Our own research shows that cyber crime hit 90% of US businesses in the past 12 months. But I also know that it’s easy to question whether purchasing an identity theft protection subscription is worth the money, especially if you are unfamiliar with how they actually work.

One of the more affordable identity theft protection services is IDShield, which is a subsidiary of PPLSI (Pre-Paid Legal Services, Inc.). However, having an inexpensive service doesn’t do you much good if the service can’t help you keep track of your personal information and help you find oddities before your identity is gone.

IDShield is not as well known as some other services, such as LifeLock, so you may not be familiar with it. That’s why I decided to dive into the IDShield service, performing a hands-on review to help you decide whether it will deliver the services you need.

During my hands-on testing of IDShield, I signed up for it just as you would. In my 2022 IDShield review, I will explain and describe the service in detail. I also will seek to answer questions that readers often have when they are considering subscribing to IDShield, including:

- Is IDShield worth the money?

- Should I trust IDShield?

- How do PPLSI and LegalShield relate to IDShield?

- Is IDShield’s customer service any good?

- Is IDShield better than LifeLock?

During my IDShield hands-on review, I found that it handles all the basic features and services you would expect to receive from an identity theft protection service. However, IDShield has just enough oddities and complexities that leave me questioning whether this service is going to be the best choice for newcomers. If you have some experience with identity theft protection services, and if you’re just looking for a low price, IDShield will work fine for you. If you want to keep things as simple as possible, though, you may want to look elsewhere.

Summary of benefits: IDShield

| No value | IDShield |

| Website | idshield.com | Free trial | Average email response time | Identity theft insurance | Up to $1 million | Stolen funds reimbursement | Up to $1 million | Special offer | Highest price per month | Credit monitoring | Investment account alerts | Social media monitoring | Lock your credit | Home title monitoring | Phone takeover monitoring | Address allocation | Dark web monitoring | Crime in your name monitoring | Credit reports | Credit score |

|---|---|

| Best deal (per month) | $14.95 Starting as low as $14.95/mo |

IDShield: Hands-on review

IDShield will do what it promises, which is to give you alerts whenever it finds any of your personal information on the internet in strange locations or being used in odd ways. IDShield also provides up to $1 million in insurance for reimbursement of expenses or for financial losses from your accounts related to identity theft.

These are the primary reasons people purchase subscriptions to identity theft protection services, so IDShield fulfills all the basics you expect to receive.

However, I’m not sure I would recommend IDShield to those new to using identity theft protection services. It has some quirks that create complexities in the way you initially begin using IDShield, which will create uncertainty and frustration for users.

For example, the signup and account activation process is far more complex than it needs to be. Additionally, IDShield forces you to enter quite a bit more personal information, where other ID theft protection services pull that information for you.

As another oddity, IDShield skips performing some basic features for you that other services handle. For example, you cannot freeze your credit directly through IDShield or pull your credit reports into the IDShield interface, making these processes needlessly complicated. Other ID theft protection services will allow you to handle these processes directly through their dashboards, which streamlines the process.

IDShield provides plenty of advice about the steps you should take to perform certain tasks related to protecting your identity. However, I’m not entirely sure that receiving this type of advice alone is worth $20 per month.

IDShield’s dashboard is well-organized, and it does have some interesting features, such as notifications when a registered sex offender moves close to you. I just wish that it did a few more things like this for you.

Versus other theft protection services, IDShield is priced competitively, and it gives you a 30-day free trial period. These are both significant advantages in its favor versus its competitors.

Before I begin breaking down the specifics related to IDShield, I must explain a few things about identity theft protection services in general.

Just because you subscribe to IDShield or another theft protection service, this does not mean you will never be a victim of identity theft. These services give you alerts about potential dangers related to your personally identifying information on the internet, but they don’t put a stop to hackers seeking to use that information. You have to take steps to protect your information and to stop hackers from using it against you.

If you are tech-savvy, you may not need to pay for a service like IDShield to keep an eye out for your personal information. You can duplicate many of the services from IDShield (and other ID theft protection services) by keeping a close eye on your credit report and by being careful about where you share your personal information.

Basically, by paying for an identity theft protection service, you are paying these services to watch your information for you. Some people prefer the peace of mind that this type of subscription provides, because they don’t trust themselves to watch their personal information closely enough.

As you read through my findings regarding IDShield’s services and features, I want to mention that I subscribed to IDShield for this hands-on testing period, just as you would. I did not receive a demo account from IDShield that would limit exposing some of the downsides of the service. I entered my personal information into the system. I subscribed to the individual tier with monitoring from all three credit bureaus on a month-to-month basis for $19.95.

IDShield features and insurance

Let’s look at the numerous features that are part of your IDShield subscription, as well as how these features rank in my hands-on IDShield review.

Insurance and compensation

IDShield follows the industry standard among ID theft protection services and carries a couple of $1 million insurance policies to help you if you ever suffer identity theft.

One of the IDShield insurance policies allows up to $1 million for lost expenses, legal fees, and expense reimbursement, as well as checking and savings account cash recovery, from an actual identity theft event.

This policy attempts to help with expenses you have related to attempting to restore your identity. If you suffer identity theft, you may have expenses for missing work while you try to restore youhttps://www.comparitech.com/go/idshield-review/r identity. You may need to hire an attorney or an accountant to help with your case. And even though IDShield promises to give you access to its own private investigator to help your case, you may need to hire your own investigator too.

A second insurance policy offers up to $1 million in recovery for financial losses from investment and HSA accounts.

Of course, you will need to prove any of your losses and expenses before IDShield will reimburse you. Don’t expect IDShield to just take your word for losses. You will need extensive documentation of your expenses and losses.

Activity alerts

One of the biggest benefits of subscribing to an identity theft protection service is that you will receive alerts when something appears odd regarding your personal identifying information on the internet.

