According to the Consumer Sentinel Network of the Federal Trade Commission (FTC), the number of Americans reporting identity theft in 2020 reached 1.4 million. Another 2.2 million Americans reported instances of fraud.

Identity Defense says the increase in reports of identity theft and fraud are directly relatable to the ease with which we now can share personal information online. As an identity theft protection subscription service, Identity Defense aims to help you protect yourself from the growing threat of fraud and ID theft.

Potential customers seeking to learn more about Identity Defense’s services may struggle to find a lot of information. Certainly, Identity Defense doesn’t have the same marketing resources of an ID theft protection service like LifeLock.

TV commercials and internet ads don’t determine the trustworthiness of an identity theft protection service, though. As long as Identity Defense can do the job you need it to do – and can do so safely – it may be a good choice for you.

I recently put Identity Defense through the paces to help you determine whether subscribing to it is worth your hard-earned money. My hands-on review of Identity Defense aims to show whether this ID theft protection service lives up to its promises. Additionally, my 2022 Identity Defense review will answer many of the most common questions people have regarding this service, including:

- Is Identity Defense worth the money?

- Can Identity Defense be trusted?

- Does Identity Defense offer a free trial period?

- Does Identity Defense protect your Social Security number?

- Is Identity Defense better than LifeLock?

Identity Defense is one of the lowest-priced identity theft protection services available, which sparks interest among potential customers. My review found that its services are not quite as detailed as some other options, so those who have complex financial lives probably will want to look elsewhere. However, if you simply want insurance coverage in place to help you in case of identity theft, and if you want to spend as little as possible, Identity Defense handles the basics. It’s easy to use as well, which is appealing for someone who wants to save time monitoring personal information.

Summary of benefits: Identity Defense

| No value | Identity Defense |

| Website | identitydefense.com | Free trial | 24/7 customer service | Identity theft insurance | Up to $1 million | Stolen funds reimbursement | As part of theft insurance | Discount with annual billing | First-year subscription discount | Credit card monitoring | Investment account alerts | Social media monitoring | Lock your credit | Home title monitoring | Phone takeover monitoring | USPS address change monitoring | Dark web monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|

| Best deal (per month) | $6.99 Only $6.99/mo for the Essential plan |

Identity Defense: Hands-on review

When you subscribe to an identity theft protection service, you expect to receive alerts about potential breaches of your personal information. You also expect to receive financial protection from identity theft through insurance that the ID theft protection service provides.

Identity Defense handles all the basics related to monitoring and protecting your identity that you would expect, and it provides insurance. However, it doesn’t offer the advanced features of some of its more well-known competitors, which means it may not work as well for someone with a complex financial life.

Identity Defense’s most important features start with its $1 million insurance policy for subscribers. If you have expenses related to trying to recover your identity, such as missing work or hiring attorneys, you can be eligible for reimbursement. Should the identity thief access your accounts and steal money from you, you also may be able to receive reimbursement for this amount.

Identity Defense makes it easy to enter your personal information to track through its interface. Finding the features you want in Identity Defense is relatively easy as well, because Identity Defense’s design is perfect for novices.

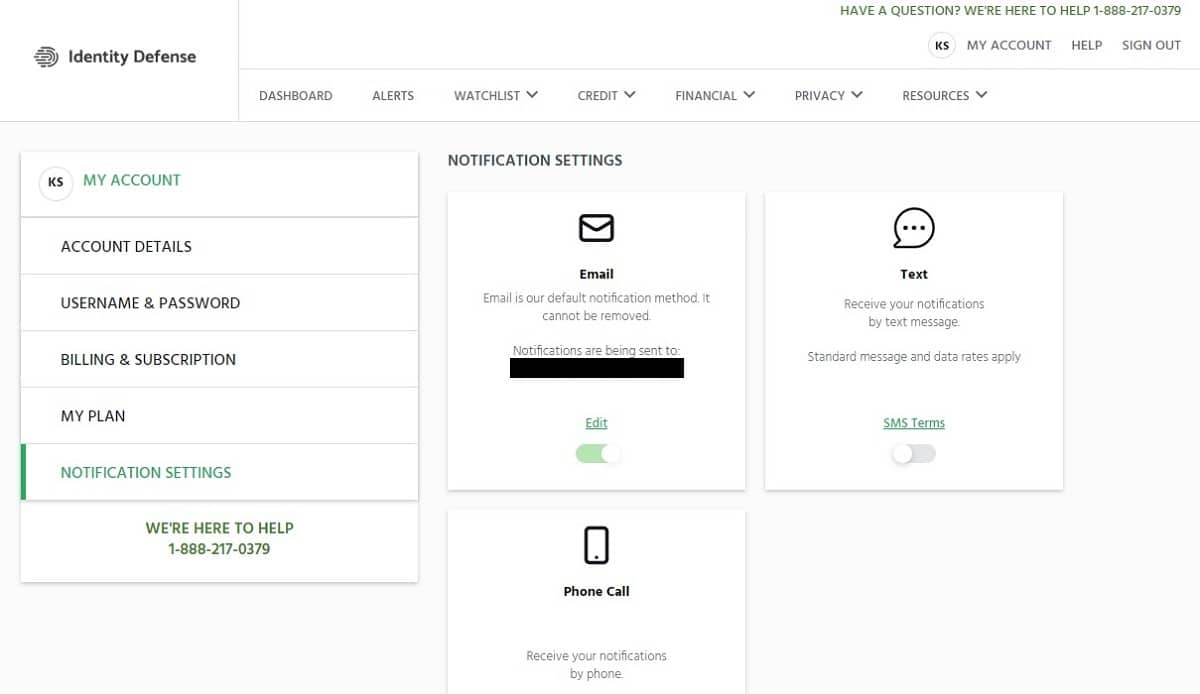

You can receive alerts about oddities regarding your personally identifying information through email, the service’s dashboard, text, or phone call. As it provides alerts, Identity Defense delivers advice on how to proceed.

Because Identity Defense is not as well-known as some of its competitors, it’s important that the service delivers maximum trustworthiness. Unfortunately, Identity Defense falls a little short in this area because of errors and inconsistencies in the information provided on its website.

Additionally, it doesn’t offer 24/7 customer service, which is a disappointment. If you discover some information related to a potential identity theft, you want to be able to speak to a professional immediately, whether it’s 2:00 in the afternoon or 2:00 in the morning. It doesn’t offer live chat, either.

Certainly, Identity Defense provides the basic services you would expect to receive at a reasonable price point. During my tests, I was able to safely share my information with Identity Defense. However, a novice may be a little leery about sharing information because of the oddities and inconsistencies in the website.

Before discussing the features that are available in Identity Defense – and the inconsistencies – I want to explain my testing process in a bit more detail. First, I subscribed to Identity Defense on my own. I paid for the service myself, and I used it over a period of time to gain a first-hand feel for how it operates. I believe this is the most accurate way to test these services.

Sometimes, demo accounts have limitations or pre-loaded data meant to generate a particular outcome. Instead, by testing the service myself in the same manner that you as a subscriber would, I can deliver the most accurate portrayal of the service for you.

Some reviewers of ID theft protection services like Identity Defense might simply read the website and make a decision. Instead, by using the service myself, I’m able to provide detailed information on how each of the features actually works, giving you the most realistic picture.

I subscribed to Identity Defense’s Complete pricing tier for an individual, which cost $19.99 per month at the time I tested the service. (Identity Defense says its regular price for the Complete plan is $29.99 per month.) There was no option for a free trial.

I should mention that Identity Defense is the brand name of the service. Pango Group operates Identity Defense, and it also goes by the company name of Intersections LLC. If you see these company names with Identity Defense, don’t be confused; they are all related.

Identity Defense features and insurance

Identity Defense covers the basic features that you need to protect your identity, but it doesn’t have some of the advanced features that competitors offer. Let’s break down the most important features found with Identity Defense.

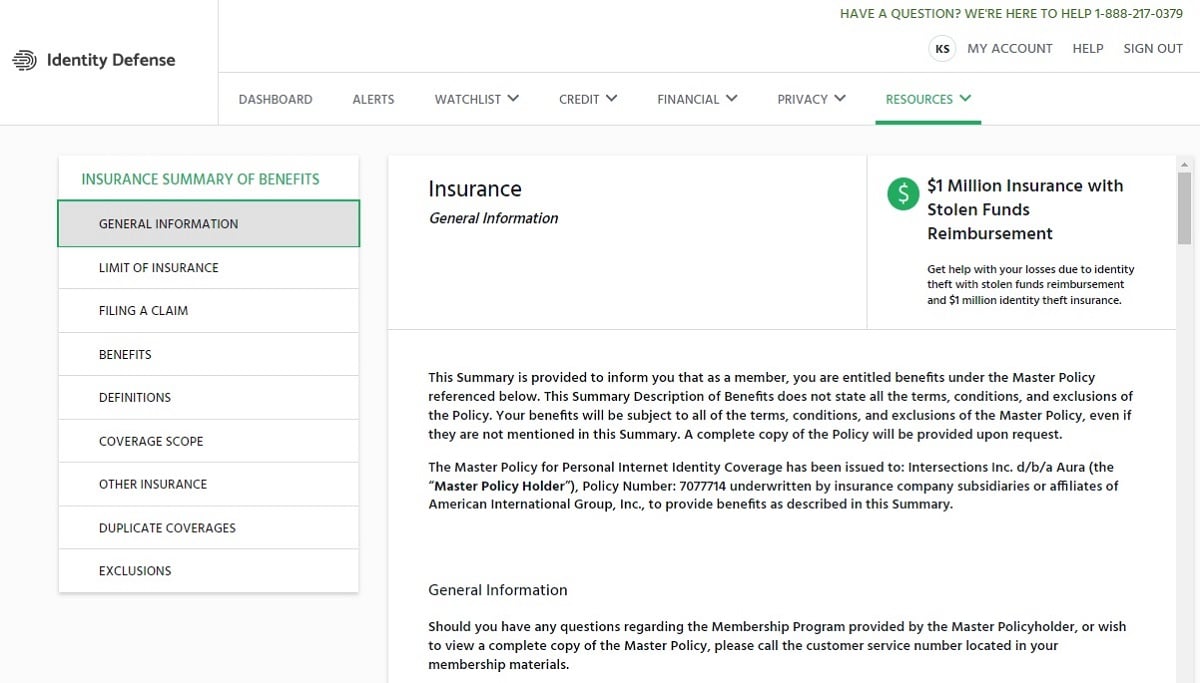

Insurance and compensation

Identity Defense provides an insurance policy designed to protect subscribers who suffer identity theft. This policy has a payout limit of $1 million, which is the standard amount that ID theft protection services offer. As part of this insurance, you can receive reimbursement for items like:

- Wages lost while you work to restore your identity

- Travel expenses

- Care for a child or other dependent while you try to restore your identity

- Costs to hire a CPA, lawyer, or private investigator

- Costs to acquire new identification cards and licenses

- Direct loss of funds to the identity thief

Identity Defense does not do a good job of explaining the insurance policy on its website. However, once you subscribe to the service, you can access a document that explains everything in significant detail. Click the Resources header and then click Insurance in the drop-down menu to see the document.

