LifeLock may be one of the most well-known names in identity theft protection. On the other hand, IDX Identity is not. There’s a good reason for that, however, as IDX Identity changed its name in late 2020. The MyIDCare identity theft protection service became IDX Identity, and the company behind it, ID Experts, became IDX.

IDX Identity did not undergo a significant alteration to its identity theft protection services when it implemented the name change. If you’re familiar with MyIDCare from a few years ago, then you understand what IDX Identity can bring to the table. So does the newly branded IDX Identity stack up well against LifeLock? We’ll break down the key features in both of these ID theft protection services to help you decide which one will best meet your needs and to help you make the most informed decision.

IDX Identity and LifeLock have a similar set of features when comparing their most expensive pricing tiers, but you will pay a bit more for LifeLock. In return, you receive excellent customer service responsiveness and a far higher level of brand name recognition. For the majority of users, I believe these advantages are enough to justify giving LifeLock the edge in this comparison, even though its prices are higher.

Summary of benefits: IDX Identity vs LifeLock

| No value | IDX Identity | LifeLock |

| Website | idx.us | https://lifelock.com/ | Free trial | Identity theft insurance | Up to $1 million | Up to $1 million | Stolen funds reimbursement | Up to $1 million | Up to $1 million | Special offer | $9.95 | $8.99 | Highest price per month | $17.96 | $23.99 | Credit monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|---|

| Best deal (per month) | $9.95 SAVE 10% on an annual plan | $8.99 GET 25% off the first year |

IDX Identity vs LifeLock: Features

Activity alerts

Providing you with quick activity alerts about any potential fraud occurring with your accounts or with your personal identifying information on the internet is probably the most important feature these services provide.

When something strange is occurring with your accounts that could indicate fraud, you need to know about it as quickly as possible. Early alerts give you the best chance of freezing your credit or changing passwords on your accounts before a hacker can gain access to them. If the activity alerts are too late, you may not be able to take action in time.

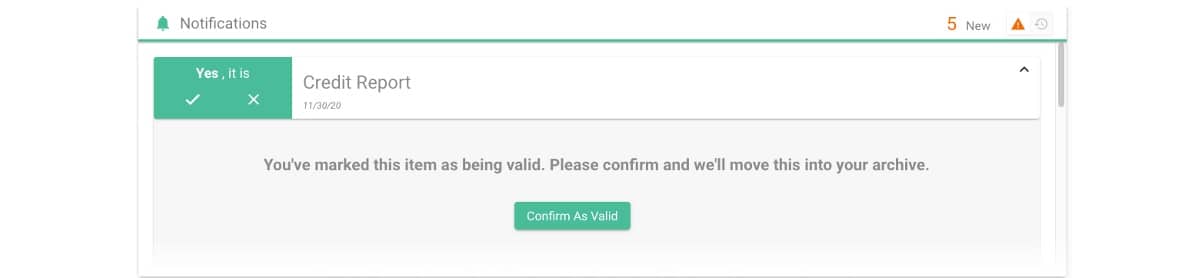

Both LifeLock and IDX Identity give you alerts in short order when something strange is occurring with your identity. When you subscribe to the higher-pricing tier with IDX Identity, TransUnion will even send you an alert whenever an inquiry occurs on your credit report, which could be a very early sign of fraud.

Both ID theft protection services monitor activity on your Social Security Number, your credit reports, and any payday loans opened in your name. IDX Identity also monitors usage of your passport in both pricing tiers, something LifeLock does not offer.

Ultimately, LifeLock has the advantage here, as it monitors your financial accounts, including credit cards, banking, and investment accounts, for odd activity (but only at its highest pricing tier). IDX Identity, meanwhile, only gives you a monthly recap of your accounts, which may not occur quickly enough for you to catch something related to identity theft. You certainly could go over monthly account statements on your own without IDX Identity’s help, so this feature is not all that ground-breaking.

To receive credit monitoring and credit reports from all three credit bureaus, you will have to subscribe to the most expensive pricing tiers these two services offer. The three US credit bureaus are Experian, TransUnion, and Equifax.

Dark web monitoring

Both LifeLock and IDX Identity monitor the dark web for any mentions of your personal identifying information, and both offer this feature starting in their lowest-priced tiers. The dark web hosts criminal marketplaces and forums where hackers go to buy and sell personal information stolen from other people.

Free credit report and monitoring

Receiving credit reports and monitoring of your credit profile are part of nearly every identity theft protection service, and both IDX Identity and LifeLock give subscribers the standard offerings in this area.