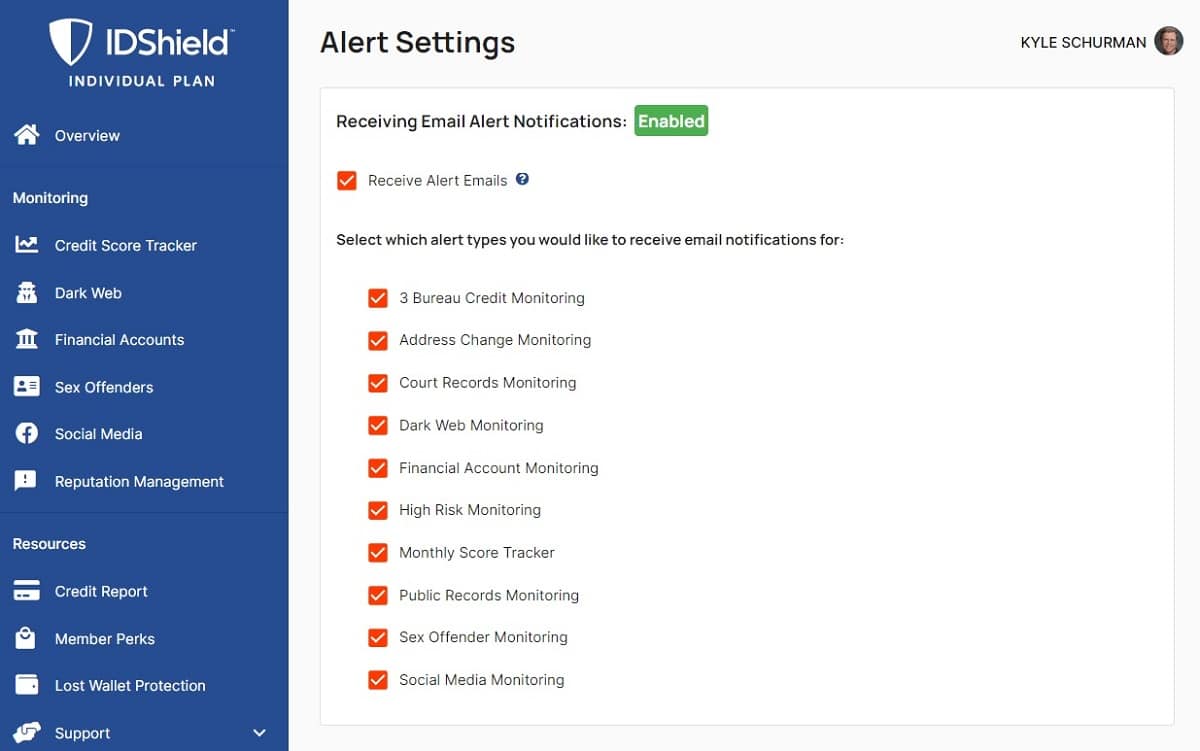

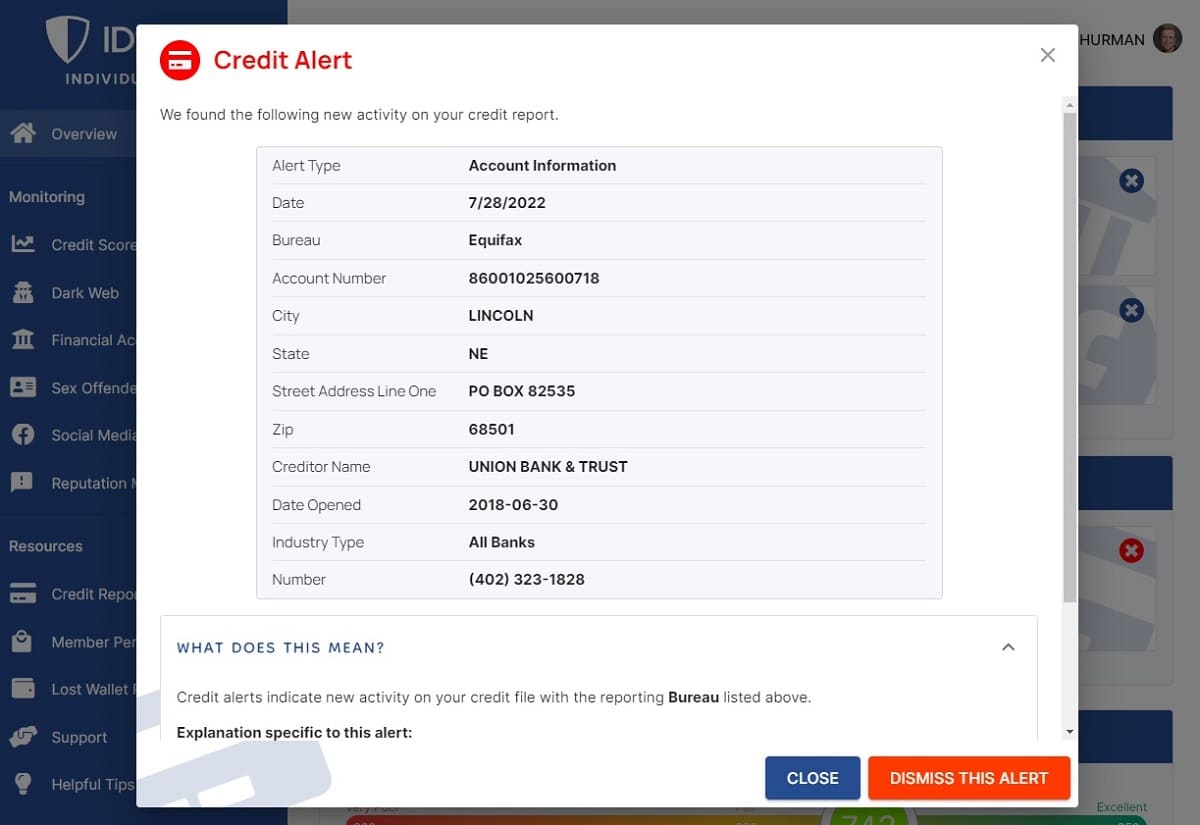

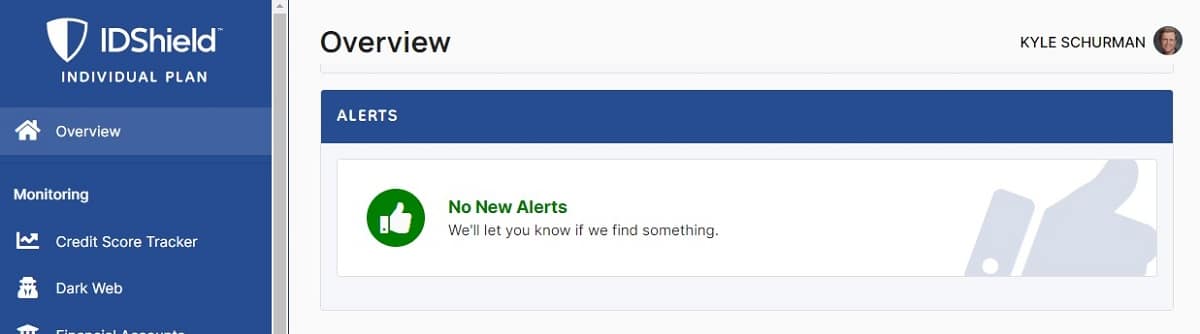

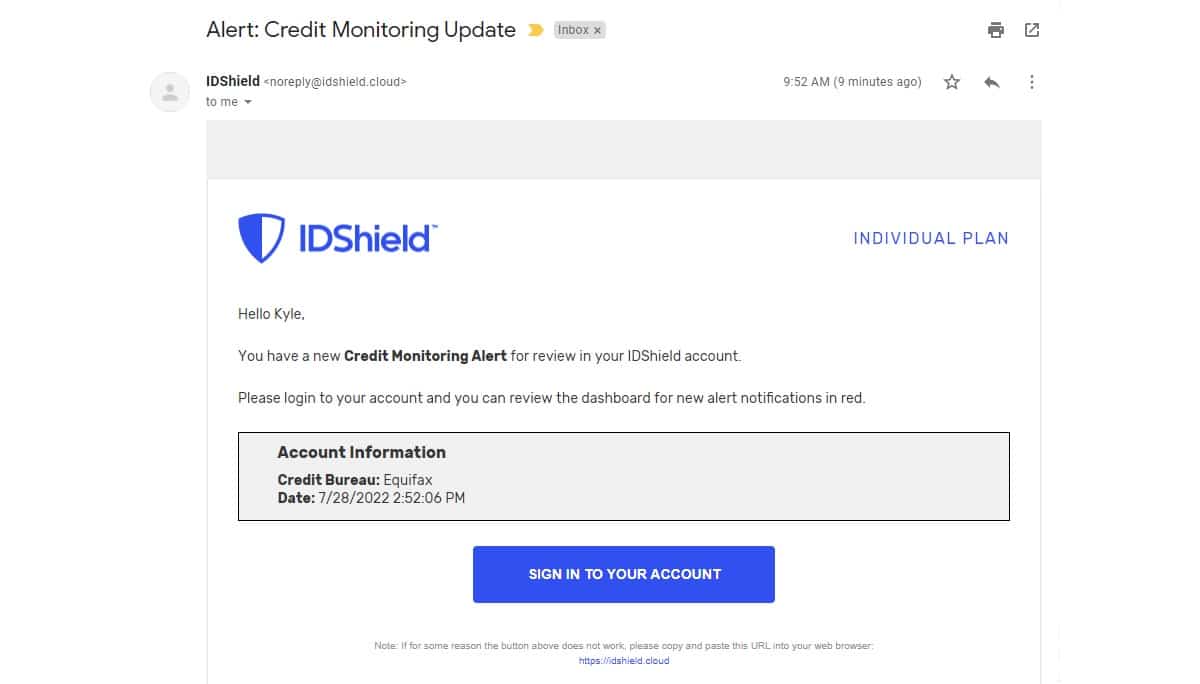

With IDShield, you can view your alerts on the Overview (or dashboard) screen. You also can choose to receive your alerts via email. Click your name in the upper right corner and then click Alert Settings.

You then can choose whether you want to see email alerts. If you choose to receive email alerts, you can individually determine whether you want to receive any or all of the 10 different kinds of alerts IDShield provides. This is a nice feature. If one category of identity tracking is generating a lot of email alerts that represent unimportant issues, you can just turn it off, so it won’t inundate your inbox.

As you set up your various accounts and other personal information in IDShield, you can request that you receive specialized alerts. For example, with a credit card or bank account, you could select to receive an alert if a transaction occurs that exceeds a certain amount, alerting you to potential fraud.

Dark web monitoring

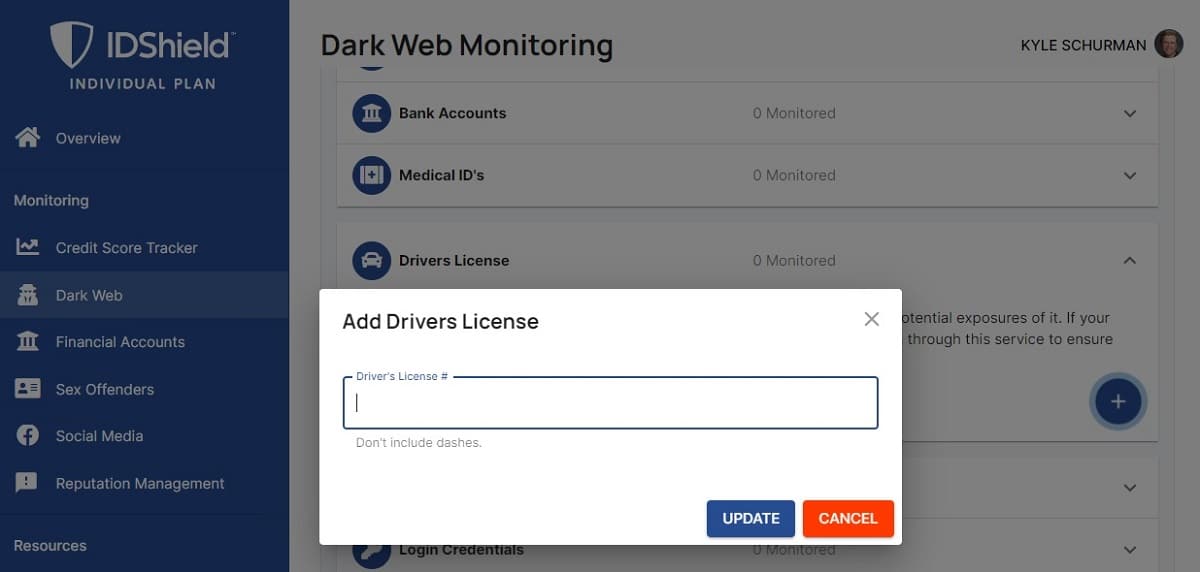

IDShield will monitor the dark web for you, looking for any areas that are exposing your personal information. The dark web consists of marketplaces, forums, and file repositories where hackers collect and sell stolen personal information. This can include things like:

- Social Security number

- Account numbers

- Usernames and passwords

- Mother’s maiden name

- Phone number

- Mailing address and ZIP Code

Should someone be able to track down enough bits and pieces of your personal information on the dark web, that hacker may be able to steal your identity or gain access to your accounts.