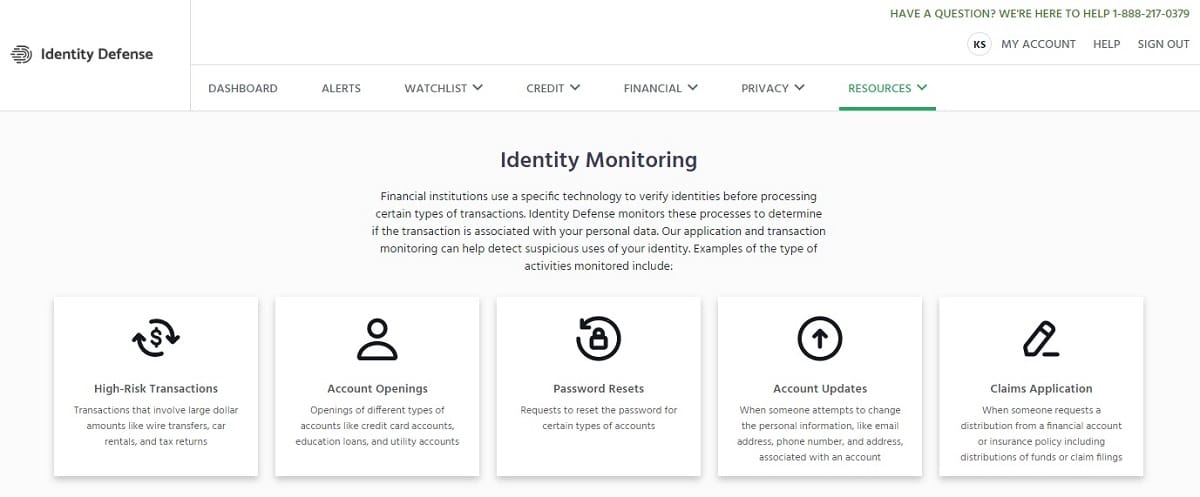

Activity alerts

When Identity Defense finds oddities with the way your personal information is appearing on the internet, it will generate alerts for you. These alerts hopefully give you notice as early as possible about these strange occurrences that could be a sign of impending identity theft.

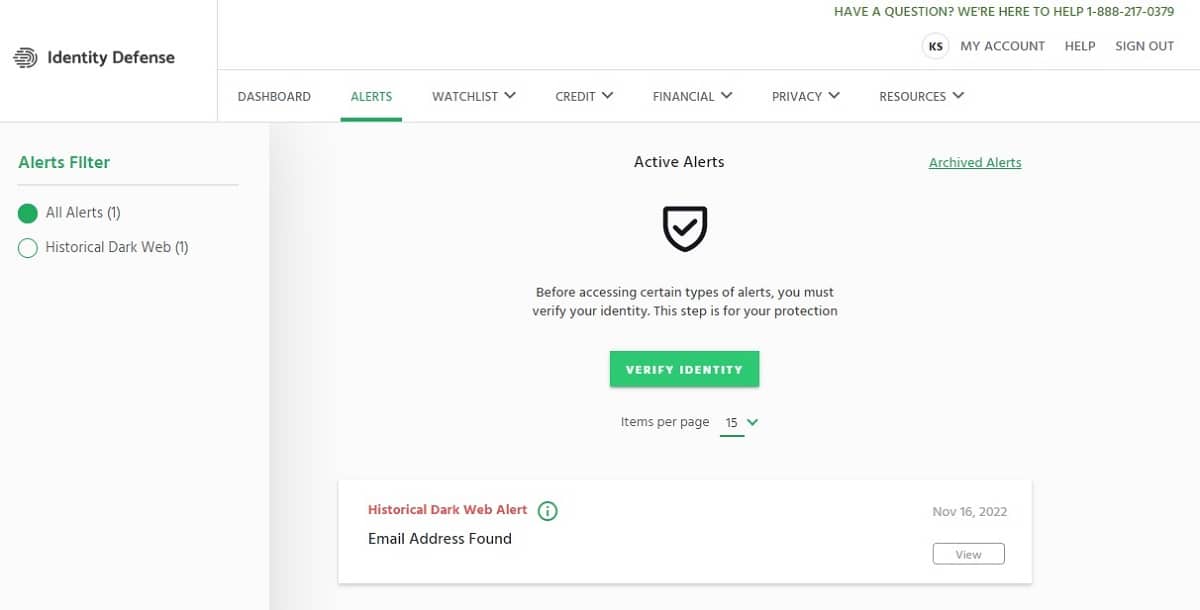

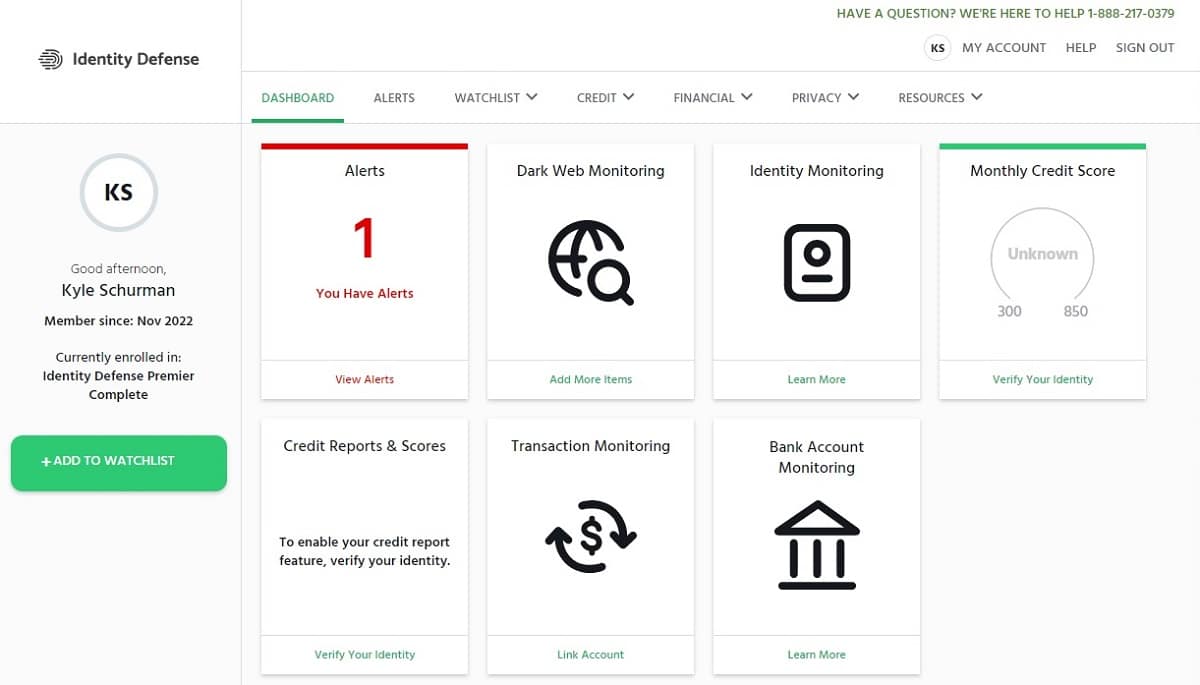

If Identity Defense finds an alert that you need to know about, it will display this information on your dashboard, and it will send an email. You can see your alerts by clicking the Alerts header on the dashboard.

On the Active Alerts screen, you can click View to see additional information about any particular alert. This information can help you determine whether you need to take any steps to try to counteract the danger that the alert is discussing. For example, you may need to change a password at a compromised website that the alert is identifying. Identity Defense does give you some advice on what you should do about each alert.

Once you take care of the alert or decide that it doesn’t represent a threat, click Archive Alert on the View screen to dismiss the alert from the Active Alerts screen.

Don’t worry if you don’t see any alerts immediately upon signing in. Because Identity Defense only requires you to submit a little bit of information at the time of the signup process, you may not have a lot of alerts right away. As you use the service and add more personal information over the next few hours and days, you may see more alerts.

Along those same lines, don’t freak out if you see dozens of alerts. ID theft protection services may go back several years in finding oddities and potential breaches regarding your information. You could have numerous alerts related to an email address you stopped using a few years ago, for example.

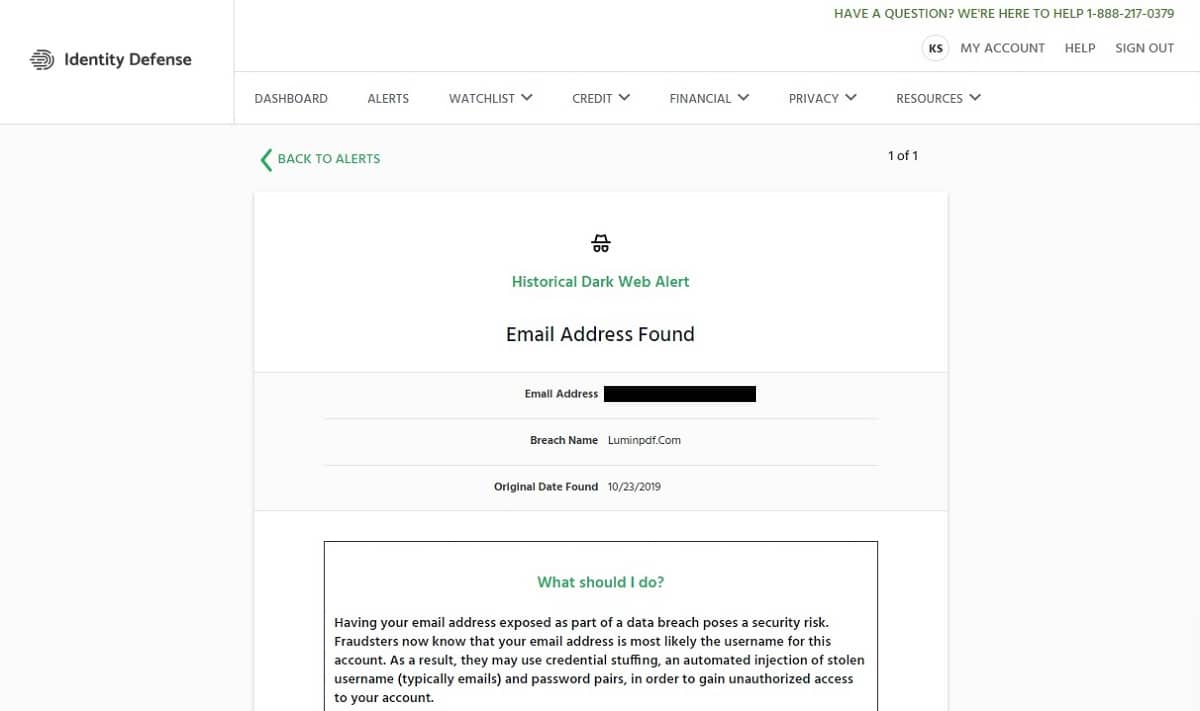

I immediately had one alert related to an email breach from several years ago when I signed up to use Identity Defense. I already knew about this issue, so it was not concerning. However, it was reassuring to see Identity Defense find this issue right away.