To receive credit monitoring and reports from all three credit bureaus, you will need to subscribe to the most expensive tiers with both LifeLock and IDX Identity. You also can receive updates on your credit score from both services, as a huge and sudden fluctuation in your credit score could indicate problems with your personal information.

When you subscribe to the higher-priced tier at IDX Identity or to one of the two higher-priced tiers at LifeLock, you will be able to use the services’ dashboards to easily freeze and unfreeze your credit at TransUnion. However, if you want to freeze your credit at Experian or Equifax, you will have to take the steps on your own outside of the services’ dashboards.

Address monitoring

You receive alerts from both IDX Identity and LifeLock if someone attempts to change your mailing address through a request at the U.S. Postal Service. When someone attempts to intercept your mail, it could be the first step toward stealing your personal information.

Public records monitoring

By monitoring court records and other public records, IDX Identity and LifeLock attempt to spot instances where someone may give law enforcement false information during an arrest. If these criminals give police your personal information at the time of arrest, your name may fraudulently appear in court records or on sex offender registries. You will receive an alert if either service finds evidence of this type of fraud occurring.

Social media monitoring

Both IDX Identity and LifeLock will monitor your social media activity, looking for evidence of fraud, of takeovers of your account, or of inappropriate social media posts that indicate someone has stolen access to your account. You will have to subscribe to the highest-priced tiers for both services to receive this level of protection.

ID restoration

With these two ID theft protection services, you will receive access to a U.S.-based identity recovery expert in an effort to try to recover control of your personal identifying information. Because it would be very difficult for any of us to start the process of recovering our identities without some guidance from experts, this aspect of these two identity theft protection services is very important.

Additionally, both IDX Identity and LifeLock offer coverage that helps you if you ever lose your wallet. This service tracks all the credit card numbers you carry in your wallet, as well as numbers for other identification cards and a debit card. Should you ever lose your wallet, you can immediately tap into this list and begin canceling your cards before someone can take advantage of stealing or finding your cards. (You do have to enter your card information into the service.)

Insurance and compensation

It is important to understand that even if you choose to subscribe to LifeLock, IDX Identity, or another identity theft protection service, that you could still suffer a loss or theft of your identity. These services are not completely fool-proof.

Should the worst-case scenario occur, leaving you on the wrong end of an identity theft, you will appreciate that both LifeLock and IDX Identity provide insurance funds designed to help you cover the costs associated with attempting to recover your identity.

Both services designate up to $1 million in identity theft insurance in all their pricing tiers. This money can help you hire a lawyer or a private investigator, open new accounts, cover any lost wages you had because you missed work while trying to deal with your identity theft, and other out-of-pocket expenses.

Should the identity thief steal funds from your accounts, both services will provide reimbursement for these funds. However, they go about it a little differently.

IDX Identity includes any lost funds as part of its single $1 million insurance policy.

LifeLock will reimburse you for lost funds from a funding source that’s separate from its theft insurance policy. This separate funding source means you are eligible to receive between $25,000 and $1 million in lost funds reimbursement, depending on which subscription tier you are using. If you have large account balances, LifeLock’s higher potential reimbursement amounts represents a better situation for you.

You will have to show information and proof of any losses you have that relate to your identity theft before you will receive any reimbursement funds.

2FA login

Both ID theft protection services give you the option of making use of 2FA, or two-factor authentication. However, you will have to set up this process on your own, as it is not an automatic process with either LifeLock or IDX Identity.

IDX Identity vs LifeLock: Pricing

| No value | IDX Identity | LifeLock |

| Website | idx.us | https://lifelock.com/ | Subscription periods | Monthly | Monthly or annually | Special offer | First-year discount for new customers | Price per month | $9.95 (Identity Essentials Individual tier) | $8.99 (Standard Individual tier) | Lowest annual price | $119.40 (Identity Essentials Individual tier) | $89.99 (Standard Individual tier) | Lowest annual price (Family) | $239.40 (Identity Essentials Family tier) | $221.87 (Standard Family with Kids tier) | Highest annual price (Family) | $479.40 (Identity Premier Family tier) | $467.88 (Ultimate Plus Family with Kids tier) | Money-back guarantee | Identity restored or your money back | 60 days for annual subscription or 14 days for monthly subscription |

|---|---|---|

| Best deal (per month) | $9.95 SAVE 10% on an annual plan | $8.99 GET 25% off the first year |

If you only pay attention to the marketing materials for IDX Identity or LifeLock, you may believe LifeLock has the better pricing plans. However, when you dig a little deeper, you’ll realize IDX Identity has the lower price over the long term.