With IDShield, you will have to enter your personal information before the service begins monitoring the dark web for you. If you want certain items monitored, you will need to enter this information, such as your mother’s maiden name or any medical ID card information. This is different from some other identity theft protection services, which automatically search for quite a bit of information associated with your name.

Free credit report and monitoring

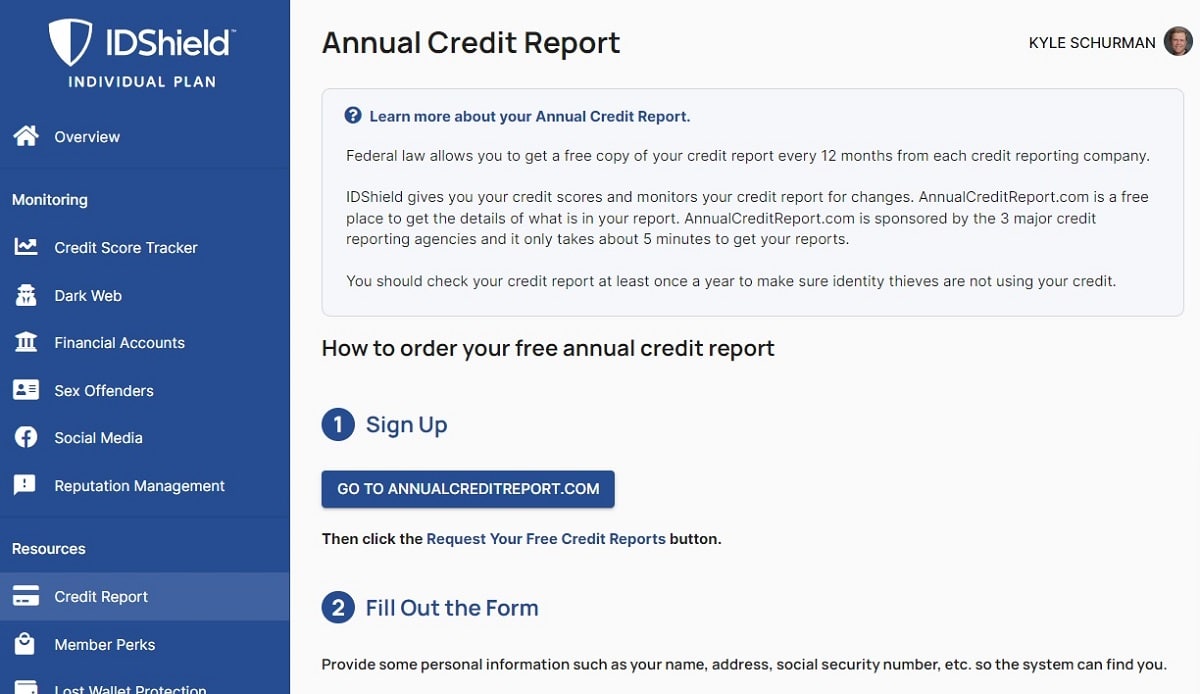

IDShield does not display your credit report as part of its dashboard, but it will walk you through the steps for requesting your credit report from AnnualCreditReport.com. You can request this free report once a year. This differs from other services, which pull your credit report into the interface.

IDShield offers a credit score and credit monitoring feature that occurs constantly. Click on Credit Score Tracker in the dashboard to start the process. You will have to answer some security questions that relate to your personal information before IDShield will provide the credit monitoring information.

If you answer the questions correctly, you will see a representation of your credit score. As you continue as a member of IDShield for a long period of time, the service will collect more and more information for you, creating graphs that show the progress of your credit score over time.

IDShield also lists a detailed explanation of how the credit bureaus determine your credit score. You can learn why your score is not quite as high as you might like to see.

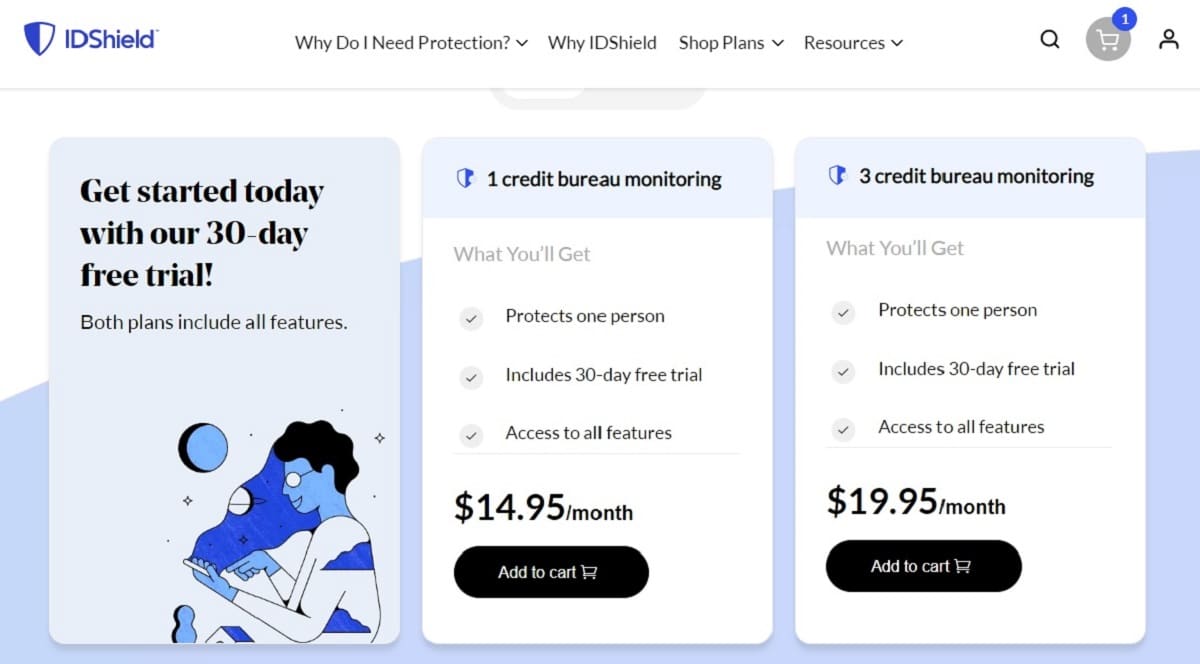

When you sign up for IDShield, you can select a pricing tier that either includes monitoring of one credit bureau or all three credit bureaus. You will pay about $5 extra per month to make use of all three credit bureaus. However, having this extra information available will give you a better handle on your personal information and on the possibility of identity theft.

Freeze your credit report

IDShield does not give you any help with freezing your credit, if you want to go this route. You still have the ability to freeze your credit by contacting each of the three credit bureaus yourself, but it is disappointing IDShield doesn’t give you more help in this area.

Address monitoring

IDShield will generate an alert if someone submits a request to the U.S. Postal Service for a change of address in your name. Someone could attempt to steal your identity by redirecting your mail to a different address.

Court records monitoring

IDShield will generate an alert if it finds any mentions of your name or personal information as part of court records. A criminal may steal your identity and then give that identity to police to try to avoid suffering charges in the criminal’s actual name. By the time police notice the error, the criminal may disappear.

Even if police catch the error quickly, if a criminal is using your personal information, it could indicate that all your personal information is in jeopardy of identity theft.

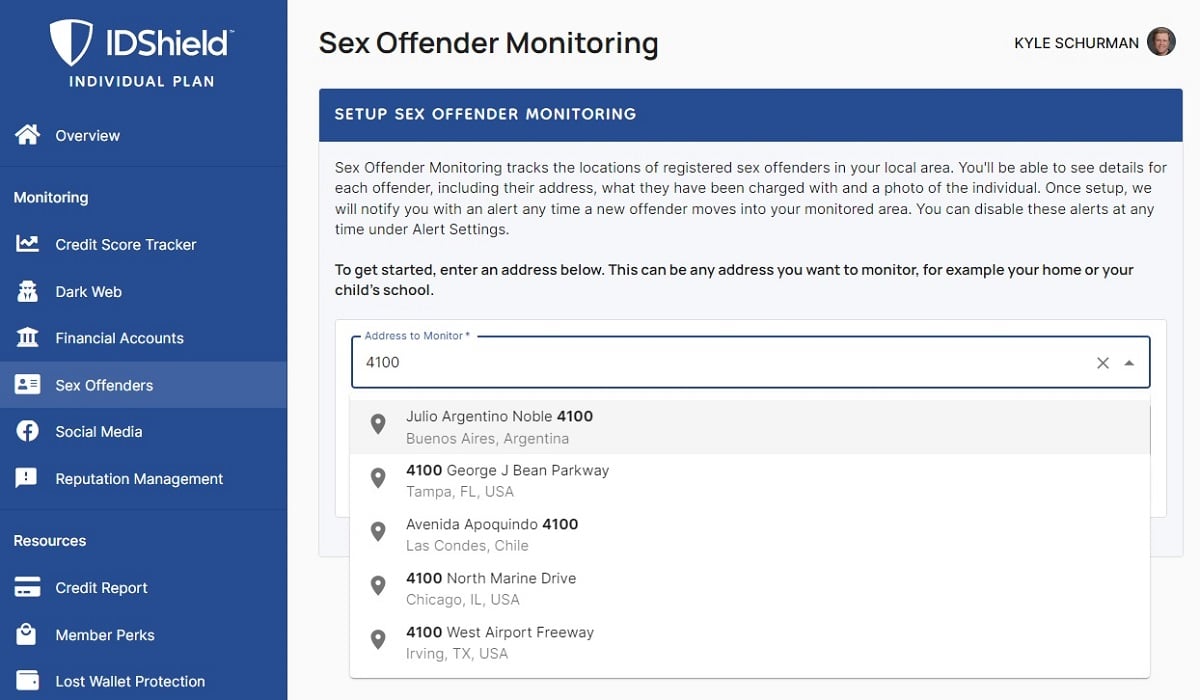

As an added feature, IDShield tracks your local sex offender registry. Through the dashboard, you can click on Sex Offenders. Then enter the address that you want to track and the distance around the address (up to five miles) that you want to seek for registered sex offenders.

