Many people now prefer streaming shows, movies, sports, and events to watching them on traditional TV. It should come as no surprise that this applies to music as well. From Netflix to YouTube to Spotify, streaming services operate in almost every country, though as we’ll see, certain platforms do better in some locations than others.

As streaming becomes increasingly popular, we’re given access to a massive amount of data that can be used to help quantify the growing trends that promise to bring an end to traditional entertainment avenues. In this post, we reveal recent facts and statistics that help paint a picture of the video and music streaming industries.

Video streaming stats and facts

As internet bandwidth and speeds increase, streaming video is becoming a viable option for more consumers across the world. In many countries, users can now stream all of their favorite video content, from live TV to on-demand video. Here are some of the most eye-opening stats from 2018–2024 that help illustrate the current trends in video streaming.

1. Netflix is starting to lose ground to other streaming services

While Netflix has long been considered the streaming service to have, other providers have been eating into its userbase. For instance, Disney+ had over 150 million subscribers as of Q4 2023, though Max was hot on its heels with 95 million. Meanwhile, Paramount+ had a fantastic year, ending Q3 2023 with around 63 million paying subscribers.

2. Netflix still has roughly 247 million subscribers

Don’t worry: Netflix isn’t going away anytime soon. By the end of 2023, this service had 247,400 million subscribers (spreadsheet), with the majority (83,760) spread across Europe, the Middle East, and Africa.

The closest competitor is Amazon Prime Video which also has more than 200 million members, although since this is rolled into its standard Amazon Prime membership, it doesn’t give a clear indicator of how many people use the streaming service. Another prominent player is China’s dominant streaming service, iQIYI, which has around 128 million paid subscribers.

3. YouTube has 2 billion monthly active users

More than two billion logged-in users access YouTube every month. The platform has over 30 million daily users watching over a billion hours of video every day, with the platform’s TikTok rival, YouTube Shorts, averaging around 70 billion views per day.

YouTube’s Android app has over 10 billion installs and the iOS version was one of 2022’s 10 most downloaded apps from the App Store.

4. Disney will spend around $25 billion on content in 2024

In 2024, Disney will spend approximately $25 billion on content, which is actually a pretty steep reduction from 2022, when it invested over $33 billion. To put this in context, Netflix has an expected annual spend of $17 billion on original content in 2024.

5. We each spend over an hour per week just looking for something to watch

Nielsen’s 2023 State of Play report found that, on average, consumers spend 10 minutes, 30 seconds per day trying to decide what to watch. That’s a 41 percent increase in browsing time since 2019 and worse still, one-in-five eventually give up and do something else entirely!

So what has caused this? Well, there are multiple factors. For instance, there are far more streaming services to choose from, and many of these offer dozens of channels to flip through. In the US alone, consumers have access to more than 30,000 channels if they subscribe to every streaming platform.

6. Ad-supported streaming is the future

Nielsen’s 2023 State of Play report also noted that Free Ad-Supported Television (FAST) is quickly gaining ground on subscription streaming services.

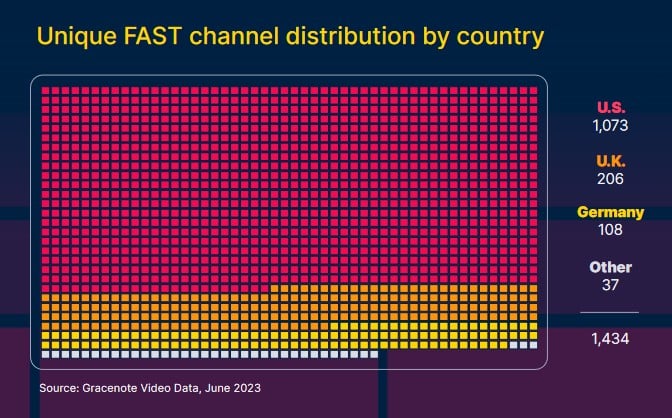

Pluto TV might have started the craze but in 2024, we’ll see rapid expansion of Amazon Freevee, Xumo Play, and Plex TV. At the moment, the US leads the pack with roughly 1,000 free channels available, though British viewers have access to 200, and Germans can stream over 100.

Ad-supported services now account for over one-third of the total time spend streaming, and with providers increasing their prices, it’s likely to become even more popular.

