“Cord-cutting” is a fast-growing trend among US residents. It involves “cutting the cord” on high-cost pay-TV options, including cable TV and satellite TV. However, cord cutters aren’t ditching TV altogether. Instead, they’re shifting to lower-cost online streaming options, like on-demand giant Netflix and Google’s YouTube TV.

Although cord-cutting is still in its infancy compared to traditional methods for viewing content, its rapid and expanding growth in the past several years means there are plenty of cord-cutting stats and trends available. Here are the most startling and interesting cord-cutting facts for the current year and beyond.

1. Major cable providers collectively lost 6 million pay-TV subscribers each year between 2019 and 2022

Cord-cutting is responsible for leading cable TV providers losing millions of customers they can’t seem to win back. In fact, traditional pay-TV providers lost around 6 million pay-TV subscribers each year from 2019 to 2022. This trend seems set to continue, with more than 4.5 million customers leaving in the first three quarters of 2023 alone.

Most cord-cutters are not just ditching live TV for all on-demand, however. The majority are instead moving to all-digital live TV streaming services, such as Sling TV, YouTube TV, fuboTV, and Hulu + Live TV.

The largest traditional cable TV providers experiencing subscriber losses include:

- Comcast: This company had 18.55 million video customers in Q3 2021. However, Q3 of 2023, it lost more almost 500,000 and now sits at around 14.5 million customers

- Verizon: Subscriber numbers for this company have decreased every quarter since Q4 2016. The company lost more than 70,000 Fios TV subscribers in Q3 2023 alone and now sits at around 3 million overall — less than half of what it had just a few years ago.

- Charter: This organization is now losing tens of thousands of video customers each year. Its CEO blames higher carriage fees imposed by programmers as a key trigger for customers who are moving on to cord-cutting services. This network has an abysmal 2023 so far, with over 320,000 customers cancelling in the third quarter alone — in other words, the company is losing subscribers even more quickly than last year, which was already a record pace.

- DirecTV (satellite): This AT&T-owned company lost an estimated 500,000 satellite TV subscribers in Q3 2023. This makes it the biggest loser out of any major network, beating Comcast by around 10,000 cancellations.

- Dish Network: The second-largest cable TV provider in the US has also seen its customer share dip. Dish Network lost 180,000 net pay-TV subscribers in Q3 2023, a slight reduction since the previous quarter.

Many Americans still maintain both traditional TV and cord-cutting services. However, due to the ease with which you can cancel a streaming service, churn is noticeably higher. In fact, in 2023, a quarter of all consumers cancelled a paid entertainment service to save money. (Deloitte)

2. The average monthly cable TV bill is now $118 per month

According to the FCC’s 2018 Report on Cable Industry Pricing (the latest as of this time of writing), the average cost of expanded basic cable services was just over $73.08. That number, however, does not include the cost to purchase or rent equipment from cable TV providers, nor does it include the cost of taxes and fees.

Now, it’s worth bearing in mind that this data is several years old, and the TV landscape has changed dramatically since then. In April 2023, Allconnect released a report claiming that the average combined cable/internet bill was $118 per month. Interestingly, internet plans cost an average of $74.99 per month, so it appears that these days cable is being thrown in as a sort of extra, rather than being the main product.