LifeLock offers new subscribers a significant pricing discount for their first year with the service. Under these discounts, LifeLock offers a better cost point than IDX Identity for nearly every pricing tier where the two services overlap.

Consequently, I think it’s important to focus on what the prices will be for LifeLock in year two and beyond. I believe most people are looking for an ID theft protection service that they can use for many years, not for just one year.

Under these parameters, IDX Identity offers the better pricing offerings for year two and going forward.

LifeLock does allow you to save some money by paying for an annual plan with its service versus paying monthly. IDX Identity only allows you to pay monthly, so it does not offer an annual pricing discount.

I do believe LifeLock offers more features than IDX Identity, which justifies its higher price. But if you are focused on price alone, IDX Identity is the cheaper option over the long run.

Auto renewal options

As is common for all identity theft protection services, LifeLock and IDX Identity both will force you to enroll in their automatic renewal services. This means that both identity theft protection services will automatically charge your payment method when your subscription period expires.

If you want to cancel, be sure to start the process well before your renewal date comes up, or you may end up with unwanted charges because of the auto renewal policies.

Cancellation options

Canceling your subscription to either IDX Identity or LifeLock is not impossible, but it may seem that way as you’re going through the process. When these types of ID theft protection services have your credit card or debit card on file and when they are able to automatically charge it for renewal, they are not going to give up that ability easily.

Occasionally, people report believing they canceled the service, yet the subscription charge shows up on the following month’s credit card statement anyway. All of this can be extremely frustrating.

We would not recommend signing up for and paying for this service without fully understanding what you will have to do to cancel. Read the LifeLock terms of service or the IDX Identity terms of service to learn more about the billing and cancellation policies they have. (You may need to visit the MyIDCare terms of service page too, as it contains some extra information not yet on the IDX Identity page.)

Understand that these pages may undergo changes without notice, so you should always visit the pages before signing up, just in case something changed recently.

During my hands-on LifeLock review, I had to go through a few steps to cancel the service after my testing period. However, it was easier than I expected it to be and easier than most other ID theft protection services I’ve tested.

IDX Identity pricing tiers

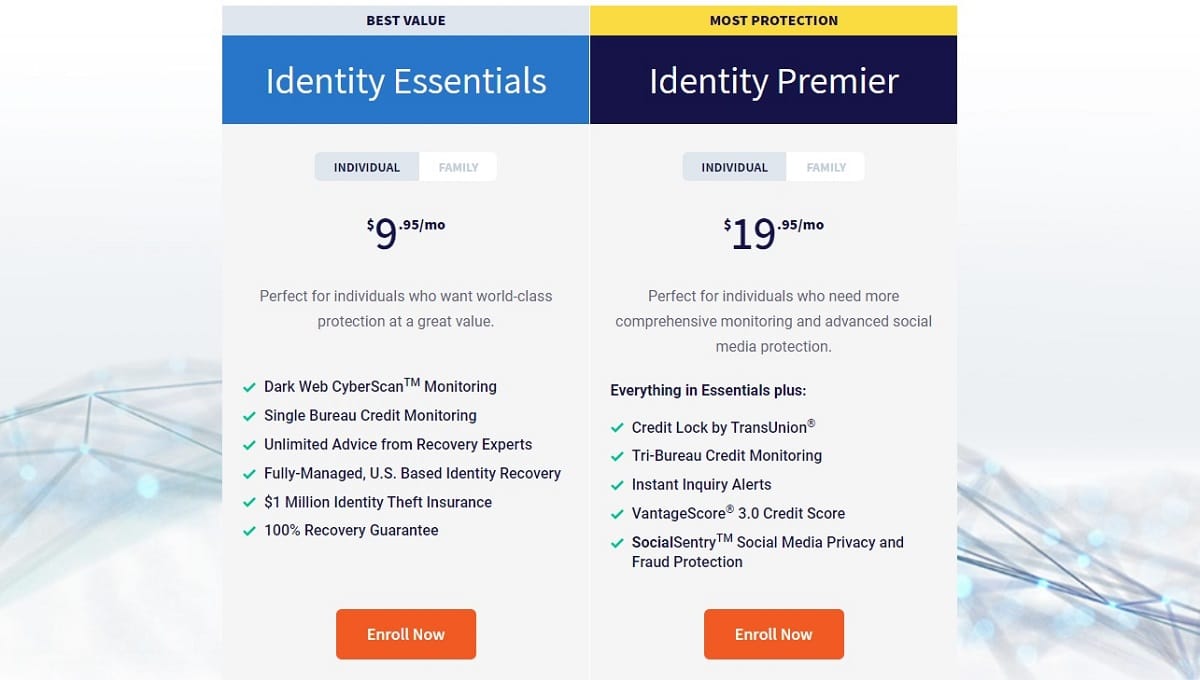

With IDX Identity, you will have access to either an individual plan or a family plan (which allows for identity monitoring for up to two adults and up to five children). Within each plan, you can select either the Identity Essentials tier or the Identity Premier tier.