7. Collectively, we’re streaming more than ever

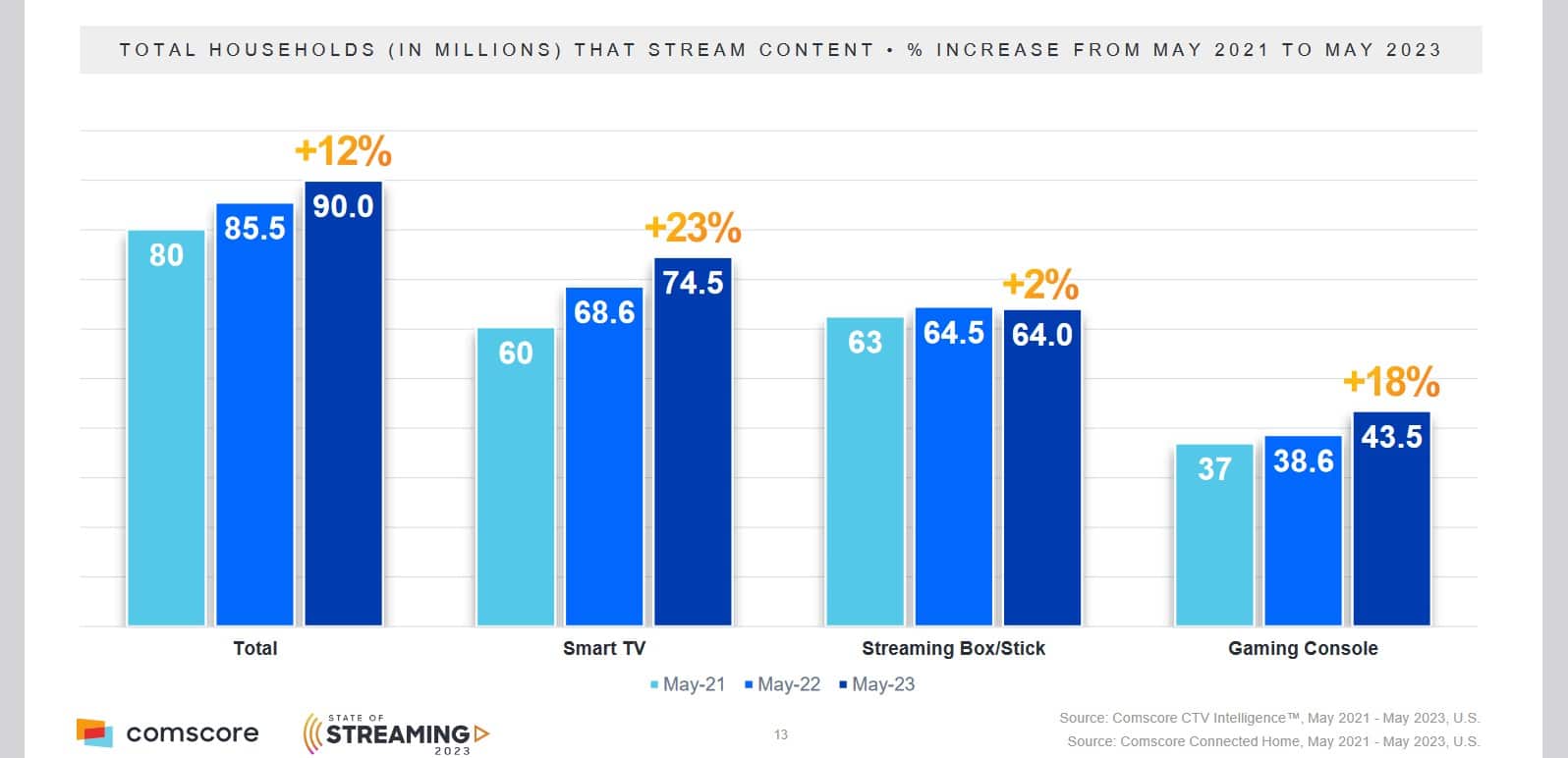

According to Comscore’s latest State of Streaming report, streaming has seen growth of 130 percent since 2019. Moreover, a full 90 percent of American households now stream content in some way or another.