Dark web monitoring

The dark web represents portions of the internet outside the mainstream. Dark web forums and marketplaces use shadow networks to hide from traditional search engines. They allow criminals and hackers to buy and sell information, some of which may relate to victims of identity theft.

Most ID theft protection services, including Identity Defense, tout their ability to search the dark web. If the service finds information related to you on the dark web, it will generate an alert.

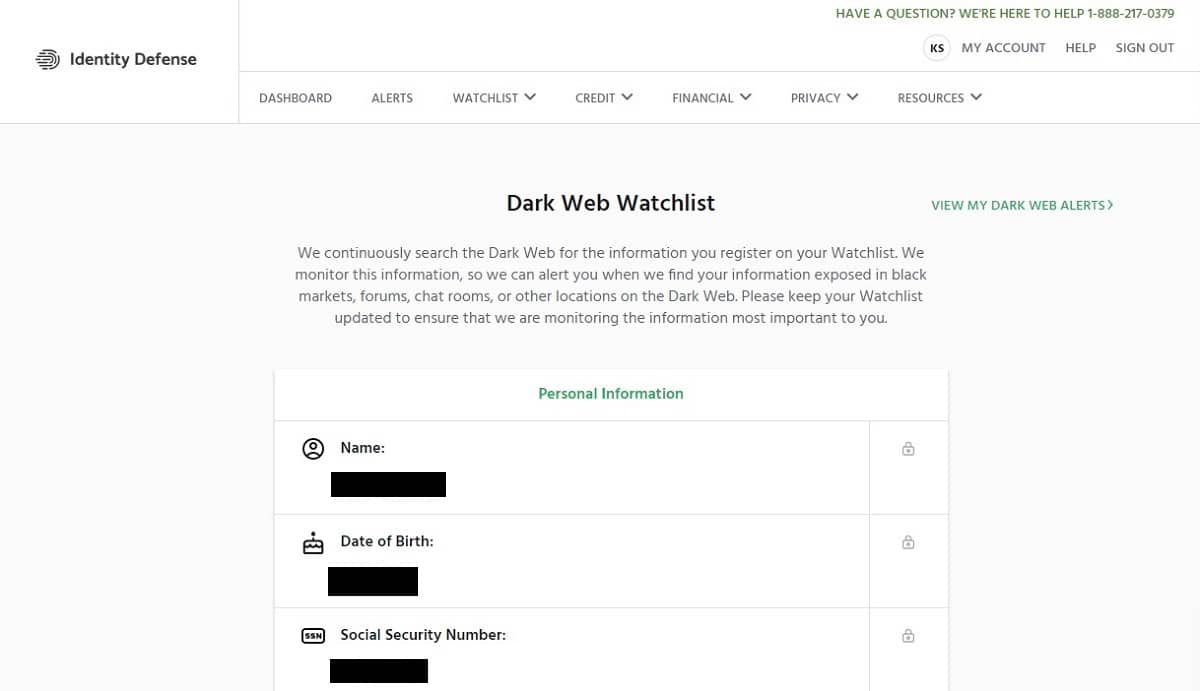

As an Identity Defense subscriber, you can control the type of personal information the service will seek on the dark web. From the dashboard, click Dark Web Monitoring to see the information that Identity Defense tracks for you by default, such as your name, date of birth, SSN, and email address. You can add other information into Identity Defense for dark web monitoring, including:

- Health insurance ID numbers

- Driver’s license number

- Passport number

- Credit card numbers

- Financial account numbers

- Loyalty card numbers

Should you receive an alert related to something Identity Defense finds on the dark web, it will designate this information as originating from the dark web in the alert.

Free credit report and monitoring

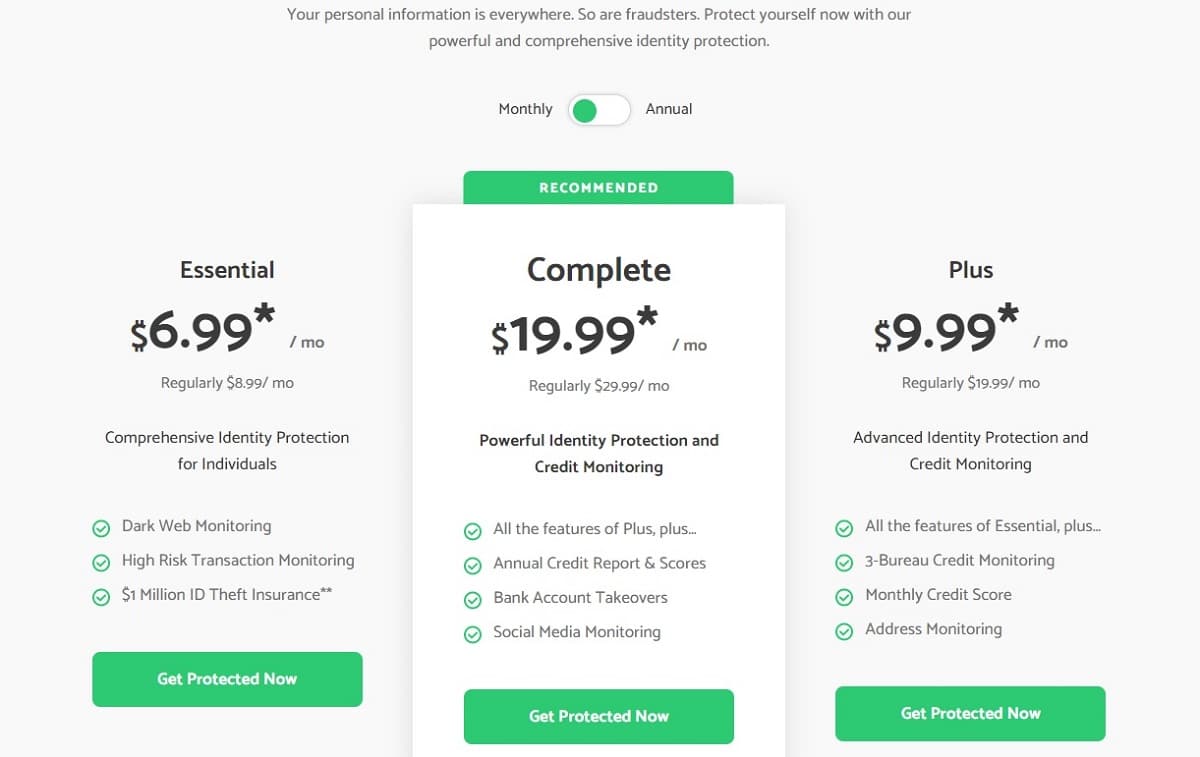

You can receive credit monitoring and a monthly credit score from Identity Defense in the mid-range price tier (Plus). If you want to receive credit reports, too, you need to subscribe to the highest pricing tier (Complete).

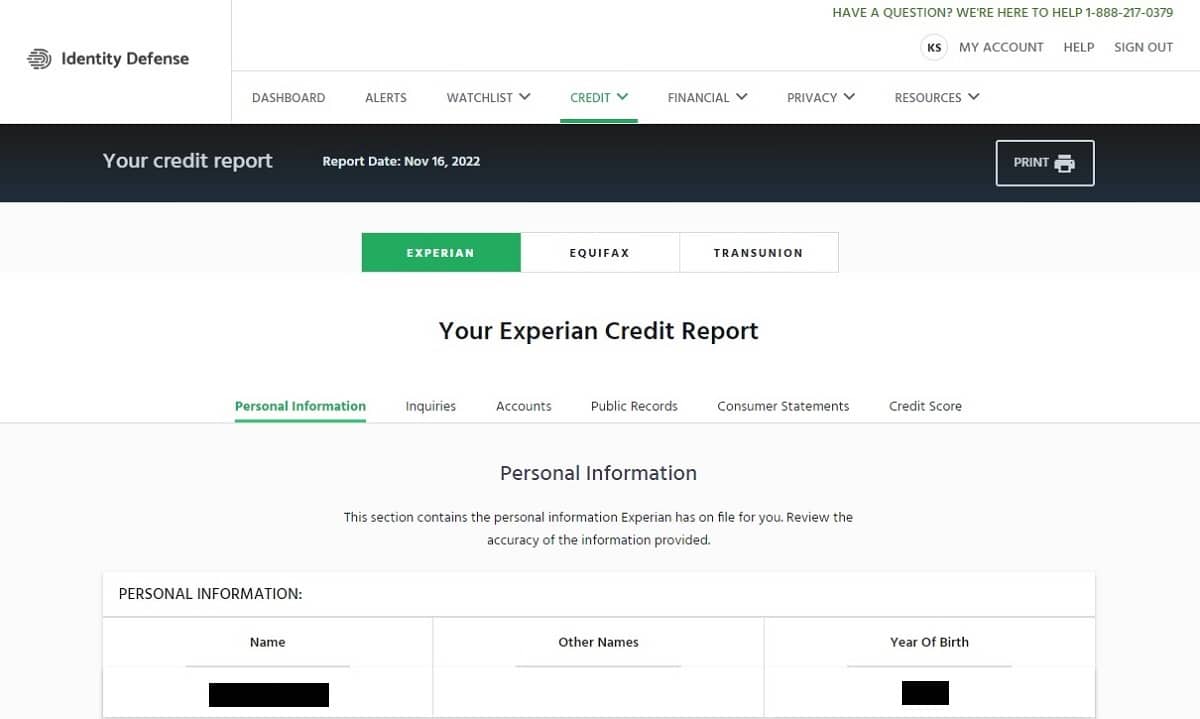

At the Identity Defense dashboard, click the Credit header. Then select Reports & Scores to see your credit report or select Score to see your Vantagescore Credit Score

The first time you attempt to see your credit report or score, you must answer a few questions that the credit bureaus use to verify your identity. Click Verify Now and follow the prompts to start the process.

On the Credit Report screen, you can select among any of the three credit bureaus listed along the top of the screen to see your report. You can print your credit report by clicking the Print button.