If IDShield finds a new registered sex offender in this area, it will generate an alert for you. You also can see a list of any registered offenders and their current addresses in a map on the Sex Offenders screen in IDShield. If you want to change the address, simply click the Change button on this screen.

I have not found this feature on any other ID theft protection services.

Social media monitoring

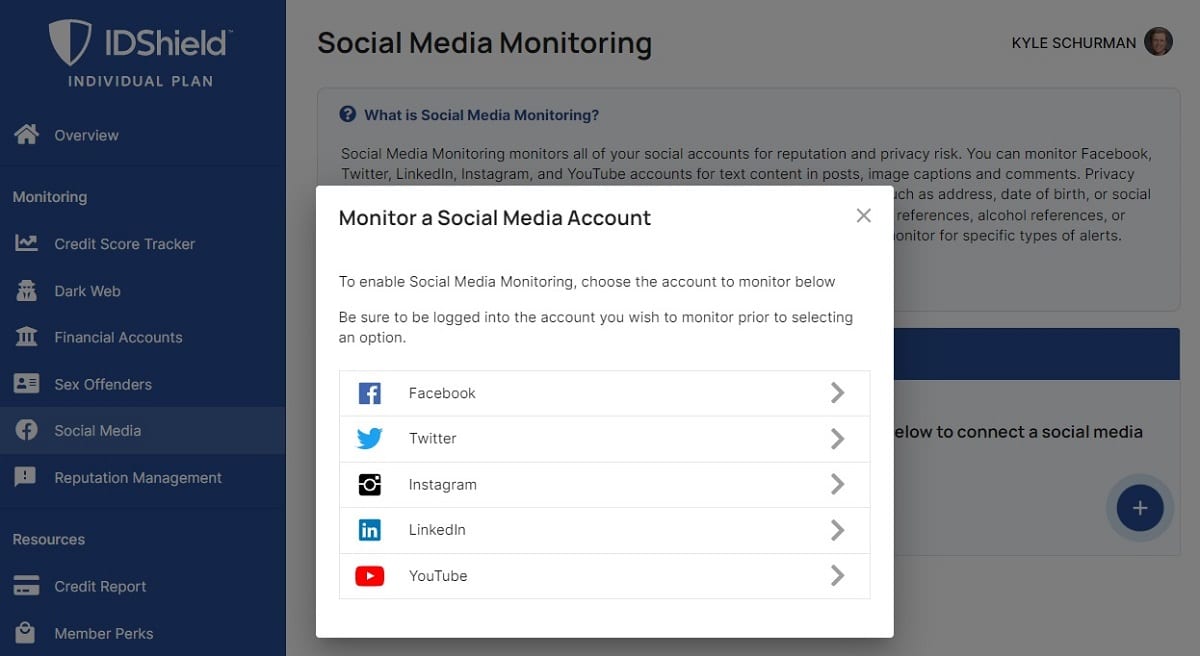

When monitoring your social media accounts, IDShield will keep an eye on the social media content associated with your name. It will provide an alert if any of your posts reveal personal information that you shouldn’t be sharing. It also will alert you if any posts contain offensive or threatening information, which could indicate someone hacked your account.

IDShield uses the ZeroFox app to provide monitoring of your social media accounts, so you will have to give the app access. (IDShield will walk you through this process.) You can monitor:

- YouTube Channel

ID restoration

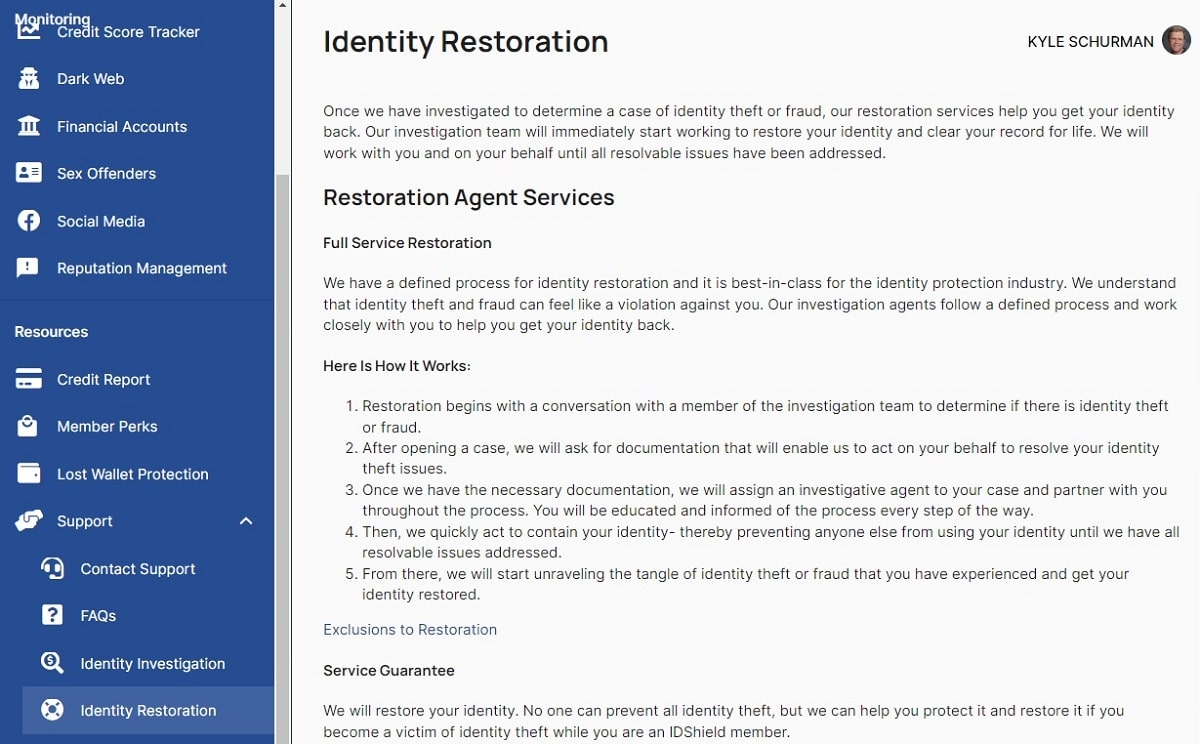

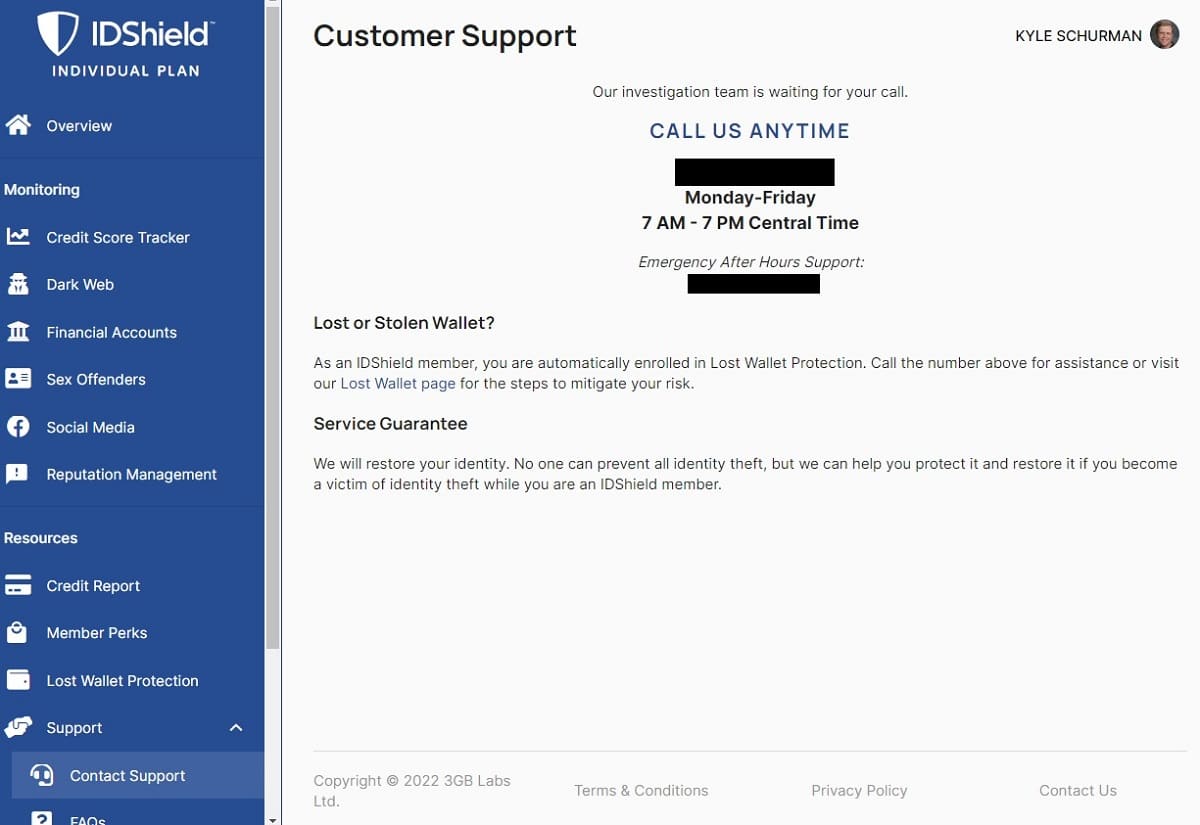

If you ever have any questions about the process related to restoring your identity, IDShield explains what you need to do. On the left side of the Overview screen, scroll down and click on Support. Then click on Identity Restoration to see the steps IDShield will do on your behalf.