Of these, the majority (74.5 percent) watch via their Smart TV. Streaming stick usage has barely changed over the last three years, with 64 percent of households watching this way. Meanwhile, streaming via a games console has become significantly more popular, jumping to 43.5 percent adoption.

8. The global streaming market will be worth upwards of $1.9 trillion by 2030

According to Fortune Business Insights, the global streaming market was worth 455 billion in 2022, with an expected growth of around 19.3 percent per year until 2030, when the industry would be worth $1.9 trillion. That’s a significant increase from prevous forecasts, which placed the industry value at around $184.3 billion in 2027.

9. Netflix branches out in a bid to keep subscribers

Netflix has continued to crack down on password-sharing, having previously trialled this in a handful of locations. However, while it seems to be a deeply-unpopular move, Forbes reports that the number of new users has offset the higher-than-average number of cancellations.

No doubt concerned by the recent flood of cancellations, Netflix has decided to add several new features to its business model. First off, it has begun including fairly high-profile games such as Into the Breach with its regular subscriptions. Additionally, it’s allowing users to continue sharing their passwords for a small additional fee (though time will tell how well this is received). Finally, it introduced an ad-supported tier in early 2023 and intends to expand this into additional territories.

10. The most-watched shows rack up billions of streaming minutes

Nielsen’s insights report showed that Netflix is very much running things in the TV department. It swept the top ten “most minutes streamed” list, and most interestingly, only needed five TV shows to do it, with each title seeing a resurgence shortly after its release. Outer Banks lead the pack, accounting for 88,000 hours of watchtime on its own — that’s more than 10 years.

The State of Streaming report found something interesting, though. While new shows certainly attract a huge amount of attention, they’re not what most people gravitate to. Classic shows like Grey’s Anatomy and Gilmore Girls account for more than half of all consumption by Americans between 18-34.

11. Disney’s monopoly on movies is slipping

In 2022, Disney+ had all 10 of the most-streamed movies. In 2023, it had just six — still an impressive number for a single distributor but undoubtedly a problem. Netflix picked up the other four, taking the top spot with Glass Onion: A Knives Out Mystery, which accrued more watchtime than Disney’s The Little Mermaid remake and Elemental put together.

12. Consumers are feeling the squeeze

Deloitte’s Digital Media Trends Survey, 17th edition revealed that around a third of all consumers have cancelled an entertainment susbcription in the last six months with the express goal of saving money.In most cases, this involved switching to an ad-supported service instead. Notably, just 11 percent chose to downgrade from a paid plan to a less expensive, ad-supported version of the same service.

13. Desktops are no longer popular choices for streaming in Asia

In previous years, people in Asian countries tended to stream significantly more on their PCs than anyone else in the world. However, the Conviva Q1 2022 report shows that this is on the decline. PCs now account for seven percent of viewing time, down from 49 percent in 2021. Most streaming is now done on mobile, with 45 percent, followed by big screens (such as a TV) at 43 percent. In last place was tablets which accounted for just five percent.

14. Users subscribe to an average of 2.6 video streaming services

Deloitte found that the average person is subscribed to 2.62 paid video streaming platforms. However, around one-third share their subscription with friends, and a full half say they’d cancel if account-sharing was forbidden. Only 15 percent said that they’d sign up for themselves.

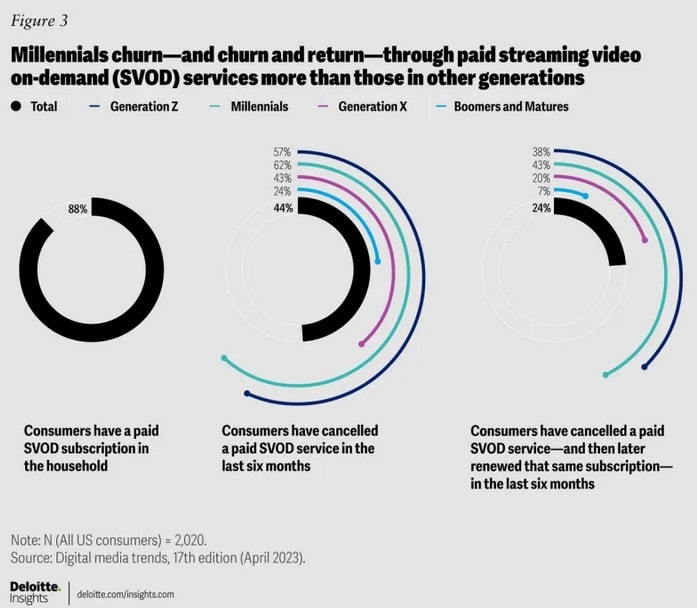

15. Younger consumers tend to cancel and resubscribe

Deloitte’s 2023 Digital Media Trends report shows that the younger a customer is, the more likely they are to cancel and resubscribe at a later date. It could be that these generations have less disposable income and so simply sign up to binge a handful of specific shows at a time.

