

Home Title Lock has two subscription tiers available, and the two options are very similar.

- Monthly: If you want to subscribe to Home Title Lock month-to-month, you’ll pay $19.99 per month. This tier offers 24/7 monitoring of your home title and access to the support team, should you need title resolution after a potential case of fraud. (For your reference, Home Title Lock’s monthly price was $14.99 a few years ago.)

- Annual: You also can subscribe to Home Title Lock year-to-year for $199, giving you a discount over the month-to-month pricing. By paying yearly, you will receive 24/7 monitoring of your home title and access to a dedicated agent to help with your title resolution, should you suffer fraud.

As mentioned earlier, your Home Title Lock subscription only covers one property. If you own more than one home, you would have to purchase a separate subscription for each home. This fact is not clear on the website, and it remains confusing even after you provide your credit card and sign up for the service. I was able to clear up this fact through a couple of calls to customer service, though. (I did appreciate the quick responses I received from Home Title Lock’s customer service, as I did not wait on hold for more than a minute or two during any call.)

Compared to LifeLock, this is a significant disadvantage for Home Title Lock, as LifeLock offers monitoring of titles to all your properties as part of your single subscription.

LifeLock pricing tiers

First, I’ll discuss the pricing options for LifeLock’s standalone product, Home Title Protect, which costs $99.99 for the full year of service. At the time you sign up, you will be agreeing to an auto renewal.

Should you subscribe to any of Norton’s other services, you may be eligible for a discount on Home Title Protect. Norton owns LifeLock.

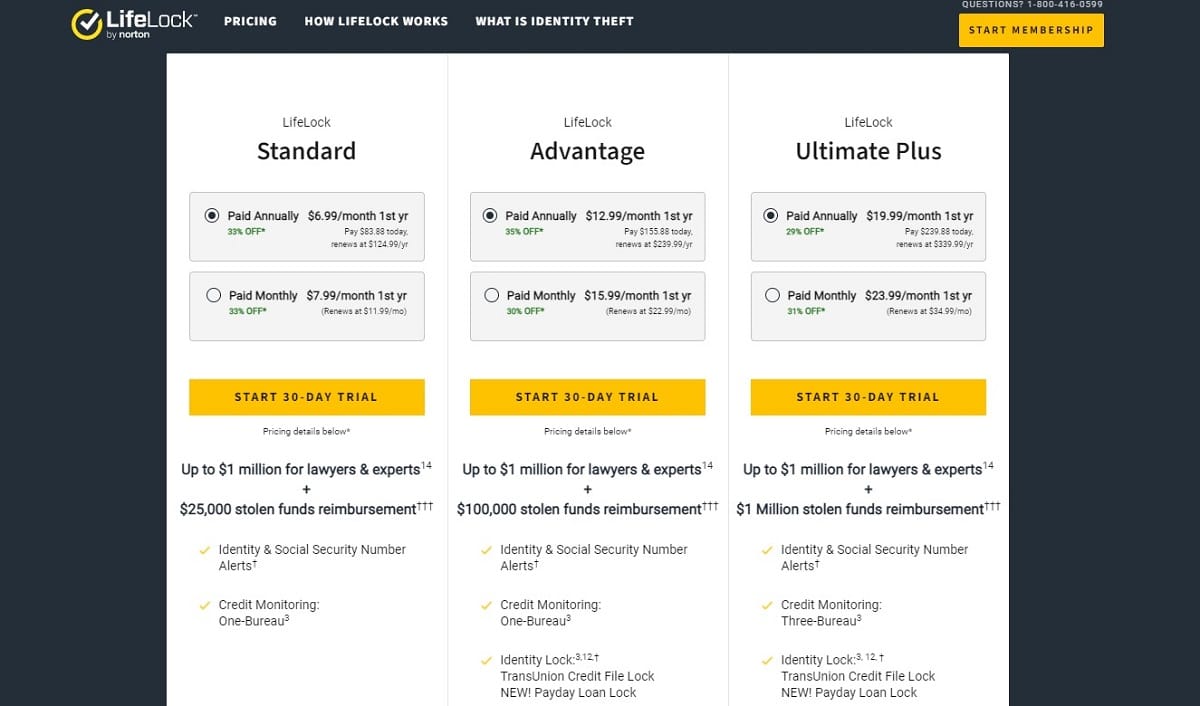

With the regular LifeLock ID theft protection service, you can select among three pricing tiers. You will receive a discount when paying annually versus paying month-to-month. Each tier has three plans available to serve an individual, a couple, or a family. The tiers within each of those plans include:

- Standard: The Standard tier does not offer home title monitoring as part of its basic features. It will give you alerts for any odd occurrences with your credit information, but it will only monitor one of the three credit bureaus.