- Essentials: The Essentials tier offers Social Security Number tracking, an annual credit report from one bureau, crime in your name monitoring, payday loan monitoring, dark web monitoring, and a monthly recap of your account activities.

- Premier: The Premier tier includes everything in the Essentials tier, along with social media privacy tracking, a credit lock option from TransUnion, an annual credit report from all three bureaus, and instant alerts when you have a hard credit inquiry in your name.

Should you suffer identity theft, you will receive identity recovery services from a U.S.-based manager with both tiers.

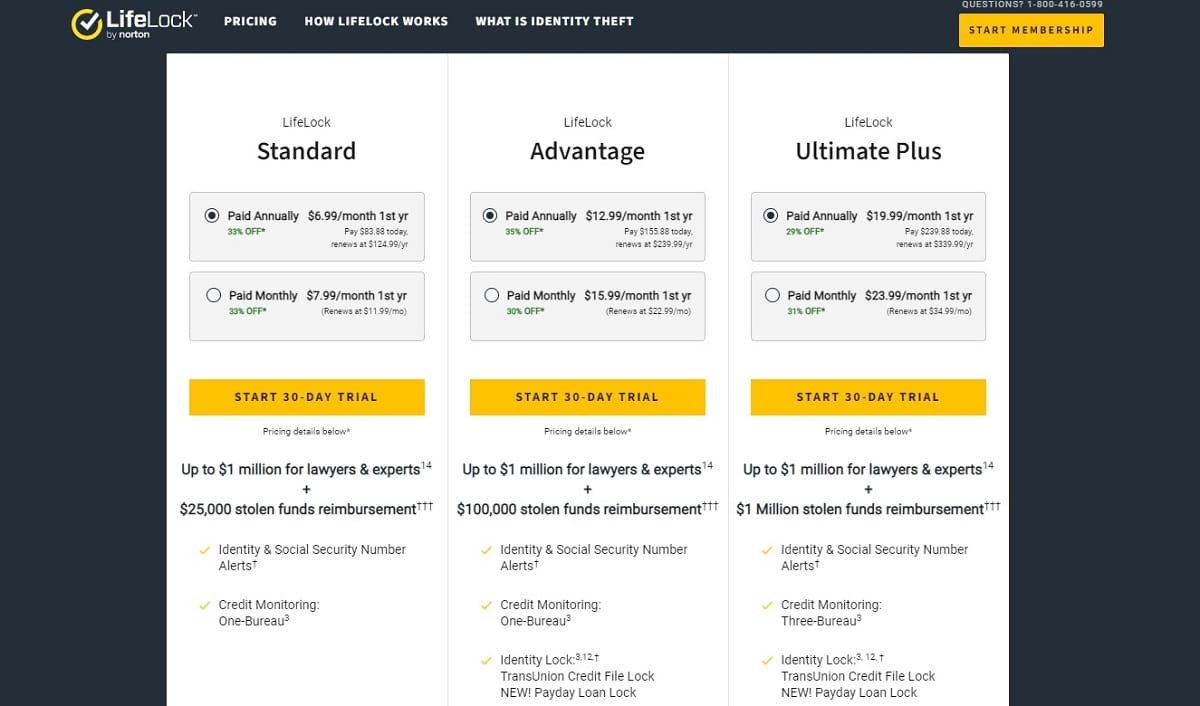

LifeLock pricing tiers

LifeLock offers one extra pricing plan and one extra pricing tier than what IDX Identity offers. This may make it easier to find the perfect plan for your needs, but some people may find having nine different options for subscribing to LifeLock more confusing than necessary.

With LifeLock, you can choose among three different pricing plans for a single adult, for two adults, or for up to two adults and up to five children. LifeLock then offers up to three pricing tiers within each plan.

- Standard: The Standard tier in LifeLock is the least expensive option, but it also offers an extremely limited set of features. It may not do everything you are hoping to find in your ID theft protection service. With the Standard tier, you only receive a minimal amount of monitoring of risks to your personal identifying information, such as your Social Security Number.