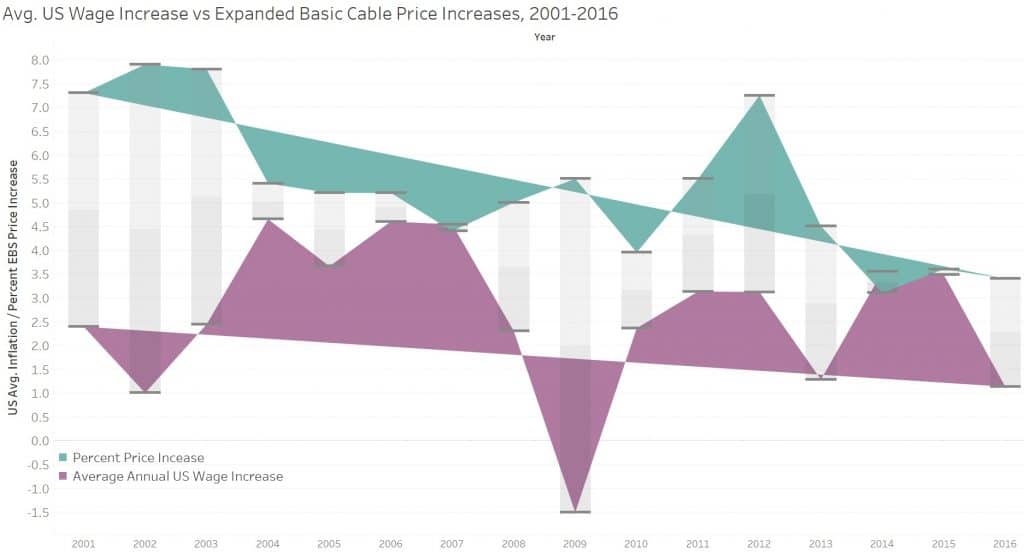

3. 2009 was the absolute worst year for traditional cable TV subscribers

A combination of price increases and decreasing wages led to 2009 being the worst year in the 2000s for cable TV subscribers.

Riding on the downwind of the housing market crash, there was a 7 percentage point gap between wage increases (negative 1.5%) and expanded basic cable price increases (5.5%). It wasn’t the only year with a huge gap (2002 saw a 6.9 percentage point gap, for example), but it was the only year where that gap was highlighted by wage decreases, versus just smaller percentages of wage growth.

As expected, we witnessed similar issues with inflation. There was a 6.9 percentage point spread between price increases and inflation in 2009 (and a 6.3 percentage point spread in 2002).

Wages and price increase percentages tend to be much closer together year-over-year. However, there is a promising trend we’ve seen happening with inflation, wages, and expanded basic cable price increases: the gap is tightening up each year.

Again, this is expected given wages and inflation are tied, but there are two takeaways as well, one negative, one positive.

Negative: Inflation and US wages always fall well behind traditional price increases. As such, Americans putting an ever-increasing share of their wages toward traditional cable TV.

Positive: The gap between inflation/wages and price increases is decreasing overall. Outliers like 2009 exist, but the overall average spread is declining. If trends continue, the average gap between price increases and wage/inflation increases could be around 0.6%.

4. Ads are becoming part of the streaming landscape

One of the biggest benefits of streaming services is that they greatly reduce the number of ads you see. However, as the price of these subscriptions increase, consumers are becoming more willing to tolerate ads in exchange for cheaper (or even free) TV.

Deloitte’s 2023 Digital Media Trends survey found that around 60 percent of respondents used a free, ad-supported streaming service, with 40 percent claiming that they watch more ad-supported content than they used to.

Ad-tolerance is also a huge issue. The 2022 report found that users in the US would rather pay $12 to remove all ads than sit through 12 minutes of ads in exchange for watching for free.

5. Live TV services come in and out of style

As subscribers abandon their traditional pay-TV providers, they’re now going into the open arms of live TV streaming services. Whether you call them “IPTV” (though that term is more regularly applied to illegal live TV streaming options) or Virtual Multichannel Video Providers (vMVPDs), there are now a handful of internet-based services on the market designed to replace cable and satellite TV.

Subscriber counts for the most-used cable TV replacers include:

- YouTube TV: Around 6.5 million subscribers as of Q3 2023 (an increase of ~200,000 since Q3 2022)

- Hulu: 48.5 million subscribers Q3 2023 (an increase of more than 300,000 from the previous quarter)

- Sling TV: 2.12 million subscribers as of Q3 2023, (up 117,000 since Q2 2023)

- FuboTV: 1.477 million subcribers, up 20 percent from the year prior.

- Philo: Over 800,000 subscribers as of Q1 2021 (an increase of ~750,000 since 2018)

Other services exist in this space, although their subscriber numbers are difficult to come by. The most notable is Vidgo. As for Philo, its numbers are also not regularly reported because, like Vidgo, the service is not publicly traded or part of a publicly-traded company and is not required to report that kind of data.

6. Some live TV service prices are up over 100% in two years

Even as cord-cutting options for live TV slowly make their way to market, their prices have gone up remarkably in the past few years. Almost every live TV streaming service that’s been on the market for more than a year has experienced at least one price increase. Most have imposed multiple price increases since launching.

Almost every live TV streaming service increased prices in 2020, with one major price increase that occurred at the start of 2021, and another increase mid-2021.

- DirecTV Stream: After phasing out its AT&T TV Now service, AT&T rolled its cord-cutting option into its broader AT&T TV offering. That also came along with a price increase that saw the base price rise from $65 per month to $69.99 per month. In late 2023, it jacked prices up again and now sits at $79.99 per month.