Click on Identity Investigation on the left side of the screen to learn more about how you can open an investigation into any potential identity fraud against you. This screen also contains the phone number to call to report identity theft. Support personnel are available at any time for emergency after hours support. (Standard customer service hours are 7 a.m. to 7 p.m. Central time).

Fortunately, I did not receive any alerts that would indicate the potential of identity theft during my hands-on test of IDShield. Consequently, I was unable to specifically test the accuracy and helpfulness of IDShield in this area.

IDShield promises to assign a private investigator to your case who will help you until your identity situation returns to the status it had before the ID theft occurred.

2FA login

As a final part of the setup process, I had to set up security questions as part of my account. However, IDShield did not force me to set up 2FA (two-factor authentication) as part of the account, which was disappointing, as 2FA is a highly effective security step.

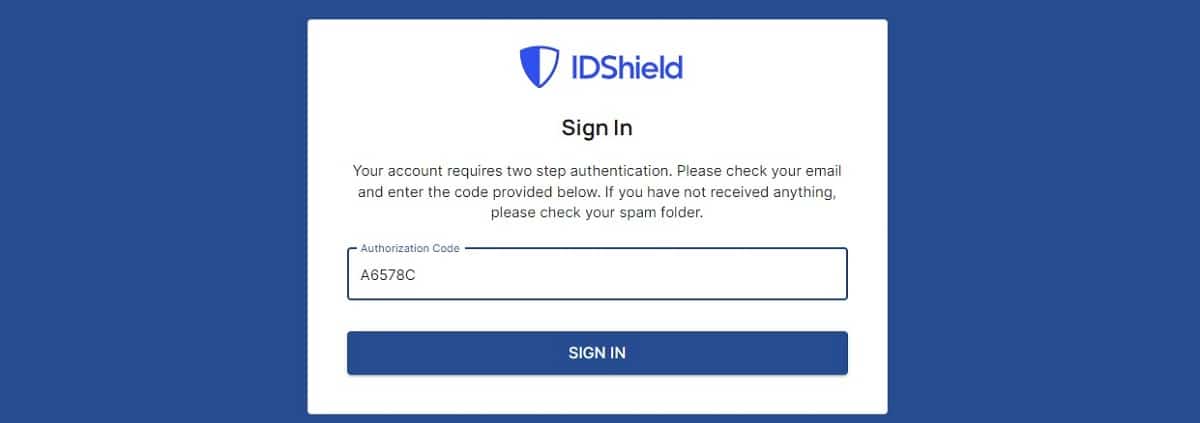

You do have the option of enabling 2FA at any time as a user of IDShield. Click on your username at the upper right corner of the screen and select Update Profile. Scroll to the bottom of the screen and click on the Enable 2-Step Verification checkbox. Then click the Update button.

Unfortunately, you do not have the chance to select how you receive the secondary notification after you enter your username and password. IDShield will only send the secondary notification via email, even if you would prefer to receive it via a text message or authenticator app.

Lost wallet protection

IDShield handles lost wallet information a little differently than some other ID theft protection services. Instead of creating a specific space for you to store copies of the various cards you carry in your wallet, IDShield just provides information about what you should do if you lose your wallet.

You can call IDShield customer service for additional help, but you will have to take the steps yourself to cancel your cards after losing your wallet.

Signup and setup

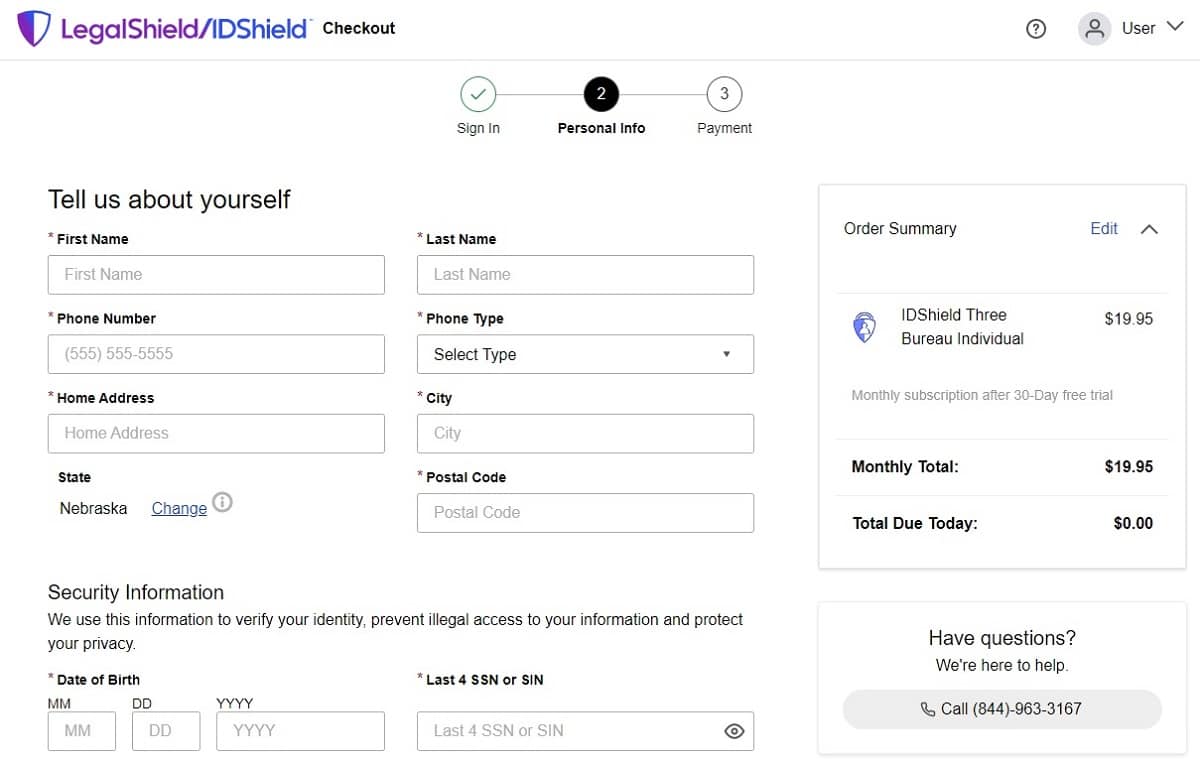

When you choose to sign up for IDShield, you can complete the basics within a few minutes. However, you will need to add more information later to track additional items. Unfortunately, this makes the IDShield setup process more complex than it needs to be.

After you select your desired plan level, you will need to pick a password. You then will enter some personal information, including name, home address, telephone number, date of birth, and the last four numbers of your Social Security Number.