- Advantage: The Advantage tier does not offer home title monitoring either. With this tier, you receive all of the Standard tier features, while also receiving credit reports from a single bureau each month.

- Ultimate Plus: For the Ultimate Plus tier, you will gain access to home title monitoring. When an individual subscribes to the Ultimate Plus tier with the year-one discount, it will cost $239.88 for an annual subscription and $23.99 for a month-to-month subscription. This tier includes everything in the Advantage tier. It adds monitoring of your credit information at all three bureaus, as well as investment account monitoring and social media account monitoring.

I also must mention that LifeLock offers a significant first-year discount to new subscribers. For the Ultimate Plus tier, you will see your cost increase by 40% to 60% starting with the second year and beyond.

Setup and ease of use

Signing up for either LifeLock or Home Title Lock is an easy process. You should be able to begin using either service within a few minutes of completing the signup process.

For LifeLock, you will need to provide a payment method as well as a driver’s license to verify your identity. With Home Title Lock, you will need to provide your payment information as well as the address that contains the home title you want to monitor. Do not make an error when entering this address, or it can be extremely difficult to fix this error down the road.

When you start using Home Title Lock, you will receive alerts about any changes or attempts to access your home title. There is no complexity with using this service. You receive an alert, and you then can choose whether you want to do something about it.

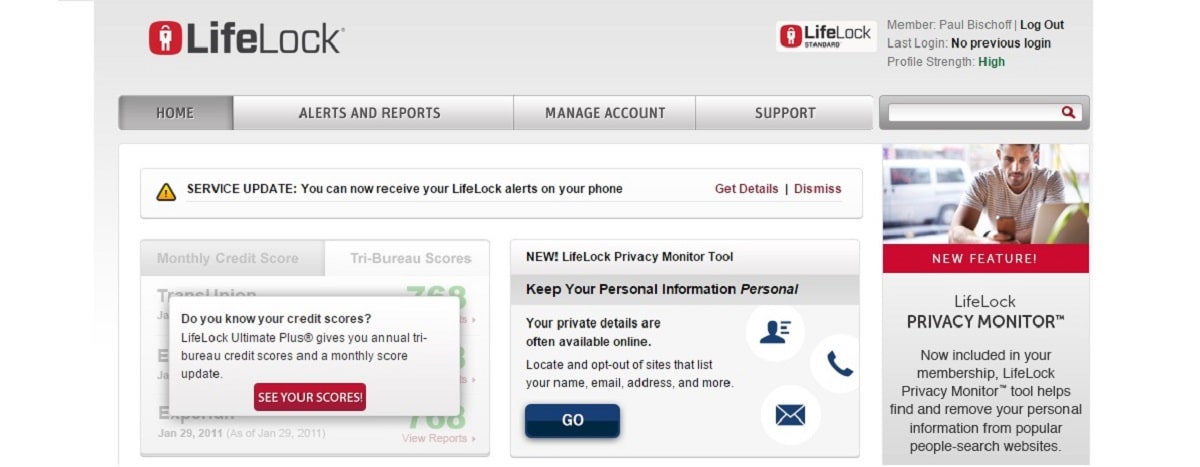

Because LifeLock is more complex and offers more services, it makes use of a dashboard and a mobile app to allow you to monitor your settings and account. The LifeLock mobile app has both an iOS and an Android version.

Pros and cons of Home Title Lock

Pros:

- Monitors any changes to your home title and offers to help you resolve any fraud

- Very easy to use

- Offers a money-back guarantee period

- Has a discount for an annual subscription versus a monthly subscription

Cons:

- Offers no identity theft protection, other than monitoring your home title

- The marketing on the Home Title Lock website uses significant scare tactics

- The Home Title Lock website may confuse you about what it actually does

- Far more expensive than the same service that LifeLock Home Title Protect offers

- Can be difficult to track down exactly what you are receiving for your price

- The majority of people do not need this service because such fraud is extremely rare

- It only covers one property or home per subscription

- Does not provide identity theft insurance or lost funds repayment

Pros and cons of LifeLock

Pros:

- The standalone Home Title Protect service from LifeLock offers the same features as Home Title Lock at a significant discount

- Has a $1 million ID theft insurance policy

- Offers stolen funds reimbursement if you suffer a financial loss in your accounts related to the ID theft

- Gives you multiple pricing tiers, so you can find something to match your budget and needs