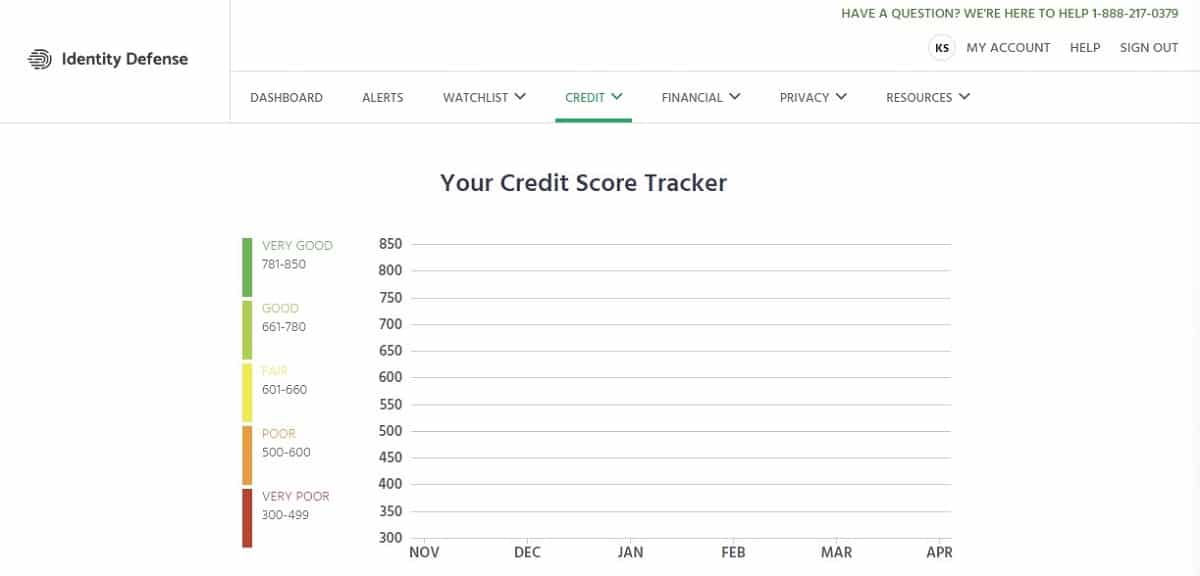

Credit score tracking

Identity Defense allows you to track your credit score over time. Click the Credit header, and then click Score Tracker in the popup menu.

The Score Tracker window shows your credit score’s movement over a six-month period. Identity Defense does not pull your historical credit scores from before you signed up for the service, so you can only track your scores from the date you signed up forward.

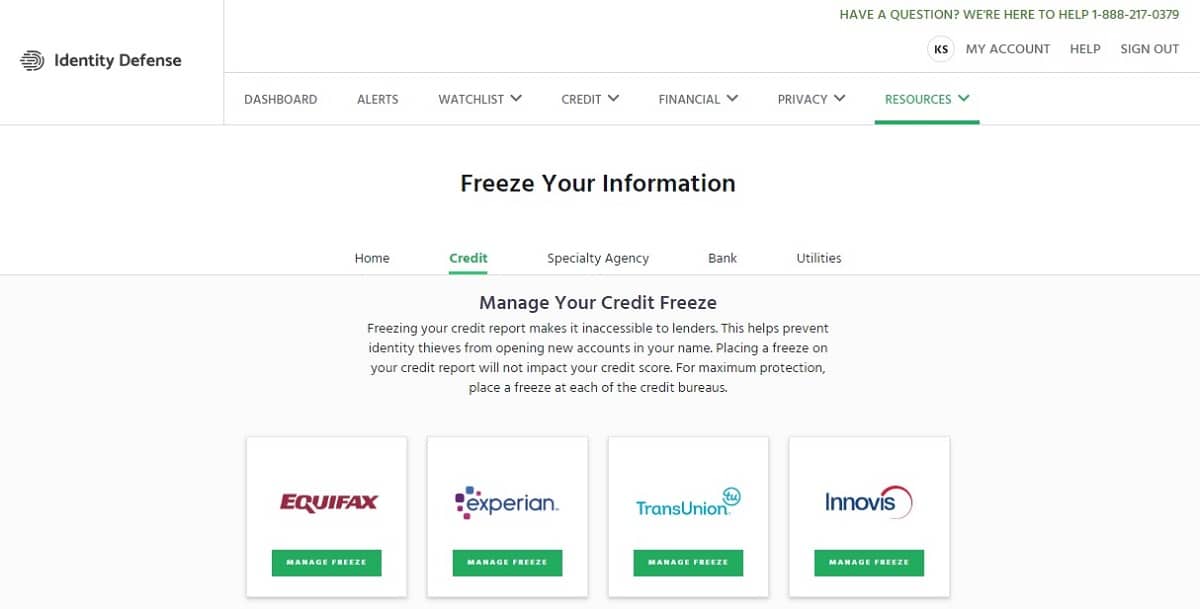

Freeze your credit report

You can freeze your credit through the Identity Defense interface, which is a nice benefit. By freezing your credit, no one can open a new account or seek credit in your name (including you). To apply for a loan, you would have to unfreeze your credit again.

To freeze your credit at Equifax, Experian, TransUnion, or Innovis, just click on the Resources header in Identity Defense, followed by Security Freeze. Then click on Credit along the top of the Freeze Your Information screen. Click on the credit report that you want to freeze. You need to have popups enabled in your web browser to allow this feature to work.

You should freeze your credit at all three major credit bureaus and at Innovis, a credit reporting service, to receive maximum protection against someone opening credit in your name. Freezing your credit does not affect your credit score.

If you currently use payday loans or specialty loans, or if you used them in the past, you may want to freeze this type of credit, too. Click on Specialty Agency across the Freeze Your Information page.

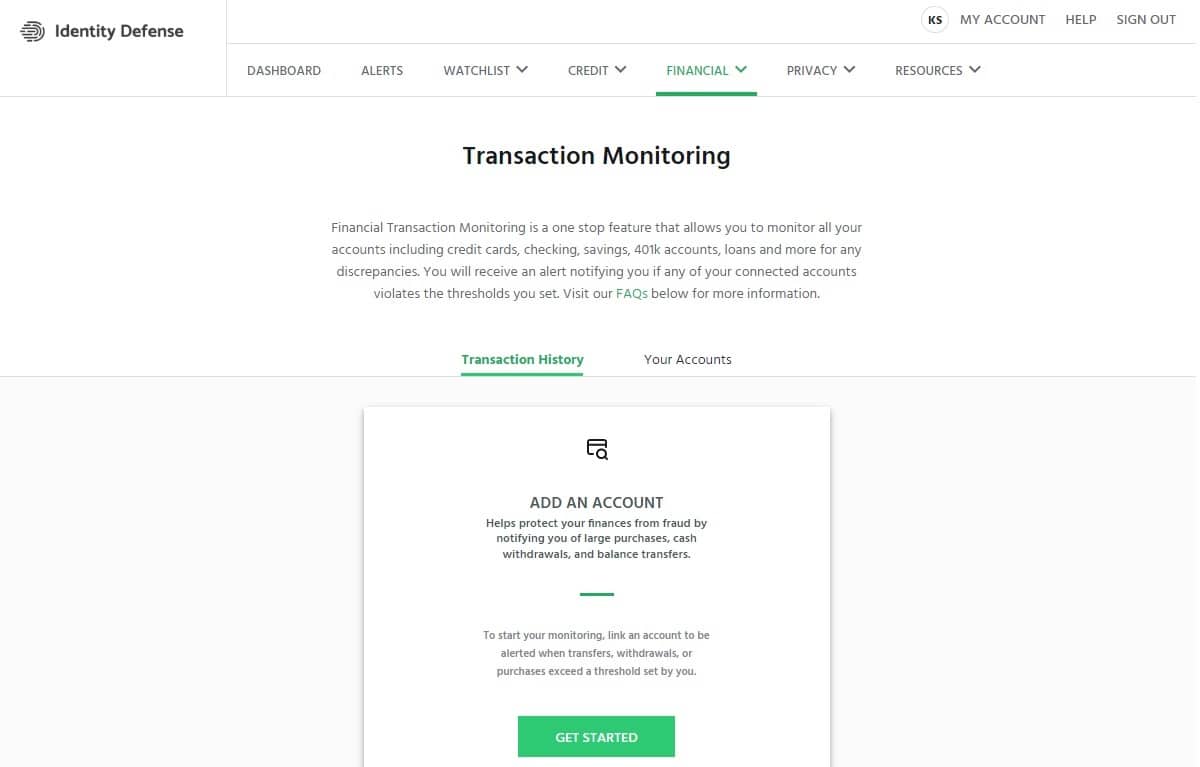

Financial account monitoring

With Identity Defense, you can view multiple pieces of information related to your financial accounts. Start by clicking the Financial header, followed by Transaction Monitoring. Through this section, you can enter the information about your accounts that you want to track.

You can set limits for large purchases and cash withdrawals. When Identity Defense finds a transaction that exceeds the limits you set, it gives you an alert. You also can receive alerts when someone opens an account in your name, changes your account information, or adds a signer to your account.

This information could be an indication that someone stole credentials to one of your financial accounts, potentially opening you up to identity theft.

Address monitoring

If someone submits a change of address form with the U.S. Postal Service featuring your home address, this could indicate an attempt at stealing your postal mail and your identity. Identity Defense would generate an alert if it detects a change of address form for your home address.

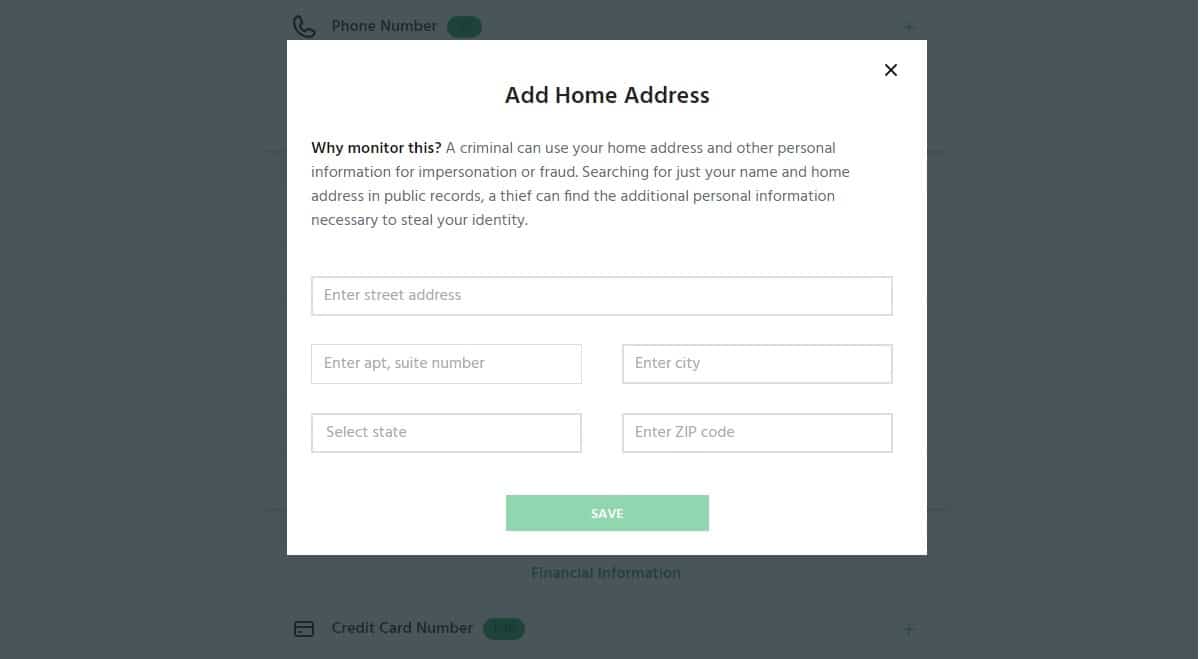

Enter or change your home address inside the Identity Defense interface. Click Dark Web Monitoring in the dashboard. Scroll down to the Home Address section and click the plus sign. Then enter your home address and click Save.