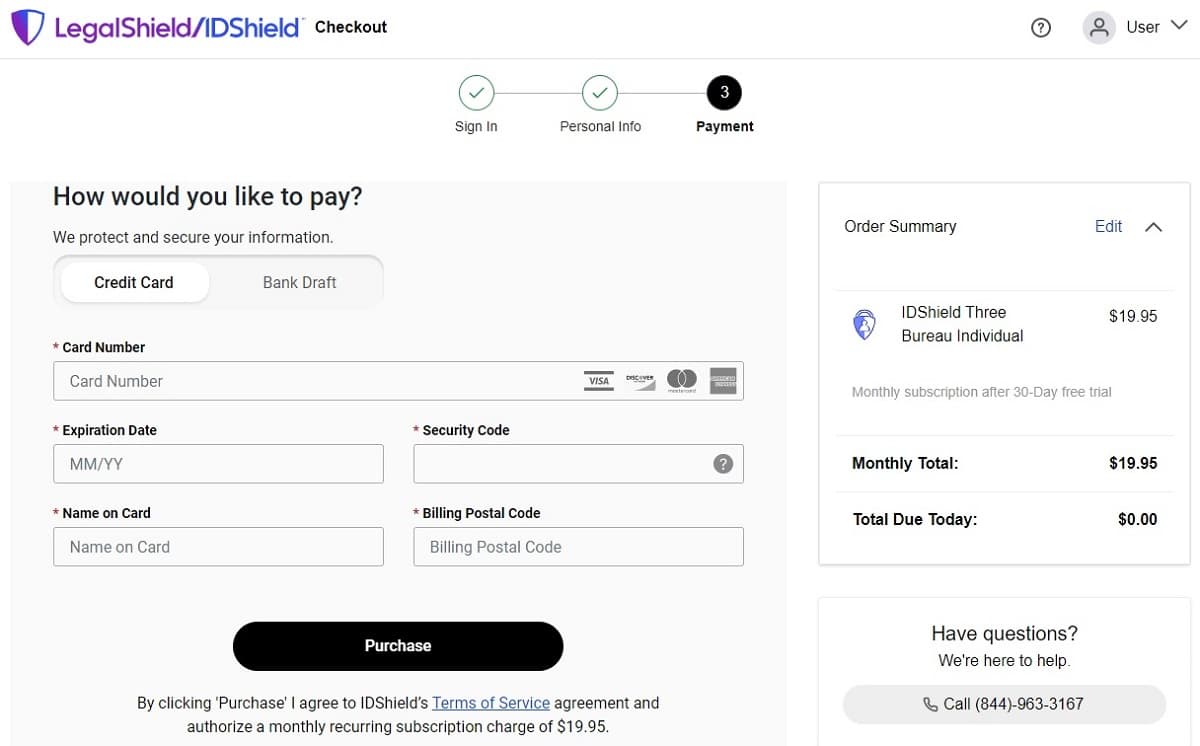

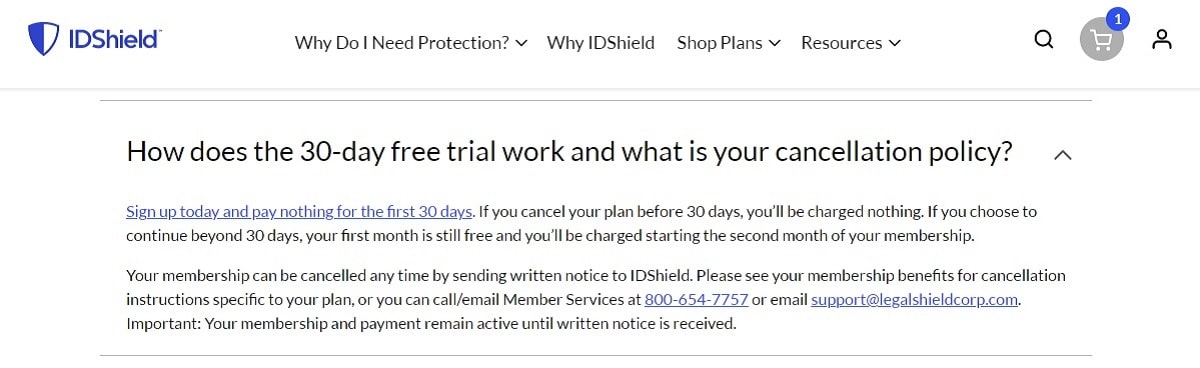

Because you receive a 30-day free trial, IDShield does not charge your credit card information immediately. However, you do have to enter your payment information at the time of signup. If you forget to cancel the service before your 30-day free trial expires, IDShield will charge you automatically.

IDShield gives you the option of paying through a credit card or a bank draft. I would always suggest going with a credit card if at all possible. If you experience a problem with trying to cancel the payment and service at some point in the future, your credit card company is going to be far more helpful than your bank.

After IDShield accepts your credit card, it displays a welcome screen that explains some of the steps you may want to take next. This is a helpful feature, as some ID theft protection services simply leave you on your own after you finish the signup process.

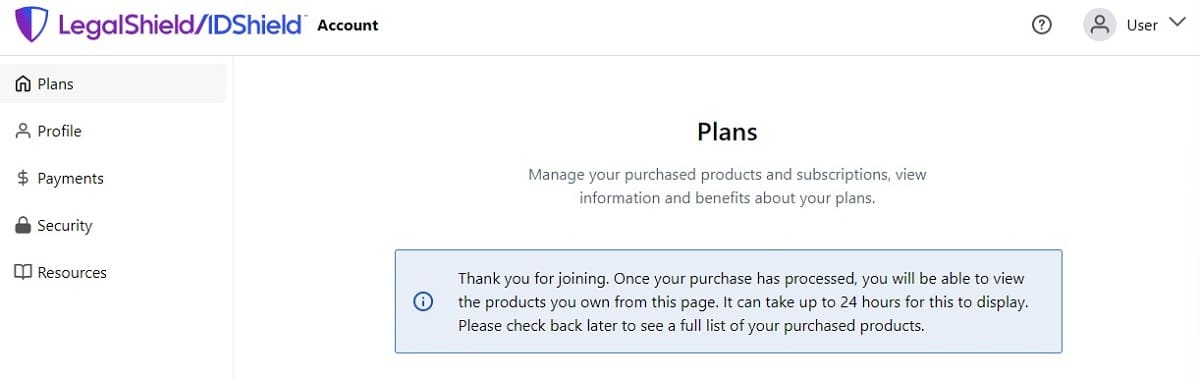

Now for the part of signup that caught me significantly off guard: After you join the service, you cannot begin using it immediately. IDShield gives you a message that says it can take up to 24 hours for IDShield to process your payment and to set up your account.

This is a major difference from other ID theft protection services, which give you immediate access to your account. In a day and age where people expect immediate service and results, a possibility of a significant delay could be off-putting.

During my hands-on test, fortunately, I received an email within a few minutes that told me my account was ready to use. I’m not sure why IDShield told me there would be a potentially 24-hour delay when the delay was only a few minutes, but it did.

Even though I’ve written about and worked with identity theft protection services for long enough that I knew IDShield was a legitimate service, this message about a potential 24-hour delay gave me a moment of doubt. Did I just give my credit card number to a scam service?

Ultimately, this was a weird situation that really did not need to happen. For those who have very little familiarity with these services, this type of message can significantly erode trust, so I’m not sure why IDShield doesn’t fix it.

Ease of use and design

Because IDShield works from the cloud, you do not need to download any files to your computer’s hard drive. You will run IDShield through a web browser window, which is similar to other protection services.

Before discussing the design of the service’s browser dashboard, I need to mention something about the usability of this service.

For some reason, IDShield does not require you to fully enter your Social Security Number at signup. You only enter the last four numbers of your SSN.

Ultimately, this means that you will have to enter this information later before IDShield can begin tracking your identity. This seems like an unnecessary (and potentially confusing) step.

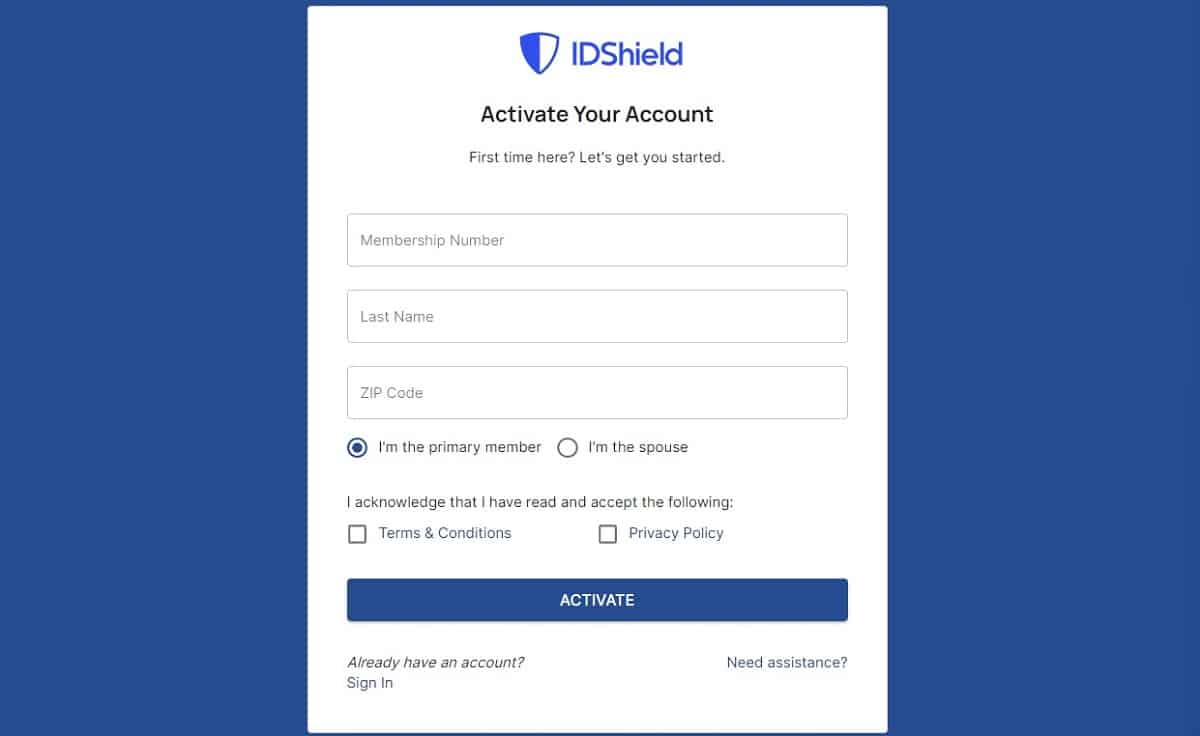

Frustratingly, as I began attempting to use IDShield, I had to “activate” my account. I had already entered my email address and password a few minutes earlier after clicking on the activation link in the email message I received. Yet, I couldn’t continue until I re-entered this information on the activation screen.

And even though I had to select a password when I signed up for the service, I was asked to set up another password, as well as a username, in the activation screen. I was able to use the same password I used earlier, but I had to select a username that was different from my email address.