- YouTube TV: Google increased the price of its single live TV streaming package from $40 to $49.99 per month in 2019, and then up to $64.99 per month in 2020. In April 2023, this jumped 12 percent to $72.99 per month.

- Philo: Philo technically didn’t raise prices in 2019, but it did drop its $16 per month plan, leaving just its higher-priced $20 plan. However, on 8 June 2021, the company raised the cost of this package to $25.

- FuboTV: Every package available through fuboTV received a $10 per month increase in 2019, starting with its “Fubo” package which jumped from $44.99 per month to $54.99 per month. The company then reorganized its package offering in 2020, and again in early 2021 that resulted in the base price rising to $64.99 per month. In 2022, this increased a further $5 to $69.99 per month. 2023 saw TWO increases, first to $74.99, then $79.99 per month.

- Hulu + Live TV: Hulu increased prices on its Live TV service in late 2019 by $10 per month, raising it from $44.99 to $54.99 per month. Then in 2020, it increased prices again to $64.99 per month. In October 2022, the company raised the cost of its ad-supported plan to $7.99 per month, with the ad-free tier now costing $14.99 per month. The Live TV plan shot up two more times and is now more expensive than its rivals at $76.99 per month (though this also includes ESPN+ and Disney+).

- Sling TV: The company delivered its second price increase in its 5-year history in late 2019. Its Orange and Blue packages increased to $30 per month from $25 per month, while its combo package increased from $40 per month to $45 per month. Then in 2020 it increased prices again, this time to $35 per month for its Orange and Blue packages, and to $50 per month for its Orange+Blue package. At the end of 2022, this crept to $40 for either Orange or Blue, and $60 per month for both.

- Vidgo: Vidgo’s pricing history has been weird and chaotic since it first hit the scene in 2018. The base cost started at $39.99 for its English package, before dropping to $19.99 in 2019 when the company introduced a light package. Then the base price increased back up to $45 per month in 2020. As of 2023, the service costs $69.99 with some plans going as high as $99.99 per month.

Almost universally, these price increases were far from insignificant—especially for AT&T TV Now (now DirecTV Stream). That service increased its entry-point subscription price in 2019 by 30 percent compared to its price in 2018. Only the now-defunct PlayStation Vue service had more modest price increases across its packages.

Meanwhile, Philo remained the lowest-cost major player despite a pseudo price increase. The company dropped its smaller and cheaper package in favor of a single-package option.

Price increases for these services are almost always tied to demands from the channel providers. Carriage fees are increasing for cord-cutting services and traditional cable TV services alike as the channel providers they offer (local broadcast networks, in particular) ask for more money.

In fact, local broadcast network fees are up over 600 percent since 2006, while all TV network fees (local, premium, and cable networks) are up around 90 percent since 2009.

7. AT&T TV is over 50% more expensive than its competitors on the high end

The slow plod toward higher streaming service prices has caused a fair amount of hand-wringing. Few services have received as much ire or backlash for this approach than AT&T. Its DirecTV to AT&T TV Now to AT&T TV to DirecTV Stream name changes were already enough to cause some frustration among customers. But its consistent and exceptionally high price increases have really put customers off the service, leading to the massive subscriber losses we’ve mentioned earlier.

Based on our analysis, the company has consistently offered higher prices for its most expensive package since 2019.

You can use the table above to explore the data a bit further. When filtering by year, you’ll see that 2017 was a real break-out year for multi-channel streaming video providers hitting the market. And most, at that time, were still what we consider “middle cost” services with an entry point that was below $50 per month. When

Starting in 2019, however, services began breaching the “high cost” $50+ range. AT&T was the worst offender on that end, as its highest-tier plan leapt 57% in price, from $75 to $135. Then, in 2020, its base package also dramatically jumped in price, from $50 per month to $65 per month, a 26% increase. It’s hardly any wonder why the company also saw a heavy subscriber bleed that year, as well.

Our data also shows the dramatic difference between Philo and its competitors. The service continues to straddle between the “middle cost” and “low cost” range at $25 per month.