Social media monitoring

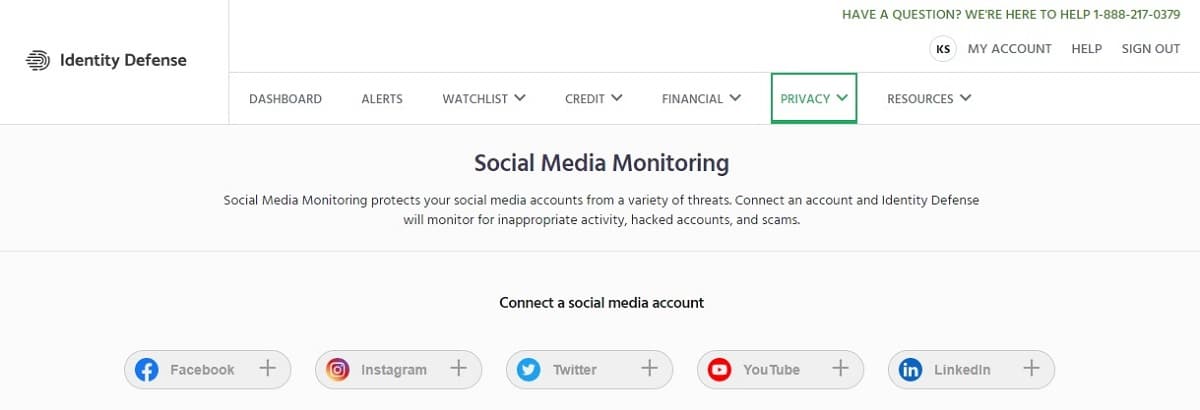

You can use Identity Defense to help you monitor your social media accounts for problems like hacking, scams, or inappropriate activity. Click the Privacy header along the top of the screen, followed by Social Media Monitoring.

You then can enter your login information for your social media accounts so Identity Defense can begin monitoring them. Click the button for the social media account, and then give Identity Defense permission to access it. The social media accounts Identity Defense can track include:

- YouTube

ID restoration

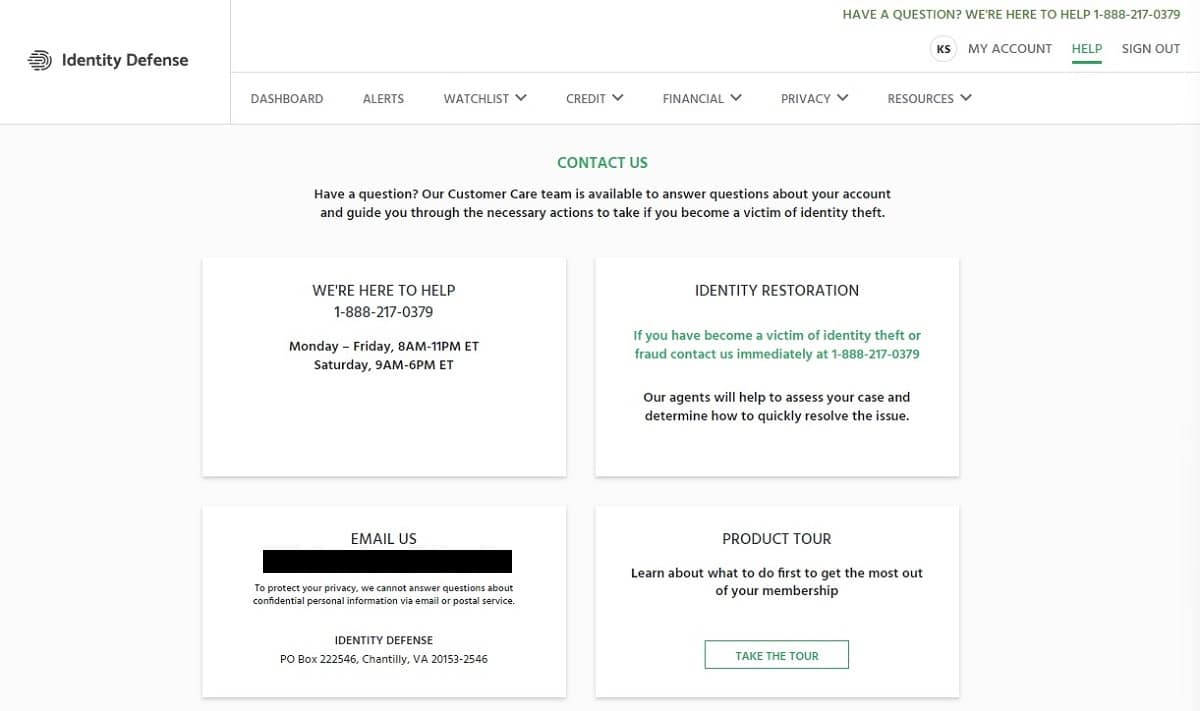

If you suffer identity theft or a similar type of fraud as an Identity Defense subscriber, then reach out to the service immediately. Click the Resources header, followed by Contact Us.

Identity Defense displays the phone number and email address for connecting to the customer service team. The better option to receive fast service is a telephone call, because the customer service team cannot discuss certain aspects of your account or your personal information over email.

Understand that Identity Defense does not offer round-the-clock help with identity restoration. Identity Defense lists its customer service times on the Contact Us page.

It is disappointing that there is no 24/7 customer service when subscribers need help with potential identity theft. If you discover a significant issue at 10 p.m. on a Saturday, you don’t want to have to wait almost 12 hours to begin trying to fix the problem.

Because Identity Defense carries a lower-than-average price point, I expected to find limited customer service hours. The disappointing reality is that quite a few identity theft protection services have limited customer service hours, even those that cost more than Identity Defense.

Unfortunately, Identity Defense does not have a live chat option to help with customer service and with identity restoration questions during off-hours.

Although Identity Defense is missing a few key customer service features, I do appreciate that the service displays its help phone number on almost every screen. If you ever have a question, you can quickly find the customer service phone number.

I did not need to make use of Identity Defense’s ID restoration services during my testing period, as I did not suffer any notifications that led me to believe I was suffering from potential identity theft. (To be fair, I was thankful that I did not have to test this aspect of the service first hand.)

2FA login

Identity Defense does not offer a two-factor authentication (2FA) login option.

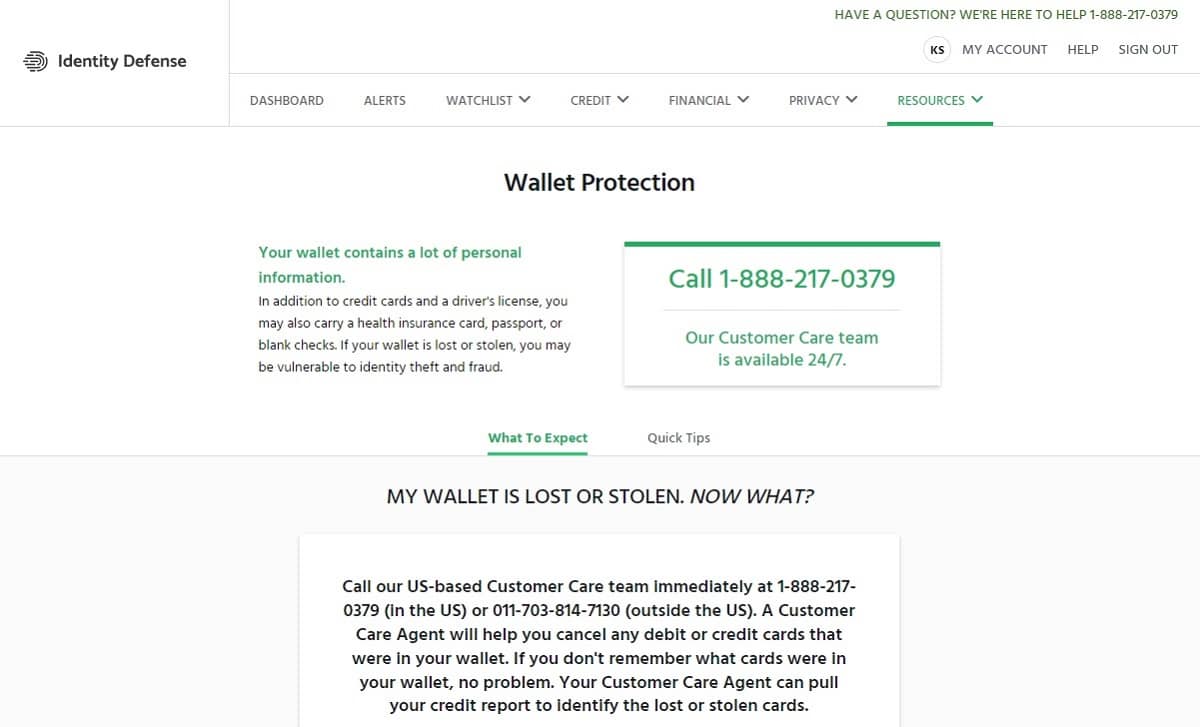

Lost wallet protection

When you are an Identity Defense subscriber, you receive protection if you lose your wallet. Identity Defense can help you cancel credit card accounts and other identifying cards after you lose your wallet. It helps you obtain new cards, too.

Call Identity Defense after you lose your wallet, and the customer service team can walk you through the process of working through the problem. Although the Lost Wallet screen in Identity Defense says the service is available by telephone 24/7, this is not the case. You only can call during the times I discussed in the ID Restoration section.

When you enter the tracking information for the items in your wallet into Identity Defense, it’s far easier to obtain help with a lost wallet. (Identity Defense will struggle to identify your cards if you don’t enter them in the software.) Use the Dark Web Monitoring button on the dashboard that I discussed earlier to enter your infromation.

Missing features

Identity Defense is missing a couple of features that the majority of other identity protection services offer. I’m not sure these are deal-breakers, but they may be important for your particular situation.

Identity Defense does not monitor court records to see if your name appears in reported crimes. Someone who is stealing your identity may give law enforcement officials some of your identifying information after an arrest, trying to avoid detection.

