Consequently, interest in subscribing to an identity theft protection service is also increasing. An ID theft protection service, such as IdentityProtect, aims to keep an eye on key pieces of your personally identifying data available on the internet. Should the service find evidence of an oddity related to your data, it will send you an alert.

IdentityProtect.com recently joined the world of identity theft protection services. Through my hands-on review of IdentityProtect, I will give you an idea about whether you can trust IdentityProtect to deliver the protection services that it promises. Ultimately, my 2022 IdentityProtect.com review will help you figure out how it stacks up against other ID theft protection service options.

My IdentityProtect review will provide answers to common questions readers have about this service, including:

- Is IdentityProtect worth the money?

- How does ID theft protection work with IdentityProtect?

- Is IdentityProtect a trustworthy company?

- Does IdentityProtect.com offer a free trial period?

- Is IdentityProtect better than LifeLock?

IdentityProtect provides the most basic information about any strange occurrences with your personal information on the internet. It also promises to give you the industry standard of $1 million in identity theft insurance if you suffer some sort of loss related to ID theft and fraud. However, IdentityProtect doesn’t really offer anything out of the ordinary, and it doesn’t have the brand name recognition of some more established ID theft protection services. It also charges quite a bit more than some other protection services, which makes it difficult for me to recommend it over its competitors. IdentityProtect does have a clean interface that’s easy to navigate, but that’s not enough for me to fully recommend it to consumers.

Summary of benefits: IdentityProtect

| No value | IdentityProtect |

| Website | identityprotect.com | Free trial | 24/7 customer service | Identity theft insurance | Up to $1 million | Stolen funds reimbursement | As part of theft insurance | Discount with annual billing | First-year subscription discount | Credit monitoring | Investment account alerts | Social media monitoring | Lock your credit | Home title monitoring | USPS address change monitoring | Dark web monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|

| Best deal (per month) | $39.90 Get a 7-day FREE trial! |

IdentityProtect: Hands-on review

As you would expect to receive with an ID theft protection service, IdentityProtect will monitor your personal information and provide alerts any time it finds something out of the ordinary. Once you see an alert, you can take a few steps to try to protect your information.

With a subscription to IdentityProtect, you receive financial protection against identity theft in the form of a $1 million insurance policy. Should you have direct expenses related to trying to recover your identity, such as hiring a private investigator or a CPA, this policy reimburses you.

You also can use this insurance policy to gain reimbursement for any wages you were unable to earn because you had to take time off work to try to recover your identity. If you lose money from a bank account because of fraud related to the identity theft occurrence, you often are eligible to receive reimbursement for these funds under the policy.

IdentityProtect offers the same basic features that the majority of the other ID theft protection services offer. However, it doesn’t bring you many extra features that other services have, like monitoring of your social media networks and monitoring of your investment accounts.

It doesn’t have the track record or brand recognition that you find with other ID theft protection options, either. And its service has advertisements and other third-party offers sprinkled throughout the design that give it an untrustworthy look.

IdentityProtect doesn’t offer 24/7 customer service, and the physical address of its parent company, Identech, LLC, lines up with a widely advertised virtual office location in Las Vegas.

Couple these question marks with the fact that IdentityProtect charges an above-average price and doesn’t offer a free trial period, and it’s easy to understand why some consumers would be leery about subscribing.

It delivers the basics, and I was able to safely share my personal information for monitoring from IdentityProtect. But my research shows there are far better options available in the identity theft protection service market.

I will discuss IdentityProtect’s features in far more detail, because there are a few sections of this service that may appeal to users with certain needs. For example, IdentityProtect greatly emphasizes understanding how credit works and providing advice for improving your credit score. This is not common in all ID theft protection services.

To test IdentityProtect, I subscribed to the service on my own, and I shared my actual information with the service. I did not use a demonstration account.

For me to be able to inform readers about the true pluses and minuses about IdentityProtect.com, I feel it is important to use the service myself. Although I could simply read marketing materials and glance at the basic features that IdentityProtect offers, such work would not provide the best level of information for readers who are seriously considering IdentityProtect.

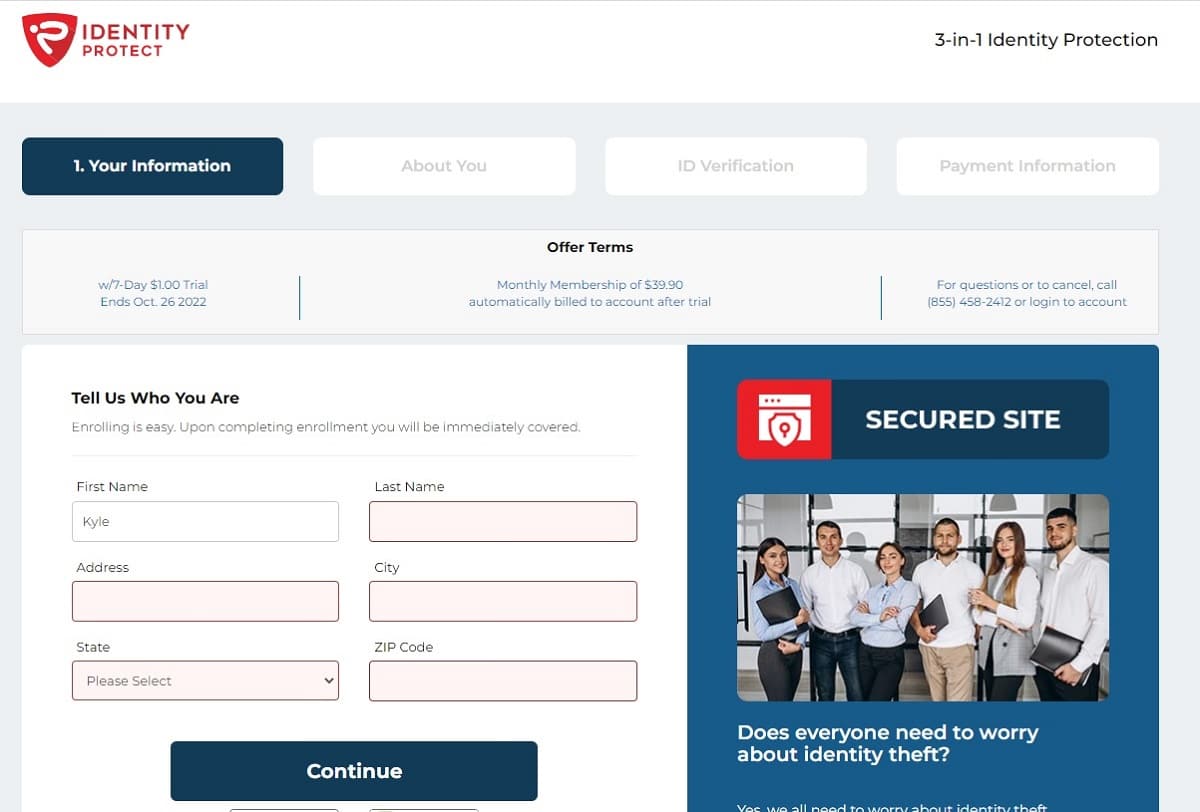

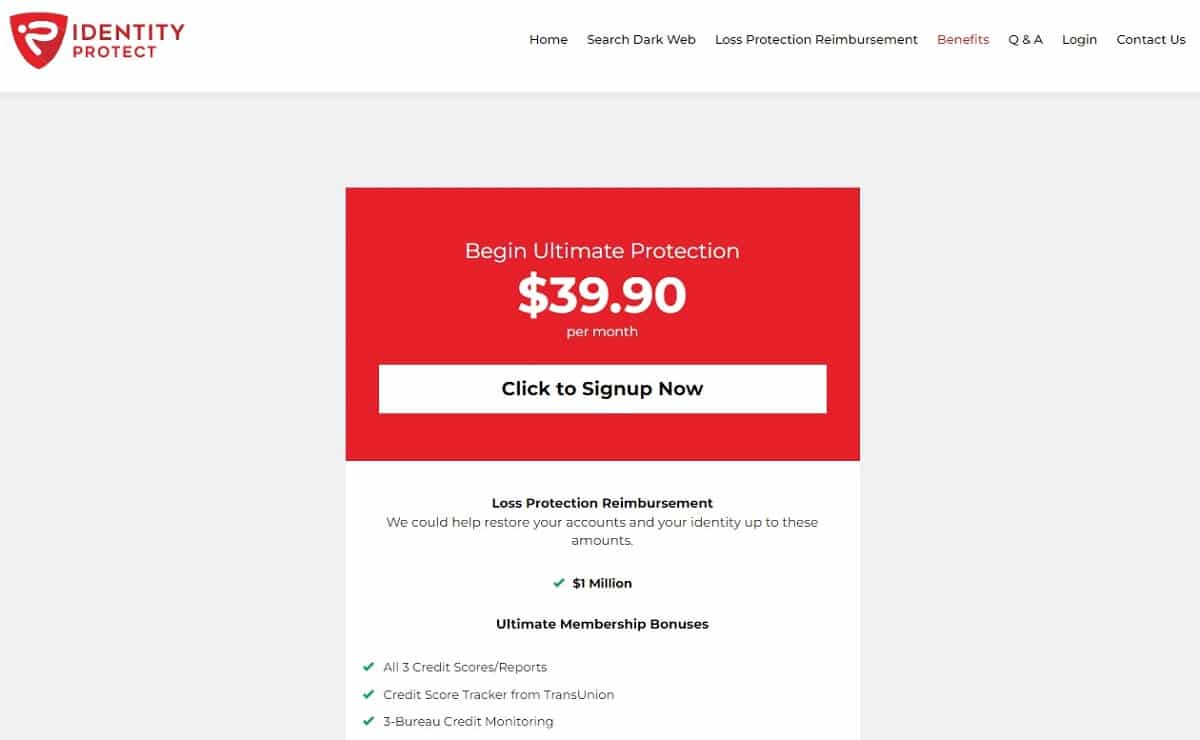

I subscribed to the $39.90 monthly price tier with IdentityProtect, which includes a seven-day trial period that costs $1. (In the past, IdentityProtect offered multiple pricing tiers, but at the time I was testing the service, only the $39.90 monthly pricing tier was available.)