- Advantage: In LifeLock’s Advantage tier, you receive everything in the Standard tier, along with active monitoring of your financial accounts and of crimes involving your name. You receive an annual credit report from one bureau as well.

- Ultimate Plus: For our LifeLock vs IDX Identity comparison, the Ultimate Plus tier in LifeLock offers the most similarities to the IDX Identity Premier tier. When you subscribe to Ultimate Plus, you receive everything in the Advantage tier, along with monitoring of your social media accounts and your investment accounts. LifeLock will offer credit reports from all three credit bureaus in this pricing tier.

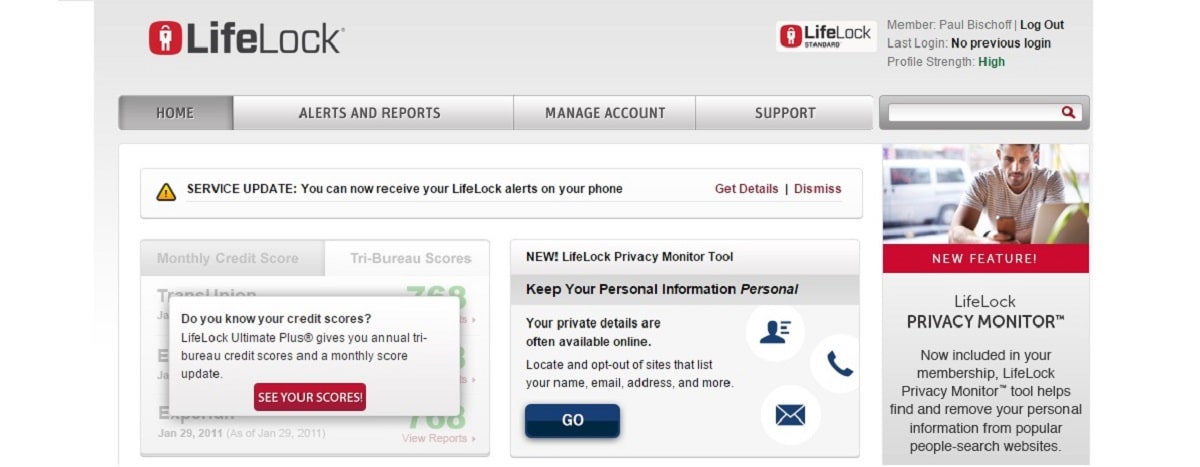

Setup and ease of use

When you want to make use of the basic features in LifeLock or IDX Identity, you’ll appreciate the ease of use with both services. If you want to explore some of the more complex features in these services, it becomes a little tougher to use them, as you might expect. With both services, you’ll have access to a dashboard where you can control your account settings and see alerts about potential identity theft issues.

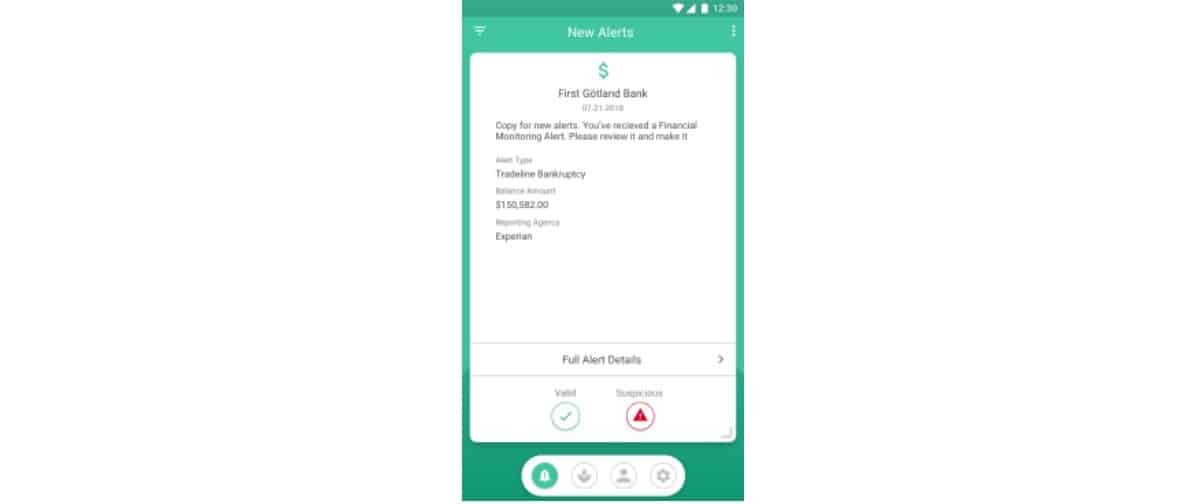

Both LifeLock and IDX Identity offer mobile apps for both iOS and Android, but I found LifeLock’s mobile app far easier to use. It also offers far better features than IDX Identity’s mobile app.