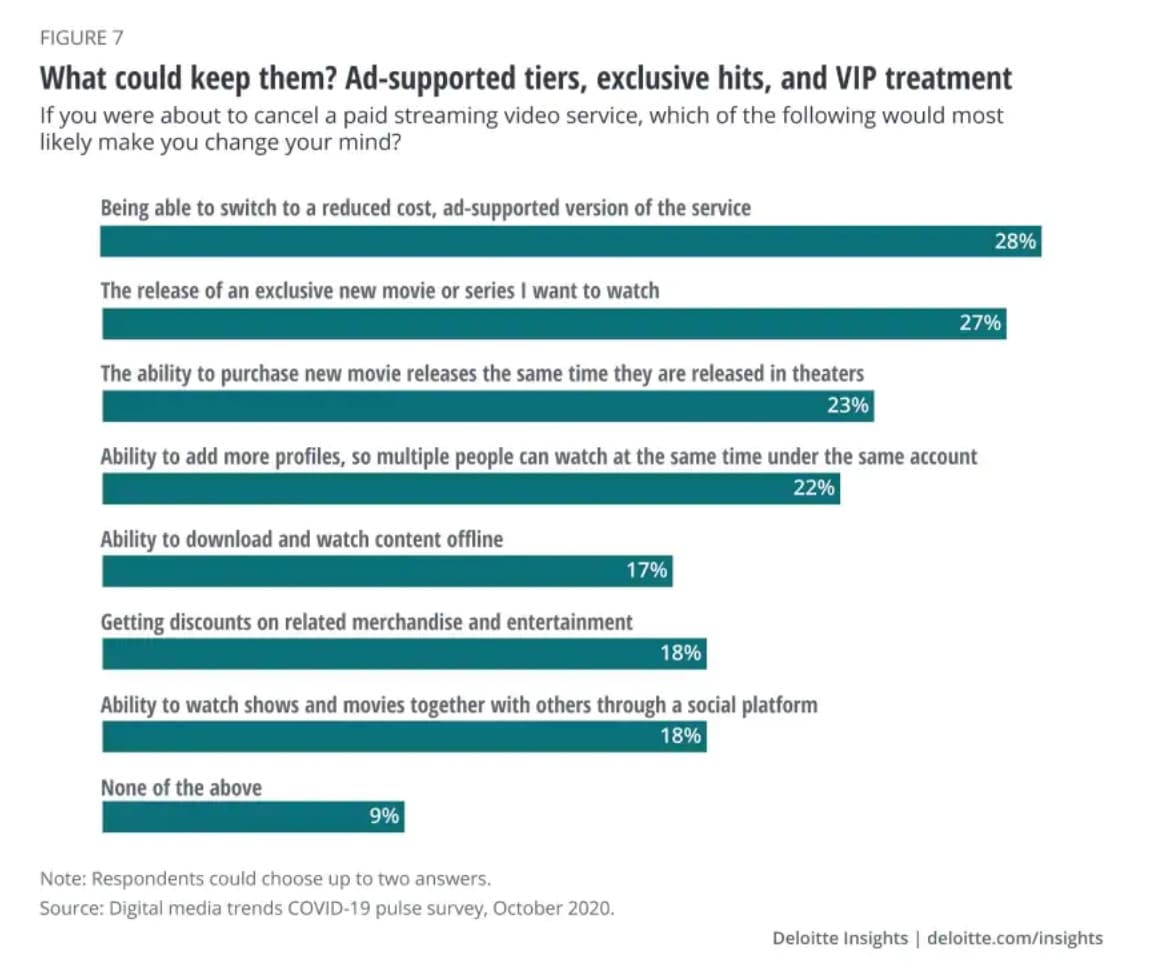

16. Access to original content is a top reason for staying subcribed

Deloitte found that one of the major reasons viewers continue to pay for streaming services is to access movies and shows that aren’t available elsewhere. 27 percent of users cited this as a top reason, with the only more popular answer being to pay less for an ad-supported version.