I also should mention that there is an IdentityProtect theft protection service that operates in Canada. This is a different entity than the American-based IdentityProtect.com. The Canadian company operating this service, called Credique Canada, has the backing of TransUnion.

IdentityProtect features and insurance

As I discuss the most important features found with IdentityProtect.com, I’ll let you know how they stack up versus the competitors.

Insurance and compensation

As with most companies in the identity theft protection arena, IdentityProtect provides up to $1 million in insurance coverage to help you recover losses and to pay for expenses if you suffer identity theft. Some of the covered expenses include:

- Paying for legal representation

- Paying for a financial advisor

- Paying for a private investigator

- Paying for child care while you work to restore your identity

- Reimbursing you for lost wages while you missed work to try to restore your identity

As shown in IdentityProtect’s explanation of the insurance policy, subscribers must provide documentation and proof that shows the losses requiring reimbursement. No ID theft protection service is going to simply take your word for any losses from identity theft.

Should you suffer a theft at your home or apartment, and should the thief use stolen checkbooks or debit cards to create a loss for you, IdentityProtect.com may reimburse you for these losses as well. If you have losses through a bank account or credit card account because of identity theft, IdentityProtect will reimburse you for one such loss per 12-month period.

Activity alerts

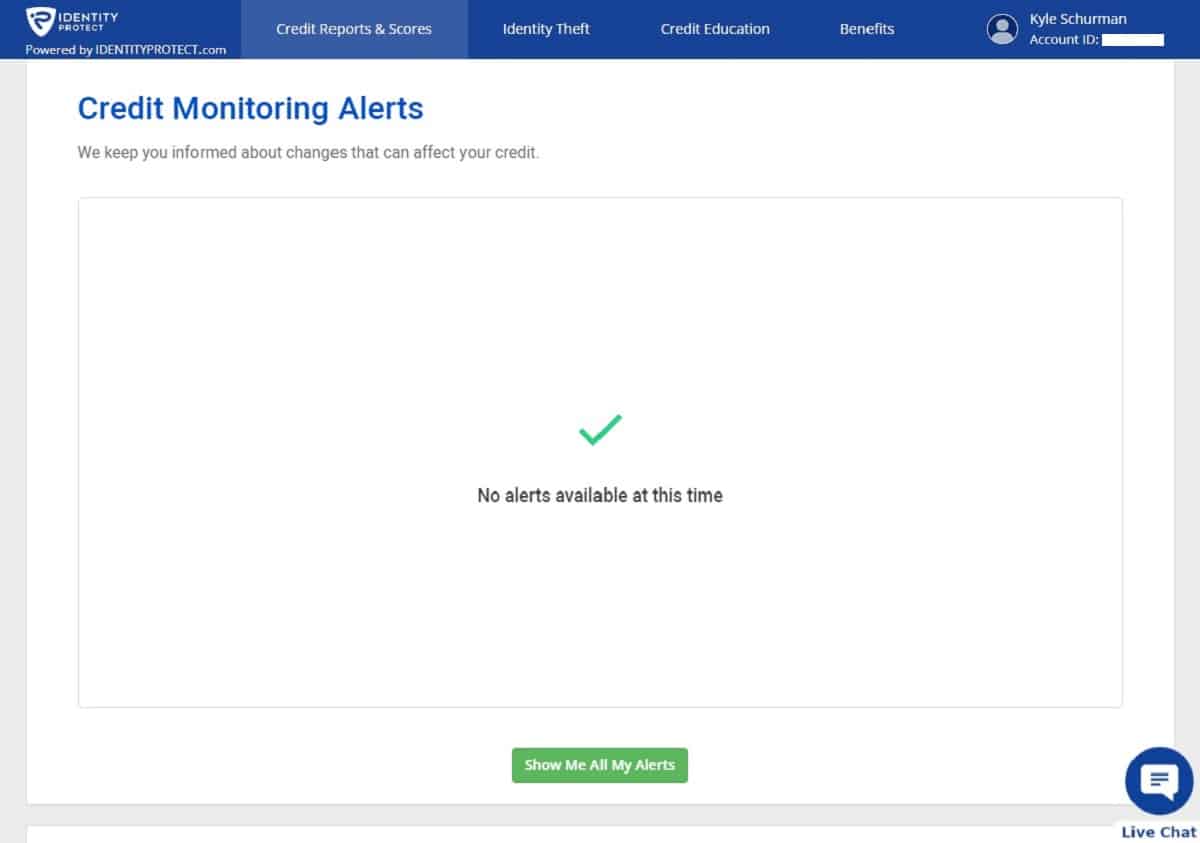

One of the most important reasons to make use of an identity theft protection service is to make sure you receive alerts related to odd occurrences with your personal information. Catching strange occurrences like this as early as possible can help you reduce the possibility of identity theft.

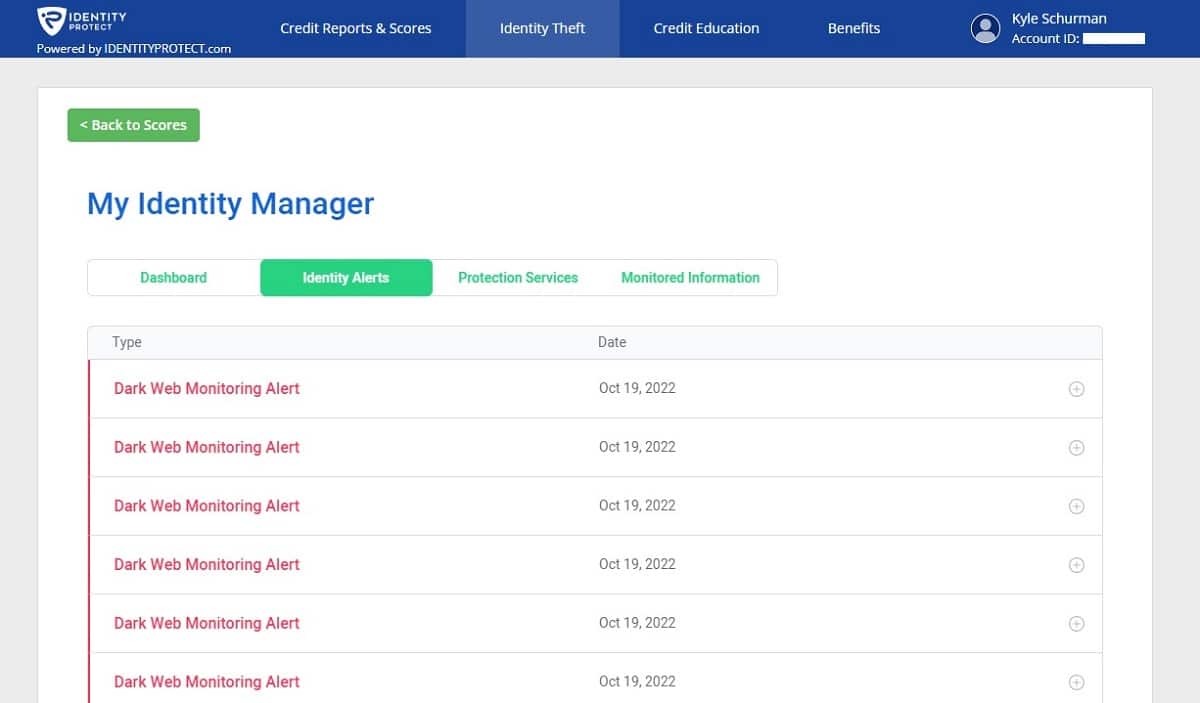

To see your alerts, click on Identity Theft across the top of the service’s window after you log in to your subscription. Then click on Identity Alerts a little lower on the page. Any alerts will be visible here, giving you the opportunity to investigate them further.