Pros and cons of IDX Identity

Pros:

- Very easy to use

- Delivers up to $1 million in ID theft insurance and reimbursement of stolen funds combined

- Its identity theft protection services are cheaper than LifeLock

- Its lower-priced tier has a nicer collection of features than most low-priced tiers from other ID theft protection services

- Offers free annual credit reports

- Provides social media account monitoring in its higher-priced tier

- Has a U.S.-based identity recovery manager available

Cons:

- No first-year pricing discount

- Mobile app is lacking in quite a few areas

- Bank and investment account monitoring services have significant limitations compared to LifeLock

- Has a separate privacy management service, which may cause some confusion for customers

- Finding information on its cancellation policies and auto renewal policies is very difficult

- Live customer service is not available 24/7

Pros and cons of LifeLock

Pros:

- Offers up to $1 million insurance against the costs of recovering your identity

- Offers up to $1 million in reimbursement for stolen funds in its highest-pricing tier

- Its mobile app is far more useful than IDX Identity’s mobile app

- Its first-year pricing discount is significant

- LifeLock’s brand name is well-known in the industry

- Offers credit reports from all three credit bureaus in its highest-pricing tier

- If you are a customer of Norton products, LifeLock works well alongside those products

- Offers far clearer information about its terms of service and auto renewal policies than IDX Identity

Cons:

- Increases its prices quite a bit in the second year and beyond

- The lowest-priced tier at LifeLock has a very limited number features and services

- LifeLock sometimes has a poor customer service rating because of its aggressive sales policies and sales-related emails

The winner: LifeLock

I decided to give LifeLock the nod in the IDX Identity vs. LifeLock comparison, but this was a close call. Even though IDX Identity has a lower price than LifeLock (after LifeLock’s first-year pricing discount expires), its overall feature set and level of service don’t quite match up to what LifeLock offers.

For example, if you are planning to subscribe to the highest-priced tier of either service, LifeLock offers a few more features here. Especially disappointing is the fact that IDX Identity does not actively monitor your credit card, banking, or investment accounts. Instead, it only reviews your monthly account statements. Should something odd happen in these accounts during the month, you might not catch it as quickly as you would with the regular monitoring that LifeLock offers.

Trustworthiness is extremely important when selecting an identity theft protection service, and IDX Identity doesn’t have the brand name recognition that LifeLock does. Part of the reason for this is that IDX Identity recently underwent a name change, going from MyIDCare to IDX Identity.

Although a name change may work out as an advantage in the long run, in the first few years after the name change, it can be challenging to maintain brand name recognition. Meanwhile, LifeLock is the most well-known brand name in this space.

Additionally, I found it concerning that IDX Identity does not make it easy to find its auto renewal policy and its cancellation policy in its terms and conditions document. This likely occurs because of the recent name change, but it still is disappointing and could leave potential customers wondering if the company is trying to hide something.

Finally, the IDX company offers both its IDX Identity product, which deals with identity theft protection, and its IDX Privacy product, which helps you protect your privacy online. You may end up purchasing both services from IDX because of the confusion, even though you only really want identity theft protection services. Some of the features of each IDX service overlap, such as dark web monitoring, further adding to the confusion.

So even though IDX has a lower price, if you have significant concerns over some of the oddities and weaknesses of IDX Identity, this lower price is not a good value for you. For the majority of users, paying a bit more and going with LifeLock is going to be the better choice.

Our testing methodology for identity theft protection

During my tests of the best identity theft protection services, my primary focus is attempting to ensure that these services actually live up to their guarantees. ID theft protection services often make extensive promises in their marketing materials that seem almost too good to believe. Unfortunately, sometimes they are.

I believe it is important to help you sort through the marketing promises and the actual services that these identity theft protection companies offer. Whether you are reading websites or you receive marketing emails from ID theft protection services, it’s important to maintain a skeptical eye, sorting the truth from the hype.

I want to determine through my testing whether these services are providing the value and features that customers expect to receive. This starts by ensuring that they provide timely alerts about potential security threats to your identity. The sooner you receive an alert about a possible problem, the sooner you can do something about it and try to head off a potential theft of your identity. My tests of these services attempt to trigger alerts whenever possible.