17. Too many ads push viewers away from pay TV

Previous Deloitte reports have found that having to sit through too many advertisements is one of the reasons viewers are opting for streaming services. 44 percent of consumers cited an ad-free experience as being a top reason for using streaming services. Ads make up a whopping 20 minutes out of every hour of TV. 75 percent of viewers think this is massive overkill and 82 percent express frustration with having to see the same ads time and again.

That said, due to the increasing cost of living, consumers are looking for ways to save money. According to Dive Brief, 57 percent of customers would prefer an ad-supported service, so long as it cut a meaningful amount from the monthly price.

18. TikTok was the most popular video streaming app

According to data.ai’s State of Mobile Report 2023, TikTok became the most popular entertainment app in 2022. Previous winner YouTube was unceremoniously kicked out of the top 10, though it did still rank highly on customer spending.

19. TikTok’s monetization is second to none

The statistics in the data.ai report combine numbers from the iOS App Store and Google Play Store. TikTok was far beyond its rivals in terms of consumer spending, becoming the second app ever (after Tinder) to reach $6 billion. In fact, in the US, it generates around $0.85 per user, per month. This doesn’t sound like a lot, but Snapchat has the second highest average monthly revenue per user, and that only makes five cents from each.

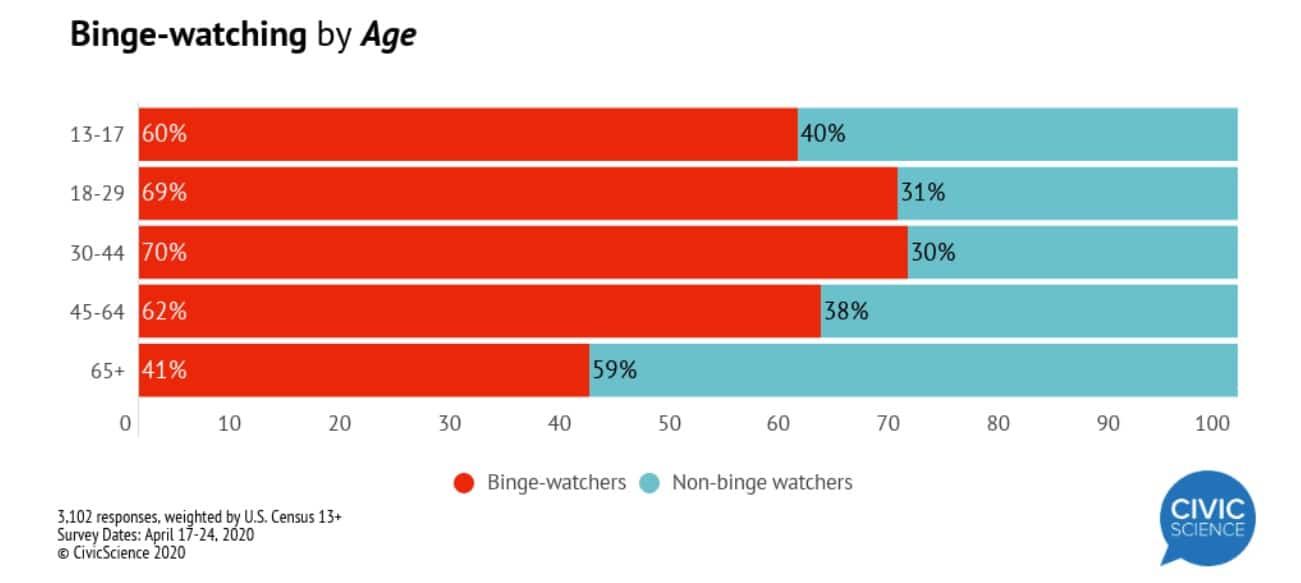

20. Gen Z and Gen Y are twice as likely as Pre-boomers to binge-watch shows

A 2020 study by Civic Science found that more than half of its respondents between the ages of 13 and 64 binge-watched shows. Millenials and Gen X adults had the highest rate of binge-watching, at 70 percent. Meanwhile, only 41 percent of people over 65 said they do the same.