Take any actions you need to take to reduce the possibility of the alert leading to a loss of your identifying information. For example, you may want to request a new credit card number from your bank, or you may want to change the password associated with your online banking to deal with these alerts successfully and to reduce your level of risk.

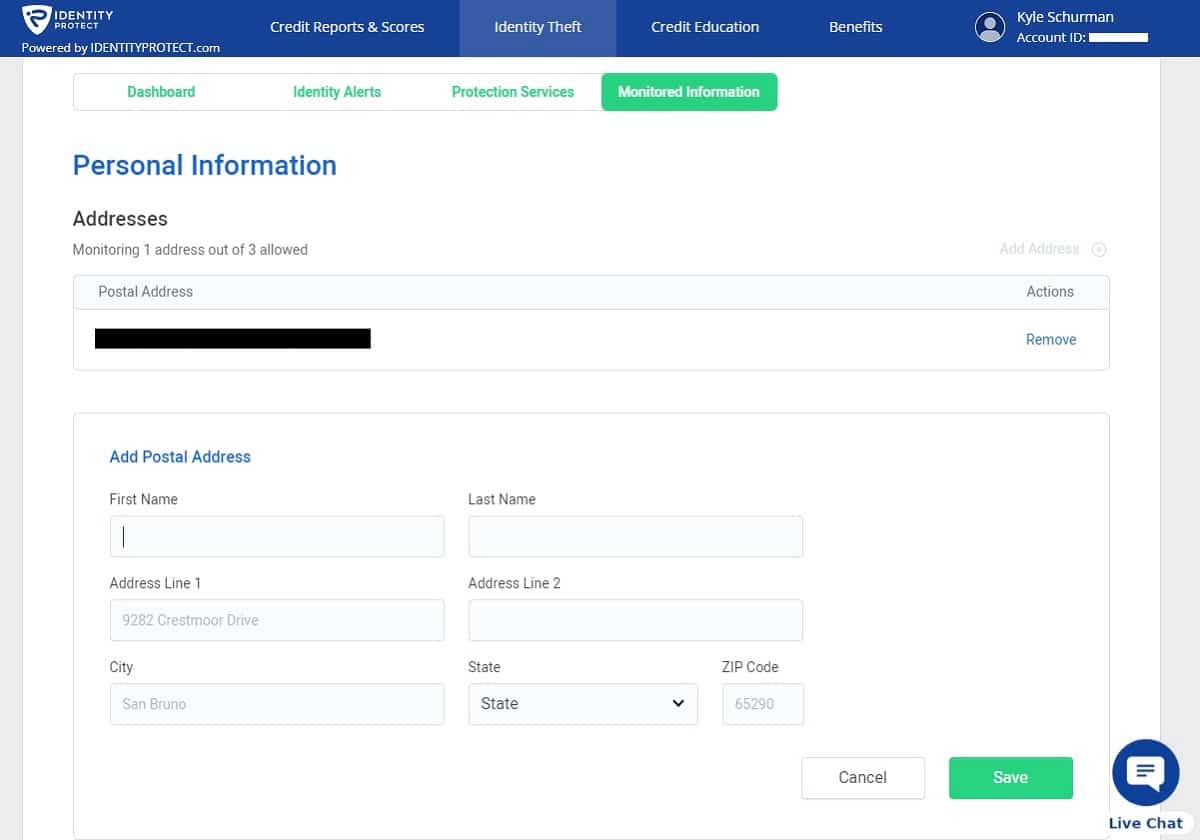

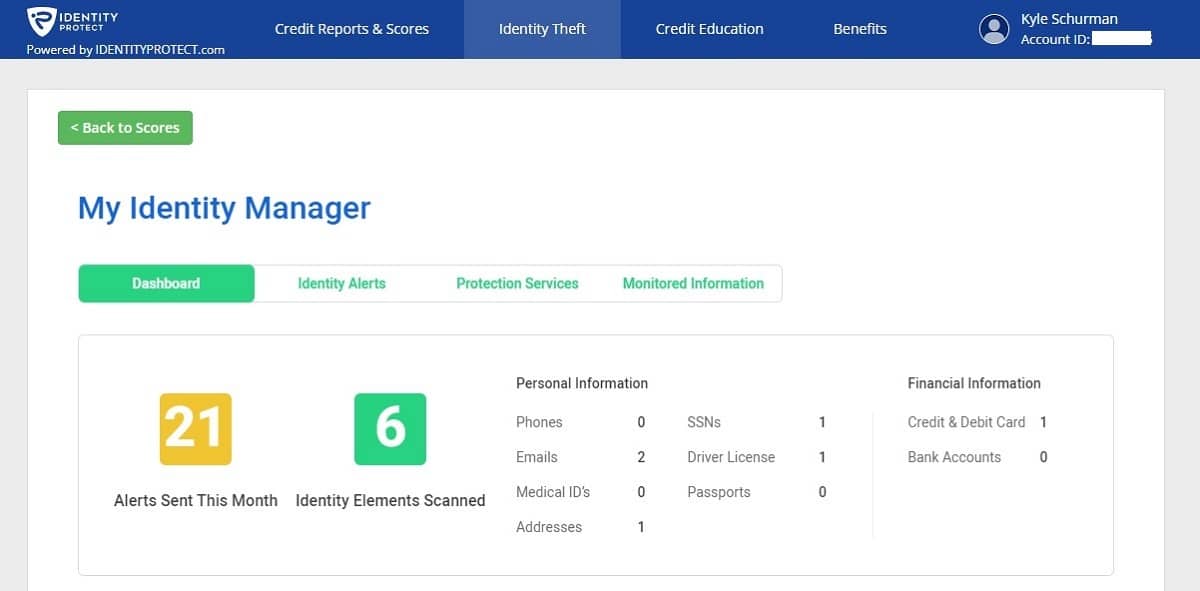

After signing up for IdentityProtect, the service will begin monitoring your Social Security Number and mailing address, as you must provide this information as part of the signup process.

You will need to add other information that you want to track on your own, though. To add information, click on Monitored Information a little lower on the Identity Theft page. Add any information you want to track, such as:

- Other mailing addresses

- Email addresses

- Phone numbers

- Medical ID cards

- Driver’s licenses

- Other Social Security Numbers

- Credit cards

- Debit cards

- Bank accounts

- Passport numbers

After entering my information, I received 21 alerts immediately. All of them related to a breach of an old email address from several years ago, but it was reassuring that IdentityProtect.com tracked them down so quickly. None of the alerts was for a serious matter that could truly affect the integrity of my identity.

Oddly, IdentityProtect did not give me the ability to clear the alert after I read through it, so it remained displayed for the entire time I was testing the service. Most ID theft protection services allow you to clear alerts once you take care of them or once you determine they are not serious.

Dark web monitoring

In its marketing materials, IdentityProtect repeatedly emphasizes that it watches the dark web for you as a subscriber. However, once you sign up for the service and begin using it, there is no mention of dark web monitoring anywhere within the dashboard.

Should you receive an alert that relates to something IdentityProtect discovered on the dark web, the alert itself carries a title of “Dark Web Monitoring Alert,” so I knew the service was monitoring my information on the dark web.

It just seemed odd not to see a more prominent mention of IdentityProtect’s dark web monitoring features after signing up for the service. It may be a little confusing for subscribers who are not familiar with the dark web but who read IdentityProtect’s marketing material regarding the dark web protection that it offers.

The dark web is any area of the internet outside the mainstream where non-traditional websites, message boards, and other areas allow users to purchase, trade, and share stolen information related to identity. Hackers and criminals may visit these sites to try to find enough information to steal your identity.