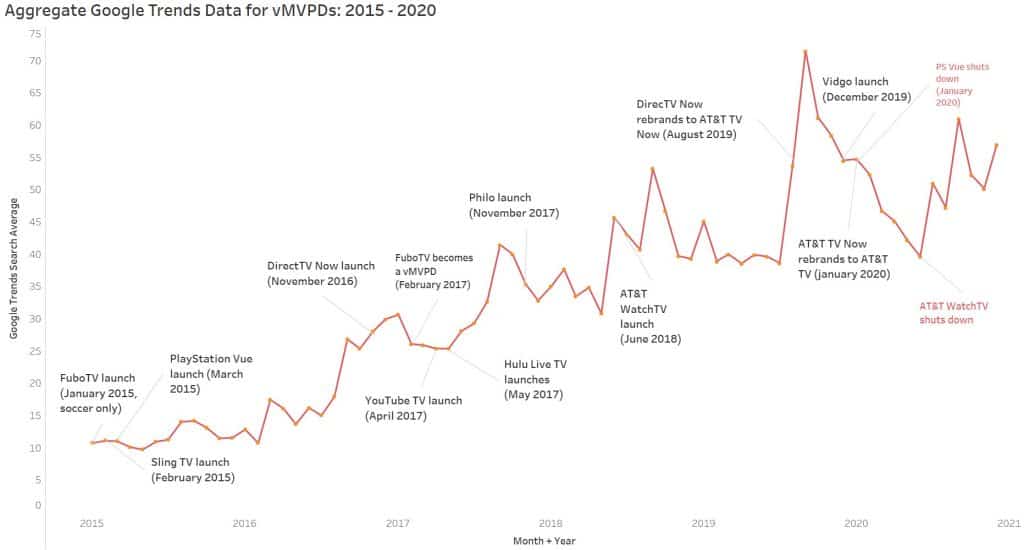

8. Search interest in vMVPDs is up 150% since 2015

Aggregated Google Trends data reveals that cord-cutters are increasingly interested in live TV streaming services, with no signs of stopping. In fact, aggregated search interest from 2015 to the end of 2020 for the 10 major vMVPDs to hit the market reveals search interest in these services was the highest it’s ever been in September 2019.

Sling TV was the first major cord-cutting service to launch on the market, offering an “a la carte” live TV model (although fuboTV preceded it by one month, but with a soccer-only streaming service). It was later followed by PlayStation Vue (also 2015). Meanwhile, 2017 was a breakout year for this niche as five out of the seven largest multi-channel streaming TV providers launched that year. The most recent major service launch was AT&T WatchTV, which entered the market in 2018. WatchTV was a direct response to the no-sports Philo.

Based on search trends, September appears to be when search interest in vMVPDs spikes, most likely due to this being the month the biggest services make major announcements or service changes.

Of the 10 major vMVPDs that have launched onto the US market since 2015, two have since gone out of business: PlayStation Vue and AT&T WatchTV.

9. YouTube TV is now the most-searched vMVPD on the market

Sling TV’s place on the market, combined with its successful marketing campaigns, helped it dominate in the OTT space for most of the past five years. However, increased competition is now eating away at its market share. This is evidenced both by Sling TV’s slowing subscriber growth rate, as well as the negative search interest it’s experiencing on search engines.

The real breaking point for Sling TV appears to have been late October/early November 2017, or around six months after YouTube TV officially entered the market. Google soft-launched its YouTube TV service in only a handful of major cities but rapidly expanded the service area by the end of 2017. YouTube TV’s search interest finally reached a sustained dominance over Sling TV in January 2019, the same month Google officially announced that its YouTube TV service was available everywhere in the US.

While YouTube TV completely dominates this space, every other service is now clamoring for the #2 spot. Philo and FuboTV have seen their presence grow but better-known providers, such as Sling TV and Hulu are noticably smaller than a few years ago.

10. The on-demand streaming market is getting fierce—and overcrowded

Netflix is currently the biggest over-the-top (OTA) on-demand streamer available for cord-cutters. The company was the first to successfully deliver a real on-demand streaming experience to subscribers, giving it an edge over the growing number of competitors. By Q3 of 2023, Netflix had over 247.15 million subscribers worldwide, buoyed by its newly-introduced ad-supported plans.

Now, there are hundreds of on-demand streaming services crowding the market (more than 300), all competing for a limited number of subscribers. One study found 70 percent of consumers think there are too many choices on the market right now, which is not good news for new entrants.

The most notable new players include:

- Disney+: Launched November 12, 2019, in select countries, with worldwide launches scheduled through 2023

- Apple TV+: Launched November 1, 2019, worldwide

- AMC+: Launched June 2020, select countries

- HBO Max: Launched May 2020, available in most countries

- Discovery+: Launched March, 2020, select regions

- Peacock (NBC): Launched July 15, 2020

- Discovery+: Launched January 4, 2021

- Quibi: Launched April 6, 2020

- Paramount+: Originally CBS All Access, rebranded and launched internationally in 2021.