By the way, don’t delete your activation email after clicking on the activation link. You will need your membership ID number that’s inside this email before you can activate the account. You also must have this membership number to be able to cancel the service in the future. (Once you activate your account, you can see the ID number if you click on your name on the Overview screen.)

Finally, after I entered the information to activate my account, I had to wait before I could start using IDShield until I received another email message that asked me to verify my email address. This occurred even though I already received an email from IDShield asking me to activate my account the first time, so the service knew my email address was valid.

These all seem like silly extra steps when I already entered similar information just a couple of minutes earlier. It makes IDShield’s usability clunky. For someone who has no experience with ID protection services, this can create unnecessary confusion.

Having said that, IDShield does a good job of giving users plenty of information about how to use the service. Once you work through the unnecessarily complex signup and activation process, IDShield gives you the ability to take a tour of the service and its features, which is a nice option.

IDShield also contains links on almost every page, marked with a question mark, that provide additional information about various features. This is very helpful for receiving a quick answer to a question you may have or for learning about a term you may not understand.

Unlike some other ID theft protection services that seem to run slowly, I thought IDShield’s cloud-based software ran quickly with no lag.

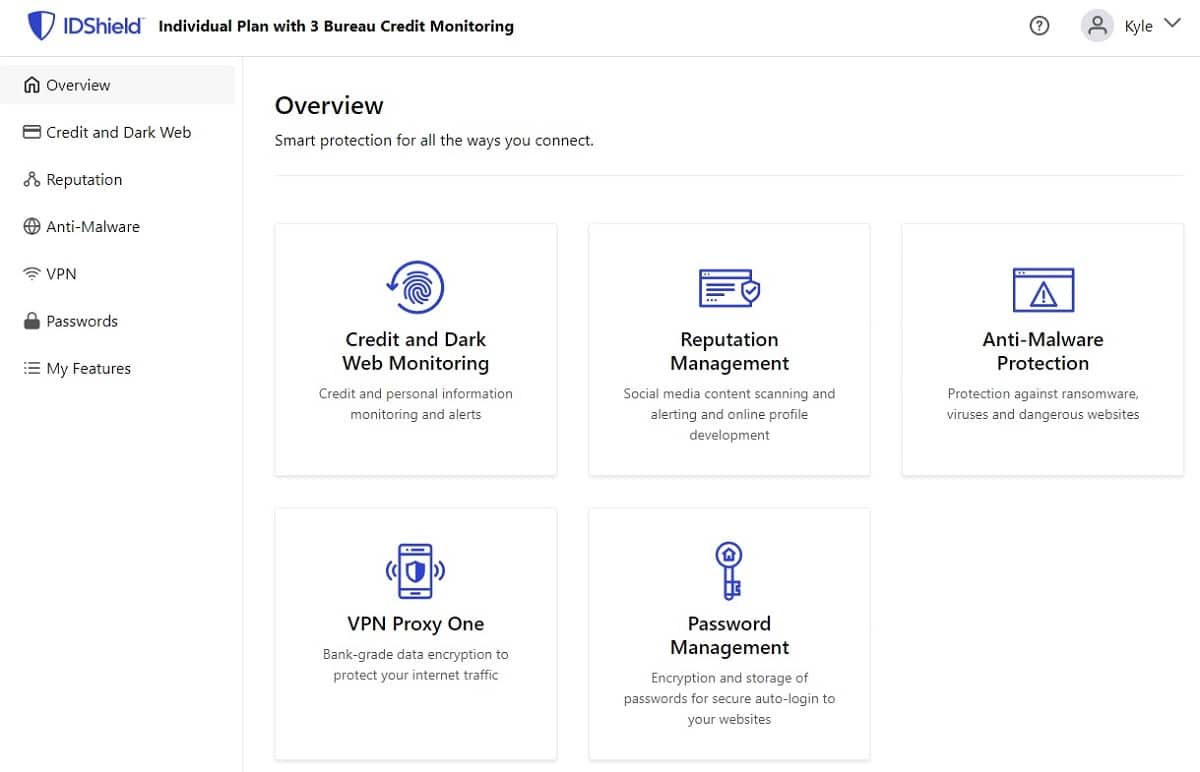

IDShield dashboard

IDShield calls its dashboard area the Overview page. It contains the navigational menu along the left side, while displaying your reminders, alerts, and credit score along the right side. The various menu options include:

- Credit Score Tracker

- Dark Web

- Financial Accounts

- Sex Offenders

- Social Media

- Reputation Management

- Credit Report

- Member Perks

- Lost Wallet Protection

- Support

- Helpful Tips

You can access your account settings by clicking on your name in the upper right corner.

The Overview screen is well-organized and makes it easy to find the exact feature you want to access.

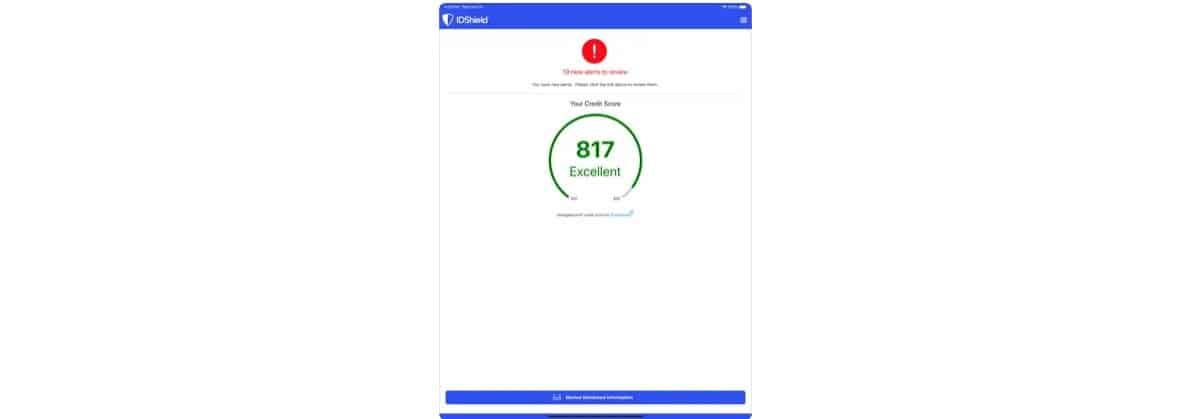

IDShield mobile app

You can download the IDShield mobile app for either Apple or Google devices. The mobile app only works if you have an account already in place with IDShield.

The app contains the Overview screen, displaying information similar to what the browser window generates. It provides alerts about any oddities IDShield finds with your personal information.

IDShield support

Unfortunately, IDShield does not offer 24-hour a day customer service. You will need to call between 7 a.m. and 7 p.m. to access customer support.

Should you need emergency service, however, IDShield does provide a phone number to use. This number primarily works for those who need ID restoration services.

During my testing of the customer service phone number at IDShield, I found that personnel answered the call within a few minutes the majority of the time.

IDShield does not offer a live chat service through the browser.

IDShield: Pricing

| No value | IDShield |

| Website | idshield.com | Subscription periods | Monthly or annually | Special offer | 30-day free trial for new customers | Price per month | $14.95 (Individual tier; 1 credit bureau) | Lowest annual price | $179.40 (1 credit bureau) | 4-year pricing plan | $239.40 (3 credit bureaus) | Lowest annual price (Family) | $359.40 (1 credit bureau) | Highest annual price (Family) | $419.40 (3 credit bureaus) | Money-back guarantee |

|---|---|

| Best deal (per month) | $14.95 Starting as low as $14.95/mo |

IDShield’s prices are pretty similar to other identity theft protection services. You do not get a significant discount in the first year like you’ll find with LifeLock, but you then don’t have to worry about a big price increase in the second year (like you’ll find with LifeLock).

You can go month to month or annually with IDShield, but I would recommend month to month. IDShield does not offer any discount if you pay annually up front.

Auto renewal options

As occurs with nearly every identity theft protection service, you must agree to an auto renewal policy with IDShield when you subscribe. You must provide a credit card at the time of signup. Should you fail to remember to cancel the service before the date of your renewal period, IDShield will automatically charge you. There is no option for recovering this money if you forget to cancel.

It’s unfortunate that these services require you to agree to auto renewal. However, that annoyance is just part of the requirement to subscribe to an identity protection service.

How do you cancel IDShield?

When you want to cancel IDShield, you must submit a written notice to the company. This can occur through an email message. There is no option for canceling over the telephone or through a web button, unfortunately.

You must follow the IDShield cancellation steps precisely, or the service will not accept your cancellation request and will continue charging your credit card. I did not experience significant problems when I canceled IDShield after using it for my hands-on review, but you don’t have to look too hard to find online reviewers who say IDShield did not cancel the service properly and continued to charge them.

This is a problem that’s not unique to IDShield, as nearly all ID theft protection services have customer reviews online that describe nightmares with trying to cancel the services.

If you want to attempt to cancel IDShield, just expect it to take several days. In other words, don’t expect to cancel the service a few hours before your renewal period kicks in again to avoid being charged for another month or year. Make sure you start the cancellation process several days ahead of time. You might end up getting lucky and having no problem with the cancellation process, but I would not count on this happening.

I also would recommend maintaining copies of all correspondence with IDShield about your cancellation request. If you end up with a dispute, perhaps your copies will give you a chance to avoid extra charges.

Should you run into problems, your credit card company may be able to help you avoid extra charges. Always sign up for an ID theft protection service with a credit card, rather than a bank draft, as credit card companies can offer more help with disputes like this than your bank likely will provide.