Free credit report and monitoring

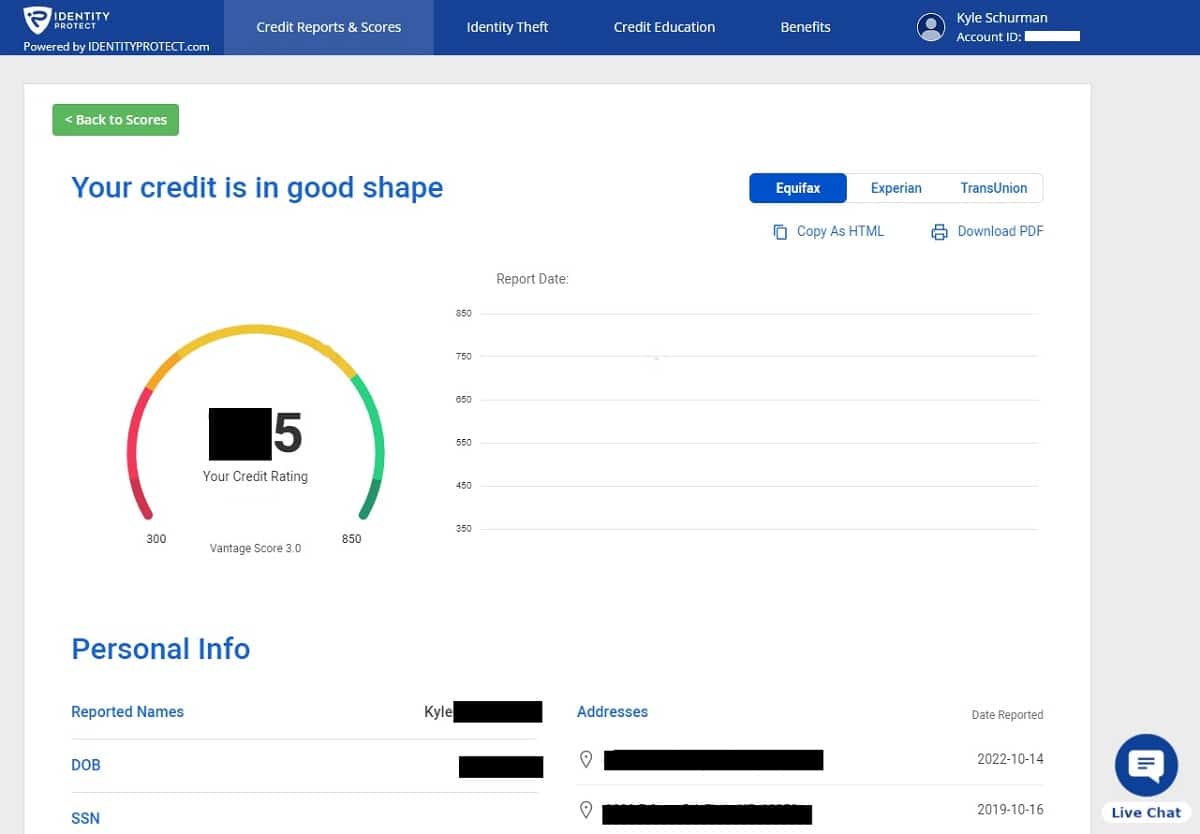

IdentityProtect.com gives you credit score monitoring and reports as part of your subscription. You can view reports from all three credit bureaus – TransUnion, Equifax, and Experian – at any time.

Some identity theft protection services limit your ability to see reports or only provide reports or scores from one credit bureau. IdentityProtect has no such restrictions, which is a significant advantage for those who need this service.

To see your credit reports, click on Credit Reports & Scores across the top of the screen. Then click on Take Me to My Reports.

You’ll see your credit report on the next screen. Scroll down to view information about individual accounts. You can view a report from a different credit bureau by clicking one of the buttons near the upper right area of the window. You also can create a copy of your credit report in a PDF format from this window.

Unlike some identity theft protection services, IdentityProtect does not give you the ability to freeze your credit report from within the service. You would have to contact the credit bureaus separately to request a freeze.

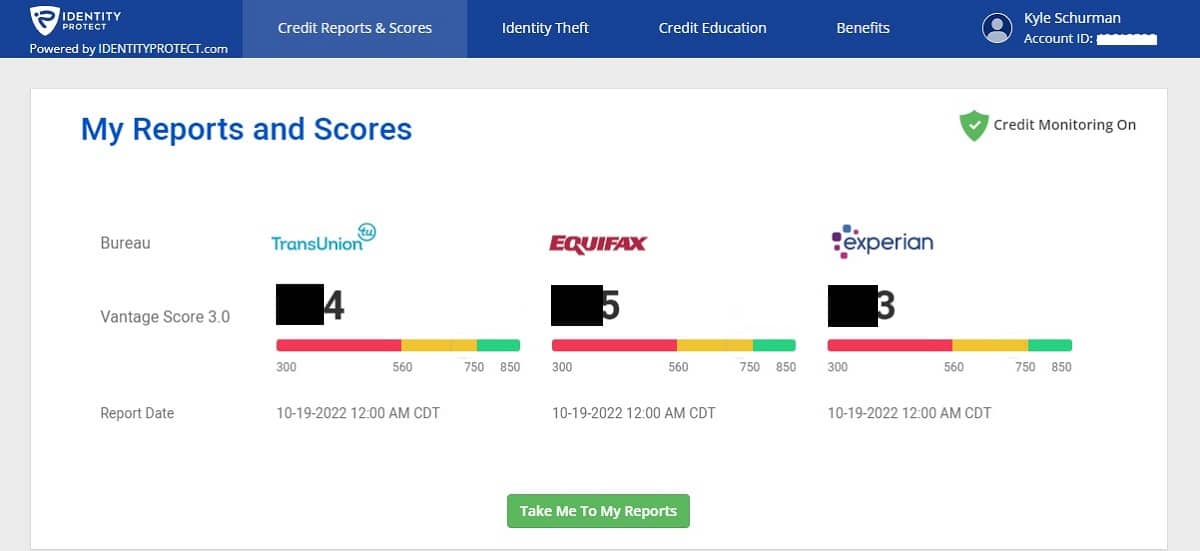

Credit score tracking

I mentioned earlier that IdentityProtect greatly emphasizes tracking and improving your credit scores. That fact is extremely obvious the first time you log in to your IdentityProtect.com subscription, as the service immediately displays your credit scores from all three credit bureaus.

If you want to see how your credit score is tracking over time, you will need to view your credit reports, as IdentityProtect only shows the current credit score on the main page.

If you scroll down on the main page, you can see a list of the various items that affect your credit score and what effect they have. This helps you form a plan to make changes that can boost your score. Click on any of the items to learn more about them.

At the bottom of the page, you can find advice for attempting to fix any inaccurate information on your credit reports.