Additionally, the design and functionality of these services should make them easy to use for the average subscriber. If the services are too challenging to use, they will be of little value to someone hoping to receive alerts and advice about identity protection.

Part of the ease-of-use testing involves determining whether the customer service team at these ID theft protection services is responsive and knowledgeable. Customer service personnel need to be able to answer your questions and help you understand exactly what you are seeking in terms of alerts associated with your account.

IDX Identity vs LifeLock FAQs

How does identity theft protection work?

When you subscribe to an identity theft protection service, you will receive alerts when anything strange is occurring with your credit report, your financial accounts or with your personal identifying information. These odd occurrences could indicate that hackers are probing your accounts and personal information, seeking a weakness that could lead to identity theft.

Should hackers steal your identity, they may be able to open loans in your name, stealing the proceeds. Hackers may also be able to impersonate you, stealing your tax refund or money directly from your accounts.

Beyond the direct financial losses you may have, you also may be facing months and years of work to try to regain control of your identity. This can be an expensive, exhausting process.

So in addition to trying to help you catch potential hacks of your identity before they can take hold, ID theft protection services provide help with trying to recover your identity after the theft of your information. Because the majority of us will be going through an identity theft for the first time, knowing where to start to try to recover our identity would be challenging. The identity theft protection service has experience with filing paperwork and with knowing who to contact.

You will have costs associated with trying to recover your identity, such as through hiring a lawyer and paying fees to file paperwork, as well as a loss of wages from possibly having to miss work while dealing with this situation. Some ID theft protection services may offer up to $1 million for cost reimbursement and stolen funds reimbursement.

Can LifeLock help me after someone stole my identity?

When you lose your identity as a LifeLock subscriber, you will receive access to an identity theft restoration specialist at LifeLock. This person will help you figure out which steps to take and how to begin working to restore your personal identifying information. The specialist also should help you communicate with the credit bureaus to try to prove that some of the information in your credit report may be fraudulent and related to the identity theft. This specialist is U.S.-based. LifeLock offers up to $1 million to reimburse costs associated with restoring your identity.

Can IDX Identity help me after someone stole my identity?

Yes, IDX Identity will help subscribers work to recover their personal identifying information after a potential identity theft. When you report an identity theft, you will receive access to a U.S.-based team of restoration specialists who will help you take the steps necessary to try to return to normal. IDX Identity offers up to $1 million in insurance for reimbursing you for costs related to trying to recover your identity and for funds the identity thief steals directly from your accounts. Additionally, you receive a 100% money back guarantee if you lose your identity and if IDX Identity cannot restore it for you.

Does LifeLock compensate me for stolen funds?

If the identity thief steals funds from your accounts directly, LifeLock will offer you a reimbursement of these funds. If you subscribe to the lowest-priced tier of LifeLock, you could receive reimbursement of up to $25,000. If you subscribe to the highest-priced tier, you could receive reimbursement of up to $1 million. You will need to show proof of any financial losses you have.

Does IDX Identity compensate me for stolen funds?

Should you have a loss of funds from your accounts because of the theft of your identity, IDX Identity has an insurance policy that provides up to $1 million in stolen funds reimbursement. This $1 million policy also covers any costs you encounter as you work to recover your identity, such as for hiring lawyers or private investigators. This is different from LifeLock, which offers separate policies for stolen funds reimbursement and for costs associated with attempting to recover your identity.

How can I protect my identity from being stolen?

Simply subscribing to an ID theft protection service is not enough for protecting your identity. The service can give you early alerts about strange occurrences regarding your personal identifying information, so you can take steps to protect your information before an identity thief takes full control.

However, you still should take some steps on your own to guard your information. Start by being very careful about where you share information when using the internet. Only share information with websites that you are certain are legitimate. If you receive an email message with a link in it, this link could lead to a fake website that a hacker is using to try to steal your information, for example. These fake sites look almost identical to the real thing. Instead of clicking on a link to go to the website, type the address to the website you want to use in a fresh browser window.

Additionally, watch your account statements closely for any odd charges, even small ones. Do not use the same password at multiple websites. Where you can, enable 2FA to access your accounts. If you receive postal mail that contains your personal information or account information, destroy it when you finish using it.

Does credit monitoring hurt your credit?

No, monitoring the activity associated with your credit report will not hurt your credit score. Requesting a copy of your credit report will not affect your credit score, either.

Do credit cards offer identity theft protection?