- Customer service team is available 24/7

- Includes an easy-to-use dashboard and mobile app

- You will receive a significant discount as a new customer for the first year

- Offers a money-back guarantee period

- Provides a discount for annual subscribers versus monthly subscribers

- Includes home title monitoring in the Ultimate Plus tier of its identity theft service

Cons:

- You will not receive home title monitoring in the identity theft service tiers of Standard or Advantage

- The majority of people do not need home title monitoring because such fraud is extremely rare

- Customer service reviews for Norton and LifeLock are poor versus similar ID theft protection services

- The increase in price from the first year of your subscription to the second year and beyond is significant

The winner: LifeLock

The clear winner in the LifeLock versus Home Title Lock comparison is LifeLock. Whether you are selecting the LifeLock identity theft protection service or LifeLock Home Title Protect as a standalone product, you will receive a far greater value than with Home Title Lock. Despite giving it quite a bit of consideration, I cannot come up with a reason to purchase Home Title Lock.

If you want identity theft protection capabilities, LifeLock is the only choice in this comparison. Home Title Lock does not offer protection services beyond home title monitoring, so it will do nothing to protect your identity.

If you only want home title monitoring, Home Title Lock and LifeLock provide the same basic services. LifeLock just does it at a significant discount compared to Home Title Lock.

Even though Norton and LifeLock have a significant number of negative customer service reviews, they have far greater brand recognition than Home Title Lock.

The Home Title Lock website and marketing materials focus on scare tactics, which, quite honestly, do not instill confidence in its service. It’s also difficult to understand exactly what you are receiving with your subscription from the website descriptions. Add in the fact that Home Title Lock pushed through a 33% price increase within the past few years, and it is difficult to recommend this service for anyone.

For all these reasons, LifeLock easily ranks as a better choice than Home Title Lock, whether you want full identity theft protection services or home title monitoring services only.

Our testing methodology for identity theft protection

When I’m researching the best identity theft protection services and services like Home Title Lock, I always attempt to approach them from the point of view of an average consumer.

During test scenarios, I use data that would simulate what an average user would do. I also try to trigger alerts through the entry of certain types of data. (Admittedly, this is not always possible, especially when trying to test home title monitoring services, which rely on catching potential frauds with public records related to property titles.)

Ease of use is another key aspect of my testing procedures. I want to be able to show that these services will work well even for people who do not have a lot of experience using web-based services and apps. In conjunction with this, I attempt to test the responsiveness of customer service teams. After all, it is important that these services respond to you promptly in case of an emergency.

In the end, I want to make sure these services live up to the promises that they make to their subscribers. I hope that my tests and reviews can help you gain a feel for the way these types of services actually work versus what they say they will do for you.

Home Title Lock vs LifeLock FAQs

How does identity theft protection work?

All of us have personal identifying data that we use on a regular basis to open financial accounts, when seeking medical care, or when applying for loans or credit. Should some of this personal identifying data end up in the wrong hands, though, someone could impersonate you, stealing your identity.

When pretending to be you, this person could access bank accounts in your name, take out loans, or incur other financial losses. It can take months or years of work to regain full control of your identity after an identity theft breach.

By subscribing to an ID theft protection service, you will receive alerts that warn you of potentially fraudulent activity related to your personal information. After you suffer identity theft, these protection services should take steps to help you recover your identity.

Some services give you payments to cover the cost of regaining control of your identity as well as to reimburse you for lost funds. It can be difficult to know where to start with trying to recover your identity, so having these services on your side after an identity breach can be a significant benefit.

However, you should understand that these services are not perfect. You could still suffer identity theft after subscribing to one of these services. The alerts you receive may not come in time to protect your identity from falling into the wrong hands. Ultimately, your best protection against identity theft is to keep a close eye on the places where you are sharing your personal information. If anything feels sketchy, don’t share your information.

How does home title monitoring work?

With home title monitoring, a service will monitor public records to determine whether your property title is part of any property ownership changes that your local government records. Should any changes happen, you should receive an alert from the service, so you can determine whether the changes involve any fraudulent activity.

Someone who is able to gain access to your home title might be able to open a loan in your name or might be able to make a fraudulent sale of your property to another party. However, occurrences of this type of fraud are extremely rare.

Does LifeLock help with home title monitoring and recovery?

If you subscribe to the Ultimate Plus tier with LifeLock, you receive home title monitoring. You also receive this service with the LifeLock Home Title Protect standalone product. Should you receive an alert about fraudulent activity related to your home title, you may receive some help with counteracting this fraud as a LifeLock subscriber through LifeLock’s U.S.-based restoration specialists.

Does Home Title Lock help with home title monitoring and recovery?

This is the primary service that Home Title Lock provides. Should the service find potential fraud with your home title, it will send you an alert. It provides support for trying to restore your home title through either a member of the restoration team or through a dedicated agent.