Outside of this, cord cutting allows users to choose between over 100 different niche on-demand services. This market saturation has created what some observers are calling a streaming service bubble. When that bubble will burst, however, is difficult to predict.

Currently, most Americans pay for multiple streaming services, with 88 percent subscribed to at least one. However, 19 percent have swapped to an ad-supported service in the last six months, with a full quarter cancelling a subscription outright to save money. This may also be part of why free, user-generated platforms like TikTok have become so popular.

11. Cord cutters are attracted to original content

Companies like Netflix, Hulu, and HBO are in an arms race of sorts over original content. One analysis found that cord cutters are driven primarily by original content when they choose to subscribe to streaming services. However, as the State of Media and Entertainment 2023 notes: “a continued stream of content is required to retain and grow a subscriber base”.

This has had unintended consequences, though. As Nielsen’s 2023 report notes, “Audiences now spend an average of 10-and-a-half minutes searching for something to watch”. Perhaps more concerning for streaming companies, 20 percent eventually give up and find something else to do entirely!

12. On-demand streaming services respond by spending big on original content

The number of on-demand services in the market is helping to drive up original content spending budgets. Consumers are hungry for unique and original stories, and providers are trying to win subscribers by providing high-quality content consumers can’t find anywhere else.

The biggest original content spenders include:

- Netflix: The company spent $17 billion on content in 2021 and plans to keep spending at this level for the next few years.

- Apple TV+: Apple is spending roughly $7 billion annually on original content.

- Disney+: In 2024, the company is expected to spend around $25 billion on original content.

- Peacock: Comcast expects to spend $5 billion on content in the next few years.

- Amazon Prime Video: Since 2018, Prime Video has tripled the number of Amazon originals. The exclusive show The Lord of the Rings: The Rings of Power is set to be the most expensive series ever produced, costing more than $1 billion, with the first season alone costing $462 million. In 2022 alone, it spent more than $16.6 billion on content.

- HBO/Max: The company planned to spend around $20 billion in 2023.

As providers deliver bigger budgets to their original content writers, cord-cutters are certainly benefiting even as they hit their breaking point for how many services they want to pay for.

13. Password-sharing remains rife

Unsurprisingly, given the number of options and the rising cost of each, many subscribers share their login credentials with friends or family. One study even puts the cost of password sharing on the streaming industry at $9.1 billion in lost potential revenue.

In 2023, Netflix introduced new rules designed to limit the practise and these didn’t seem to have any real repercussions for the company beyond a small number of initial cancellations. This differs from one generation to another, though: more than half of Gen Z and millenials said they’d cancel a service that didn’t allow them to share passwords, whereas only 25 percent of Gen X and boomers agreed.

14. The COVID-19 pandemic caused a 72% decrease in top-rated Netflix content releases

Hollywood came to a grinding halt in 2020 as a result of the COVID-19 pandemic. We are just now starting to see the damage, and for Netflix’s release schedule, the damage was huge. The company has two types of content releases: TV shows and movies it produces and owns through its studios or through partners, and content it licenses from other copyright holders.

As the pandemic set in and production halted, Netflix released 72% fewer TV shows and movies with high ratings (IMDb scores of 80% or more) from its own production cycle than it did in 2019.

To note, Netflix has produced far more content than what our data shows. We included only TV shows and movies Netflix has released that earned a score of 8/10 or higher on IMDb. Since 2008, Netflix has produced 164 titles and licensed 67.

Prior to the pandemic, Netflix was rapidly increasing the number of titles it produced. Covid-19 put a halt to that in a rather dramatic fashion. To keep the flow of content going, however, Netflix instead increased the number of titles it was licensing. The company licensed and released 12 high-rated TV shows and movies in 2020, compared to 9 in 2019.

See also: How to change Netflix region

Cord-cutting predictions

There are some interesting trends to watch going forward. Here are five key predictions on the future of cord-cutting statistics:

- Larger media organizations will begin absorbing smaller streaming platforms or offering bundles of packages. This will begin with the Max/Discovery+ merger and slowly become the norm.

- Major streaming services will continue to phase out free trials and attempt to stop password sharing for good

- “Free with ads” tiers will increase across on-demand streaming services

- The Vidgo live TV streaming service will either get purchased by a competitor or will completely shut down after failing to draw subscribers

- Apple TV+ will begin licensing content to boost its lackluster content library

- Companies will compete to create more accurate recommendation algorithms in a bid to stop users from scrolling endlessly.