Some ID theft protection services monitor sex offender registries, alerting you if anyone on the registry lives within a certain distance of your home address. Identity Defense does not offer this service.

Signup and setup

It doesn’t take long to sign up for Identity Defense. However, there are a couple of tricky situations that you need to keep an eye on, so that you sign up for the pricing tier that you actually want to use.

From the Identity Defense home page, click Get Protected Now. The page will automatically show the three pricing tiers that are available.

Use the toggle button at the top of the page to see the monthly and annual prices. If you subscribe annually, you’ll save about 17%, but you will have to pay the entire amount up front. Set this toggle switch to the payment frequency you want to use.

Once you select the pricing tier and payment frequency you want to use, click Get Protected Now underneath the plan you want.

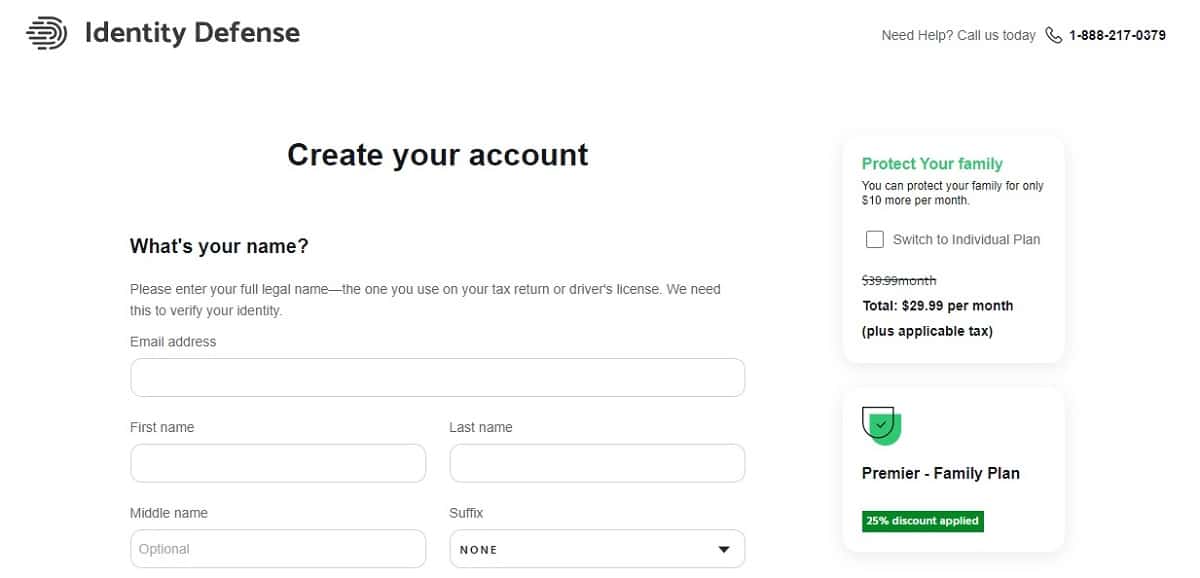

On the Create Your Account page, you can begin entering your information. However, before you do this, be sure to look on the right side of this page. When I signed up, Identity Defense automatically switched me to the family plan, rather than the individual plan it advertised on the previous page. The family plan for the Complete tier costs $10 more per month than the individual plan.

This feels like a bait-and-switch tactic, especially when Identity Defense doesn’t mention the family plan or its cost anywhere on the home page.

If you want to use the family plan, you don’t need to do anything before filling in your personal information. If you want to go back to the individual plan, though, you need to click the checkbox next to Switch to Individual Plan. When you click this box, the service then displays the price for the individual plan. If you click the box again, it switches back to the family plan.

This is a far more confusing process than it needs to be. It doesn’t generate a feeling of trust in Identity Defense when things like this are happening before you even sign up for an account.

Another area of confusion: the home page calls the highest-priced plan the “Complete” tier. On the Create Your Account page, though, it’s called the “Premier” tier. Additionally, the “Essential” tier also is called the “Value” tier, and the “Plus” tier also is called the “Total” tier on various pages inside the website. This lack of consistency does not inspire confidence in the service.

For the initial sign up, you must enter:

- Email address

- Full name

- Phone number

- Home address

You also need to create a strong password. After entering the required information, click Continue.

On the following screen, you need to enter your credit card information. You will receive a charge immediately upon signing up for the service, as Identity Defense offers no free trial period. You do have a final chance to decide on either the annual or monthly pricing plan before submitting your payment. Scroll down and click Continue.

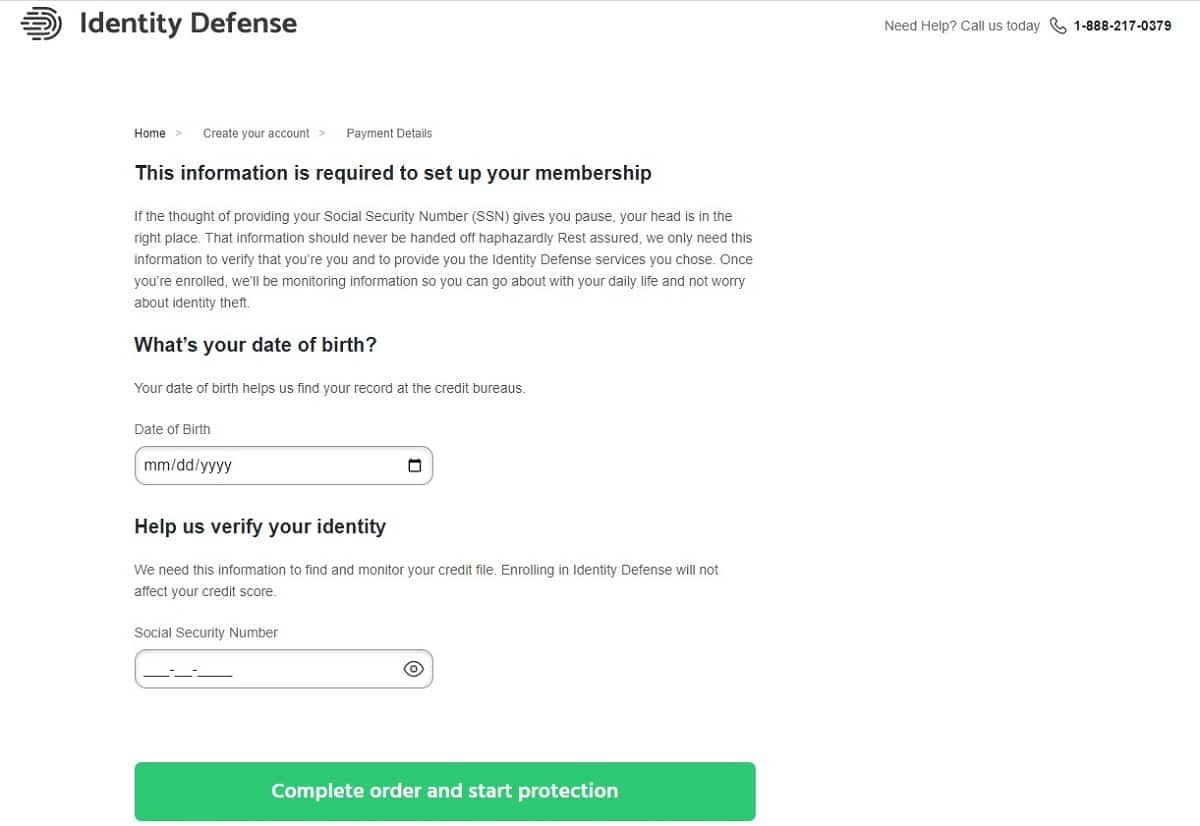

On the next page, you must submit your date of birth and your Social Security number, which allows Identity Defense to identify you and to begin accessing the information needed to monitor your identity. If you don’t submit this information, the account creation process will not work. After entering the information, click Complete Order and Start Protection.

After about a minute, Identity Defense will ask you to create your account. However, this screen returned an error message when I tried to complete it. Because I created my account by specifying a username and password earlier in the process, I already created an account, hence the error message.

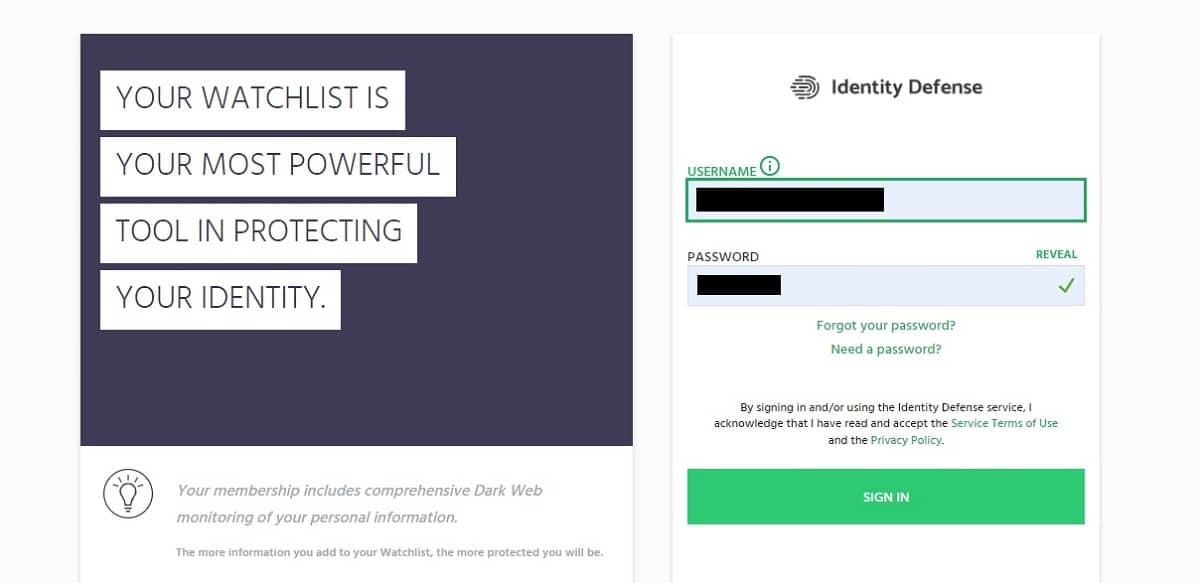

I’m not sure why Identity Defense generates this screen to create an account, but I was able to skip it and log in to my account successfully from the website’s home page. Just click Sign In at the upper right corner of the website’s home page. Then enter your username and password and click Sign In again.

Having an extra screen that is unnecessary and generates an error message is incredibly frustrating. With my experience with using identity theft protection services, I was able to figure out the workaround quickly, but novices may not be able to do this.

Ultimately, the number of glitches and oddities that are part of the Identity Defense signup process are not going to engender faith and trust in the service. If Identity Defense has a sloppy signup process, it’s fair to question how well it will protect you.

