Your bank account is constantly attacked, even if you don’t realize it. Cyber threats are evolving alarmingly, with hackers constantly developing new methods to breach security systems and steal financial data. This makes online banking security a good idea and an absolute necessity.

Are you doing enough to protect your hard-earned money from these ever-present dangers?

This guide cuts through the technical jargon and complexity, providing practical, easy-to-understand steps and essential tools to secure your finances while banking online. Don’t wait until it’s too late – take control of your online security today.

Tips for secure online banking

- Strong passwords: Your first defense is a solid password. Mix at least 12 letters, numbers, and symbols to make it tough for hackers to guess. Don’t use common words or phrases.

- Two-factor authentication (2FA): Add an extra security layer with two-factor authentication. This could be a code sent to your phone or generated by an app. 2FA makes it much harder for someone else to access your account, even if they steal your password.

- Check your accounts regularly: Keep an eye on your transactions. Regular checks can help spot anything odd and fast. Set up alerts to stay informed of any transactions.

- Use secure connections: Public Wi-Fi isn’t safe for online banking. Use a private connection or a VPN like NordVPN to encrypt your online activity, keeping your data confidential.

- Update your devices: Keep your software and devices up to date. Updates fix security gaps that could let hackers in.

Essential security tools

While many best practices exist, various tools can further bolster your online banking safety.

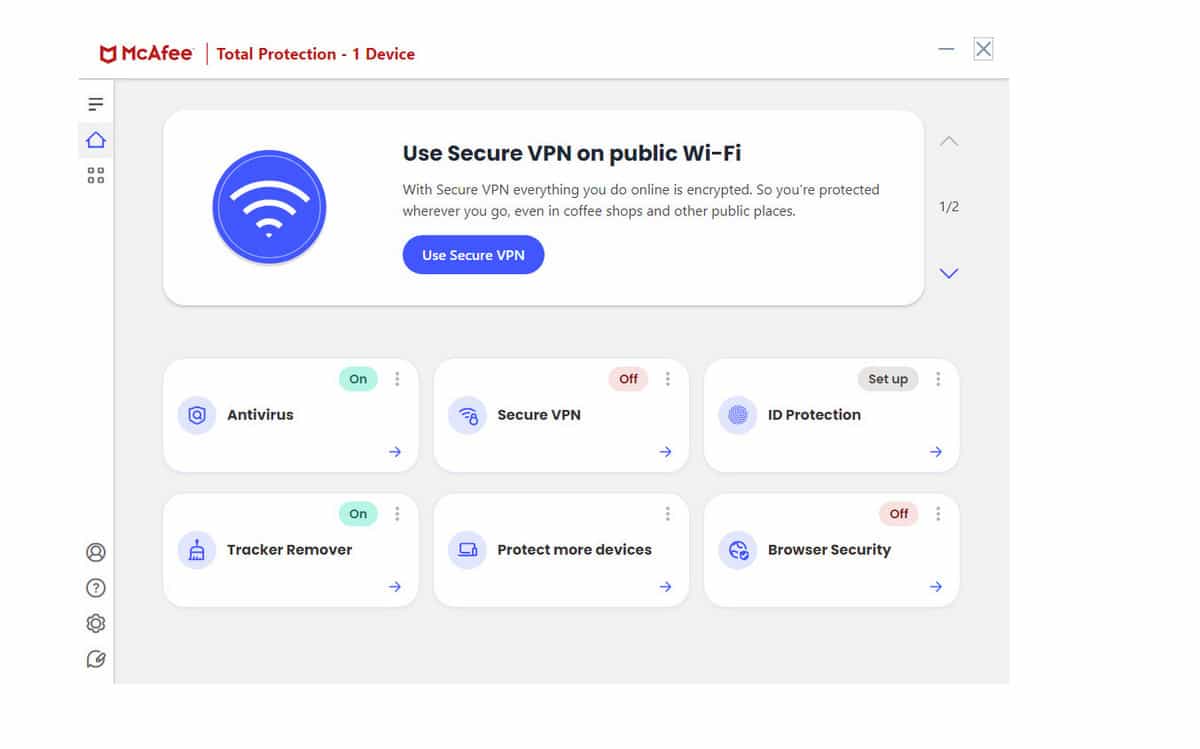

Antivirus

Ensure your device remains clean of malware, ransomware, spyware, and other threats like keyloggers that could allow a hacker to spy on your online banking activity. Antivirus software scans your system for existing threats and prevents new malware from infecting your device with real-time scanning. A typical antivirus regularly updates its malware definitions database to keep up with the latest threats.