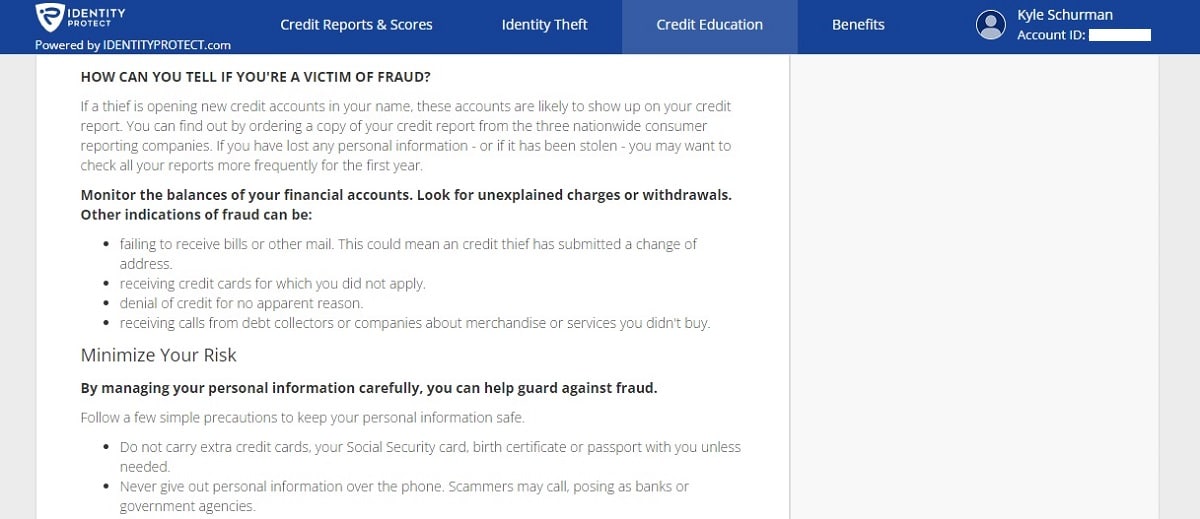

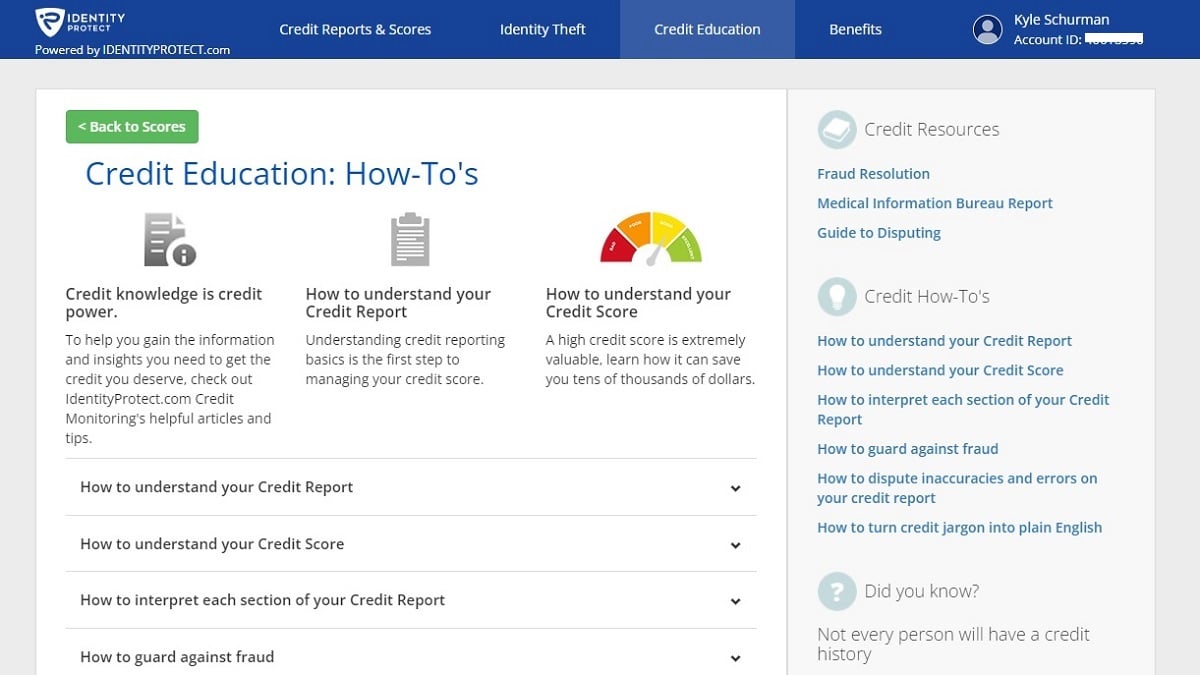

Credit education

As further emphasis on the importance IdentityProtect.com places on monitoring your credit, the service has an entire section devoted to educating you about your credit score and devoted to improving your credit. Just click on Credit Education across the top of the page.

This page provides information about resolving any disputes you find on your credit report. It also helps you learn more about how credit works and about how you can decipher the information in your credit report.

Financial account monitoring

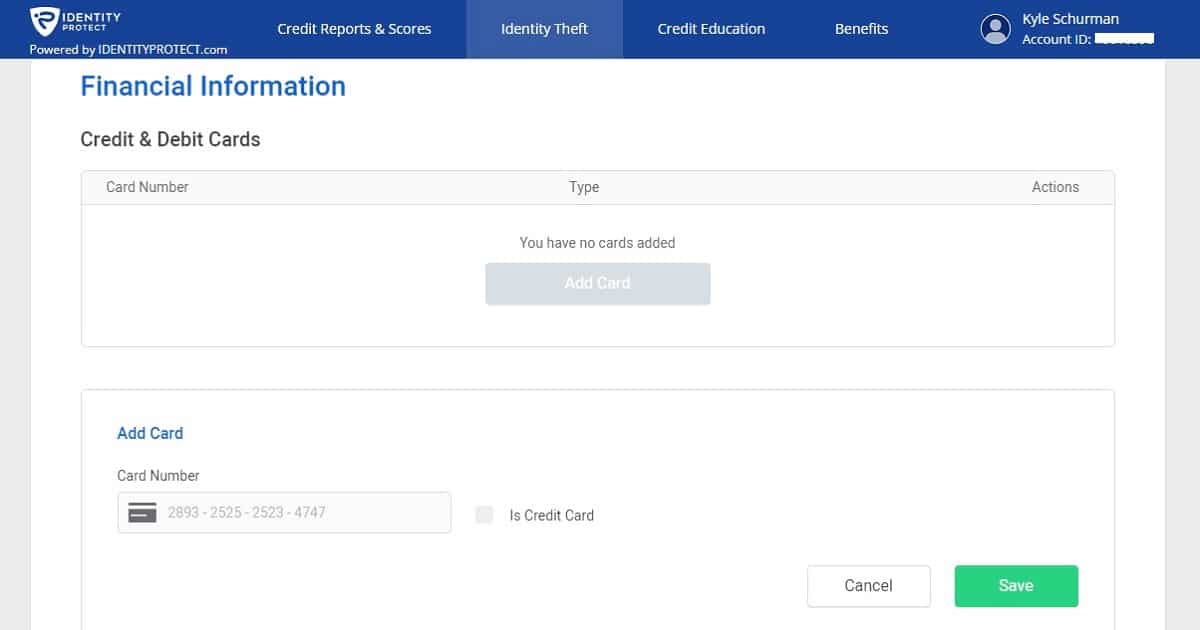

You can monitor a few different types of financial accounts through IdentityProtect, but it is missing some options that other ID theft protection services offer to monitor. IdentityProtect.com can monitor your:

- Credit cards and debit cards (up to 10 total cards)

- Bank accounts (up to 10 accounts)

However, IdentityProtect does not include the ability to monitor access to things like investment accounts and short-term loans opened in your name.

Address monitoring

Should someone attempt to change your mailing address with the U.S. Postal Service, IdentityProtect will send you an alert. Such an action by someone else could indicate an attempt to steal your mail and to capture important personal information

You can include up to three mailing addresses with your account.

ID restoration

If you ever suffer a theft of your personally identifying information as a subscriber to IdentityProtect, you can receive telephone support. You can speak to a restoration specialist who will walk you through the steps you need to follow to attempt to restore your identity.

IdentityProtect does offer an American-based call center, which is helpful for avoiding potential language barriers. However, you do not have access to the call center 24/7. During the week, you can call during normal business hours and in the evening. On weekends, the call center’s hours are far more limited.

This is a disappointment, as most people who suddenly learn they may be the victim of identity theft would like to be able to speak to a professional at any time of the day or night—especially considering the above-average price you are paying for IdentityProtect.

To start the process of trying to restore your identity as an IdentityProtect subscriber, open the dashboard. From the dashboard, scroll to the bottom of the page. Along the right side, click on Learn More About Identity Protection Services to see the customer service phone number.

Because I did not suffer identity theft while I was testing the IdentityProtect.com service, I did not have a chance to test the identification restoration services first hand. (And this was good news for me.)

Lost wallet protection

Should you lose your wallet while subscribing to IdentityProtect, the service will attempt to help you take the steps to cancel cards and request replacements.

I was glad to see that IdentityProtect allows you to call a customer service representative to work on restoring the items in your lost wallet, rather than simply giving you written instructions, like some ID theft protection services do.

However, you will have to call during the hours that the customer service center is open. If you lose your wallet on Sunday evening, you may have to wait 12 hours or more to contact customer service. You probably won’t want to wait that long to start canceling your cards.

To receive the maximum benefit from this lost wallet service, you will need to have entered as much personal information as possible into IdentityProtect. Without having things like your credit card numbers and your driver’s license number saved, IdentityProtect isn’t going to be able to help you cancel these cards as efficiently.

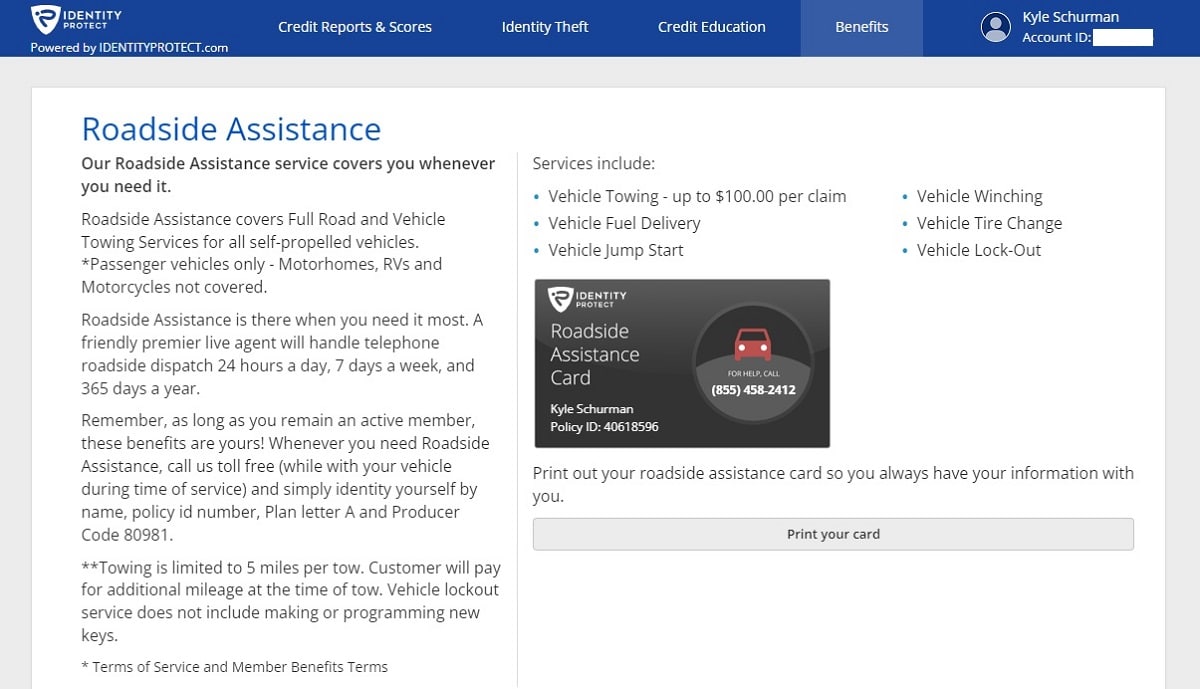

Extra benefits

One area where IdentityProtect goes beyond the typical ID theft protection service is through providing extra services as part of your subscription. Click on Benefits in the upper right corner of any IdentityProtect screen to see the extra benefits you can access with your subscription.