Ease of use and design

Identity Defense uses an extremely clean design. The interface and dashboard have an organizational structure that makes a lot of sense, allowing users to find the information they need quickly.

Having a series of header menus across the top of every screen makes it easy to find the feature that you want to use. Additionally, the dashboard uses multiple graphical elements to simplify tracking down features.

For those new to using ID theft protection services, having the customer service phone number at the top right corner of the main dashboard screen is a nice feature, too. Although some aspects of the signup process made me feel leery about the trustworthiness of Identity Defense, the fact that the service displays its help phone number prominently does provide some peace of mind about the way Identity Defense takes care of customers.

Identity Defense ran smoothly in my web browser with no lag in performance. It’s a browser-based dashboard, meaning you never have to download any software to subscribe to Identity Defense. Some other ID theft protection services run far slower.

Some low-priced ID theft protection services place advertisements on the dashboard screen and on other patges. I appreciate that Identity Defense does not include ads, focusing solely on the ID theft protection services that it offers.

You do need to actively use your Identity Defense account to remain logged in to the account. After about 10 minutes of inactivity, Identity Defense will automatically log you out of the system. (You do receive a popup warning message before the system logs you out of your account.)

Ideally, Identity Defense would automatically log you out to protect your information in a situation where others may see your computer if you step away. If Identity Defense was open in a browser tab, this other person could access all your personal information.

However, because Identity Defense does not offer a 2FA login option, and because most users will choose to have their web browsers automatically load the username and password for Identity Defense, someone who can access your computer probably can easily log into your account and see your identifying information, even after Identity Defense logs you out after a period of inactivity.

For maximum protection, I would recommend not having your web browser save your login information and automatically recall it for you, unless you are certain no one else will access your computer.

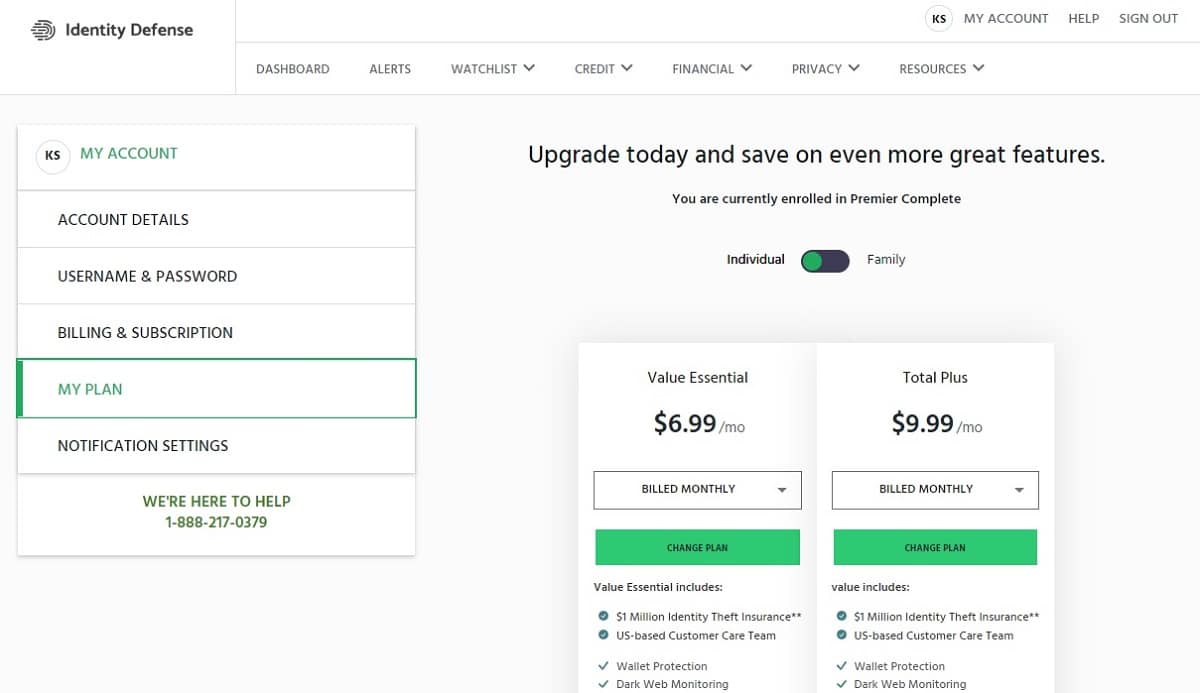

If you need to see information about your account and your pricing tier, click on My Account at the top right corner of the dashboard screen.

Identity Defense dashboard

If you prefer to use graphical elements to make selections regarding the features you want to access in Identity Defense, the service’s dashboard has a clean graphical design. You can access nearly every feature that’s available in Identity Defense through the dashboard. Click any of the buttons on the dashboard to access the feature. Scroll lower on the page to see more buttons.

To return to the dashboard from any other screen, just click on the Dashboard header across the top of the screen.

Identity Defense mobile app

Identity Defense does not offer a mobile app.

Identity Defense support

As I mentioned earlier, I like how Identity Defense displays its customer service phone number on nearly every screen. However, I would prefer to see 24/7 customer service accessibility with Identity Defense.

Identity Defense does not offer a live chat feature, either, which is disappointing, but you can send basic questions by email at any time. Just don’t expect an answer until normal customer service hours resume.

During my testing of the Identity Defense customer support responsiveness, I was able to contact a team member within a couple of minutes during the listed customer support hours.

As part of support, you will receive notifications of alerts that Identity Defense discovers. By default, these notifications arrive in your email box. However, you can change the way you receive alerts through your My Account screen. You can receive alerts via text and phone call, if desired, along with email notifications. You cannot opt out of receiving alerts via email.

Regardless of the changes you make to how you receive alerts, you also continue to receive notifications through your dashboard.

You should expect to receive marketing emails from Identity Defense after you choose to subscribe. The service may ask you to jump to a higher pricing tier, or it may give you special offers via marketing emails. Even if you cancel the service, you will continue to receive marketing messages. This is an unfortunate aspect of nearly every identity theft protection service.

Identity Defense: Pricing

| No value | Identity Defense |

| Website | identitydefense.com | Subscription periods | Monthly or annual | Special offer | $6.99 (Essential Individual tier) | Price per month | $6.99 (Essential Individual tier) | Lowest annual price | $69.90 (Essential Individual tier) | 4-year pricing plan | $199.90 (Complete Individual tier) | Lowest annual price (Family) | $129.90 (Essential Family tier) | Highest annual price (Family) | $299.99 (Complete Family tier) | Money-back guarantee | 60 days (only on annual plans) |

|---|---|

| Best deal (per month) | $6.99 Only $6.99/mo for the Essential plan |

You have three different pricing tiers to select from with Identity Defense, and you then can choose either individual or family plans in each pricing tier, giving you six different subscription options.

Because of the lack of detailed information about each pricing tier on the Identity Defense website, it’s not exactly clear what types of benefits you receive from subscribing to a family plan versus an individual plan. The primary advantage of the family plan, which costs between $6 and $10 per month more than the individual plan at each pricing tier, is that you can enter information for a few people instead of just one.

You can save about 17% on the cost of the Identity Defense subscription by choosing to pay annually instead of month by month. If you are sure that you want to use Identity Defense for a long time, subscribing annually is the better deal. However, if you think you might want to cancel after trying the service for a couple of months, paying monthly is the safer option.

Identity Defense does not offer a trial period for free. When you sign up for the service, you must pay for the first month or first year immediately. If you subscribe to the annual plan, Identity Defense does offer a 60-day money-back guarantee. However, there is no money-back option for those who subscribe monthly.

Overall, Identity Defense’s prices are a little lower than the average for identity theft protection services with comparable features.

Auto renewal options

As with nearly every identity theft protection service, when you sign up for Identity Defense, you must agree to abide by the service’s auto renewal option. This means that you agree to allow Identity Defense to charge your credit card each time your renewal time comes up. If you do not actively cancel the service before your renewal date, you will have to pay for the entire month or year.

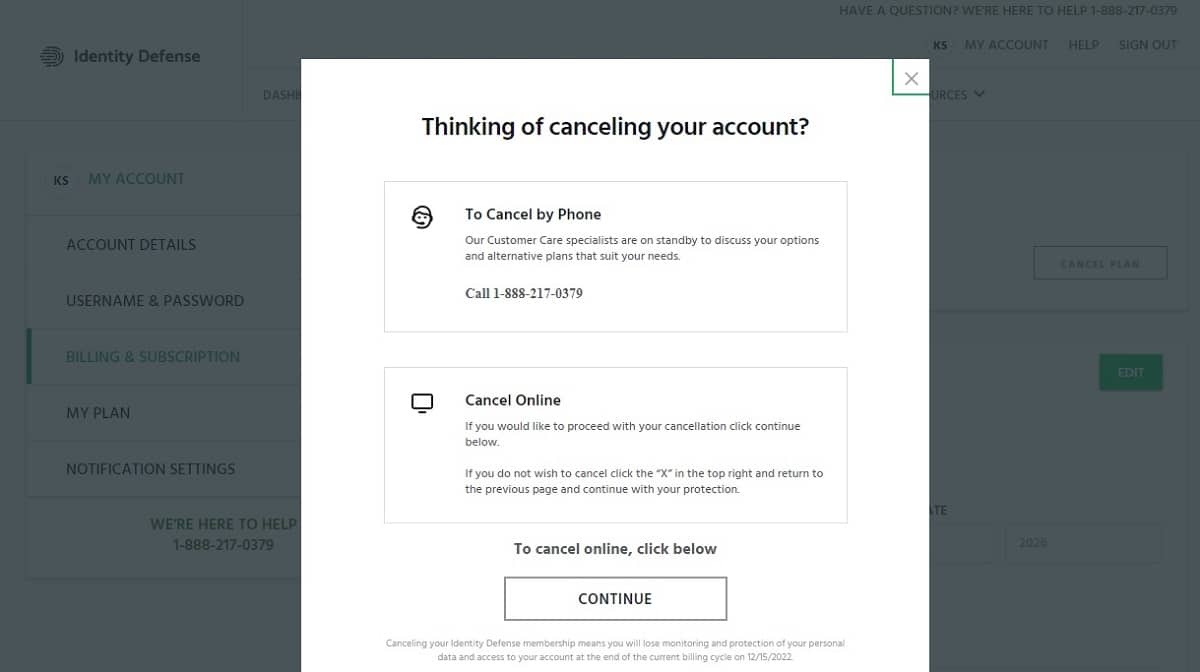

How do I cancel Identity Defense?

When canceling Identity Defense, you can call customer service during the hours the team is active. You also can cancel the service through your web browser dashboard and account.

Click My Account at the top right corner of nearly any screen in Identity Defense. Along the left side of the screen, click Billing & Subscription.

At the top of this screen, you will see the current subscription plan you have, as well as the date of the next charge for renewal. In this area of the screen, click Cancel Plan. In the popup window, click Continue to move forward with trying to cancel Identity Defense. Follow the prompts for your account from there.