A credit card company may offer some protection for your identity, but these services have significant limitations versus what an ID theft protection service offers. If you have a strange charge on your credit card, the credit card company likely will immediately notify you to see if the charge is legitimate. Depending on your credit card company, you may receive some additional services related to protecting your identity, such as dark web monitoring or receiving access to your credit report. Identity theft protection services offer far more features. However, you will have to pay a subscription fee to the ID theft protection service, whereas credit card companies often offer their limited features for free.

Why would I want monitoring for all three credit bureaus?

When you subscribe to a lower-priced ID theft protection service, you may receive reports and credit monitoring from one of the three credit bureaus. When you subscribe to a higher-priced tier, you might receive monitoring from all three bureaus.

Receiving information from all three credit bureaus is a slight advantage over just one bureau. Occasionally, initial clues that may indicate something strange is occurring with your personal identifying information may only appear at one credit bureau, rather than at all three bureaus at the same time. This could lead to a delay in receiving notification of a potential identity breach, leaving you more vulnerable than if you have access to information from all three bureaus from the start.

Should I get ID theft protection?

Determining whether you should purchase an identity theft protection service subscription is a personal choice. I cannot make a blanket recommendation about whether this type of service is worth the subscription price for you personally. Some people need these services to help them monitor their financial accounts and identifying information, while others can duplicate the work that the ID theft protection services provide on their own.

If you are able to monitor your account statements on a regular basis on your own, while also monitoring the information on your credit reports regularly, you may not need to subscribe to an ID theft protection service. These services essentially do the same thing for you, creating alerts when they find something odd.

Some people have an incorrect picture of what identity theft protection services do. Even when you subscribe to a service, you cannot sit back and let the service take care of everything for you. If the service sends you alerts, you must deal with this information on your own.

Subscribing to an ID theft protection service does not fully guarantee that you will never be the victim of identity theft, either. You will need to take the time to guard your information, including after you receive alerts. Bottom line: Even if you are paying a monthly fee to the ID theft protection service, you will need to do some of the work on your own to give yourself the highest chance of avoiding identity theft.

I do believe there are a few types of people who can receive the greatest level of benefit from subscribing to identity theft protection services.

- Past victims of identity theft: Once you suffer a loss of your identity, you have a greater chance of having another identity theft in the future. Subscribing to a service can help you keep a closer eye on your credit information than you may be able to do on your own.

- People who aren’t able to monitor their own information: Some people simply aren’t comfortable monitoring their own credit reports or financial accounts. Maybe you don’t have the time to do it, or maybe you don’t want to use the internet for accessing your financial information. Having professionals watching this information for you can give you peace of mind, making the subscription price worth it.

- Rare users of credit: If you rarely take out loans or if you don’t use credit cards, you may not have a reason to check your credit score or your credit report, even occasionally. If so, the ID theft protection service can help you track your information more regularly.

- Children: It may seem unlikely, but children can become victims of identity theft. Because children don’t have bank accounts or active credit reports, it can be difficult for parents to spot the signs of a potential identity theft until well after they happen. The ID theft protection service can keep an eye on your children’s personal identifying information.

If you choose to try to monitor your own credit information and you suffer an ID theft, you will have to absorb the costs of trying to recover your information on your own. If you subscribe to an identity theft protection service, however, you will be eligible to receive reimbursement for your costs. Understand that the service will not simply hand you the money. You will have to show proof of any losses you suffered and of any costs you had while trying to recover your identity. It sometimes can be difficult to receive the payment you believe you should have.

One of the biggest hassles of subscribing to an identity theft protection service is the possibility of false alerts. Just because the service flags something regarding your personal information as odd, it doesn’t mean that the oddity relates to identity theft. You may end up spending quite a bit of time dealing with these false alerts.

Additionally, when you subscribe to one of these services, expect to receive marketing email and other materials from the service. The service may try to convince you to subscribe to a higher-priced tier or to purchase add-on services through this bombardment of marketing messages. Some people find these messages highly annoying.

Auto renewal policies that are common with ID theft protection services also can represent quite a hassle for people, as it can be challenging to cancel the services and to stop the automatic payments if you decide to stop using the service. I recommend that you only use a credit card to pay for these services, because the credit card company will be more helpful in trying to resolve a disputed charge than your bank will be.

Ultimately, as you are deciding whether you want to subscribe to an identity theft protection service, I would recommend maintaining a bit of skepticism about what the service is promising to do for you. Although the service’s marketing materials may sound great, they may oversimplify the features that the service offers and the ease of working with the service. Take the time to understand both the pros and cons of subscribing to an identity theft protection service before you give the service your credit card information and take on the monthly cost.

Thank you for a very well put together article, it really helped me decide which company I will use.