- Roadside assistance: IdentityProtect gives you the ability to seek help for free when you run into problems with your vehicle, like jump starts, tire changes, lock-out services, and delivery of fuel.

- Pharmacy discounts: IdentityProtect provides a free discount card to help you possibly save money on prescription medications.

- Entertainment discounts: For some odd reason, IdentityProtect gives members the ability to save money on certain entertainment services, such as movies, theme park tickets, ski lift tickets, and shopping.

It may seem odd to receive items like this for free with an ID theft protection service, and, well, it is. I guess it’s nice to receive some unexpected benefits like this, but these benefits certainly aren’t a good reason to select IdentityProtect over other identity theft protection services.

It’d be better if IdentityProtect focused on offering more advanced ID theft protection features and lowered the price a bit versus offering extra benefits that you didn’t ask for and may not need.

Missing features

Versus some of its competitors, IdentityProtect does not offer the same breadth of advanced features.

- Court records: There is no monitoring of court records for crimes committed in your name, which could indicate someone is giving law enforcement fake information, based on your identity, after an arrest. Other ID theft protection services offer this feature.

- Sex offender registry: IdentityProtect does not perform sex offender registry monitoring, either, alerting you when anyone on a sex offender registry moves into your neighborhood. Other ID theft services include this feature.

- Social media accounts: You will not receive social media account monitoring with IdentityProtect, which could alert you to a compromised account. Again, many other ID theft protection services include this feature.

- 2FA login: IdentityProtect.com doesn’t provide an option to set up highly secure two-factor authentication as part of your login process, which some services do offer.

Signup and setup

Signing up for IdentityProtect.com is an easy process. I was able to finish signup in just a few minutes, and I gained immediate access to my account. Not all ID theft protection services make the signup process so easy (although I believe they all should).

From the IdentityProtect home page, just click on the Start Membership Now button to start the signup steps. You will need to enter your full name and mailing address on the first screen. Next, you will enter your Social Security Number and date of birth before selecting a username and password.

IdentityProtect then pulls information from your credit report and asks you verification questions. These questions relate to things like the amount of your most recent car loan payment that are part of your credit report. These are things very few people besides you should know, so IdentityProtect can be certain you are who you are claiming to be.

You then will need to submit a credit card to pay for your subscription. You cannot test the service without submitting credit card information.

The IdentityProtect seven-day trial period costs $1, so you will receive an immediate charge on your credit card for the $1 fee. (Many other protection services offer a free trial, and some trials are as long as 30 days.)

If you do not cancel the IdentityProtect.com service within the seven-day trial period, the service will automatically charge your credit card for the $39.90 monthly charge. This is an automatic charge, and you must agree to allow this automatic renewal at the time you sign up for an account. There is no other option to pay for the service.

If you decide that you don’t want to use IdentityProtect any longer, you must take the steps to cancel the service. If not, you will continue to receive a charge of $39.90 per month until you cancel.

Once the service verifies your credit card, it will open your account screen, and you can begin using IdentityProtect right away. Some ID theft protection services require you to wait a few minutes or even a few hours before you can start working with your account.

Additionally, IdentityProtect runs completely from inside your web browser over your internet connection. You do not need to download any software to run this service. (Nearly all identity theft protection services also run from the cloud in your web browser.)

Once you are working inside the account, you can add more information that you would like IdentityProtect.com to monitor for you.

Ease of use and design

I like the simplicity of the design of IdentityProtect. The service has plenty of buttons and clickable tabs that allow you to find the features you want to use in very little time.

It can be a little confusing at first to find the area you need to access to begin entering your personal information, but you’ll gain the hang of using IdentityProtect relatively quickly.

Admittedly, a big part of the reason that IdentityProtect can make use of such a simplistic design is that it doesn’t offer a lot of advanced features. When you only offer a basic set of features, you can keep the design pretty simple.

There are quite a few graphical elements included throughout the IdentityProtect interface, making it easier to understand the information versus rows and rows of text. Again, the simplicity of the information IdentityProtect provides makes it easier to rely on graphics versus what some other ID theft protection services do.

I do appreciate how IdentityProtect has quite a few educational resources for novices who need to learn more about how to protect their identity or about how to improve their credit score.

I appreciated the speed with which IdentityProtect operated in my browser. There never seemed to be a pause or lag in the performance of the service when loading information.

IdentityProtect does log you out of the service after about 15-20 minutes of inactivity, but this feature didn’t seem overly aggressive like some ID theft protection services that log you out far too quickly.

One area of concern is that it’s almost too easy to log back in to your IdentityProtect account, as you can choose to have your browser automatically save and load your password.

If you leave a web browser tab open with IdentityProtect in it and walk away from the computer, someone else could log in to your account relatively easily with the automatic filling in of your password. They then could see your personal information and potentially steal it (which defeats the purpose of subscribing to an ID theft protection service). This is why having 2FA as a sign-in option would be extremely beneficial.

Ultimately, I would prefer if the IdentityProtect design focused more on its identity theft protection services, rather than on its credit monitoring and education services. For example, you should see any alerts you have related to threats to your personal information and identity when you log into the service, rather than a list of your credit scores. You have to click through a couple of screens to see your alerts.

Additionally, IdentityProtect.com places an advertisement for a third-party service on the home page, just underneath your credit scores. This ad, along with a few other ads placed across the service’s various screens, does not inspire confidence that IdentityProtect’s primary purpose is to protect your information and to alert you to potential data breaches.

When you visit the IdentityProtect website to start the process of signing up for an account, you also will notice a site that looks a little less professional than I’d like to see. The site is light on explanations of the features that IdentityProtect offers and heavy on scary headlines and photos, designed to entice you to sign up for the service quickly out of fear, rather than after doing your homework.

Like the IdentityProtect service itself, the website is as simple as possible. However, it would be far better – and it would make the service seem more trustworthy – if the website had more information, so visitors could study the features and determine if IdentityProtect is a good choice for them.

The educational features available to subscribers within the IdentityProtect dashboard are far more detailed and extensive than what the website offers to visitors before they subscribe, which seems backwards. IdentityProtect would appear far more trustworthy with a much better design of its website.

As a newer ID theft protection service that doesn’t have the brand recognition of competitors, IdentityProtect needs to deliver a feeling of trustworthiness. The current website design and the inclusion of third-party ads on your account screens once you subscribe doesn’t accomplish this.

IdentityProtect dashboard

When you initially log in to the IdentityProtect service, you can gain access to the main features through the tabs at the top of every screen, including Credit Reports & Scores, Identity Theft, Credit Education, and Benefits.

To open the IdentityProtect.com dashboard, click on Identity Theft across the top of the login screen. The dashboard gives you an overview of how IdentityProtect is monitoring your personal information. It alerts you to any types of information you have yet to enter into the service.

From the dashboard, you can select Identity Alerts to see what alerts the service found for you; Protection Services to see what types of services IdentityProtect can provide for you; and Monitored Information to enter new information that you would like to track.

You can see your account number and other information about your IdentityProtect account by clicking on your name in the upper right corner of every screen.

IdentityProtect mobile app

IdentityProtect does not offer a mobile app.