Music streaming statistics

Music streaming is now bigger than ever, with billions of dollars going into the music streaming industry every year. Most music fans are now using subscription-based streaming services such as Spotify and Apple Music, but video services like YouTube are also massive sources for music fans. Here are some key stats that help show how the industry is progressing.

21. Americans collectively streamed about 1.3 trillion songs in 2022

The music streaming biz hit a huge milestone on November 25, 2019. This was when number of audio and video-on-demand music streams in the US since the start of the year hit the one trillion mark. Having climbed to 1.13 trillion in 2021, this grew 12.2 percent to reach an unprecedented 1.3 trillion in 2022.

On-demand audio song streaming accounted for the majority (1.1 trillion) of the 2022 streams, although video represented a large chunk (200 billion). This shouldn’t come as any surprise, given that music streaming services gain roughly 120,000 new tracks per day, up from 93,400 in 2022.

22. Streaming grew by nine percent in 2022

According to a 2022 IFPI report, the global music industry increased by nine percent that year. That’s no small feat given that this marked its eighth consecutive year of growth. Additionally, music streaming services saw a jump in growth of 10.3 percent!

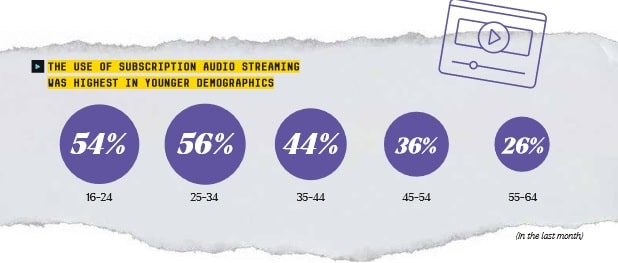

23. Nearly 40% of 35-64 year-olds streamed music in the past month

A 2022 study from IFPI found that Gen Z and millenials were most likely to be subscribed to a music streaming serivce, but older generations are moving away from radio as well. In fact, over a quarter of people aged between 55 and 64 had streamed music in the last month.

24. Instant access to songs is a top reason for choosing paid streaming services

The top three reasons IFPI found for users adopting a premium music streaming service in 2022 were:

- Ad-free listening

- Being able to choose what music to listen to

- Access to large libraries of songs

25. Sweden has the largest percentage of paid subscription streamers

A large portion of music listeners in many global markets are turning to streaming to get their fix. However, the popularity of paid subscription streaming is most pronounced in Sweden, where 56 percent of music listeners did so via paid services. The other top five countries included the UK (52 percent), the USA (51 percent), Germany (51 percent), and Mexico (50 percent).