I did not have any problems canceling my Identity Defense subscription through the Cancel Plan button. However, because problems with canceling identity theft protection services occur more frequently than they should, I always recommend keeping a copy of all email messages you receive about the cancellation. Take screenshots if you are canceling online to show that you completed the cancellation steps properly.

Additionally, watch your credit card statement for a couple of months after you cancel the service to be certain that you are not still receiving charges.

Identity Defense makes the cancellation process easier than some of its competitors, but you should always keep good records of the steps you took, just in case you run into a problem down the road.

Before signing up for the Identity Defense service, I would recommend that you read Identity Defense’s privacy policy (which runs through Pango Group) and the Identity Defense license and terms of service. These documents spell out the legal obligations you have after giving Identity Defense your credit card number and subscribing.

Although the information I listed in my Identity Defense hands-on review is accurate at the time of writing, any subsequent changes to the service’s policies will appear in these documents. Because the Identity Defense website has so little information about what the service entails, I would highly recommend reading these documents before signing up with the service.

As one final piece of advice, I would always recommend using a credit card to sign up for Identity Defense or any other ID theft protection service. Should you run into disputed charges after you try to cancel the service, your credit card company is far more likely to help you fight the charges than your bank if you pay with a debit card or a direct draw from your bank account.

Pros and cons of Identity Defense

Pros:

- Offers lower prices than an average ID theft protection service

- Interface is well-designed

- Receive credit scores and reports from all three credit bureaus

- Receive a significant discount for paying annually

- Displays the customer service phone number on nearly every screen

- Can create an account in a short amount of time

- The service runs smoothly inside a web browser with no lags

- Offers $1 million in ID theft protection insurance

- Includes monitoring of your social media accounts

- Can select how you receive alerts

Cons:

- Website does a poor job of explaining the features you receive

- Unclear exactly what benefits you receive with the family plan

- Several errors are sprinkled throughout the website

- Not the best option for those with complex financial lives

- The lowest-pricing tier only offers the most basic features

- Does not have 24/7 customer service

- No free trial period is available

- Automatically tries to enroll you in a family plan, rather than the individual plan

- No option to set up a 2FA sign-in process

- Does not monitor for crimes that occur in your name

Identity Defense: Our final verdict

Identity Defense handles all the basics you would expect from an identity theft protection service. It delivers a $1 million insurance policy to protect subscribers from potential financial loss related to identity theft. It keeps an eye on the way your personal information is in use online, alerting you to oddities that could indicate a situation where identity theft is imminent.

If an identity theft protection service doesn’t offer at least these basic items, it can’t compete in this area of the market. Identity Defense does a nice job at handling all the basics, offering a great price point in the process.

However, if you have a complex financial life and need your ID theft protection service to go beyond the basics, Identity Defense doesn’t quite match up to competitors.

By focusing on the basics and by offering a lower price than average, Identity Defense aims its service at those who simply want protection services without a lot of hassle and without breaking the bank.

For novices, I appreciate the clean interface Identity Defense offers. Beginners will have no problem finding the features they need to use or the financial information they seek. I really like how Identity Defense allows you to freeze your credit through the service’s interface.

However, if you are someone who is unsure whether you can trust an identity theft protection service with your sensitive personal information, Identity Defense may create some anxiety for you. Identity Defense has multiple inconsistencies on its website and in its dashboard after you subscribe that are concerning.

For example, when you try to sign up for the service on the website, you’ll see no option for a family plan. All information listed is for an individual plan. However, once you begin entering your personal information for the subscription, Identity Defense automatically shifts you to the family plan (and its higher price point) without notification. You must manually switch back over to the individual plan.

Once I completed the signup process and paid, I became stuck in a loop where I was receiving error messages while trying to log in. Because of my experience with these types of services, I was able to overcome this problem, but novices may struggle to figure out exactly what is happening.

Additionally, Identity Defense says it has 24/7 customer service on some screens and lists limited customer service hours on other screens. To clarify, Identity Defense does not offer 24/7 customer service.

Although I really like quite a few aspects of Identity Defense, these red flags are worrisome. They indicate sloppy design and a lack of attention to detail, something that cannot happen when it comes to guarding the personal information you share with the site.

Identity Defense does a good job of keeping an eye on your personal information and giving you alerts when it spots oddities. However, the design’s bugs and inconsistencies make it fair to wonder if the service will protect your personal information properly.

Bottom line: Identity Defense is an appealing option for those seeking basic identity protection services, as it has a clean interface that’s easy to use. It handles the basics of monitoring your personal identifying information, giving you a chance to catch and correct potential problems before they evolve into potential identity theft. However, a lack of 24/7 customer service and a few oddities and inconsistencies in the design of the interface are concerning. I appreciate the low price for Identity Defense, and I did like using it during my testing period. But it’s hard for me to recommend this service until it cleans up some of the problems and errors with the website and with the service.

Our testing methodology for identity theft protection

When it comes to my methodology for testing identity theft protection services, I know the importance of having first-hand experience with the software. Accurately testing the best identity theft protection services requires having used the service and finding its strengths and weaknesses.

Reading the ID theft protection service’s website and marketing materials is not enough to perform an in-depth review. Making recommendations for a service that is so important to protecting your information requires hands-on testing.

I start the testing process by signing up at the service’s website and paying for the subscription with my own credit card. I then submit my own personal information to the service, ensuring that I can test all aspects of the service.

I do not ask the identity theft protection service company for a demonstration account or for a free account. I want to be able to use my own realistic data, rather than some data that the company provides that could skew my testing. I also want to be able to let you know how easy or difficult it is to cancel the service, and I can only test this process when I sign up myself.

I reach out to customer service randomly during the testing period as well, determining response times and helpfulness.

Ultimately, I am trying to make certain these companies live up to the promises they make to their customers and potential customers. When a service is not truthful in its marketing materials, this is a red flag about the trustworthiness of the company.

Hopefully, by following such a detailed testing process, I am able to give you the information you need to determine whether you want to subscribe to an ID theft protection service and which one best fits your needs.

FAQs

Is Identity Defense worth the money?

Identity Defense offers a lower-than-average price point versus competing ID theft protection services. For the money you’re spending, it offers a good value. However, because it offers only basic features, it may not be a good value for someone who has complex financial tracking needs.

Can Identity Defense be trusted?

During my testing, I did not experience problems with the way Identity Defense maintained my personal information. However, the service did raise a few red flags for me regarding its design. I encountered a price switch when I tried to sign up, the service gave odd error messages when I tried to sign in to my account initially, and some information listed in the service contradicts other information. Such sloppiness in the design of the website’s information is concerning in terms of the trustworthiness of the service.

Does Identity Defense offer a free trial period?

No, Identity Defense does not have a free trial period. You must pay for the service during the signup process.

Does Identity Defense protect your Social Security number?

You must share your Social Security number during the signup process. Without an SSN, you cannot subscribe to the service. I did not have any problems with Identity Defense protecting my personal information during my testing period, including my Social Security number.

Is Identity Defense better than LifeLock?

Based on the LifeLock review I wrote recently, I believe most people will receive better results with LifeLock than Identity Defense. Although Identity Defense has a significantly lower price, the oddities with its website and its lack of advanced features leave it lagging a bit behind LifeLock and its far longer track record of work in the identity theft protection market.

Should I get ID theft protection?

It is impossible for me to give advice on this question to a wide range of people with varying backgrounds and financial needs. Your personal circumstances and your level of risk for possibly suffering identity theft will play a role in determining whether subscribing to an ID theft protection service is a good idea for you. Some of those who may be at the greatest risk for identity theft include:

- Previous victims: If you suffered identity theft in the past, you have a greater risk of becoming a victim again. Some of your breached information could circle back and open you up to fraud again in the future.

- Senior citizens: Because older people don’t have as many reasons to check their credit report as younger people who may be regularly obtaining loans, senior citizens may not notice oddities in their personal information as quickly as younger people.

- Children: Children can become victims of identity theft, just like anyone else. Because there is no reason for parents to check credit reports for their kids on a regular basis, it can be tough to catch information that could indicate identity theft is occurring.

- Busy people: If you are too busy to keep an eye on your financial information and on your credit report, you might not notice signs of a possible identity theft situation, even though you are actively seeking loans and using credit cards.

An identity theft protection service regularly monitors your information for you. If it discovers something strange or if it finds some of your personal information exposed in a breach, it alerts you to this issue. Learning that your information could be at risk as early as possible gives you the best chance to make some changes aimed at avoiding a full-blown identity theft situation.

Before going any further, it is important to explain what identity theft protection services actually do (and what they don’t do). Misconceptions about these services are common, which causes some people to think they are more valuable than they actually are.

For example, the ID theft protection service is not going to fix problems with your identity for you. If the service sends you an alert about a potential breach, it’s up to you to make the change necessary to try to protect your information. These services only alert you to possible problems. They may provide some advice on how to fix the issue, but you still must do it on your own.

Additionally, these services are not perfect. They might miss a clue about potential fraud occurring, leaving you susceptible to identity theft. Even more likely, they may generate false alerts, forcing you to waste time investigating them. Simply subscribing to an ID theft protection service does not guarantee that you never will become a victim of identity theft.

On the other hand, one of the most popular reasons people subscribe to these services is for insurance. If you are a subscriber when you suffer identity theft, you potentially are eligible to receive up to $1 million in insurance to reimburse you for expenses and direct losses related to the identity theft. You must have concrete proof of these losses, as the service is not going to hand you several thousand dollars on your word.

The identity protection service would assign a specialist to your case if you suffer ID theft as a subscriber. This specialist walks you through the process of trying to restore your identity. Again, however, you need to spend time doing much of the day-to-day work on your own, including potentially hiring a lawyer, a private investigator, or a CPA. (The insurance coverage should reimburse you for these hiring costs.)

Some people choose not to subscribe to an ID theft protection service because they believe they can duplicate the work that the service provides. In many ways, this is true. If you keep a close eye on your account transactions and on your credit report, you may be able to spot potential fraud that could lead to identity theft almost as fast as an ID theft protection service spots it.

Your best bet is to try to reduce your risk of ever suffering identity theft. Always be extremely careful about where and how you share your information online. Consider leaving your credit report frozen the majority of the time. Only unfreeze it when you need to actively open a new line of credit. If your credit report is frozen, no one (including you) can open a new line of credit in your name.

Freezing your credit is one of the best ways to prevent fraud, and it doesn’t cost anything. Some ID theft protection services, such as Identity Defense, even allow you to freeze and unfreeze your credit through the service’s dashboard.

As you try to decide whether to subscribe to an identity theft protection service, keep all these things in mind. As long as you have a realistic expectation about what these services do, and as long as you understand they are not perfect, you can fairly evaluate whether you want to subscribe. Try to pay more attention to the realities of what these services do for you and place less emphasis on their claims in their marketing materials.