IdentityProtect support

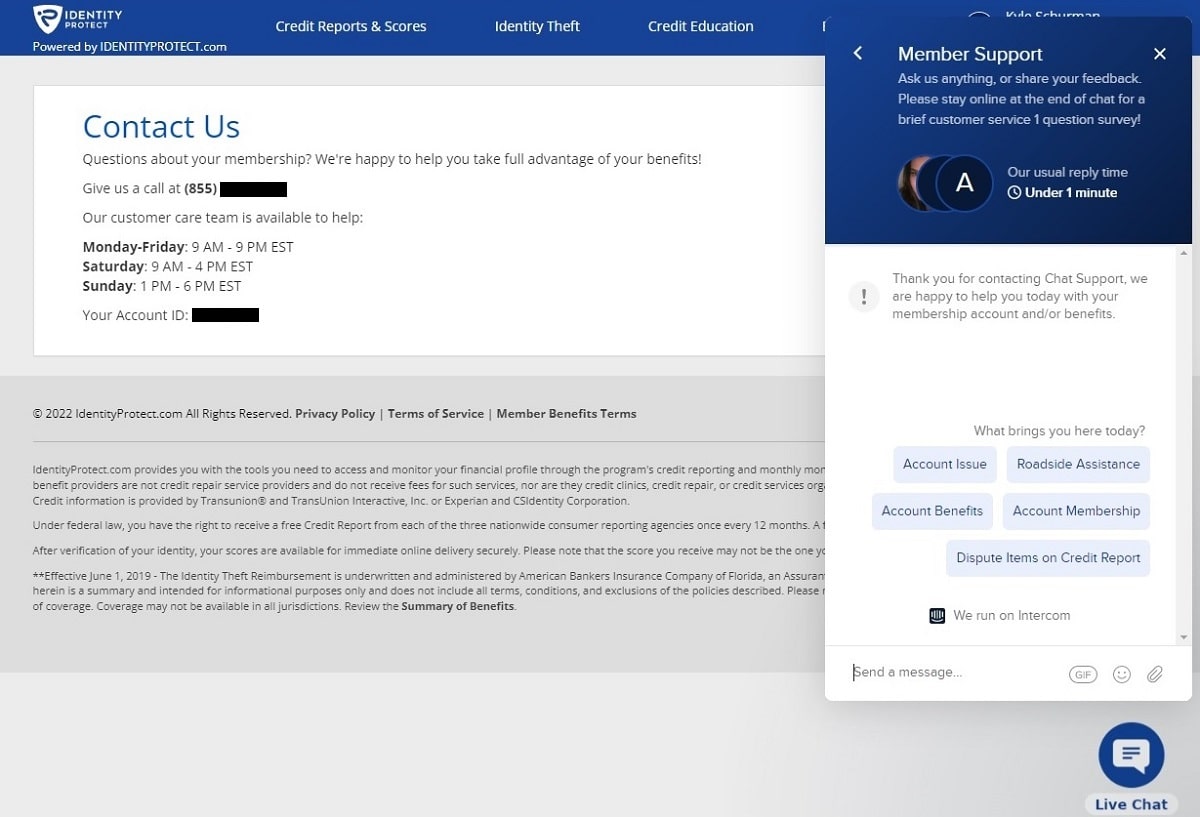

With IdentityProtect.com, you can gain access to phone support, but it is not available 24 hours a day, seven days a week. Click on your name in the upper right corner of any IdentityProtect screen and then on Contact Us.

You will see the phone number to use for customer service, as well as the times support is available. It’s unfortunate IdentityProtect doesn’t offer 24-hour phone support to subscribers, especially at a time when they might be experiencing identity theft.

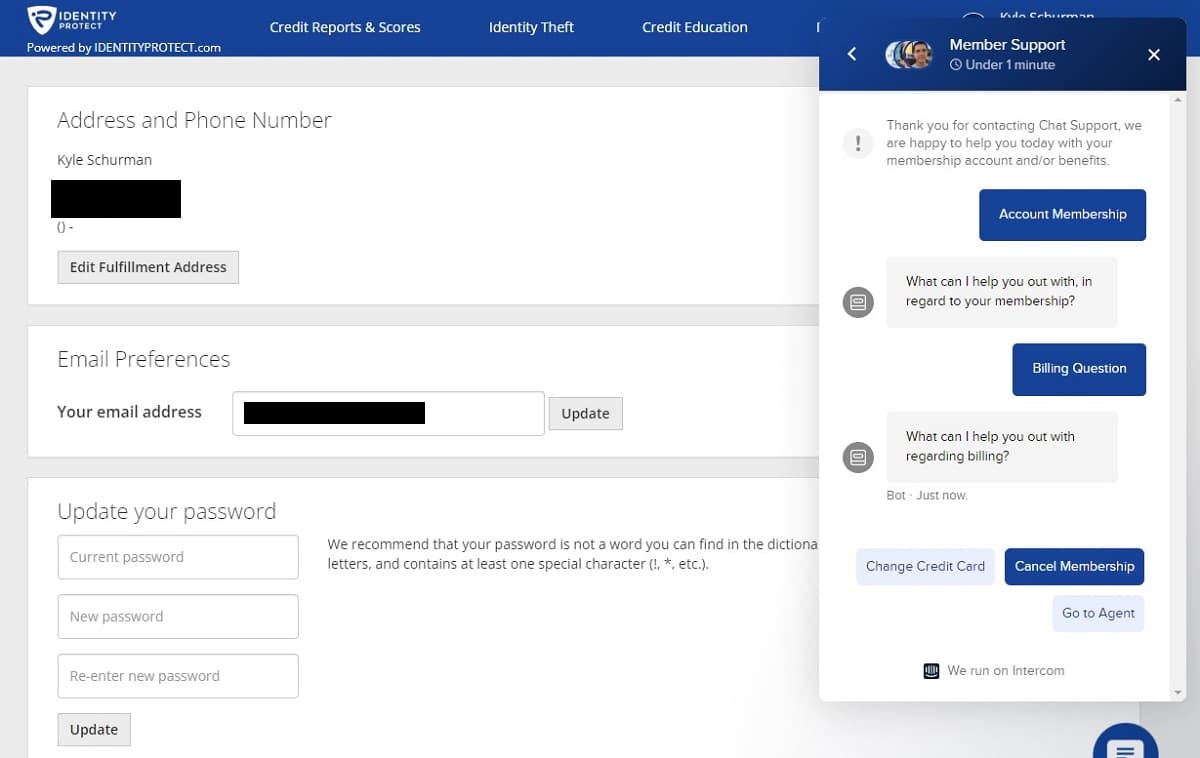

For 24/7 support, you can access live chat at any time. The chat button is available on every screen in the IdentityProtect interface in the lower right corner. Through chat, you can ask simple questions to the chatbot. When your questions become more complex, the chat service will connect you with a live chat customer support agent.

During my tests, I was able to connect with a live person on chat within a minute most of the time. IdentityProtect answered my phone calls in a minute or two the majority of the time, too.

Expect to receive some marketing emails from IdentityProtect after you subscribe to the service. Should you cancel the service later, you almost certainly will continue to receive quite a few marketing emails. I could not find a way to opt out of such emails. Unfortunately, this issue is common among nearly all ID theft protection services.

IdentityProtect: Pricing

| No value | IdentityProtect |

| Website | identityprotect.com | Subscription periods | Monthly | Special offer | 7-day trial for $1 | Annual price | $478.80 | Monthly price | $39.90 | Money-back guarantee |

|---|---|

| Best deal (per month) | $39.90 Get a 7-day FREE trial! |

In its early days, IdentityProtect.com had multiple pricing plans, but at the time of my review, it had simplified the pricing to only offer one plan. This plan costs $39.90 per month.

There is no need for a separate family plan. IdentityProtect allows you to track multiple items within each category, such as up to five Social Security Numbers, up to 10 email addresses, and up to 10 credit and debit cards. However, you can only track one driver’s license.

IdentityProtect does not offer the option to pay for a full year up front at a discounted price. Instead, you only can pay month to month. If you fail to cancel the service before the next month’s payment date, you will be on the hook for the entire month.

You can try IdentityProtect for seven days for $1 before the full monthly price starts. There is no free option with this ID theft protection service.

Although IdentityProtect’s monthly prices are roughly comparable to the highest pricing tiers of a few other identity theft protection services, it doesn’t offer as many advanced features as those other protection services.

Auto renewal options

When you sign up for a subscription to IdentityProtect, you must agree to allow automatic renewal and billing. This is no different than other identity theft protection companies.

When signing up at IdentityProtect.com, you initially will agree to try the seven-day trial period for $1. You must provide a credit card to pay the trial cost. Then, if you fail to cancel the service before the seven days expire, the automatic renewal starts, and IdentityProtect will charge your credit card $39.90.

IdentityProtect charges you every month until you cancel the service.

How do I cancel IdentityProtect?

You have a couple of options for trying to cancel IdentityProtect. Regardless of which method you choose, I would suggest keeping copies of any email messages you receive about the cancellation, and I would suggest taking screenshots of any chat sessions during which you tried to cancel the service.

Should you have a dispute over the cancellation later, or should IdentityProtect continue charging your credit card after you believed you canceled the service, you will want to have this proof available.

To cancel IdentityProtect over the telephone, click on your name in the upper right corner of any screen. Then click on Contact Us. You will see the customer service phone number for IdentityProtect. You can call the company during the listed business hours to speak with a customer service agent to try to cancel your service.

To cancel IdentityProtect through chat, click on Live Chat in the lower right corner of any window. You will start by dealing with a chatbot. Click on Account Membership inside the chatbot, and then click on Billing Question. Next, click on Cancel Membership, and the chatbot will send you to a live agent to complete the process.

After I finished testing the service, I was able to cancel my subscription successfully through the chatbot, but some past users of IdentityProtect report problems with trying to cancel the service. Just check your credit card statement for a couple of months after you cancel to ensure you still aren’t receiving charges.

Canceling any ID theft protection service can sometimes be a confusing challenge, so IdentityProtect is not alone in this regard.

Before you sign up at IdentityProtect.com, read through the IdentityProtect terms of service, the IdentityProtect member benefits, and the IdentityProtect privacy statement. Make sure you fully understand the services you will receive and the obligations to which you are agreeing before you give IdentityProtect your credit card number.

These documents should have the latest information about the IdentityProtect service as well. Recent changes in the service may not be part of my review.

These documents are especially important to read because the IdentityProtect.com website has so few details about the service listed.