26. Older generations are less likely to stream music

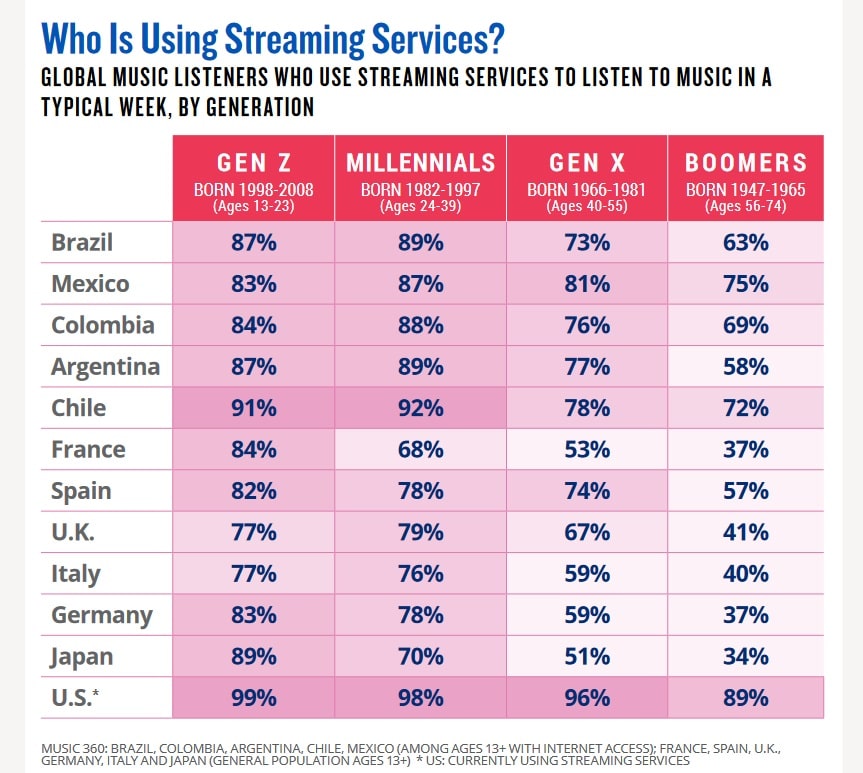

Billboard’s 2021 year-end report gives us a good look at how different generations stream music. As you might expect, Gen Z leads the way with more than three-quarters of respondants using music streaming services, regardless of location.

What’s particularly surprising is that almost 90 percent of American boomers do too. It’s hard to overstate how much of an outlier this is, given that the average adoption rate for this age group is just 56 percent. In fact, in Japan, only 34 percent of people over the age of 56 rely on streaming services for music.

27. Spotify is the most-used music streaming app globally

According to Midia Research, Spotify is the most popular streaming app in the world, accounting for 30.5 percent of all subscriptions. Apple Music is in a distant second place with 13.7 percent, while Tencent Music accounts for 13.4 percent.

According to Spotify’s most recent financial statements, it has 515 million monthly active users, up 26 million from last quarter, with 210 million Premium subcribers. In other words, 40 percent of people who use this service choose to pay for it.

28. Bad Bunny had the top-streamed album two years running

IFPI’s annual Global Music Report offers up a ton of information about the music streaming scene. For instance, it lets us know that Bad Bunny’s Un Verano Sin Ti was the most popular album, having been streamed 4.2 billion times in 2022 and a further 4.5 billion in 2023.

29. Drake rules as the most-streamed artist of the 2010s

Drake racked up a total of 36.3 billion on-demand streams over the course of the decade. Although Post Malone did well to come in at second place, he was way behind with 18.9 billion streams. Rounding out the top three was Eminem with 17.8 billion streams. However, 2021’s most streamed artists were Bad Bunny, Taylor Swift, and BTS.

30. Miley Cyrus’ “Flowers” was the most-consumed song of 2023

With 1.6 billion streams, “Flowers” by Miley Cyrus was the top song of the year. Other hits included “Kill Bill” by SZA and last year’s top song, “As It Was” by Harry Styles.

31. More than 45 percent of people find new music while gaming

Deloitte’s 17th digital media trends survey revealed that 49 percent of people discover new music while playing games.

So what does this mean for creators? Simply, there’s a huge market out there that isn’t hearing your music, even if it’s being played on the radio. In fact, the Undertale soundtrack accounts for almost 950,000,000 streams on Spotify alone, and Minecraft‘s soundtrack has almost 800,000,000 streams.

32. Unlicensed streaming remains a problem

According to IFPI, around a third of people reported having used illegal methods to download and listen to music. This includes 43 percent of people under the age of 24.

33. Different regions have their own preferences

While the most popular genres in 2022 were pop, rock, hip-hop, and dance, there are around 500 genres for music lovers to choose from. More interestingly, these differ in popularity from one place to another.

It likely wouldn’t surprise you to learn that the US loves motown and that Japan has a huge audience for anime music. However, did you know that Canadians are big fans of goregrind or that in the UK, shoegaze is having a resurgence? One interesting nugget of information from IFPI’s report is that on average, users in India spend 25.7 hours each week listening to music.

34. Audio streaming companies seek to branch out

In 2022, Spotify acquired Findaway, an audiobook platform, as well as Sonantic, an AI service that it plans to use for text-to-speech services. It then introduced an AI-powered DJ and the ability to purchase audiobooks directly from the app.

Meanwhile, Apple Music has introduced a time-synced lyrics feature, and Amazon Music reworked its service to make all of its music free to Prime subscribers.

With so many large companies innovating their products, companies in the music streaming space cannot afford to stand still, even if they’re currently on top. After all, there are plenty of alternative options for users to try.

See also: Cord-cutting statistics 2023