Antivirus programs are primarily designed for Windows PCs, but you can find them for MacOS and Android. iOS antivirus programs are more limited.

WANT TO TRY THE TOP ONLINE BANKING ANTIVIRUS RISK-FREE?

Surfshark One is offering a fully-featured, risk-free 30-day trial if you sign up on this page. You can use the #1-rated antivirus for online banking with no restrictions for a month.

There are no hidden terms—just contact support within 30 days if you decide Surfshark One isn't right for you, and you'll get a full refund. Start your Surfshark One trial here.

VPNs

A Virtual Private Network (VPN) keeps your internet connection private. It routes your internet traffic through an encrypted tunnel, away from your ISP and hackers looking to snoop on your online banking activities. VPN apps are available for almost any device, so you can secure your connection to the bank while on the go or on unsafe public Wi-Fi hotspots.

Authenticator apps

The most common form of two-factor authentication is a one-time code sent via SMS or email, which is not optimal for security. Authenticator apps are both more secure and easier to use.

Microsoft Authenticator, Google Authenticator, and Authy are some of the most widely used authenticators. These apps sync with the service you intend to log into. The app generates a temporary code, which you are prompted to enter upon login.

Staying safe while banking online means being proactive about your security. With these tips and tools, you can keep your financial information protected and enjoy the convenience of online banking without worry.

How to recognize and avoid phishing scams

Phishing remains a prevalent threat to online banking security. Cybercriminals use deceptive tactics to trick you into revealing sensitive information, such as login credentials, account numbers, and personal details. Being aware of these tactics is crucial for protecting yourself.

One common phishing technique involves suspicious emails and messages. These messages often mimic legitimate communications from your bank or other trusted institutions. They may contain urgent warnings about account issues, requests to verify your information, or enticing offers. Never click on links or open attachments in emails or text messages from unknown or suspicious senders. Legitimate banks will almost never ask for your login credentials or other sensitive information via email or text. If you receive a suspicious message, contact your bank directly using their official website or phone number to verify its legitimacy.

Another common tactic involves lookalike websites. Phishers create fake websites that closely resemble legitimate banking websites. These websites often have similar logos, layouts, and branding, making it difficult to distinguish them from the real thing at first glance. Always double-check the website address (URL) in your browser’s address bar before entering sensitive information. Look for the “https://” at the beginning of the URL and a padlock icon, which indicates a secure connection. Be wary of slight variations in the URL or unusual domain names.

Be equally cautious of unexpected phone calls. Cybercriminals may impersonate bank representatives or other trusted officials to trick you into divulging your information over the phone. They may use scare tactics or urgent requests to pressure you into acting quickly. Be extremely wary of unsolicited phone calls claiming to be from your bank or any other financial institution. If you receive a suspicious call, hang up immediately and contact your bank directly using their official phone number, which you can find on their website or on the back of your debit or credit card. Never provide personal or financial information over the phone unless you initiated the call and are certain of the recipient’s identity.

Secure online banking FAQs

Can I use the same password for multiple accounts?

It’s best to use a unique password for each account. If a hacker discovers one password, they might attempt to use it on your other accounts. This attack is called “credential stuffing”. Use a password manager to securely generate and keep track of different passwords.

Are public Wi-Fi networks safe for online banking?

It’s advisable to avoid using public Wi-Fi for online banking due to potential security risks. If you need to access your bank account on the go, use a VPN to secure your connection.