Finally, I would always recommend using a credit card to sign up for any identity theft protection service, including IdentityProtect. I would not recommend using a debit card. Should you have a dispute over charges at some point, your credit card company is going to be far more helpful in trying to resolve the dispute than your bank.

Pros and cons of IdentityProtect

Pros:

- Offers a simple, easy-to-use interface

- Gives you credit scores from all three bureaus

- Gives you credit reports from all three bureaus

- Only has one pricing tier, which simplifies signing up

- Allows you to enter multiple Social Security Numbers for tracking

- Has many educational features aimed at helping you with your credit score

- Focuses many of its features on monitoring your credit

- You gain immediate access to your account after signup

- Only takes a few minutes to create an account

- Phone support number is easy to find

- Reach a live agent quickly through chat support

Cons:

- Does not offer 24/7 customer service

- Includes only basic ID theft protection services

- Doesn’t monitor for crimes in your name

- Doesn’t monitor investment accounts

- No annual payment option with a discount

- Pricing point is higher than its competitors

- Trial period is shorter than average and is not free

- Its website doesn’t give off a trustworthy feel

- Includes third-party ads as part of the main interface

- Focuses too much on credit score improvement and too little on ID theft protection

- No 2FA capability

IdentityProtect: Our final verdict

When you are seeking an identity theft protection service, you want to feel like the service is extremely trustworthy and professional. You need to be confident about sharing your personal information with the service. You need to trust that it is guarding your information as securely as possible.

I believe IdentityProtect does protect your information adequately. And it does give you the basic ID theft protection services to help you spot oddities in the way your personally identifying information appears on the internet.

However, it’s easy to understand why some potential customers may feel uneasy about the level of service they receive with IdentityProtect. The website’s design feels spammy, and it is far too short on explanations about the features you will receive.

The inclusion of third-party ads on various screens of IdentityProtect after you subscribe is also unsettling. It just makes the service seem as though its focus is less on ID theft protection and more on other features that may not be all that important to you.

If you believe you can trust IdentityProtect and if you choose to subscribe, you will find a service that has a clean interface that’s easy to understand. You won’t be wasting time searching for features.

Part of the reason for such a simplistic design in IdentityProtect is that it doesn’t offer many advanced ID theft protection services and features. It is missing a few key monitoring features that IdentityProtect’s competitors will give you.

If you are looking to make improvements to your credit score and to study your credit report at the same time you are receiving identity theft protection services, IdentityProtect offers a nice mix of these features. However, a separate credit monitoring service may offer many of the same credit-related features for free or for a far lower price than IdentityProtect.

Speaking of IdentityProtect’s price, it is above average, especially considering the limited ID theft protection features that it offers. It’s tough to recommend this service to readers when other services offer more features at a better value.

Because of the high price, it is especially disappointing to not receive 24/7 customer service on the telephone with IdentityProtect. I do like that IdentityProtect makes its customer service phone number easy to find, especially considering some of its competitors do everything possible to hide their phone numbers, preferring to deal with subscribers through other means of communication.

However, IdentityProtect’s customer service phone accessibility advantages are less important than they may seem at first, because it doesn’t offer round-the-clock phone support.

Bottom line: Because IdentityProtect only provides the basics in terms of its identity theft protection monitoring services, you might expect to receive a bargain price. Unfortunately, this is not the case. IdentityProtect’s monthly price is higher than average, and it has no discount for paying annually. For what you are paying, IdentityProtect is missing features I’d expect to receive, such as investment account monitoring, social media account monitoring, and 24/7 customer service via telephone. IdentityProtect is very easy to use, and it delivers plenty of educational information about improving your credit score, so it will be a solid choice for certain people. For the majority of people seeking ID theft protection services, though, better choices are available at a better price.

Our testing methodology for identity theft protection

When readers are looking for information about the best identity theft protection services, they need to be able to trust that my review of any individual ID theft service is a realistic look at its pros and cons. The only way to truly do that is to actually use the ID theft protection service.

It isn’t enough for me to simply read the service’s website and marketing materials. I don’t feel comfortable making recommendations about a particular service without testing it myself over a period of time.

When I test a protection service, I subscribe to it myself, just like you would do. I pay for my subscription myself, rather than seeking a free account from the ID theft protection company. I need to not only test the usability and accuracy of the service, but I also want to be able to tell you how easy or difficult it is to cancel the service.

By entering my personal information and some information that I know will generate alerts, I am able to test the performance of each service. I also reach out to the customer service teams of these companies, ensuring they are responsive and helpful.

My goal is to make certain the services are living up to the promises they are making to consumers. You don’t want to subscribe to a service that lies or exaggerates in its marketing materials. I hope my reviews are able to help you find a trustworthy service that perfectly fits your needs.

FAQs

Is IdentityProtect worth the money?

IdentityProtect is not going to deliver great value for many people. Its price is higher than many of its competitors, which is especially disappointing when it is missing some of the advanced ID tracking features that its competitors offer. Its strongest features center on credit monitoring and on improving your credit score, but these features are easily duplicated with services that focus on credit monitoring and that cost quite a bit less.

How does ID theft protection work with IdentityProtect?

IdentityProtect delivers its ID theft protection subscription service through a web browser. When you enter your personal information into the IdentityProtect interface, it will begin tracking how your personally identifiable information is in use on the internet. If it finds any oddities in the information, it will generate an alert for you. During my testing period, I found that IdentityProtect did a good job of generating accurate alerts.

Is IdentityProtect a trustworthy company?

I did not have any problems with IdentityProtect during my testing period. However, the IdentityProtect website doesn’t have a lot of information about what the service does for you, which is a red flag for site visitors. Additionally, it’s difficult to find much information about IdentityProtect’s parent company, called Identech, LLC, other than its listed physical address tracks to a virtual office in Las Vegas. All of these are worrisome facts that may make potential subscribers leery about doing business with IdentityProtect, especially considering IdentityProtect’s brand is not well-known and doesn’t have a long track record.

Does IdentityProtect offer a free trial period?

No. The service’s trial period only lasts seven days, and you must pay $1 to use it.

Is IdentityProtect better than LifeLock?

I wrote a LifeLock review recently, and I would give LifeLock the nod over IdentityProtect. Both services are expensive, but LifeLock offers more features than IdentityProtect for the price. Additionally, LifeLock has a far longer track record of service and a more recognizable brand than IdentityProtect.

Should I get ID theft protection?

This is a difficult question for me to answer in a general manner. You need to think about your personal situation and about your potential risk for ID theft. If you believe you are in a higher risk category for identity theft because of the way you share information on the internet, having the peace of mind of a subscription to an ID theft protection service may be worth the cost for you.

Others who may be in a higher risk category for ID theft include people who suffered identity theft in the past, people who rarely check their credit reports (such as retired people and children), and people who need to share a lot of personal information on the internet.

Many people can duplicate the work that an identity theft protection service does. For example, you can request copies of your credit reports regularly and watch them for any oddities. If something looks weird or wrong on your credit report, it could be an early indicator that your information may be at risk of theft.

If you have the time and desire to monitor your information on your own, you can save the money that a subscription would cost. However, some people simply don’t feel comfortable trying to do this type of research on their own. They believe the price of the ID theft protection service is worth it, allowing professionals to handle the monitoring for them.

Before discussing this topic any further, I must mention three misconceptions about what identity theft protection services do.

- First, no identity theft protection service is perfect. Just because you subscribe to a service doesn’t mean the service will find every oddity related to the way your personal information appears on the internet. If the service misses something, you could end up suffering identity theft anyway.

- Second, the identity theft protection service does not automatically fix any oddities that it finds. The protection service simply alerts you to potential problems and may provide advice on what you should do. You have to take the actions to fix the potential problem yourself. Some people expect to subscribe to a service and never have to think about ID protection again. This is not the case.

- Third, the ID theft protection service is almost certainly going to generate some false alerts. Some people find it frustrating to have to spend time and effort investigating false alerts.

One significant benefit to subscribing to an identity theft protection service is that you receive insurance to help you with costs related to trying to restore your identity. If you don’t have a subscription, you would have to absorb the costs of hiring people like private investigators, lawyers, and CPAs to try to fix your identity issues.

Additionally, these services give you guidance on how to fix your identity. Some services even assign a restoration specialist to your case, which is someone who will help you work through the multiple steps required. Without a subscription, you would have to try to figure out how to restore your identity on your own.

Should you suffer identity theft, it can take a long time to return things to normal. Your better option is to take steps to guard your identity as tightly as possible, potentially in addition to subscribing to an ID theft protection service.

For example, you should be very careful about where and when you share your personal information on the internet. You even may want to contact the three credit bureaus and freeze your credit. This is a service that prevents anyone (including you) from opening a new line of credit in your name until you unfreeze your credit. Honestly, freezing your credit is one of the best ways to protect yourself from identity theft losses, and it’s free.

Deciding whether to subscribe to an identity theft protection service is a personal decision. As long as you understand that these services are not perfect and that they may struggle to live up to their marketing promises, you can make a more informed decision about whether you want to pay to subscribe to one of them.