Before you sign up for IDShield, or any identity theft protection service for that matter, I always recommend reading through all the service’s legal documents, including the Terms & Conditions document and the Terms of Service document.

IDShield pricing tiers

IDShield does not offer a bunch of pricing tiers or various options to pick from for subscribers, which makes it easier for you to settle on the tier you want to use. Although it’s nice to have choices, I believe some ID theft protection services go overboard, resulting in confusion for customers. IDShield keeps things simple in this area.

Start by choosing either an individual or family pricing plan. The individual plan will cover one person, while the family plan covers two adults and all dependent children under the age of 18.

Within either the individual or family tier, you can select to have credit monitoring from one credit bureau or all three credit bureaus. You will pay $5 extra per month to receive monitoring from all three bureaus, which I believe is worth the extra money.

Beyond the number of people covered and the number of credit bureaus monitored, the coverage and monitoring features for all four pricing options are exactly the same.

With any pricing tier you select, you receive a 30-day free trial. IDShield does not charge your credit card until the 30-day period expires. If you are able to complete the cancellation process within the 30 days, you will not receive any charges.

As mentioned earlier, I would recommend only using the monthly subscription option with IDShield. It does not offer any pricing discount for those who pay annually.

Pros and cons of IDShield

Pros:

- Reasonable price for the level of services you receive

- Limited number of pricing tiers, which keeps things simple

- Has a $1 million insurance policy for reimbursement for expenses and losses related to recovering your identity

- Has a well-designed dashboard, so you can find the features you need

- Can try the service for free during the 30-day trial period

- Offers its own private investigator to help you with restoring your identity

- Allows you to set up two-factor authentication

- Allows you to select the precise types of alerts you receive via email

- Offers explanations of features and terminology on almost every page

- Offers all of its most important and best features in every pricing tier

- Gives subscribers access to all three credit bureaus in the upper pricing tier

- Mobile app provides the basic features that you’ll want

- Displays detailed information about registered sex offenders in your area

Cons:

- Signup and account activation processes are needlessly complex

- Two-factor authentication does not allow you to receive text messages or use an authenticator app as the means of secondary notification (email only)

- It’s difficult to find a list of all the services IDShield offers

- Cancellation of the service is a challenging process

- IDShield does not pull your credit reports into the web browser or access them for you

- IDShield does not freeze your credit for you

- You have to enter quite a bit of information to receive dark web monitoring protection

- No refund if you cancel before your subscription period expires

- Must agree to auto renewal payment process

- No discount for choosing the annual subscription plan versus the monthly plan

IDShield: Our final verdict

Through my hands-on review of IDShield, I found plenty of positives and negatives. It provides the basic services as promised at a reasonable price point, but it also has a number of oddities that give me pause.

Let’s start with some of the oddities. The signup process and account activation process are nowhere as streamlined and simple as they should be. The need to sign up and pay for the service before needing to come back later and activate your account is going to confuse quite a few newcomers.

If you are someone who is a bit leery about sharing your personal information and credit card number with an ID theft protection service, the odd way you must go about activating your account with IDShield is going to fuel your concerns.

Additionally, IDShield doesn’t automate a lot of services I would expect it to do for you. For example, when you are seeking a free credit report, IDShield tells you how to order one, but it doesn’t just do it for you. It also doesn’t freeze your credit for you. These seem like simple tasks that you should receive with your subscription cost.

Finally, IDShield’s cancellation service is more challenging than it needs to be. To be fair, the majority of identity theft protection services don’t make canceling easy, but IDShield complicates the process more than it should by requiring written notification.

I do like the clean user interface found with IDShield. It offers the basic services and features that you would expect to receive with an ID theft protection service, so if you can put up with the oddities, it will serve you well. Having a 30-day money back guarantee with IDShield is a nice feature as well.

I also appreciate that IDShield gives you the option of receiving monitoring from all three credit bureaus for a very reasonable price. With all three bureaus in play, the chances of receiving an alert about an odd situation regarding your personal identity will be greater than with only one credit bureau available.

Should you suffer identity theft, IDShield promises to assign your case to a private investigator to help you restore your identity. It promises to give you a full identity restoration. Ultimately, this is the reason you probably are subscribing to IDShield, so it’s nice to have this kind of guarantee.

Bottom line: IDShield does the basics well, and it has some extra services that will be helpful in certain situations, such as providing alerts if a registered sex offender moves nearby. It does have some strange complexities, though, which likely will frustrate newcomers. Because of my extensive experience working with identity theft protection services, the oddities with IDShield didn’t bother me as much as they may bother a newcomer to this type of service. I like IDShield’s price point, especially versus a more well-known service like LifeLock, but its oddities and unnecessary complexities leave it lagging behind some other options.

Our testing methodology for identity theft protection

I believe it is extremely important to perform hands-on usage when I am testing the best identity theft protection services. Although it might be easier to simply read the marketing materials from these ID theft protection services and come up with a review, it wouldn’t be as useful for readers or as accurate as actually testing the services.

Through these reviews, I want to be able to show you exactly how the services work – warts and all – and help you decide whether you want to spend the money on them. I’m also trying to help you figure out if the services are easy to use and if they deliver what they promise. I can’t do that by simply reading marketing materials or by making use of a demonstration account with fake information that the company provides.

Additionally, I test the customer service response times and attempt to determine how well they will help you when you are facing a tough situation related to your personal identity. When you are paying for a subscription, you want to have confidence that someone will pick up the phone when you call for help.

As I mentioned previously, I paid for a subscription to IDShield myself, and I entered my personal information into the system. I wanted to attempt to use the service in the same manner that you would use it.

FAQs

Is IDShield worth the money?

IDShield certainly offers its services at a very comparable price point to other ID theft protection services, especially considering you can gain access to reports from all three credit bureaus. It also offers up to $1 million of payments to reimburse you for expenses and losses you have related to identity theft. However, I cannot tell you whether IDShield is worth the money for your personal situation. You will need to determine whether IDShield’s features are valuable for you and whether the service fits in your budget.

Should I trust IDShield?

IDShield began operation in 2015, so it has several years of operation in the books. Although IDShield is not as well known as some other identity theft protection services, it does have the backing of LegalShield and PPLSI, which date back to the early 1970s.

How do PPLSI and LegalShield relate to IDShield?

PPLSI and LegalShield are part of the same ownership group as IDShield.

Is IDShield’s customer service any good?

IDShield offers customer service via telephone during the hours of 7 a.m. to 7 p.m. Central time. If you attempt to call outside of these hours, you will not be able to access customer service. IDShield does offer 24-hour emergency care by telephone for those who believe they may be an identity theft victim. During my calls to test the customer service features, I connected with someone within a few minutes nearly every time.

Is IDShield better than LifeLock?

I have extensive hands-on experience with both LifeLock and IDShield. But deciding which service is better will really depend on what you are hoping to receive from the service. If you are looking to save money, while receiving the basics, IDShield is the better choice. However, if you want a smoother user experience and some features aimed at those with complex financial lives, LifeLock likely is the better choice, despite a significantly higher price in year two and beyond.

Should I get ID theft protection?

I cannot give you a surefire recommendation about whether you should purchase an ID theft protection service. Deciding to purchase a subscription to a service like this really depends on your personal situation and budget.

For starters, you can duplicate on your own many of the features that ID theft protection services do for you. You can keep a close eye on your credit reports, looking for entries that seem out of place. You can freeze your credit report to prevent anyone from opening a new line of credit in your name. You can be extremely careful about sharing personal information on the internet.

If you don’t feel comfortable monitoring this information on your own, or if you simply don’t have time to do it, then paying an ID theft protection service to do the work may appeal to you.

Another reason why identity theft protection services are popular is because the majority of them offer reimbursement for expenses and losses if you suffer identity theft. They also provide guidance on how to proceed if you suffer identity theft. This is a valuable service, as most would struggle to know where to start.

If you have children, you probably are not keeping a close eye on their credit reports, which means you may miss a warning sign that an identity theft protection service may catch. Senior citizens who no longer take out loans also may not monitor their credit as closely as working adults, meaning an ID theft protection service can be helpful.

I often find that people have a misconception about what identity theft protection services do for them. It’s important to understand this, so you can make an educated decision on whether you want to purchase a subscription.

The ID theft protection service does not guarantee that you will not become a victim of identity theft. The service tries to alert you when it finds your personal information in an odd or dangerous situation, but this alone does not prevent identity theft. You must take steps to change passwords or security questions to prevent hackers from being able to use this information against you.

If you suffer identity theft, the protection service will attempt to help you restore your identity. Even so, you may need to hire accountants, lawyers, and private investigators on your own to try to restore your identity. In other words, subscribing to these services does not fully prevent identity theft, and the service will not take all the steps to restore your identity for you.

Some other aspects of subscribing to an ID theft protection service can be frustrating. You may receive marketing emails on a regular basis, asking you to purchase extra services or to jump to a higher priced subscription tier. Additionally, canceling these services sometimes can be a significant hassle.

It is important to understand that identity theft protection services are not perfect. They will serve some people well, but some people really don’t need to purchase a subscription, because they can duplicate the services themselves.

You should always approach an identity theft protection service with some caution and skepticism. Take the time to study how they work and the services they provide, rather than relying on marketing materials. Think about the pros and cons of these services, rather than focusing only on the benefits. You then can make an educated decision about whether you want to subscribe.