Can LifeLock help me after someone stole my identity?

When you are a LifeLock subscriber and you suffer a theft of your identity, LifeLock does offer specific help in trying to recover your identity. LifeLock also can help you challenge fraudulent financial losses in your name related to the ID theft.

LifeLock’s team will help you with figuring out which documents you should complete when trying to recover your identity. You will receive U.S.-based support specialists to help with your case. Should you need legal help, LifeLock can help you find experts to provide this service. LifeLock also provides up to $1 million in funds to reimburse you for costs related to trying to recover your identity.

Can Home Title Lock help me after someone stole my identity?

No, Home Title Lock does not deal with identity theft.

Does LifeLock compensate me for stolen funds related to identity theft?

With your LifeLock subscription, you could be eligible to receive between $25,000 and $1 million in compensation for any financial losses you have from your accounts related to identity theft. The exact amount you could receive will depend on the subscription tier you are using.

Does Home Title Lock compensate me for stolen funds related to identity theft?

No, Home Title Lock does not handle identity theft situations.

What are some disadvantages of home title monitoring services?

One of the biggest disadvantages of these services is the difficulty customers often have with trying to receive a refund or when trying to cancel the service. With subscription services like this, it often takes long phone conversations and sometimes multiple calls to cancel the service and to receive a refund.

Another frustrating aspect is the number of emails and text messages you could receive related to marketing. Even after you cancel the service, you likely will receive multiple messages asking you to restart your subscription.

How does home title monitoring compare to title insurance?

Title insurance is a service you often will use when you are purchasing a property. This service uses a title search to ensure that the property you are purchasing has a free and clear title. This means that no other person or entity has a claim to ownership of the property. If the title search misses someone else’s claim to the property, the title insurance protects you from any financial loss related to this issue with the title.

Title monitoring will monitor the public records related to your property title. Should the monitoring service notice any oddities related to your title, it will send you an alert about potential fraud.

These two services do entirely different things. Title monitoring cannot let you know if other people have claims on the title of a property you are trying to purchase, nor can it protect you financially if mistakes in the title search occur. Stick with title insurance when purchasing a property, rather than purchasing a subscription to a title monitoring service.

Should I get ID theft protection?

It is impossible to give a blanket statement about whether every person needs identity theft protection. Many of the services that the ID theft protection companies provide are things you can do on your own for free, such as monitoring your credit reports.

However, if you don’t have time to do this monitoring yourself, or if you don’t feel comfortable using websites to keep an eye on your personal information, paying a service to do this for you may be worth it.

Certain types of people may benefit more from identity theft protection services than others. If you suffered a theft of your identity in the past, you could be more susceptible to another breach of your personal information in the future. For children or others who rarely need to check their credit status, this type of service can be beneficial as well, watching your credit profile that usually sits dormant.

ID theft protection services do give you financial protection in the case of identity theft. This is a significant selling point of these services. You may be able to receive reimbursement for funds you lost in your accounts through identity theft or for money you had to spend to try to recover your identity.

Sometimes, however, receiving these payments can be challenging. You may believe that your claim to these funds is legitimate, but the identity theft service may disagree. The service may require that you provide proof of your loss, which can be difficult to do when you don’t have full control over your identity. You may end up needing to hire an attorney to help you restore your identity and to try to recover the funds you believe the service owes to you.

You also should know that these services use a subscription model, which means you must provide a payment method at the time of your account setup. You then will be subject to auto renewals, which can make it difficult to cancel the service or to receive refunds after canceling.

I would always recommend using a credit card to pay for this type of service, rather than your bank account. If the ID theft protection company is giving you the runaround about trying to cancel the service, you may be able to have your credit card company help you put an end to the charges.

Before you decide to pay for one of these types of identity theft protection services, take the time to fully understand what services you are receiving. Don’t just skim over the marketing materials and focus solely on the positives they provide and the promises they make.

Should I get home title monitoring services?

As with ID theft protection services, no easy answer exists to this question that fits all circumstances. Fraud related to existing home titles is extremely rare, even though the marketing materials for home title monitoring services try to make this fraud seem commonplace.

For most people, home title monitoring is not necessary. Perhaps, if you own multiple properties, having title monitoring that handles all your properties for one price may be a good idea, especially if you do not have time to occasionally check on these records on your own.

Again, though, this type of fraud is extremely rare. And even if you receive an alert about potential fraud, the alert may come too late to prevent the fraud.

However, if this type of service gives you some peace of mind, you may decide that the cost is well worth it, even if the chances that you ever will need it are extremely small.